Document order to encourage an employee. Order for awarding a certificate of honor: sample

The employer can use incentives as a good motivation for an employee to achieve increased work efficiency and discipline. In this material we outline how to correctly draw up an order to reward an employee. We will also provide the completed sample.

What are the employee incentive measures?

To increase labor discipline and production indicators, various organizations often practice comprehensive measures of incentives for work and punishments for shoddy work. If we rely on the Labor Code of the Russian Federation, in particular Article 191, on the part of the employer, incentives for employees can be expressed in the following:

- appointment of a bonus;

- formal thanks;

- donating a valuable item;

- highlighting an employee as the best in the team;

- issuance of a certificate.

Bonus rules

Most often, employers use a bonus system to reward employees. In order to create such conditions in his organization, the manager should:

- calculate the amount of remuneration;

- plan the conditions for issuing bonuses;

- think over the procedure for their calculation;

- highlight the necessary indicators and criteria.

The amount of the bonus is specified in the employee incentive order. It can be expressed:

- as a fixed value;

- as a certain percentage of salary.

Another calculation option is using the entered surcharge factor.

The mentioned reward order can be issued as a reward for increased labor productivity and various achievements.

Such a bonus should be organized on the basis of calculated performance indicators. If this information is correctly defined and provided to staff, employees will see clearly defined goals, rather than a vague concept of hard work that must be achieved in order to receive a raise.

So, for example, for a call center operator this may be a certain number of successful calls.

Let us remind you once again that it is imperative to specify the incentive motive in the order. An example is an increased number of sales or manufactured products over a certain period of time.

Incentive procedure

The type of remuneration in question is drawn up in the form of an order to reward the employee on form T-11 (approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1).

The basis for the publication of this document is:

- title business paper;

- reports on the employee's work done.

Another criterion may be a memorandum of encouragement for the employee, a sample of which is prepared in free form. Typically, these documents come from the immediate supervisor assigned to the employee.

Persons to whom it is decided to apply incentive measures must be familiarized, against signature, with a sample order to encourage an employee drawn up in their address.

In addition, this document becomes the basis for making a note in the work book, which should be done in a timely manner - no later than 7 calendar days. Moreover, the entry in it must fully correspond to the text in the order. Additionally, information about the incentive is entered into the employee’s personal file.

This document should mention:

- full initials of the employee - last name, first name and patronymic;

- his personnel number;

- job title;

- the department in which he works;

- reasons for incentives - success in sales, birthday, etc.;

- the selected type of incentive - gratitude, certificate, gift or bonus amount.

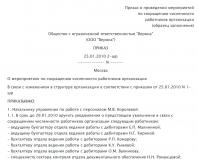

Below is a completed sample order for rewarding an accounting employee for the first half of 2017.

One of the forms of recognition of the labor merits of enterprise employees is monetary or other incentives. The use of incentives is a right, not an obligation, of employers. The decision is made solely by the employer, based incl. from the financial capabilities of the organization. For this decision to come into force, it is necessary to approve the order to reward the employee.

For what purpose does the employer encourage employees?

Personnel bonuses are regulated by a number of articles of the Labor Code of the Russian Federation (Articles 135, 191 of the Labor Code of the Russian Federation). But labor legislation does not say anything about the amount and frequency of payment of monetary remuneration, as well as the method of payment. The incentive motive in a bonus order may be as follows:

conscientious performance by the employee of the duties assigned to him;

increasing labor efficiency;

high achievements in work;

long and impeccable work in the company, etc.

Also, the motivation for the order may be related to labor achievements in a certain industry or professional holidays. For example, an order to reward a teacher may contain the wording “for efficiency in methodological work and high performance indicators”; bonuses for builders may be made “in connection with high performance indicators and a professional holiday - Builder’s Day”, etc.

Art. 191 of the Labor Code of the Russian Federation provides not only for the payment of cash bonuses to employees, but also for other incentive options: awarding a certificate of honor, presenting a valuable gift, declaring gratitude, nominating for the title “Best in the Profession.” It is desirable that the process of rewarding employees be public and carried out in a solemn atmosphere. Thanks to this, other employees will have a motive to increase their work efficiency.

The procedure for issuing incentives must be prescribed in the internal documentation of the organization (“Regulations on Bonuses”, Internal Rules, etc.).

Order of encouragement

The promotion order, a sample of which can be found below, applies to orders for personnel. If the implementation of this order is related to bonuses, it must be transferred to the accounting department. The shelf life of the order is 75 years.

In organizations, incentive orders are usually drawn up in form No. T-11 or T-11a (for several employees at once). The unified form of the incentive order was approved by Resolution of the State Statistics Committee of January 5, 2004 No. 1. The document can also be drawn up in free form.

The procedure for encouraging staff is as follows:

the head of the unit or trade union body sends a memorandum (or decision of the trade union) to the management of the organization on awarding a specific employee;

the management of the organization puts a mark on the document about the decision made and indicates the deadline for its implementation;

HR department employees issue an order to reward employees and submit it to senior management for approval;

After the order is approved by the manager, the employee must be familiarized with it against signature.

Unified document form: is it mandatory to use?

From January 1, 2013, it is not necessary to use the forms of documents approved by law contained in the “Albums of Unified Forms” (with the exception of some primary documents). There is also no ban on their use. In this regard, non-governmental organizations have the right to decide whether to use unified forms or use document forms developed independently (Information of the Ministry of Finance of Russia No. PZ-10/2012).

The order of encouragement is an important accounting document, therefore it must indicate the details established by law, in accordance with Art. 9 of Law No. 402-FZ of December 6, 2011 “On Accounting”.

Drawing up an order using the unified form T-11

An order for a bonus (monetary or otherwise) to an employee of an organization in form T-11 is filled out as follows:

At the top of the document indicate the name of the organization and OKPO code.

Information about the rewarded employee is entered (full name, position, structural unit, personnel number).

The motive and type of incentive are indicated.

If the incentive is of a material nature, indicate the amount of monetary reward (in numbers and in words). If the incentive is not monetary, this line can be removed from the document.

Then you need to indicate the name of the document that became the basis for drawing up the order (representation, petition, trade union decision, etc.).

The order for monetary incentives (or otherwise) is signed by the head of the organization. The employee referred to in the order must read the document and sign. The order must also be familiarized with the signature of the person responsible for calculating bonus payments or for processing other employee incentives (for example, the chief accountant, head of the human resources department, etc.).

Drawing up an order in any form

In order for the order to have legal force, it must indicate the following information:

Title of the document;

number and date of compilation;

name of the legal entity or individual entrepreneur;

FULL NAME. and the position of the rewarded employee;

incentive motive and its type;

for a cash bonus - its size (in numerical form and in words);

FULL NAME. and the position of the person approving the order.

The procedure for familiarizing yourself with the order is similar to that given above.

The most effective way to motivate an employee to achieve excellent results is to evaluate his work and recognize personal achievements through personal encouragement. This must be implemented through an official administrative document. This document is related not only to personnel records, but also to financial ones. The order serves as primary accounting documentation, the preparation of which has specific requirements. Let's look at how to correctly prepare an order in general and using the completed sample as an example.

Employee incentives: options

Is your employee doing a good job? You, as an employer, have the right to individually reward him. This possibility is provided for at the legislative level. Incentives under Article 191 of the Labor Code of the Russian Federation are possible:

- cash payment - bonus;

- in a material way - the presentation of a valuable gift;

- in an intangible way - an announcement of gratitude, awarding a diploma of honor, nomination for the title of the best in the professional field.

The list of awards for labor success can be expanded, for example, it could be an award with a tourist voucher, or placement of a photograph on the honor board. Other types of incentives are provided for by the collective agreement, labor regulations and discipline, and the organization’s Charter.

An employer can apply several types of awards at once. For particularly outstanding labor services to the state and society, nomination for state awards is provided.

Important: rewarding an employee is an individual incentive; monthly bonuses regulated by the internal bonus procedure do not apply to it.

In order for bonus payments to be classified as incentive payments, specific circumstances for their assignment must be approved, for example:

- achieving a certain length of service in general and at a given enterprise in particular;

- birthday, anniversary date of the recipient;

- high performance indicators, etc.

The incentive motive must be indicated in the incentive order.

Read about what personal and professional competencies of a director influence business development and increased team productivity in the following articles:

Preparatory procedure

The issuance of an order for encouragement precedes a submission for encouragement, drawn up in any form. The immediate superior of the awarded employee indicates in the memo:

- personal information about the person being promoted (full name, division, position, personnel number);

- data on length of service, career movements, achievements, awards;

- characteristics of personal and business qualities.

After reading the note, the head of the company imposes an approving resolution, indicates the deadline and those responsible for execution. An official representation with a resolute inscription serves as the basis for issuing an order for encouragement. A document of this kind refers to orders for personnel with a specified storage period of 75 years.

Order on employee incentives: sample

Since 2013, the use of officially approved forms of primary documentation for personnel records and remuneration has become optional. However, in practice, it is convenient to use options No. T-11 and No. T-11a, proposed by Resolution of the State Statistics Committee of January 5, 2004 No. 1 “On approval of unified forms...”. Form No. T-11 is provided for orders for one employee, and No. T-11a - for 2 or more employees.

It will not be a violation to use your own form, provided that the standard details of the order, information about the employee and the specific reason for the incentive are observed. The order must indicate the type of remuneration and for non-monetary incentives, it is allowed to exclude the “amount” field from the form. No. T-11.

The order is signed by the manager (executor authorized by management), after which the employee is familiarized with the document under his personal signature. Based on the administrative document, the fact of promotion is recorded in the personal card and work book. The order is sent to the accounting department to draw up documents on the issuance of the award.

As you can see, even one order requires a lot of formal actions and official papers. All these functions can be taken over by an outsourcing company. Chief Accountant Assistant solves not only accounting problems, but also personnel issues.

Completed sample order to encourage an employee

|

Unified form N T-11 Approved by a resolution of the State Statistics Committee of Russia |

|||||||||||||||||||||||||||

|

dated 01/05/2004 N 1 |

|||||||||||||||||||||||||||

|

Code |

|||||||||||||||||||||||||||

|

OKUD form |

0301026 |

||||||||||||||||||||||||||

|

according to OKPO |

|||||||||||||||||||||||||||

|

name of company |

|||||||||||||||||||||||||||

|

Document Number |

Date of preparation |

||||||||||||||||||||||||||

|

ORDER |

|||||||||||||||||||||||||||

|

(order) |

|||||||||||||||||||||||||||

|

on employee incentives |

|||||||||||||||||||||||||||

|

Personnel Number |

|||||||||||||||||||||||||||

|

Full Name |

|||||||||||||||||||||||||||

|

structural subdivision |

|||||||||||||||||||||||||||

|

position (specialty, profession) |

|||||||||||||||||||||||||||

|

incentive motive |

|||||||||||||||||||||||||||

|

type of reward (gratitude, valuable gift, bonus, etc. - specify) |

|||||||||||||||||||||||||||

|

in total |

|||||||||||||||||||||||||||

|

in words |

|||||||||||||||||||||||||||

|

rub. |

cop. |

||||||||||||||||||||||||||

|

rub. |

cop.) |

||||||||||||||||||||||||||

|

in numbers |

|||||||||||||||||||||||||||

|

Base: performance |

|||||||||||||||||||||||||||

|

Head of the organization |

|||||||||||||||||||||||||||

|

job title |

personal signature |

full name |

|||||||||||||||||||||||||

|

The employee is familiar with the order (instruction) |

|||||||||||||||||||||||||||

|

“Non-material motivation of employees: examples from Russian and foreign experts” will give you useful ideas in organizing goals for your team. For an entrepreneur, the award carries an additional financial burden, but a competent manager also understands the opposite result of saving on personnel. For small business news, we have launched a special channel on Telegram and groups in | |||||||||||||||||||||||||||

In addition to paying the basic salary, the employer can reward the employee with additional amounts of money - bonuses or valuable gifts.

All types of bonuses must be issued using an order, which is the basis for their accrual.

To process these payments, unified forms are provided: T-11 and T-11a. The first form is intended for bonuses to one employee, and the form with the letter “a” is used if two or more employees of the company are awarded bonuses.

Is it necessary to use these forms?

Now the use of unified forms in personnel records management is no longer mandatory, so the employer can use forms T-11 and T-11a at will. He can develop his own form or make changes to the unified ones. The main thing is to approve the new form by order of the organization.

Also, an order for bonuses can be issued in free form on a general form for orders approved by the organization. Typically, this method of issuing bonuses is used when it is necessary to describe in detail the employee’s achievements for which he receives a bonus or when orders for incentives are posted in publicly accessible places (information corners, honor boards, etc.).

In these cases, an order issued in free form is better understood when read.

An example of the text of an incentive order in free form:

According to the results of the “Best Production Site” competition, held from May 21 to May 30, 2020, the production site of Branch No. 4 took first place.

I ORDER:

1. Reward with a cash bonus for achieved results:

- A.A. Ivanenkov, head of the site - in the amount of 5,000 (five thousand) rubles;

- N.N. Egorov, site foreman - in the amount of 4000 (four thousand) rubles;

- V.V. Nikitin, electrician of the site - in the amount of 3000 (three thousand) rubles.

2. Pay the bonus at your own expense.

3. The order should be brought to the attention of all employees of the organization.

Order for financial assistance

In addition to various monetary bonuses, there is also such a thing as financial assistance.

For these purposes, there is no separate unified form and therefore forms T-11 and T-11a are very often used to register financial assistance, especially if the organization uses automated programs for conducting personnel records (KAMIN, HR Department PLUS, etc.) , in the standard versions of which only unified forms are included.

The unified form can be adapted by changing the name. That is, initially the order is called “On the encouragement of employee(s)”, but it needs to be replaced with “On financial assistance”, or “On the payment of financial assistance”.

You can also use a free order form. But in any case, you need to clearly indicate the type of monetary payment; you should not write statements like: “pay a sum of money in the amount of …”. The type of payment the amount of money issued will depend on:

1) Personal income tax– the premium is taxed in full. In the case of material assistance, personal income tax does not apply to the amount of 4,000 rubles per year in general cases and up to 50,000 rubles for a one-time payment for the birth of a child.

Or it is not subject to taxation at all, regardless of the amount, if paid in connection with natural disasters or terrorist acts;

2) Income tax organizations - financial assistance does not reduce the tax base. A bonus can reduce the tax base only if it is awarded for the labor achievements of employees (fulfilling a plan, achieving certain indicators, making rational proposals, etc.).

Bonuses paid in connection with anniversaries and holidays do not relate to labor costs that reduce the amount of profit of the organization;

3) Insurance charges– financial assistance is exempt from payment in cases provided for by law (in the amount of up to 4,000 rubles, at the birth of a child up to 50,000 rubles, compensation payments for damage caused in connection with natural disasters, payments in connection with the death of family members). The premium is subject to insurance contributions in all cases.

Grounds for issuing an order

The following documents can serve as the basis for issuing an order for bonuses (material assistance):

- Employee statement. Most often, it is written for the payment of financial assistance in the event of cases when the employer’s local documents provide for such payments.

- Service note. Written by the employee’s immediate supervisor with a request to reward him for achieved results, excellent work, etc.;

- Employer's order to pay bonuses for holidays and anniversaries;

- Local regulations of the organization, which stipulate the procedure for paying financial assistance and bonuses. Moreover, the employer himself decides what to call this or that payment. For example, some organizations may pay a bonus for an employee’s anniversary (retirement, marriage), and some may pay financial assistance. It depends on the corporate policy of the organization. In cases where bonuses and financial assistance are prescribed by law, their names do not change (material assistance for the birth of a child, in connection with the death of a family member; bonus for work results);

- Other documents on the basis of which the employer may decide to make payments in favor of the employee.

After the order is issued, a copy of it is sent to the accounting department for the calculation of the amounts specified in it. There are no specific dates set for the payment of bonuses and financial assistance. They can be issued to the employee immediately after accrual or timed to coincide with a salary or advance payment.

Instructions for filling out form T-11

Using form T-11, a bonus is issued for one employee. The procedure for filling it out is as follows:

Name of company

It should be included here in full, without abbreviations. It is allowed to enter an abbreviated name (if available) in brackets, as in the constituent documents. This procedure is established by Decree of the State Standard of the Russian Federation dated March 3, 2003 No. 65-Art.

The above document is valid only until 07/01/2018, and then GOST R 7.0.97-2016 will come into force, but it also contains the same requirement regarding the name, as a document requisite.

All the above rules fully apply to individual entrepreneurs.

Next to the name there is a small field reserved for OKPO; the data for filling it out is taken from the list of codes issued by statistical authorities when registering a company. But leaving this field empty will not be a serious mistake.

The employee's last name, first name and patronymic are entered in full, in the genitive case.

Personnel Number

Structural subdivision

If he is not present in the organization, this line is not filled in.

Promotion motive

In this line, you can describe in detail the reason for awarding an employee a bonus if the organization does not use free-form order forms or the order is issued using a specialized program.

Type of promotion

This line explains in what form the encouragement (material assistance) will be provided: cash, a valuable gift, or simply a declaration of gratitude or presentation of a certificate of honor.

Then the document that served as the basis for issuing the order is indicated (employee statement, memo, manager’s order, etc.)

The signature of the manager, as well as the signature of the employee, indicates that he has read the order.

Instructions for filling out form T-11a

Form T-11a is intended for processing payments to several employees at once. The main details of the order are drawn up in the same way as in the previous form.

Also, similarly to the T-11 form, the following lines are filled in: “Motive of encouragement” and “Type of incentive”, after which subsequent information is entered in the form of a table. This means that the motive and type of incentive must be the same for all employees listed in the order. That is, even if the same employee simultaneously receives a bonus and financial assistance, it will be necessary to issue two different orders for him.

Filling out the tabular part of the order:

- Last name, first name and patronymic of the employee - entered in full;

- Personnel number – if available;

- Structural unit - if available;

- Position – in full, without abbreviations;

- Amount – the amount that will be paid to the employee. This form does not provide for duplication in words. If the employee is not rewarded with money, then the form of reward is indicated (gratitude, certificate of honor, valuable gift);

- The employees' signature confirms that they have read the order.

- Grounds for issuing the order (deadline after the table). There may be several reasons, the main thing is that the motive and type of encouragement coincide. Or, conversely, one document can serve as the basis for issuing several orders. For example, there is one memo that contains information that the employee needs to be rewarded with a certificate of honor and a cash bonus. In this case, two orders will be issued, but the basis for them will be the same - the above memo.

- Signature of the head of the organization.

Duration and place of storage of bonus orders

The original order is stored in the personnel order book. A copy is in the accounting department, where it is either filed in a separate file where all copies of orders are stored, or attached to the documents on awarding bonuses.

Orders for awarding bonuses to employees and providing them with financial assistance must be kept in the organization for 5 years and then must be destroyed. But in practice, it is better to destroy such documents after a tax audit has been completed.

Since during its course various questions may arise about the taxation of amounts accrued on the basis of these orders, and it will be necessary to confirm the wording, on which, as mentioned above, depends how these amounts will be reflected in the tax accounting of the organization.

- Related Posts

-

Sample of filling out form T-10

Sample of filling out form T-10 -

Note-calculation on granting leave

Note-calculation on granting leave

An order for a one-time bonus is an administrative document of an organization, which is issued if the manager decides to reward one or more employees. In addition to the order, other documents may be required.

An employee's salary may consist of a salary and bonus parts. The salary part has its own minimum threshold, indicated by the minimum wage rates, but the bonus part does not have any maximum limits. In other words, the manager decides whether to assign a bonus to an employee or not, and he also determines the size of the bonus.

One of the ways to reward an employee for successful work and achieving high results in work is a bonus. The employer is interested in increasing the efficiency of the company's performance indicators, therefore it has the right to motivate employees in the form of bonus payments. To formalize the decision, an administrative document such as an order for a one-time bonus is used (if we are talking about only one employee). There are details that are recommended to be used in this form. A sample order for bonuses for employees can be found in the appendix via the link.

Types of employee incentives

An employee can be rewarded not only in material form. The main types of incentives used in practice:

- announcement of gratitude;

- cash bonus;

- nomination for the title of the best in the profession;

- issuance of a valuable gift;

- awarding a certificate of honor.

List, in accordance with Art. 191 Labor Code of the Russian Federation, is not closed; the bonus system is established for each specific enterprise in local regulations. For special achievements, a presentation for state awards may follow.

What documents are required to document the bonus?

The announcement of the payment of a bonus to an employee is made in the form of issuing a corresponding order.

It has several varieties:

- mass - imposed on an entire group of workers, the majority of the team and personal;

- scheduled - published with a certain frequency and unscheduled;

- production - taken in connection with achieving results in production;

- organizational - published in gratitude for active participation in the public life of the enterprise, for example, for achievements at sporting events;

- festive - in connection with the onset of memorable dates, holidays, anniversaries.

Memo about bonuses

The basis for issuing an order is a memo, presentation or petition from the employee’s immediate supervisor or the head of another service or department. This document must indicate the employee’s achievements or other grounds for bonuses. The payment amount can be indicated specifically or indicating a percentage of the salary, etc. The head of the enterprise can decide to increase or decrease the monetary reward.

Orders in form T-11 and T-11a

The form can be drawn up according to the standard form T-11, approved by the State Statistics Committee (but not currently mandatory for use), or in free form. The organization has the right to develop its own sample.

Form T-11 is used if one employee needs to receive a bonus.

If several employees are worthy of a bonus, a collective agreement is issued in form T-11a.

Document structure:

- a header containing the details of the organization and the document (name of the enterprise, number, date of issue of the order, its subject);

- the main part with written documentation of the employer’s order and its basis;

- final (signatures, their transcripts, there must be a note about the employee’s familiarization).

The main part must indicate:

- who exactly is being rewarded (full last name, first name and patronymic, personnel number, department and position held);

- what the bonus is for (indication of specific achievements, merits or other reasons). For example, the following formulations are often used: “in connection with the anniversary”, “for production successes”, “for professionalism and processing”, etc.;

- the amount of remuneration or the procedure for determining it;

- the period for which the allowance is made.

Order on monthly bonuses

Sometimes an employer, when determining the form of remuneration at an enterprise, opts for a salary-bonus system. In this case, an administrative document is also issued, which sets out the conditions for payment of bonuses.

Sample order for monthly bonuses for employees

Order on the 13th salary

There is no such term in the current legislation; it is a relic of Soviet times. The 13th salary is a type of monetary incentive paid at the end of the year. The employer's obligation to calculate the 13th salary is not defined by law; this is his right, not an obligation. If a positive decision is made, an order is issued based on the T-11a form.

An example of an end-of-year bonus order

The manager may decide not to make such a payment or make it only to a part of the employees. Exception: a situation where the obligation for purpose is enshrined in local regulations. By the way, in budgetary institutions, the internal documents most often enshrine the rule that such a bonus is assigned within the limits of budgetary allocations. Thus, the payment depends on the economic and financial capabilities of the enterprise. After receiving data for the year, the possibility of incentive measures for the workforce is determined.

This type of incentive, just like a regular bonus, can be formalized as an additional payment of a certain, fixed amount or part of the salary. As a rule, employees do not have the right to count on such a bonus:

- having disciplinary sanctions for the year;

- have not achieved certain indicators;

- those who made serious mistakes in their work, leading to a decrease in performance indicators;

- workers on maternity leave.

As judicial practice shows, dismissed employees have the right to claim a portion of the incentive.

The manager signs the order and determines the person responsible for its execution (who must also be familiar with the document before signing). The obligation to familiarize the employee is determined by the fact that the employee must know why he is being awarded. Section 1 of the Instructions, approved. Resolution of the State Statistics Committee of Russia dated January 05, 2004 No. 1 definitely states that the worker must be familiar with the order for any incentive, including the 13th salary.