What basic economic concepts and terms do you need to know? Basic terms for the course “Economic Theory” Economics terms in simple words.

Basic terms for the course “economic theory”

ALTERNATIVE (OPPORTUNITY) COSTS (opportunity (economic) costs) – monetary income that an economic entity sacrifices

BASE YEAR – the year taken as a basis when constructing price indices.

BUDGET DEFICIT - the amount of excess government spending over revenue in any given year.

BUDGET PROFICT - The amount of excess government revenues over government expenditures in any given year.

GROSS DOMESTIC PRODUCT (GDP, gross domestic product) is the total market value of all final goods and services produced in the economy of a given country within its territory during one year, regardless of the nationality of the manufacturer.

GROSS NATIONAL PRODUCT (GNP, gross national product) is the total market value of all final goods and services produced by the national economy during one year, regardless of location.

QUANTITY SUPPLIED (Qs) - the quantity of a given product that producers are willing to offer to the market at given prices, at a given time and in a given place.

QUANTITY DEMANDED (Qd) – the quantity of a given product that buyers are willing to purchase at given prices, at a given time and in a given place.

COMPLEMENTARY GOODS - goods for which there is an inverse relationship between the prices of one product and the demand for another.

INTERCHANGEABLE GOODS (substitute goods) are goods for which there is a direct relationship between the prices of one product and the demand for another.

GNP deflator is an indicator of the general price level, calculated as the ratio of the real volume of gross national product (GNP) to nominal GNP.

DEFLATION (deflation) - a decrease in the general price level; a process opposite to inflation.

VALUE ADDED – the difference between the cost of products produced by an enterprise (or industry) and the cost of purchased intermediate products.

LONG PERIOD (long run) - a period sufficient for a firm to change the volume of all factors of production it uses.

INCOME (revenue) - the total amount of money received by an economic entity during any period of time.

NATURAL RATE OF UNEMPLOYMENT – the level of unemployment in conditions of full employment in the economy.

OWKEN'S LAW (Okun's law) is an inverse relationship between the unemployment rate and the real volume of GNP, showing that an increase in the level of actual unemployment (U) relative to its natural level (U*) by one percent leads to a lag in real output by 2.5% .

LAW OF DEMAND - if the price of a product increases and all other parameters remain unchanged, then the quantity demanded for this product will decrease

LAW OF DIMINING RETURN (LAW OF DIMINING RETURN) - the principle according to which additional use of a variable resource with a constant amount of a constant resource leads, starting at some point in time, to a decrease in marginal returns or marginal product.

WAGE (wage) – the price of labor (labor services) per unit of time (hour, day, etc.).

COSTS - expenses of a company for the production of goods or services over a certain period of time.

CONSUMER SURPLUS (consumer's surplus) is the additional benefit from trade that the buyer receives. It is defined as the difference between the demand price and the equilibrium market price of the product

PRODUCER'S SURPLUS is the additional benefit from trade that the seller receives. It is defined as the difference between the producer's minimum price and the equilibrium market price.

ISOQUANT - a line that shows all possible combinations of resources to produce a given volume of output.

ISOCOST line - a line that shows all combinations of economic resources that a firm can purchase, taking into account market prices for resources and the full use of its budget.

PRICE INDEX (price index) – an index showing the dynamics of price changes, used to recalculate the nominal volume of production (income) into real volume (income).

INDIVIDUAL PRIVATE ENTERPRISE (individual proprietorship) is one of the forms of entrepreneurial activity; sole proprietorship

INFLATION – an increase in the general price level in the economy.

Cost-push inflation is inflation caused by a decrease in aggregate supply as a result of rising production costs.

DEMAND-PULL INFLATION – inflation caused by an increase in aggregate demand.

CAPITAL (capital) – investment resources, means of production; factors of production created by man during the production process. Financial capital (financial assets) is not a factor of production.

COMMAND ECONOMY (command economy) - an economic system in which material resources are state property, and the direction and coordination of the economic activities of society are carried out through centralized planning.

SHORT PERIOD (short run) - a period of time during which the company cannot change the quantity of at least one production resource.

PRODUCTION POSSIBILITY CURVE (production possibilities curve) - a curve showing possible combinations of production of two products under conditions of full employment, full use of all economic resources, unchanged technology and a constant supply of resources. This curve allows you to graphically illustrate the need for choice in conditions of limited resources and the presence of increasing opportunity costs.

SCALE OF PRODUCTION (see Economies of scaleproduction)

MICROECONOMICS (microeconomics) is a part of theoretical economics that studies individual economic entities (individual consumers, individual firms, states) in the process of production, exchange and consumption of goods and services in order to satisfy their unlimited requiredste through limited resources.

MODEL - a simplified representation of economic reality that allows you to highlight the most important things in a concise, compact form (for example, using graphs and equations) or an accurate description of a simplified imaginary economy.

MONOPOLISTIC COMPETITION - a market in which there are a significant number of firms producing differentiated products;

MONOPOLY – a market in which there is one seller and there are significant barriers to entry.

IMPERFECT COMPETITION - all markets in which the conditions of perfect competition are not met: monopoly, monopsonia, monopolistic competition, oligopoly And oligopsony; markets in which buyers or sellers are able to unilaterally influence market prices.

implicit costs - determined by the cost internal resources, those. resources, located inproperty of this company. An example of an implicit cost for an entrepreneur would be the wages he would otherwise receive as an employee.

NOMINAL income (nominal) - measured in current prices, not recalculated for inflation.

NORMAL PROFIT - part of the firm's total costs; the payments a firm must make to acquire and retain entrepreneurial talent; the minimum income that should reward entrepreneurial ability; imputed fromholders

NORMATIVE ECONOMICS (normative economics) is an approach to assessing economic phenomena from the point of view of what the economy, economic development goals, and economic policy should be.

TOTAL (TOTAL) COSTS (total cost – TC) – the total costs of an enterprise for the acquisition of the economic resources it needs (factors of production);

TOTAL REVENUE (TOTAL) (total revenue – TR) – the total receipts of a company from the sale of its products.

TOTAL PRODUCT (TOTAL) (total product – TP) – the total volume of products produced by the enterprise over a certain period of time.

LIMITED RESOURCES (scarce resources) – the impossibility of simultaneous and complete satisfaction of all the needs of all members of society.

OLIGOPOLY is a market in which a small number of large firms operate, producing both homogeneous and differentiated products.

NEGATIVE EFFECT OF PRODUCTION SCALE (decreasing returns to scale or diseconomies of scale) - the increase in output is less than the increase in costs, expressed in an increase in long-term average total costs with an increase in the scale of production.

PARTNERSHIP (partnership) is one of the forms of organizing business activity; a business owned and operated by two or more people.

CROSS-PRICE ELASTICITY OF DEMAND - characterizes the percentage change in the quantity of demand for one product when the price of another product changes by 1%. Used to characterize complementary and interchangeable goods.

VARIABLE COSTS – costs, the total value of which depends on changes in output volume.

VARIABLE FACTOR OF PRODUCTION (RESOURCE) (variable resource) – a resource whose quantity can be changed.

POSITIVE ECONOMICS (positive economics) - a direction in economic theory that involves the explanation and forecasting of economic phenomena, the study of general economic patterns on the basis of which the principles of economic behavior are formed, the identification of cause-and-effect or functional relationships between phenomena.

FULL EMPLOYMENT - the level of employment at which there is only frictional and structural unemployment, but no cyclical unemployment (and when the real national product is equal to the potential one).

POSITIVE EFFECT OF PRODUCTION SCALE (increasing returns to scale or economies of scale) - an increase in output greater than an increase in costs is expressed in a decrease in long-term average total costs with an increase in the scale of production.

FIXED COSTS – costs of a company, the value of which does not change when the volume of output of the company changes.

CONSTANT FACTOR OF PRODUCTION (RESOURCE) (fixed resource) – a resource, the quantity of which the company cannot change.

CONSTANT PRODUCTION SCALE EFFECT - the increase in output is equal to the increase in costs, expressed in a constant value of long-term average total costs with increasing scale of production

NEED (needs, wants) - the objective need of a person or group of people for something necessary to maintain the vital functions and development of the body and personality (see. Maslow's hierarchy of needs theory),

MARGINAL RATE OF TECHNOLOGICAL SUBSTITUTION (MRTS) - The amount of one resource that must be reduced in exchange for a unit increase in another resource so that the firm's output remains unchanged.

MARGINAL COST (MC) - the increase in the total costs of the company from the production of one additional unit of output.

MARGINAL REVENUE (MR) is the increase in the total income of a company from the sale of one additional unit of its products.

MARGINAL PRODUCT (MP) of any factor is the additional volume of output obtained when the costs of this factor increase by unit.

ENTREPRENEURIAL ABILITY is one of the most important economic resources. It assumes a person’s ability to: 1) organize the production and release of goods and services by combining all other resources; 2) make basic decisions on production management and business management; 3) risk your money, time, labor, business reputation; 4) be an innovator, i.e. introduce new technologies, new products, methods of organizing production.

PROFIT – the amount of excess of a company’s income over its costs; income of the owner of entrepreneurial talent.

PRODUCTION FUNCTION (production function) – reflects the relationship between the amount of resources used and the maximum possible volume of output per unit of time.

EQUILIBRIUM PRICE – the price at which the amount of market demand is equal to the amount of market supply.

EQUILIBRIUM STATE (equilibrium position) is a state of the market in which market demand is equal to market supply and there are no tendencies to change.

EQUILIBRIUM VOLUME (equilibrium quantity) - the amount of market demand and the amount of market supply at the equilibrium price.

RENT (rent) - 1) the difference between the income of a factor of production and the minimum amount necessary to retain the factor in a given area of use; 2) income of the owner of natural resources, land.

RESOURCES (resource) - the totality of all material goods and services used by a person to produce the products he needs.

MARKET (market) is a special form of relationship between individual, independently decision-making economic entities, between buyers and sellers,

MARKET SUPPLY – the total supply of any product from all producers; the sum of the individual supply values of a given product at different prices.

MARKET DEMAND (market demand) - the total demand for any product from all potential consumers; the sum of the individual demand values presented by each consumer for a given product at different prices.

MARKET ECONOMY (market economy) - an economic system based on private property and the use of the mechanism of supply and demand to solve basic economic issues.

MIXED ECONOMY – an economic system based on different forms of ownership and the economic development of which is regulated by the market, traditions and centralized decisions.

PERFECT COMPETITION - a market in which there are a significant number of independent manufacturers producing homogeneous products, there is no non-price competition and barriers to the entry of new firms.

AGGREGATE DEMAND (AD) – the sum of expenditures of households, firms, the state and the external sector.

AGGREGATE SUPPLY (AS) is the total volume of national product that is produced in the country at a given price level.

DEMAND (demand) is the solvent need, desire and ability of an economic entity to buy this or that quantity of a given product.

AVERAGE TOTAL COSTS (ATC) – the volume of total costs per unit of output.

AVERAGE VARIABLE COSTS (AVC) – the volume of variable costs per unit of output.

AVERAGE FIXED COSTS (average fixed cost - AFC) - the volume of fixed costs per unit of output.

AVERAGE REVENUE (AR) – the amount of total income of a company per unit of output.

AVERAGE PRODUCT (AP) of any production factor is the volume of output per unit of the factor used.

TRADITIONAL ECONOMY (traditional economy) is an economic system in which traditions, experience, and customs determine the practical use of production resources.

LABOR - the totality of human physical and mental abilities expended in the production of goods and services.

ELASTICITY - the ratio of the percentage change in one variable, for example A, to the percentage change in another variable B. To quantify elasticity, the elasticity coefficient is used. Most commonly used elasticity of demand according toprice, income elasticity of demand, price elasticity of supply, cross (volume) elasticity of demand and crossreal price elasticity of demand.

INCOME ELASTICITY OF DEMAND - characterizes the percentage change in the quantity of demand for a product when the consumer’s income changes by 1%.

PRICE ELASTICITY OF SUPPLY - characterizes the percentage change in the supply of a product when its price changes by 1%.

PRICE ELASTICITY OF DEMAND - characterizes the percentage change in the quantity of demand for a product when its price changes by 1%.

EFFECT OF PRODUCTION SCALE (economies of scale) - the process of increasing production output by increasing the use of all production resources, or changing the scale of production;

PRODUCTION EFFICIENCY (productive efficient) - production of goods at the lowest cost; using the minimum amount of resources for a given volume of output.

EXPLICIT COSTS - determined by the amount of the enterprise's expenses for paying and purchasing resources from external suppliers.

Absolute advantage- the ability for a country to produce goods at lower costs (volumes of involved factors of production) compared to other countries (trading partners).

Prepaid expense- a sum of money issued against upcoming payments for material assets, work performed and services rendered.

Advice- an official notification from the bank about the execution of a settlement transaction sent by one counterparty to another; especially widely used by banks in mutual settlements.

Autarky- policy of voluntary or forced isolation of the country from the world market, economic isolation of the state.

Holdings- 1) assets, property; 2) the client’s funds in the bank.

Aggregation- combining individual units or data into a single indicator. For example, all prices of individual goods and services form one common price level, or all units of output are aggregated into real net national product.

Market aggregation- the opposite of market segmentation, or a strategy by which a firm treats the entire market as a homogeneous area and standardizes marketing activities.

Agio- excess of market rates of banknotes, bills or securities compared to their face value.

Acquisition- acquisition of an enterprise by a shareholder or group of shareholders by purchasing all shares of this enterprise on the stock exchange.

Letter of Credit- an order to the bank to pay a certain amount to an individual or legal entity upon fulfillment of the conditions specified in the letter of credit; a monetary, personal document issued by a bank to a person who has deposited a certain amount and wishes to receive it in full or in parts in another city within a certain time.

Assets- 1) property of an individual or legal entity; 2) part of the balance sheet.

Acceptance- agreement to accept the counterparty’s offer to conclude an agreement; consent to pay a payment request when making payments through a bank.

Excise tax- a type of indirect tax, mainly on consumer goods, as well as on services. Included in the price of goods or fees for services.

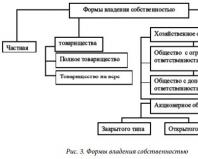

Joint-Stock Company- an enterprise created on the basis of a voluntary association by citizens and (or) legal entities of their property by issuing shares. Distinguish open And closed joint stock companies.

Promotion- a security that certifies ownership of a share in the capital of a joint-stock company and gives the right to participate in its profits, and in certain cases (simple share) to participate in the management of the enterprise.

Ordinary share (simple)- a share giving the right to participate in the management of a joint-stock company and receive a dividend.

Preferred share- a share that does not give the right to vote at a meeting of shareholders, but gives the right to a fixed dividend paid on a priority basis.

Alpari- compliance of the exchange rate of securities or market exchange rates with their face value.

Opportunity Cost- the cost of producing a good or service, measured in terms of lost opportunity to engage in the best available alternative activity that requires the same time or the same resources.

Depreciation deductions- deductions of part of the cost of fixed assets to compensate for their wear and tear (for complete restoration).

Annuities- a type of government long-term loan for which the lender annually receives a certain income (rent), established with the expectation of constant repayment of the capital amount of the debt along with interest on it.

Antimonopoly policy- government regulation aimed at demonopolizing the economy and preventing the emergence of monopolies.

Rent- the transfer by the owner of his property for a predetermined time for the use of another person, who in exchange undertakes to regularly pay the owner certain amounts of money, called rent or rent.

Range- a set of goods, products or services, specified by grade, brand, size.

Auditors- organizations (officials) checking the state of the financial and economic activities of enterprises and associations.

Auction- open auction, at which ownership of the property being sold is transferred to the buyer who offered the maximum amount during the auction.

"Buy-back"- a long-term commodity exchange operation in which the supply of machinery and equipment is carried out on credit with subsequent payment for the products produced with their help.

Balance- a system of indicators that characterizes, as of a certain date in monetary terms, the state of the means of production both in composition (asset) and in terms of their sources, intended purpose and return period (liability). They are divided into a system of summary (payment, trade, settlement, etc.) and accounting balance sheets.

Bank- a financial institution that attracts funds from legal entities and individuals and places them on its own behalf on the terms of repayment, urgency and payment.

Commercial bank- a private enterprise providing credit and cash services to enterprises and individuals.

Bank Central- a state bank that manages the entire monetary system of the country and has a monopoly right to issue money; stores temporarily available funds and required reserves of commercial banks.

Bank reserves- funds of commercial banks stored in a special account with the Central Bank, plus bank cash.

Bank interest- “price” of money, payment for the use of money borrowed.

Banknotes- 1) bank notes, bills of exchange for the banker; 2) paper money issued by the Central Bank.

Bankrupt- an enterprise that is unable to pay off its obligations with creditors; declared insolvent and closed.

Barter- balanced and valued exchange of goods, carried out without the involvement of money.

"Escape from Money"- the desire of people and firms to avoid accumulation and storage of unstable currency, depreciating money by quickly converting it into material assets, i.e. through the purchase of movable and immovable property.

Poverty- the standard of living of a family at which its income does not allow it to cover the costs of meeting even the most basic material needs, i.e. are below the subsistence level.

Non-cash funds- a form of making cash payments and settlements, in which the physical transfer of banknotes does not occur, but simply entries are made in special books for recording monetary transactions.

Unemployment- a socio-economic phenomenon when part of the economically active population cannot find work.

Business- economic activity aimed at making a profit.

Business plan- justifying the goals of the new business and determining ways to achieve them. Used as the main document to justify investments.

Exchange- the form of the market (institution) on which securities are traded (stock Exchange), goods (commodity exchange), foreign currency (currency exchange).

Stock quote- prices of exchange traded goods or securities rates registered and published by the exchange quotation commission.

Bonitet- solvency, the ability of the borrower to repay the loan.

Bonification- 1) a premium to the price of goods whose quality is higher than that provided for by the standard; 2) government subsidy, which allows reducing the interest rate on loans provided to certain categories of borrowers.

Bonds- debt obligations issued by the state treasury, individual institutions and enterprises.

Bonus- remuneration for commission services provided. The size of the bonus is determined as a percentage of the cost of the goods sold (exchanged or purchased).

Broker- an exchange intermediary who buys goods on behalf of the client and with his money.

"Bull"- a speculator who buys or retains previously purchased goods or securities in anticipation of rising prices.

Family budget- the structure of all family income and expenses for a certain period of time (month or year).

Budget deficit- the amount of excess of government expenditures over government revenues.

All in- risk associated with the possibility of either losing everything or gaining a lot.

Gross National Product- a macroeconomic indicator characterizing the volume of national production. Defined as the sum of market prices of all final products produced in the national economy during the year.

Valorization- an increase in the price of goods and the exchange rate of securities as a result of government measures.

Currency- 1) the country’s monetary unit; 2) banknotes of foreign states and credit means of circulation and payment, expressed in foreign monetary units (bills, checks, etc.) and used in international payments.

Exchange rate- the price of a monetary unit of one country expressed in the monetary unit of another country.

Currency intervention- operations of the Central Bank for the purchase and sale of the currency of its country in order to influence the exchange rate.

Warrant- an additional facility issued along with a security and giving the right to additional benefits (for example, the right to purchase a certain number of ordinary shares of the same issuer after purchasing its bonds).

Voucher- 1) privatization check issued during the privatization process for the acquisition of shares of privatized enterprises; 2) written evidence, mandate, guarantee or recommendation.

Veblen effect- a phenomenon described by the American economist T. Veblen in the book “The Theory of the Leisure Class” (1899), which occurs when, as a result of a fall in the price of a product, some consumers decide that this was due to a deterioration in its quality, and reduce consumption of this product.

Bill of exchange- a security (debt, mortgage) containing an unconditional monetary obligation to pay a certain person or bearer of a bill of exchange a certain amount within a certain period.

Venture capital companies- knowledge-intensive research and development organizations, with the help of which risky projects are implemented (in order to maximize profits).

Complementary Products- goods for which there is an inverse relationship between the price of one product and the demand for another, namely: a decrease (increase) in the price of one product leads to an increase (decrease) in demand for another product.

Interchangeable goods- products that can satisfy the same need; in this case, a decrease (increase) in the price of one product leads to a decrease (increase) in demand for another of the interchangeable goods.

External effects- effects of production or consumption of a good, the impact of which on third parties who are neither buyers nor sellers is in no way reflected in the price of this good.

External public debt- state debt for outstanding external loans and unpaid interest on them.

Reproduction- continuous resumption of production activities on the same or expanded scale.

Secondary market (securities)- a market on which securities are resold after their initial sale, distribution, placement by issuers. Secondary market agents are usually banks and firms specializing in the sale of securities.

Revenue- funds received (proceeds) by an enterprise, firm, entrepreneur from the sale of goods and provision of services.

Garan giya- guarantee; ensuring fulfillment of obligations. For example, a bank guarantee is provided by the buyer if the seller doubts his solvency.

Hyperinflation- accelerating growth of inflation rates, in which the value of money falls so quickly that they cannot fulfill their main economic functions - a means of payment and especially a means of storing value (wealth). The formal criterion of hyperinflation was introduced by the American economist F. Kagan, who proposed that the beginning of hyperinflation be considered the month in which price growth for the first time exceeded 50%, and the end - the month preceding the month in which price growth falls below this critical level and does not reach it again for at least least during the year.

Horizontal merge- merging into one company or taking under unified control two or more enterprises carrying out the same stages of production or producing the same products.

"Hot money"- monetary capital that spontaneously moves from one country to another in order to preserve value or extract speculative excess profits.

State regulation of the market- state intervention in the functioning of market mechanisms, impact on the economy through administrative (legislative acts and actions of executive authorities based on them) and economic (monetary, financial, monetary, fiscal) methods and levers.

Government loans- the main form of public credit, which is a credit relationship in which the state acts primarily as a debtor (in this case, the debt is included in the amount of public debt).

Finished products- products of main or auxiliary workshops intended for export.

Gradualism- economic policy aimed at slowly reducing inflation over a long period of time by managing aggregate demand and without harming employment.

Production Possibility Frontier- an indicator of the maximum possible volume of output of a certain product or type of service that can be produced in the economy under the existing level of use of available resources and knowledge, as well as with given volumes of production of other goods and services.

Grant- 1) deed of gift, document on transfer of rights; 2) subsidy, subsidy, scholarship.

G udvil - the conditional value of business connections, the price of accumulated tangible assets, the monetary value of intangible capital (prestige, trademark, experience of business connections, stable clientele). For example, the Coca-Cola trademark is valued at $3 billion, Camel at $2.5 billion, and Stolichnaya vodka at $100 million.

Movable - 1) property that is not directly connected with or attached to land (as opposed to real estate); 2) moved things, money, securities.

Debit - 1) the amount due for payment or receipt as a result of economic relations with a legal entity or individual; 2) an account of receipts and debts of a given institution or organization.

Debtor - an individual or legal entity that has a debt to a certain enterprise, organization, institution, or citizen.

Devaluation - official depreciation of the national currency against foreign currencies.

Mottos - means of payment in foreign currency intended for international payments.

Declaration of income- a corresponding statement on the amount and sources of income, filled out by individuals and legal entities.

Decor- a discount on the price of goods provided by the seller to the buyer upon early payment or due to the fact that the quality of the goods is lower than that stipulated in the contract.

Demonopolization- elimination of state or other monopoly that dictates its terms to the market.

Dumping- waste export - sale of goods at prices below costs (cost); carried out, as a rule, on the foreign market.

Money supply- a set of generally accepted means of payment in the economy.

monetary mechanism- the way in which changes in the money supply affect the economy.

Money market- a market for short-term transactions for lending and borrowing money, bringing together commercial banks, companies and the government.

Denomination- consolidation of the national monetary unit by exchanging old banknotes for new ones according to the established ratio in order to streamline monetary circulation, facilitate accounting and settlements in the country.

Money- any generally accepted means of payment that can be exchanged for goods and services and used to pay debts.

Deposit- all types of funds (money, securities, etc.) transferred by their owners for temporary storage to the bank with the right to use this money for lending. Deposits vary poste restante And urgent.

Depression- a very severe recession lasting more than a year. Characterized by a stagnant state of the economy, low prices, weak demand for goods, mass unemployment, etc.

Gross Domestic Product Deflator- price index for all goods and services produced, used to obtain real gross domestic product. The importance of information and real GDP is explained by the fact that it reflects the physical output of goods and services, and not their monetary value.

Deflation- the process of reducing the general price level in the country.

"Cheap money"- cheaper loans as a result of the Central Bank’s expansionary credit policy in order to expand lending to the economy.

Decile coefficient- an indicator of uneven distribution of income between different groups of the country’s population; calculated as the ratio of the income of the richest 10% of people to the income of the poorest 10% of people.

Jobbers- dealers of the London Stock Exchange, carrying out transactions for the purchase and sale of securities on their own behalf and at their own expense.

Diversification- simultaneous development of many directly unrelated industries; a strategy of reducing risk by spreading investments across multiple risky assets.

Dividend- income (profit) received by the owner of shares based on the results of the activities of the joint-stock company.

Dizagio- deviation of the exchange (market) rate of securities or banknotes downward compared to their nominal value; usually expressed as a percentage of face value. The deviation of the exchange rate from the nominal value towards an increase is called we screw up.

Dealing- a range of trade, intermediary and business services.

"Dynamite"- a trader who sells unreliable goods or securities.

Discount - 1) the difference between the current price and the price at maturity or the face value of the security; 2) the difference between prices for the same product with different delivery times.

Discounting- a method of determining the present equivalent of the value of money that will be received or spent in the future. If the discount rate is 10%, and the amount that will be received in a year is $110, then the today's value of this amount will be $100. The discounting operation is the inverse of calculating compound interest. The discounting method is widely used to evaluate investment projects when costs and income are distributed over time.

Distributor- a company that carries out sales on the basis of wholesale purchases from large manufacturing companies.

Product differentiation- a process that occurs when a product sold on the market is not standardized.

Added value- the total sales of a firm minus the cost of materials and other intermediate goods used in the production of goods sold. The added value does not include depreciation charges.

The household- the most important subject of economic relations; an economic unit that produces and consumes goods and services.

"Expensive money"- 1) an increase in the cost of credit as a result of the Central Bank’s measures taken to curb economic growth and regulate inflation; 2) money whose purchasing power increases.

Subsidy- free financial assistance to compensate for any costs.

Income- flow of cash and other income per unit of time. There are four main forms of income: rent, wages, interest and profit.

Subsidiary- a branch of the parent joint-stock company, which is under the control of the parent company. Control is ensured by purchasing shares of a subsidiary.

Natural monopoly- an industry in which the production of goods or services provided are concentrated in one company due to objective (natural or technical) reasons, and this is beneficial to society.

Natural rate of unemployment- the unemployment rate corresponding to the objectively achievable level of full employment in the economy (frictional and structural unemployment).

Market volume- total effective demand of buyers.

Mortgage- a document on the debtor’s pledge of real estate (land, buildings), giving the creditor the right to sell the pledged property at auction if the debt is not paid on time.

Law of Diminishing Marginal Productivity- states that with a larger amount of a variable production resource used (assuming that other resources and technologies are constant), the marginal product of this resource will most likely decrease.

Wage- equilibrium price in the labor market; income in cash or in kind received by an employee.

Overstocking- excess goods on the market; excess of supply over demand.

Ground rent- 1) part of the surplus product created by agricultural workers, appropriated by land owners; 2) the main part of the rent paid to land owners by its tenants.

Earth- a factor of production that is not reproduced, but is naturally available, but in a limited volume.

gold standard- a mechanism for the exchange of national currencies, based on the establishment of a fixed weight of gold (gold collateral), to which a paper monetary unit of a certain denomination was equated, and the exchange of currencies based on the ratio of the sizes of such gold collateral.

Economic free zone- a special economic zone (free trade zone), limiting a part of the national-state territory, in which special preferential economic conditions apply for foreign and national entrepreneurs (customs, rental, currency, visa regime benefits, etc.), which creates conditions for industrial development and investment of foreign capital.

Costs- the firm's expenses for producing goods or services sold during a certain period of time; equal to the sum of fixed and variable costs. As a rule, the amount of costs in accounting terms differs from the level of economic costs.

Opportunity costs- the opportunity cost of any resource chosen to produce a good, equal to its cost under the best of all possible uses.

Accounting costs- actual consumption of production factors for the production of a certain amount of products at their acquisition prices.

Gross costs- the sum of fixed and variable costs.

Implicit costs- the cost of non-purchased resources used in production.

Variable costs- costs, the total value of which for a given period directly depends on the volume of production and sales.

Fixed costs- costs, the amount of which in a given period does not directly depend on the size and structure of production and sales.

Production costs- cash costs of the enterprise for the means of production consumed in production and payment of wages.

Costs are average- total costs per unit of output.

Explicit costs- opportunity costs, which take the form of explicit cash payments to suppliers of factors of production and intermediate goods.

Consumer surplus- the difference between the maximum amount that consumers are willing to pay for a certain quantity of a good they want and the amount they actually pay. It is measured as the area between the demand curve and the horizontal line at the market price level.

Producer surplus- the total effect of price exceeding production costs. It is measured as the area between the supply curve and the horizontal line at the market price level.

Moral wear and tear- partial loss of value of elements fixed capital due to the production of more productive or cheaper analogues.

Physical wear and tear- gradual decrease in the efficiency (value) of elements fixed capital due to their constant use.

Import- purchasing goods from a foreign counterparty and importing them into the country.

Investment- the process of investing public or private capital in various sectors of the national economy.

Index- a relative indicator characterizing the relationship between socio-economic processes in time or space: prices of individual goods, volumes of various products, costs, etc.

Herfindahl index- an indicator of market concentration, calculated as the sum of the squares of the market shares (in percentage) of all market entities in its total volume.

Dow Jones Industrial Average- a popular industrial stock market index used on the New York Stock Exchange. It is calculated in dollars and consists of four indicators: the average stock price of 30 industrial corporations, 20 transport corporations, 15 utility companies and a consolidated rate for all 65 corporations combined.

Price index- an indicator expressing the ratio of prices for goods and services for two different periods of time.

Indexing- automatic adjustment of payment amounts taking into account inflation rates calculated on the basis of the price index.

Indicative planning is non-directive, recommendatory, orienting planning at the state level.

Endorsement- giro - an endorsement on the back of a security, bill, check, certifying the transfer of rights under this document to another person. The person making the endorsement is called endorser(otherwise - girant).

Engineering- provision of engineering, construction and design services.

Collector- an employee who delivers money from the company's cash desk to a banking institution.

Collection- a banking operation through which the bank, on behalf of its client, receives funds due to the enterprise on the basis of settlement documents and credits them to its bank account.

Innovation- the process of investing funds in the economy, ensuring scientific and technological progress.

Integration- the economic process of interaction between the national economies of two or more states based on cooperation and international division of labor.

Intensive economic growth- economic growth, in which the volume of production increases through more efficient use of existing factors of production through the use of modern technologies, labor organization, etc.

Inflation- imbalance of supply and demand, manifested in rising prices; growth of the general price level in the economy and overflow of money circulation channels.

Cost inflation- an increase in the general price level as a result of a decrease in aggregate supply due to increased wages and prices for raw materials. Accompanied by a reduction in real output and employment.

Demand inflation- an increase in the general price level caused by the fact that the level of aggregate demand exceeds the level of aggregate supply in the economy of a given country. According to the monetarist point of view, excess demand arises from too rapid an increase in offers of money.

Infrastructure- a complex of production and non-production industries that serve production and provide the living conditions of society (roads, communications, transport, education, healthcare).

Mortgage- pledge of land or other real estate in order to obtain a loan, called mortgage loan.

Costing- calculation of the cost per unit of production or work performed.

Cadastre- a register containing a list of information about taxable objects that are subject to direct real taxes. Such objects include land, houses, and industries.

Capital- one of the factors of production; all means of production and resources used to produce goods and services.

Fictitious capital- capital (stocks, bonds, mortgage notes, etc.), which, unlike real capital (in the form of money and equipment), is not a value, but only the right to receive income.

Capital investments- the totality of costs of material, labor and monetary resources aimed at the expanded reproduction of fixed assets in all sectors of the national economy.

Cartel- one of the forms of monopoly, which is an agreement between enterprises on price, production volume and division of the market for the sale of goods.

The quality of life- a general indicator of the comfort of people’s lives, taking into account the level of material well-being, the amount of free time for personal needs, the degree of safety of citizens, the economic situation in the country and many other factors.

Product quality- a set of technical, economic and aesthetic properties of a product that determine its ability to satisfy certain needs in accordance with its intended purpose.

Quasi-money- non-cash funds held on time and savings deposits in commercial banks.

Quota- share in the production or marketing of products established by law or agreements.

Keynesian model- an economic model (named after the English economist John Maynard Keynes), where prices and wages are fixed in the short term. The aggregate supply curve is represented by a horizontal line, with the result that real gross national product is completely determined by the level of aggregate demand.

Classic model- a model of the labor market and aggregate supply in which absolute flexibility in wages and prices results in a permanent situation of full employment. In this case, the aggregate supply curve is a vertical straight line.

Quantity theory of money- a theory that states that changes in the price level are mainly based on the dynamics of the nominal money supply.

Clearing- a system of non-cash payments by offsetting mutual claims and obligations.

Command economy- an economy in which the entire volume of resources is distributed by central government authorities.

Commission- 1) an agreement under which one party (the commission agent) undertakes, on behalf of the other party (the principal), for a fee, to conclude a transaction on its own behalf, but in the interests and at the expense of the principal; also the fee for completing such a transaction; 2) in banking practice - a payment to a commercial bank for conducting operations performed on behalf and at the expense of clients.

limited partnership, limited partnership - a company in which, along with general partners, there are one or more participant-investors (limited partners), who bear the risk of loss only within the limits of the amounts of contributions made by them and do not take part in the business activities of the partnership. Limited partners receive a portion of the partnership's profits due to their share in the joint capital.

Limited partner- a member of a limited partnership (limited partnership), who bears limited liability for the obligations of the partnership within the limits of his contribution (in contrast to the complementor - a personally responsible partner who is liable for the obligations of the company with all his property).

Commerce- trading and trade-intermediary activities, participation in the sale or promotion of the sale of goods and services; in a broader sense - entrepreneurial activity.

Traveling salesman- a traveling agent of a trading company who offers customers goods according to the samples, catalogs, etc. he has.

Conversion - 1) transfer of military enterprises to the production of civilian products or vice versa; 2) a change in the initial conditions of government loans, expressed in the repayment of interest, deferment of payments, change in the method of loan repayment, etc. (loan conversion); 3) exchange of one currency for another at the current exchange rate (currency conversion).

Currency convertibility- the opportunity to freely exchange national currency for foreign currency at the current exchange rate, as well as pay for foreign goods and services in national currency (both within the country and abroad).

Final product- part of the total social product minus intra-production consumption.

Competitiveness- the ability of a product or its manufacturers to win competition in the market with goods manufactured by other companies, due to better compliance with the requirements or financial capabilities of buyers.

Competition- competition between commodity producers for better, more economically advantageous conditions for the production and sale of goods, for obtaining the highest profits.

Unfair competition- economic competition in which non-market forms of competition are used: unfair advertising, dissemination of false information about competitors, illegal use of a trademark, etc.

Competition is imperfect- an economic competition in which two or more sellers, having some (limited) control over price, compete with each other for sales.

Non-price competition- economic competition in which competing firms use methods other than changing the selling prices of their products.

Perfect competition pure - economic competition in a market where many firms sell a standard product and none of them has a sufficient share to control the market and prices.

Consulting- activities of special companies to advise producers and consumers in the field of technological and economic activities.

Consignment- the owner of goods sold abroad through the intermediary of a commission agent (consignee).

Consortium- a temporary voluntary agreement between several banks, firms, companies in order to coordinate actions to service a single capital-intensive project.

Smuggling- illegal movement of goods and other valuables across the state border.

Counterparty- each of the parties to the contract in relation to each other, assuming certain obligations.

Contract- a legally binding agreement, a contract between two or more participants with mutual obligations to supply and purchase goods, perform certain work.

Controlling- accounting and control at the enterprise.

Controlling stake- a share of shares giving the right to manage a joint-stock company.

Concern- diversified joint stock company; a form of association of many enterprises from different industries, trade, transport, services and financial institutions.

Concession- 1) a contract or agreement for the state to commission industrial enterprises or plots of land with the right to extract minerals, construct structures, etc. to domestic or foreign firms; 2) the enterprise itself, organized on the basis of such an agreement.

Conjuncture- a temporary economic situation in the market, characterized by the appropriate relationship between supply and demand, price level, inventory, order portfolio for the industry, etc.

Cooperative- an enterprise (firm) created on the basis of the voluntary association by citizens of their property. A member of a cooperative takes personal labor participation in its activities.

Corruption- merging of state structures with the criminal world, corruption and bribery of political and public figures, as well as government officials.

Indirect taxes- taxes on goods and services, established in the form of a price premium and paid by producers. The final payer is the consumer who purchases goods at increased prices, including indirect tax.

Quoted- 1) be traded on the stock exchange; 2) have a certain price (about currency, securities, goods).

Credit- a loan in cash or commodity form on the terms of repayment and usually with the payment of interest.

Laffer curve- a curve showing the relationship between tax rates and the volume of tax revenues to the state budget. Allows you to identify a tax rate (from 0 to 100%) at which tax revenues reach a maximum. Named after the American economist.

Lorenz curve- a curve illustrating the distribution of income in the economy. The total percentage of families (recipients of income) is measured along the x-axis, and the total percentage of income is measured along the ordinate axis. Named after the American economist.

Production possibility curve- a curve showing the maximum quantity of any good that can be arbitrarily produced in some economic system given the output of all other goods, limited resources and a given technology.

Cross course- the relationship between two currencies, which is determined on the basis of the exchange rate of these currencies in relation to any third currency.

Share price- the selling price of a share, determined by the relationship between supply and demand and depending on the size of dividends, as well as on the stability of the position and commercial prospects of the joint-stock company.

Courtage- remuneration to the broker for mediation in making an exchange transaction.

Lag- a time gap between two phenomena or processes that are in a cause-and-effect relationship.

Phillips curve- a curve describing the relationship between the unemployment rate (along the x-axis) and the annual growth rate of the price level (along the ordinate). Named after the English economist.

Label- any product label that indicates the country where the product was made, the manufacturer, its trademark or brand name, etc.

Liberalization(economy, prices) - expanding the freedom of economic action of business entities, removing restrictions on economic activity, emancipating entrepreneurship. Price liberalization is the transition from state-set prices (state pricing) to a system of free market prices (market pricing).

Leasing- provision of long-term lease of fixed assets. Leasing companies purchase equipment to rent it out. This is a relatively new way of financing investments, based on the retention of ownership rights of the lessor.

Liquidity- the ability of material assets and other resources to quickly turn into money; the ability of an enterprise to pay its obligations on time, to convert balance sheet asset items into money to pay liability obligations.

Listing- list of securities admitted to circulation on the stock exchange.

License- permission issued by state or local authorities to conduct certain economic activities.

Lloyd- English insurance association, one of the largest monopolies in Great Britain.

Lobby, lobbying- private or public organizations that influence the legislative or executive decision-making in the interests of certain groups of the population.

Logo- a specially designed original style of the full or abbreviated name of the company.

Pawnshop- a credit institution that accepts valuables (movable property) from citizens as collateral and issues them loans for a period and in an amount that is only part of the value of the pledged item.

Lot- an auction trade term meaning a unit or batch of goods offered for sale.

Lumpen- a person deprived of any (even movable) property.

Broker- an individual or legal entity acting as an intermediary in the purchase and sale of goods and securities. The broker can carry out transactions both at his own expense and at the expense of the client.

Macroeconomics- a branch of economic theory that studies the economy as a whole.

Margin- bank profit, defined as the difference between the amount of interest charged and paid by the bank; a term also used in exchange and trading practice to denote the difference between prices and rates when concluding transactions.

Marketing- the general name of a group of methods that make it possible to more accurately determine the real needs of consumers for certain goods, as well as influence the amount of demand for these goods.

"Bear"- a speculator who believes that prices will soon go down and sells contracts (plays on the decline).

Management- enterprise organization and management system; a branch of economic science that studies the theory and practice of organizing and managing production and sales of products.

Mercantilists- economists whose scientific school developed in the 15th century. and dominated for almost two centuries. Mercantilists considered wealth only that which could be converted into money. They believed that the main sphere where wealth is born is the sphere of circulation and, in particular, trade. In their opinion, the state should strive to ensure that as much gold and silver as possible settles in the country: in this they saw the main source of the nation’s power.

Microeconomics- a branch of economic theory that studies economic processes at the level of an individual enterprise.

Minimal salary- the minimum wage established by law at enterprises of any form of ownership.

Economic-mathematical model- an equation or system of equations that reflects the basic properties of real objects, processes, systems. With its help, a researcher can conduct computational experiments on complex economic systems over which a direct full-scale experiment is impossible (or undesirable).

Monetarism- an economic theory based on the determining role of the money supply in circulation in the implementation of policies to stabilize the economy, its functioning and development.

monetary rule monetary rule - a rule formulated by supporters of monetarism, according to which the mass of money in circulation should increase annually at a rate equal to the potential growth rate of real GDP.

Monitoring- a system of measures that allows you to continuously monitor the condition of a certain object or system.

Monopoly- an enterprise that has a dominant position in the market, which allows it to determine prices.

Monopsony- a type of market structure in which there is a monopoly of a single buyer of a particular type of product.

Moratorium- deferment of payments on debt obligations for a certain period or until the relevant condition is met.

Cash- funds used in cash circulation. In a modern economy, their volume is equal to the sum of coins and banknotes in the hands of the population and non-banking institutions.

Tax- a mandatory payment, a fee levied by the state or local government from citizens (individuals) or enterprises (legal entities) on the basis of special legislation.

Inflationary tax- a tax implicitly paid by consumers in an economic situation in which the government pursues policies that cause inflation. This type of tax is preferred by the government because it is less noticeable than directly increasing tax rates.

Value added tax (VAT)- a tax representing the withdrawal to the budget of part of the increase in value created in the process of production of work. The taxable amount is established as the difference between the goods sold and purchased by the enterprise.

C.O.D- a method of payment for cargo (or postal item), in which the sender instructs the transport organization (or mail) to release the cargo (postal item) to the addressee only upon payment of the declared value of the cargo.

Natural economy- a type of economy in which products are produced only for one's own consumption and not for sale or exchange.

Nationalization- transfer of property from private ownership to state ownership.

National income is a macroeconomic indicator characterizing the sum of incomes of all owners of production factors. Determined by subtracting the amount of indirect business taxes from net national product.

Inferior commodity- a product for which demand falls as consumer income increases.

Denomination - 1) nominal value indicated on securities, paper banknotes and coins; 2) the price of the product indicated in the price list or on the product itself.

Profit rate- the book profit of the company divided by the amount of equity capital, expressed as a percentage.

Normal profit- a concept used to denote the opportunity costs of the owner of capital; When calculating economic profit, it is included in costs.

Normative economic theory- that part of economics that deals with judgments about whether certain economic conditions and policies are good or bad.

Know-how- a set of technical, technological, commercial and other knowledge.

Bond- a type of securities issued by the state and joint-stock companies as a debt obligation for an internal loan. Grants the right to its owner to pay a nominal amount at a specified time and specified annual interest.

General equilibrium- a stable state of a competitive economy, in which consumers maximize the value of the utility function, and competing producers maximize the resulting profit at prices that ensure equality of supply and demand.

Public good- a good that, after being consumed by one person, is still available for consumption by other people (for example, national defense).

Joint Stock Company- an enterprise whose authorized capital is divided into a certain number of shares. Shareholders bear the risk of loss only up to the value of their shares.

Closed joint stock company- a joint stock company whose shares are distributed only among its founders.

Open joint stock company- a joint-stock company that has the right to conduct open subscription and sale of shares issued by it.

Additional liability company- a company whose participants are liable in the same multiple of the value of their contributions.

Limited Liability Company- a company that has a charter fund, divided into shares, the size of which is determined by the constituent documents, and is liable for obligations only to the extent of the value of its property. All property of the company belongs to its participants, and the company itself is in many ways similar to a joint-stock company.

Overbot- a jump in prices for a certain product due to large volumes of its purchases.

Oversold- a sharp drop in the price of a product due to large volumes of its supply to the market.

Oligarchy- the political and economic dominance of a small group, as well as this group itself. Financial oligarchy is a group of the largest owners of industrial and banking monopolies, which actually dominate the economic and political life of the country.

Oligopoly- a type of market structure of an industry in developed countries, in which the majority of sales are carried out by several firms, each of which is large enough to influence the level of market prices through its actions.

Open market operations- an instrument of monetary policy of the Central Bank, through which the purchase or sale of government treasury bills and bonds is carried out to manage the supply of money in the country.

Wholesale- transactions for the sale of goods in large quantities, when the buyer is the owner of a wholesale trading company that supplies stores or manufacturing companies with goods.

Option- a transaction with a condition - a contract under which one of the parties acquires the right (but not the obligation) to buy something in the future at a price determined on the day the contract is signed.

Offer- a formal offer to a certain person to conclude a transaction, indicating all the conditions necessary for its conclusion. The person making the offer is called the offeror.

Offshore centers- states that provide benefits in the field of financial and credit operations in order to attract foreign capital.

"Public Relations"- various activities to form a favorable public opinion about a company, product, service, etc.

Publicity- 1) fame, popularity, advertising; 2) dissemination of information about the company and its products in order to stimulate demand.

Share- a contribution paid by organizations or individuals upon joining a partnership, cooperative or other share enterprise.

Parity(currencies) - the ratio of the purchasing power of various national monetary units, calculated on the basis of a comparison of the amounts of money required to purchase the same set of goods in each country.

Passive- the totality of debts and obligations of an enterprise.

Patent - 1) certificate certifying authorship and exclusive right to the invention; 2) a document granting any right or privilege (for example, the right to engage in trade).

Pauperism- poverty (massive) of the working masses, lack of necessary means of subsistence; is a consequence of increasing exploitation of workers and unemployment.

Lump sum- taken in bulk; general, without differentiation of constituent elements (tax, duty, payment, etc.).

Penya- a type of penalty, a sanction for failure to fulfill monetary contractual obligations, which is accrued for each day of delay as a percentage of the amount due.

Variable costs- costs depending on the quantity of products produced (costs of raw materials, materials, wages, etc.).

"Pyramid"- a method of profit used by financial companies. The funds received by the company from the sale of securities are partially paid in the form of dividends to those persons who purchased the securities earlier, and are also used for large-scale advertising and as income for the financial company.

Floating exchange rates - a regime of freely fluctuating exchange rates, based on the use of a market mechanism of currency regulation; one of the structural principles of the modern world monetary system.

Positive economic theory is that part of economic science that studies facts and the relationships between them.

Positioning is the development of a marketing and advertising mix that ensures that the offered product is clearly distinct from other products and has a competitive position in the market, as well as in the minds of target consumers.

Purchasing power is the ability of a monetary unit to be exchanged for a certain amount of goods.

Tight money policy is a monetary policy of the Central Bank in which it sets high interest rates and sells government bonds on the open market to reduce the money supply. Carried out in conditions of inflation.

Full employment is the level of employment of labor resources, characterized by the absence cyclical unemployment. This is achieved if only frictional and structural forms of unemployment take place in the economy.

Fixed costs are part of gross costs that do not depend on production volumes.

Potential national income is the amount of real national income that could be produced if all factors of production were fully employed.

A consumer basket is a set of food and non-food products, housing and communal services, cultural and educational, health care and other paid services necessary to satisfy human physiological needs. The consumer basket is assessed in current prices for goods and tariffs for services. The size of the minimum consumer basket is determined by the set of goods and services necessary for the reproduction of the labor force of an unskilled worker and his dependents.

Needs are those goods and services that people would like to have if they did not have to pay for them or for which they had enough money.

A duty is a type of consumption tax levied on those individuals or legal entities that enter into economic relations with the state or among themselves.

Limit value - an increment (increase) in the value of an economic indicator due to an increase by one unit in the factor on which this indicator depends.

Marginal cost is the cost associated with producing an additional unit of output.

Marginal revenue is the additional income a firm receives when its product sales increase by one unit.

Marginal product is the additional product or output created by an additional unit of any factor of production, provided that other factors of production remain constant.

Entrepreneurial activity is an independent initiative activity of citizens aimed at making a profit through the effective use of factors of production.

An enterprise is an independent production and economic unit created for the purpose of making a profit; in market conditions, an enterprise is called by the company.

Price-list- a reference book of prices for products, goods or services.

Press release- information about a product, company or reseller, distributed for possible publication in the press.

Surplus value- part of the cost of goods produced in enterprises, which is created by the unpaid labor of hired workers.

Profit- economic value, defined as the difference between total revenue and total costs; excess of income over expenses.

Profit is normal- remuneration to the entrepreneur sufficient to support activities in the chosen direction.

Economic profit- the difference between gross income (gross revenue) and economic costs release of a given volume of products.

Privatization- the process of transferring state and municipal property into private ownership for a fee or free of charge.

Living wage- the level of income necessary for a person to purchase an amount of food not lower than physiological norms, as well as to satisfy, at least at the lowest level, his needs for clothing, shoes, housing, transport services, sanitation and hygiene items. It is calculated based on the consumer basket for various population groups.

Labor productivity- indicator of productivity, labor efficiency; characterizes the amount of products produced per unit of time, or the time spent on producing a unit of product.

Prolongation- extension of the validity period of a contract, agreement, loans, etc.

Proportional tax- a tax whose average rate remains unchanged as the taxpayer's income increases or decreases.

Protectionism- government foreign trade policy aimed at increasing barriers to trade with other countries. Instruments of protectionism are tariffs and quotas, which are introduced to protect domestic producers from foreign competition.

Percent(loan) - payment for a loan; price for using borrowed funds.

Direct taxes- taxes levied directly on the income or property of the taxpayer.

A pool is an association of enterprises that is temporary in nature.

Paragraph- a unit of measurement when comparing relative values expressed as a percentage. For example, in the base year the growth rate of national income was 2.5%, and in the reporting year it decreased to 1.4%, i.e. by 1.1 points.

Dividing the pile- specialization, differentiation of labor activity, leading to the emergence and existence of its various types.

Ramburs- 1) payment of debt through a third party; 2) in international trade - payment for purchased goods through a bank.

Rentier- a person living on rent - on interest from a capital loan or on income from securities.

Future expenses- costs incurred by enterprises in the reporting period, but subject to inclusion in the cost of production in subsequent periods.

Real income- the number of goods and services that can be purchased with your nominal income.

Revaluation- an increase in the exchange rate of a monetary unit in relation to the currencies of other countries, carried out by the state in an official manner.

Regressive taxation- a taxation system in which the average tax rate decreases (increases) as the taxpayer's income increases (decreases).

Reinvestment- repeated, additional investments of funds received in the form of income from investment operations.

Renovation- the process of updating morally and physically worn-out fixed assets.

Rent- income received from land, capital, property and does not require entrepreneurial activity from its recipients. The most common is ground rent.

Profitability- one of the main indicators of enterprise performance. It is calculated as the ratio of profit to production cost.

Report- an exchange forward transaction for the sale of securities (or currency) to a bank with the obligation of subsequent repurchase after a certain period at a new, higher rate; the difference between the sale and purchase price is also called the report.

Restriction- 1) restriction of production, sales and exports in order to inflate prices for goods and obtain high profits; 2) restriction of loans from the Central Bank to commercial banks of the country.

Refinancing government debt- payment by the government to holders of maturing government securities of money received from the sale of new securities, or the exchange of redeemed securities for new ones.

Recession- a decline in production or a slowdown in its growth rate for two or more quarters in a row.

Recipient- an individual, legal entity or state receiving any payment. The term is applied, as a rule, in relation to countries that are objects of foreign investment (host countries).

Realtor- real estate agent.

Royalty- a form of licensing fee, carried out as periodic percentage payments, most often from the cost of products produced under a license.

Market- the sphere of exchange of goods and services between sellers and buyers.

Buyer's market- a market situation characterized by the fact that the supply (of producers and sellers) of a product exceeds the demand for it at current prices.

Seller's Market- a market situation characterized by the fact that the demand for a product exceeds its supply.

Market economy- a way of cooperation between people in the economic sphere, based on a commodity economy and presupposing for everyone the freedom to choose a transaction partner and the freedom to set prices for their goods.

Racket- extortion of state or personal property, money through threats, blackmail and violence.

Balance- the difference between cash receipts and expenses for a certain period of time.

Swap- an operation to exchange national currency for foreign currency with the obligation of reverse exchange after a certain period.

Cost price- the amount of costs (in monetary terms) for the production and sale of a unit of product or the entire volume of its output, for the performance of work and the provision of services.

Market segment- a set of consumers who react identically to the same product (service).

Seleng- one of the types of leasing. In this case, money is rented without changing ownership rights. Only the profit made from the transaction is taxed, not the entire amount (unlike a loan).

Certificate- 1) a document certifying this or that fact; 2) bonds of special government loans, as well as bearer securities issued by the bank.

Syndicate- one of the forms of monopoly - an association of homogeneous enterprises created for the purpose of marketing products through a common sales office, organized in the form of a special trading partnership, with which each of the syndicate participants enters into an agreement on the same terms for the sale of their products.

System of National Accounts- a set of interconnected balance sheets designed to calculate the volume of income consumption, savings and capital expenditures.

Own- the right of a citizen, company or state, recognized by society and protected by law, to own, use and dispose of any property or economic resource.

Aggregate offer- the sum of individual offers of many goods and services in the economy, measured by the volume of the national product.

Aggregate demand- the sum of individual surveys of all consumers in the economy for the entire volume of national production characterizes total expenses in the economy.

Aggregate demand for money- the total amount of cash that economic entities hold for transactions and for preserving wealth (savings). Depends on the level of national income and interest rates.

Social market economy- a social system in which the state actively supports the development of free competition, helps to reduce conflicts between employees and employers, and also implements extensive programs to support socially disadvantaged groups of citizens.

Specialization- concentration of production in the hands of the most efficient worker (firm).

Spot- a type of transaction for cash goods or currency, involving immediate payment and delivery.

Demand- the effective need for the amount of goods that people want and can buy at a given price.

Demand for money to make transactions transaction demand - the amount of cash that households and firms want to have for use as a medium of exchange and which is determined by the level of nominal GDP.

Demand for money as a precaution- the amount of money people keep in cash for unexpected expenses. Depends on income level.

Demand for money from assets, Speculative demand is the amount of money people want to hold as savings to benefit from transactions in financial and real assets. Depends on the interest rate level.

Average propensity to consume- the share of disposable income that households spend on consumption.

Average propensity to save- the share of disposable income that households save.

Demand is elastic- demand in which an increase in the price of a product leads to such a drop in the volume of demand that the total costs of buyers for this product decrease.

Demand is inelastic- demand in which an increase in the price of a product leads to such a drop in the volume of demand that the total costs of buyers for this product increase.

Comparative Advantage- the country's advantages in the production of goods, due to lower opportunity costs compared to other countries.

Tax rate- the amount of tax per unit of taxation.

Interest rate- the amount of payment for the loaned money and material resources paid by the borrower to the lender.

Stagnation- stagnation in all economic activities (in production, trade, etc.).

Stagflation- the state of the country’s economy, characterized by stagnation with the simultaneous development of inflationary trends.

Insurance- a form of accumulation of funds and reduction of the risk of expenses in the event of events undesirable for a person or company, based on the insurance company accepting the risk from economic transactions.

String- a set of lots at an auction, formed by goods of similar quality and having a common representative sample.

Structural crisis- imbalances covering two or more sectors of the economy and leading to structural unemployment.

Subvention- type of cash benefit from the state to local authorities; unlike a subsidy, it is provided to finance a specific event and is subject to return in case of violation of its intended use.

Subsidy- non-refundable state monetary assistance to producers of goods, designed to stabilize prices for their goods or help avoid ruin and continue their activities.

Consumer sovereignty- the right of owners of any types of resources (land, real estate, labor, money) to independently make decisions related to the disposal of these resources and their use.

Producer sovereignty- the right of a citizen or a company to independently determine what and in what quantity they will produce from existing at their resources, as well as to whom and at what prices the manufactured goods will be sold.

Customs- a government agency that controls the import and export of all goods passed across the country’s border, including luggage, postal items and all cargo, including transit.

Customs duty- tax on goods passed across the border. Distinguish imported And export customs duties.

customs tariff- a list of customs duties systematized by product groups.

Bonus- remuneration paid as a percentage of profits to directors and senior employees of joint-stock companies, banks, and insurance companies.

Targeting- establishing targets for regulating the growth of money supply in circulation.

Rate- a rate system that determines the amount of payment for production and non-production services.

Hoarding- accumulation (folding) of paper money by the population. Gold hoarding in the broadest sense means the creation of countries' gold reserves by central banks.

Rate of increase- the ratio of the increase in the value of an economic indicator to its initial level.