Order t 11a sample filling. Order on bonuses for employees

An order to reward an employee is issued when management wants to recognize the conscientious work of its employee. For your convenience, we have collected in one article completed samples of such orders in forms T-11 and T-11a.

Sample and form of an order to encourage an employee. Form T-11

Completed sample order to encourage an employee

Form

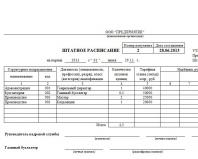

Sample and form of an order to encourage employees. Form T-11a

Sample

Form

Such an order is drawn up on the basis of a submission, petition or memo from the employee’s immediate supervisor.

As an incentive, a cash bonus, a valuable gift, a letter of gratitude, a certificate of honor, etc. can be given.

An incentive order can be issued in free form on the company’s letterhead, or an employee of the secretariat can use the unified form T-11 and T-11a (to encourage a group of employees).

Rules for filling out an order to encourage employees

The order form for rewarding one employee (form T-11) contains:

- “header”, which indicates the name of the organization, its OKPO code, document number and date of its publication.

- the actual text of the order, which indicates the full name, personnel number (if assigned), position, structural unit of which the employee is a member; motive for the award (for what - for conscientious work, high production performance, in connection with an anniversary, for length of service, etc.), type of award, amount indicated in words and figures, if it is a monetary reward; the basis for issuing an order is a petition, presentation, memo, etc.

The order is signed by the head of the enterprise.

The employee to whom the incentive is assigned also signs the order, confirming that he has read the document.

A bonus is one of the main types of employee incentives. On the other hand, this is a type of financial transaction that must be reflected in documents, for example, in an order for bonus payments to employees. A sample and instructions for compilation are in this article.

The specifics of the bonus are determined by 2 points:

- This is a voluntary act of the employer, i.e. This is his right, not his duty. As a rule, the employment contract stipulates that the company can provide bonuses to the employee, which in practice implies only one possible case - the initiative of the employer.

- On the other hand, there are no uniform rules for calculating bonuses: i.e. The legislation does not provide for the mode, amount and specifics of payment (on the day of salary or advance payment).

Thus, as for the very fact of paying the bonus, the procedure for this procedure, all this is the good will of the company, and specifically of the authorized persons who have the right to make the appropriate decision. That's why responsibility arises only for the correct execution of this financial transaction in the documentation. Exceptions are those cases when the employment contract initially specified the amount of the bonus and the procedure for paying it to the employee.

NOTE. According to labor law, the bonus is a component of the salary. Accordingly, it can only be issued on those days specified in the employment contract.

Procedure for drawing up an order largely depends on the size of the enterprise and the number of its staff: if bonuses for employees in a small company can be organized literally in 1 day, then in a large division the procedure is much more complicated. In general, the order is as follows:

- All heads of branches and separate divisions are notified of the need to prepare for bonuses and, in response, draw up initial lists of employees indicating the position, full name and grounds for the possible accrual of bonuses.

- According to the declared employees, authorized persons are studying the possibility of bonuses in each specific case in accordance with the internal regulations of the companies (fulfillment of the plan, performance indicators, etc.).

- Based on this analysis, the list is adjusted or left unchanged and distributed to all departments.

- The final version is transferred to the draft order, after which the finally approved document on bonuses for employees is printed.

- Each employee included in the list familiarizes himself with the document and must sign.

If some types of bonuses are awarded annually, quarterly and even monthly, others may be allocated on an extraordinary basis. That's why classification of orders depends on the order of awarding:

- mass and isolated cases – i.e. immediately to the entire team (or department) or individual colleagues for individual successes;

- planned (periodic) and unscheduled (irregular) - depending on the financial capabilities of the company, bonuses can be issued constantly or only in individual cases.

These payments are classified depending on the reason for the premium:

- Holidays – this often includes corporate gifts in the form of additional payments for the New Year, March 8, as well as a professional holiday.

- Production – i.e. for services related to the implementation of the plan, the implementation of effective measures that improve the work process, optimize production, help save resources, etc.

- Organizational in nature – i.e. awards for successful preparation and implementation of certain events in the interests of the company. For example, a seminar, a round table on an issue, a meeting of clients or guests from abroad, organizing a corporate event, etc.

NOTE. The bonus can be awarded not only in connection with labor successes, but also in connection with holidays, i.e. the employer himself has the right to choose the basis. However, such payments are not intended to help an employee in a difficult life situation. Then we are talking about providing financial assistance. Therefore, most often a bonus is understood as an additional payment exclusively for labor achievements, which, at the same time, can be timed to coincide with holidays.

Sample and examples of filling out an order 2020

Form T-11.

Form T-11a.

The employer has the right to use any form or develop an independent design option. The main thing is to correctly reflect the transaction in accounting documents and other financial papers. The main requirement for content is to whom the bonus is awarded, in what exact amount and on what basis. Usually the order also reflects the name and position of the person who is responsible for its implementation.

An example of a bonus order (in the case of payment to two employees) could be like this.

Thus, the document includes:

- Title - a header with the usual information: full name of the company, number, date and name of the order.

- The main part, which lists the persons awarded the bonus (full name, position, personnel number), the basis for the issuance and the amount of the amount. In this case, the size can be indicated either in numbers or as a percentage (for example, 10% of the salary). It is also stated here on the recommendation of which employee the bonus is awarded if there was a business recommendation.

- The manager’s signature, date and annex with the signatures of all awarded employees confirming the fact that they have become familiar with the award.

Which is better – a ready-made form or your own?

As a rule, it is more convenient to use a ready-made form, since it provides:

- convenience in terms of design - no need to waste time developing your own sample;

- ease of working with the document in the accounting department - all key details are already registered;

- and most importantly, thanks to the indication of details, the inspectors will have fewer questions about bonus payments, which in large companies can amount to large amounts - on the order of hundreds of millions of rubles.

Employee bonuses: 6 risks for the employer

Since issuing a bonus is a financial transaction, there are certain risks on the part of the inspection inspectors. They concern, first of all, tax inspectors, but often come from representatives of the labor inspectorate.

Risk 1. Incorrect wording in the employment contract

Often, an employer indicates that its employee with whom the contract is concluded is entitled to a monthly or quarterly bonus in a set amount, for example 15% of his salary. In this case, the bonus in fact becomes an integral part of the salary, since the employer pays it within the agreed terms and in the established amounts, the obligations of which he himself has assumed. It is more correct to reflect the fact of payment in the category of “right” rather than “obligation” of the employer - otherwise, in essence, it is no longer a bonus, but a salary.

Risk 2. Payments of “13 salaries”

A bonus at the end of the year in the amount of the entire average salary or a significant part of it is traditionally called the “13th salary.” There is no such concept in the law; accordingly, such a bonus is the exclusive goodwill of the employer. But again, it is important to correctly reflect it in the employment contract (individual and collective), as well as in the local internal acts of the enterprise. At the same time, only references to these acts can be indicated in contracts, and the payment procedure must be spelled out in as much detail as possible in the acts:

- connection between salary payment and employee performance indicators;

- the possibility of non-payment of this type of premium with a detailed description of the entire list of reasons, including due to an economically unfavorable situation;

- It is especially important to pay attention to the procedure for payment upon dismissal: should the employee work the whole year or not, how to pay if the dismissal occurs due to layoffs, liquidation of the company, etc.

Risk 3. Holiday bonuses

Such payments are considered by most managers as symbolic gifts in the amount of 500-1000 rubles. Therefore, attention is often not paid to this point, and everything comes down to the wording “The employer pays each employee a bonus of 1000 rubles annually by March 22 – the company’s Founding Day.” In this case, it is better to protect yourself from financial risks and indicate that the company undertakes to do this only if possible, and also reserves the right not to pay a bonus if the employee grossly violated the work schedule, etc.

Risk 4. Bonus amount and working hours

One should also take into account the important point that not all employees work the standard/quarterly/monthly hours due to various circumstances - vacations at their own expense, sick leave, maternity or child care leave, etc. Therefore, the amount of the bonus, as well as the very possibility of its payment, should be closely and unambiguously linked to a certain norm: for example, at least 180 working days.

Risk 5. Deduction of bonuses and deprivation of the right to a bonus

These concepts are widely present in real labor practice, however, confusion often arises with the interpretation both in documents and at the level of oral explanation by management of company standards for employees. In an employment contract, collective agreement and other documents, it is important to clearly distinguish both concepts. If deprivation of bonuses is a measure that is legally taken by the employer in the event of a significant mistake made by an employee while performing his duties, then deprivation of the right to a bonus may also have purely economic, objective reasons. Usually all these nuances are spelled out in detail in local acts.

Risk 6. How to properly develop premium reduction mechanisms

Both the grounds for accrual/non-accrual of the premium and the grounds for its justified reduction should be specified in the local act in great detail. It is best to give not specific numbers (a reduction of 500 rubles, etc.), but percentages - for example, “if an error is made when servicing a client, which leads to his refusal to cooperate, the monthly premium is reduced by 10% from the initially established amounts." Most often, the size of the reduction is set using a simple formula - proportional to the extent to which the plan was fulfilled, and it is important to take into account not only individual indicators, but also the connection with the performance indicators of the department and the entire unit. This is especially true for large companies.

Thus, it is better to foresee all the key points given in advance. The main criterion for the correct procedure for awarding bonuses to an employee is drawing up orders and contracts in such a way that he himself can calculate the amount of payment at any time. Those. The calculation of the premium must be extremely transparent, and the grounds for payment or non-payment must be extremely clear.

Regulations on bonuses

The features of the procedure can be reflected in the following documents:

- Regulations on bonuses.

- Individual and collective labor contracts.

- Relevant local acts.

At the same time, the contracts do not need to spell out in detail the entire procedure, which itself should take up several printed pages, but only refer to a document that contains the relevant information. Wherein it is important to familiarize each employee with the Regulations on bonuses against signature.

Thus, the scheme for establishing a bonus procedure may look like this.

An order for bonuses is a document issued by the management of an enterprise if it is necessary to reward subordinates. The reason for issuing an order can be a variety of reasons: exceeding the plan and production standards, high labor results, quality of work performed, etc.

An important clarification: bonuses do not at all mean rewarding an outstanding employee or group of employees with monetary amounts only. The bonus can be a written thank you from management, a certificate, or some other type of material incentive.

It is difficult to overestimate the role of bonuses: this form of recognition of employees’ services to the organization is a powerful incentive for their further fruitful and effective work.

FILES

Bonus system at enterprises

In many organizations, provisions on bonuses are contained in the collective agreement or other separate regulations. They specify the reasons, conditions, form, size and procedure for issuing bonuses. If there is no such document in the internal policy of the enterprise, then bonuses can occur on an individual basis, based on a simple written order from the director.

Basis for issuing the order

Any order issued by the management of an organization must always have a documentary basis. In this case, it is usually a presentation or report from the head of a structural unit, which indicates an employee or group of employees who have achieved certain successes in their professional activities.

Who is drafting the document?

As a rule, the execution of such orders is the responsibility of a legal adviser, a specialist in the personnel department, the head of a structural unit or, in extreme cases, the secretary of the enterprise. And regardless of who is filling out the document, it must be submitted to the director of the organization for approval.

Basic rules for placing an order

As the current law states, an order for bonuses can be issued in a free form. However, many enterprises and organizations continue to actively use previously approved and generally applicable

- form T-11(if one employee is nominated for a bonus)

- or form T-11a(if bonuses are intended to be given to a group of employees).

Both of these forms are quite similar in both structure and content.

The adherence to the “old” forms is quite understandable: they include all the necessary data, including information about the employer and the employees being awarded, information about the reason for the bonus and the award itself, etc.

The order can be issued in two versions: either in writing, by hand, or in printed form. But no matter which one is chosen, it must always contain the original signature of the manager and the signatures of the awarded employees.

A document is being drawn up in a single copy, which serves as the basis for further actions in relation to the awarded employees.

After registration, the order must be registered in the internal document register, then transferred first to the accounting department, and then for storage in the company’s archive.

Example of filling out order T-11

Standard forms T-11 or T-11a are quite simple and understandable, so they should not cause any difficulties when filling out.

In the first part of document T-11, which was developed for bonuses for one employee, the full name of the company, OKPO code (in accordance with registration papers), as well as the order number for internal document flow and the date of preparation are indicated first.

Then in the form you need to enter the last name, first name, patronymic of the employee, his personnel number (if such records are kept at the enterprise), the name of the position and structural unit (site, workshop, team) in which the applicant for the award works.

In the second part of the order, you must indicate the motive, i.e. the reason for the award, then its type, and if it is a sum of money, then its exact amount (in words and figures).

In line " Base» a specific document is written on the basis of which the bonus is awarded (its date and number, if one was assigned).

Finally, the order is signed by the head of the organization, dated, and then handed over to the awarded employee for review and signature.

Example of filling out order T-11a

This order form is filled out when a group of employees is expected to receive bonuses.

The first part of form T-11a almost exactly repeats the contents of form T-11 and is also filled out in the same way. The difference is that the full name and department in which a particular employee works is not indicated here, but instead the incentive motive and its type are written.

In the second part of the document, first there is a table in which the full name of each bonused employee, his personnel number, as well as the structural unit to which he belongs are entered in order (it should be noted that employees may belong to different departments of the enterprise). Then the position of the employees and the amount of bonus due to each of them is indicated (the amount of the bonus may vary).

Then in the line below it is entered again base, with reference to the date and number of the document, as well as the signature of the manager. After the order is approved by the director, it is handed over to each employee for review, who must put his signature in the appropriate table opposite his last name.

Copy URL

Current legislation gives the right to draw up an order for bonuses in a free manner. However Many companies and organizations still use the long-accepted and applied:

- Form T-11 (in case of promotion of one employee);

- form T-11a (when a certain group of employees is awarded bonuses).

Other types of material gratitude

Both the T-11 form and the T-11a form are very similar in structure and content.

The habit of the old design is quite natural, since they contain everything that is necessary when drawing up (here is information about the employer and the employees being rewarded, and information about the motives for the award, etc.).

The document can be prepared in two ways: in writing (by hand) or in printed form. In principle, this does not matter, the main thing is that the order contains the original signatures of the manager and the employees being awarded.

A single copy is required to draw up the document. It will serve as the basis for further actions in the situation of rewarding employees.

Important! Upon completion of the order, it is necessary to register it in the internal journal of documents, then transfer it to the accounting department, then for safekeeping in the organization’s archive.

In addition to bonus payments, material gratitude also implies other things:

- a small supply of paid vacation days;

- compensation for health-improving business trips and vacation vouchers;

- personal allowances for long-term employees;

- borrowing money without interest to buy a home;

- payment for specialized classes, conferences, exhibitions.

An employee may be offered training paid for by the employer's company as an incentive. However, payment for training is not a bonus. This is the employer’s duty, but not his right, of course, if the requirements of the law are met (the educational institution has state accreditation, and such education is being mastered for the first time).

Where and how can I obtain forms?

The HR department handles the promotion process. If there is a local regulatory act that spells out all the nuances of incentives, the preparation process goes faster. In its absence, PVTR (internal labor regulations) is usually used.

Each company may develop its own way of issuing incentive orders. Nevertheless, it is similar to the established document flow scheme, but differs slightly in relation to submissions for promotion. The head of the organization or another authorized person makes a verdict on rewarding the employee.

Attention! The document containing the request for incentives follows from the personnel service to the directorate, where the proposed decision is implemented through a resolution.

According to custom, before a decision is made, the submission is endorsed by a representative of the personnel officers. In the case of material remuneration - the chief accountant of the organization.

What sections do they consist of?

Title

At the beginning of the document, information about the organization (its originator) and initial information about the order are included.

The name of the organization is written in all official documents (and in the order on promotion too), according to the designation enshrined in the constituent documents (including foreign names and abbreviations).

In the presence of abbreviations, the full name comes first, followed by the abbreviation in brackets.

This is the main section of the document where the whole meaning and application is contained:

Who does the compilation?

Registration is the responsibility of a legal adviser, personnel specialist, head of a structural unit or (rarely) the secretary of the enterprise. All of them are required to submit the document for approval to the director of the enterprise.

Instructions for filling out forms

There are two cases of filling out a bonus order:

- unified forms T-11 and T-11a, approved by the State Committee of the Russian Federation on May 5, 2004;

- a form written at your own discretion, constructed and secured by a specific organization.

All of them have legal force (because from October 1, 2013, the use of exclusively precise design has been canceled) and must contain specific information:

- Document name.

- Date of preparation.

- Name of company.

- Witnessing:

- Full name of the employee;

- his position and structural unit;

- basis for incentives;

- its forms;

- payment amounts;

- promoting encouragement.

T-11

At the beginning you need to write:

- Name of the organization;

- unique OKPO code (corresponding to the registration document);

- unique number (according to the rules for writing document flow).

- Full name of the employee.

- His personnel number.

- Position and separate division.

The second part contains the type of incentive and its size. In the “Bases” section it is written:

- The document on which the award is drawn up.

- Date of compilation of this document and number (if present).

At the end, the signature of the manager with the number and the signature of the employee himself.

T-11a

Now about issuing orders and instructions on encouraging employees:

Now about issuing orders and instructions on encouraging employees:

- The beginning is almost the same as in T-11, with the exception of omitting the employee’s full name with his information about the work (the reasons and type are immediately written).

- The next section of the order contains tables with the full names of employees, their personnel numbers and structure. divisions.

- Next, the corresponding positions and the amount of bonuses for each are written.

- At the end, the basis is indicated with reference to the date on which it was issued, the unique document number, the signature of the manager, familiarization of the employees and their signatures.

Note! For a small enterprise, it is best to use a free form to issue an order to encourage an employee and not waste important resources on studying this issue.

But if the organization is engaged in medium, large business, or wants everything to be done according to standards, then in this case forms T11 and T-11a would be an excellent choice.

Video on the topic

Video about why it is necessary to draw up a bonus order and how it is filled out:

Didn't find the answer to your question? Find out, how to solve exactly your problem - call right now:

The head of the organization issues an order for incentives (bonuses or awards). This order is issued in the personnel department using the unified form No. T-11 or T-11a (for a group of employees). The order serves to document the fact of rewarding employees. Information from the order is entered into the employee’s personal card.

The unified form No. T-11 was approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

(Submit documents without errors and 2 times faster by automatically filling out documents in the Class365 program)

How to simplify work with documents and keep records easily and naturally

See how Business.Ru works

Login to demo version

How to fill out an incentive order correctly

An employer can reward its employees for the impeccable performance of their duties, conscientious work, and more. Encouragement can be expressed in the form of gratitude, a cash bonus, a certificate of honor or a valuable gift, as well as in the form of a nomination for the title of the best in their profession.

In order to give an employee a bonus, the head of the enterprise issues a special order to reward the employee. The basis for it is usually a petition from the head of a particular division of the company, but it can also be other documents confirming the merits of the recipient (for example, confirming his work experience at the enterprise). As for the order itself, here you don’t have to invent or invent anything. The document is not only unified, but also approved by the State Statistics Committee.

You will need a standard T-11 form. You need to enter the name of the company in it as it is written in your constituent documents. If you are an individual entrepreneur, enter your OKPO code in the employee incentive order. The document number and date of the order are entered in accordance with current data.

In the order to reward an employee, you must also enter the personnel number of the employee whom you want to reward, his full last name, first name and patronymic, the name of the department (structural unit) where he works, and the name of the position (according to the staffing table).

The incentive motive is written with a small letter. This could be, for example, “high achievements in work”, “conscientious performance of official duties”, etc.

In the “grounds for promotion” field, enter the name of the basis document (for example, a petition from the head of a department).

Now all that remains is to sign the document. The first person to do this is the head of the organization, its first person - he enters the name of his position (for example, general director, chairman of the board of directors or president), surname and initials and signs. After this, the order is certified by the company’s seal.

After reading the incentive order, the employee also puts his signature on it and indicates the date of signing.

Get started with Business.Ru right now! Use a modern approach to business management and increase your income.

Connect for free to Business.Ru