Statistics: reports. Procedure and example of filling out the MP-SP form (nuances) Example of filling out MP SP year

Until April 1, 2016, small companies had to submit a new report in the MP-SP form (Rosstat letter dated January 14, 2016 No. 03-03-1/1-SMI).

Filling out the MP-SP Form for 2015

The MP-SP form was approved by Rosstat order No. 263 dated 06/09/2015. Let us name a number of key features that are important to take into account.

1.In section 1.1.“date of commencement of production of goods and provision of services (line 01)” indicate the date of commencement of business activity

2. In section 1.3.“the number of months during which the organization carried out business activities in 2015” - the number of months in 2015 during which the company carried out activities. It is also necessary to take into account those months during which the company operated at least one full working day

3. To section 2.1. p.12record the number of employees of the organization and accrued wages. It is calculated as the sum of the average number of employees, the average number of external part-time workers and the average number of employees performing work under civil contracts

4. To section 2 page 13It is not necessary to include in the average number of employees: - women who are on maternity leave:

Employees who are on leave in connection with the adoption of a newborn child directly from the maternity hospital, as well as on parental leave

Employees who are undergoing training in educational institutions (additional leave without pay was issued), and also enter educational institutions (additional leave without pay was issued to take entrance exams)

5. In section 2 page 17fill in the actual purchase price (excluding VAT, excise taxes and similar mandatory payments), including the amount of non-refundable taxes. That is, it is necessary to reflect goods purchased specifically for resale and accounted for on Credit account 41

6. Section 2 page 18To fill out this section, you need to take data on Credit accounts 10, 11, 15, 16 and Debit expense accounts 20, 23, 25, 26, 29, 44

7. Section 2 page 28“total for all types of economic activity.” If the organization is on OSNO, fill out the data in accordance with Article 249 of the Tax Code of the Russian Federation. The amount must be equal to line 010 (page 040 of Appendix 1 to sheet 02) of sheet 02 of the tax return for corporate income tax.

If the company is on the simplified tax system– in accordance with Article 346.24 of the Tax Code. The amount must be equal to line 113 of section 2.1 (object of taxation - income), line 213 of section 2.2 (object of taxation - income reduced by the amount of expenses) of the tax return for the tax paid in connection with the application of the simplification.

If the organization is on the Unified Agricultural Tax– in accordance with paragraphs 1 and 8 of Article 346.5 of the Code. The amount must be equal to line 010 of section 2 of the tax return for the unified agricultural tax.

If the organization is on UTII– indicate the cost of products sold, goods, works and services provided in the reporting year based on primary documents, that is, according to accounting data

8. In section 3 page 35“availability of fixed assets at the beginning of 2015 at full accounting value” data is filled in based on the original value of fixed assets, taking into account its changes as a result of revaluation, completion, modernization, additional equipment, reconstruction and partial liquidation

MP-SP form for 2015

Forms of the MP-SP form (Information on the main indicators of the activities of a small enterprise for 2015) for companies and form No. 1-entrepreneur (Information on the activities of an entrepreneur for 2015) for individual entrepreneurs were approved by Rosstat order No. 263 dated 06/09/15. Information that will be required fill in: address, type of activity, fixed assets, revenue and expenses, staff, payroll, etc. Reports can be submitted both on paper and electronically. Below we have provided a sample of filling out the MP-SP form for 2015.

Fine for failure to submit the MP-SP form in 2016

For late submission or failure to submit a report, a fine is possible under Article 13.19 of the Code of Administrative Offenses of the Russian Federation. For organizations from 20 to 70 thousand rubles, for entrepreneurs and directors - from 10 to 20 thousand rubles. Therefore, it is risky to be late with reporting.

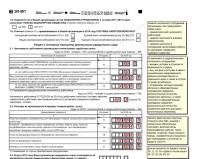

MP-SP form for 2015 sample filling

Entrepreneurs submit a similar report, but fill it out using the “1-entrepreneur” form, approved by Rosstat order No. 263 dated 06/09/2015. The deadline for submitting the form is no later than April 1, 2016. You can download the new form on our website by following the link.

Based on materials from: http://www.glavbukh.ru/

Form MP-SP — a one-time reporting document for Rosstat (it had to be submitted before April 1, 2016). But the experience of filling it out can always be useful to the company when interacting with the department in the future. We will tell you in our article what causes this and where you can find a sample form.

Why do you need the MP-SP statistics form?

Form MP-SP— a one-time statistical reporting document that, before April 1, 2016, all legal entities related to small businesses and microenterprises had to submit to Rosstat. The agency collected data on businesses for 2011-2015 as part of continuous statistical surveillance in the manner established by the norms of Art. 5 Federal Law “On the development of small and medium-sized businesses in the Russian Federation” dated July 24, 2007 No. 209-FZ.

Continuous statistical observations are carried out once every 5 years. And if the legislation does not change, next time the reporting will be similar MP-SP form, will be requested from respondents no earlier than 2021. However, Art. 5 of Law No. 209-FZ provides for Rosstat to also conduct selective statistical observations: for small businesses monthly or quarterly, for microenterprises annually.

It is possible that for the relevant observations, Rosstat will collect information from enterprises similar to what they provided according to MP-SP form. So the experience of filling out the form will be useful to the manager or responsible person of the enterprise in terms of readiness to participate in subsequent observations initiated by Rosstat.

Let's study the basic principles of working with MP-SP form, the structure of which could potentially become the basis for other reporting forms.

How to fill out the MP-SP form for 2015

Filling out the MP-SP form for 2015 year involves the work of a specialist from the reporting company with 4 sections of the document.

Section 1 provides basic information about the organization:

- date of commencement of the company’s commercial activities, its duration in 2015 (in months);

- company address;

- the presence or absence of changes in the composition of the company’s shareholders or its founders in 2011-2015;

- tax systems under which the company operated in 2015.

In section 2 forms MP-SP The main economic indicators of the enterprise are recorded:

- the average number of employees in 2015 (indicating separately the number of full-time employees), the total accrued wage fund, as well as its part spent on paying only full-time employees;

- average number of personnel in 2014;

- classified according to the categories given in the form, the costs of production and sale of goods, services and work;

- the cost of raw materials transferred for processing to third-party companies (if such operations were carried out);

- the presence or absence of the fact that the company provides any services to citizens as a supplier (intermediary);

- the presence or absence of import of any services by the company;

- total revenue of the company in 2014 and 2015;

- the company’s revenue in 2014 and 2015, distributed by type of activity (indicating OKVED);

- the cost of construction and scientific and technical work performed by the company with the involvement of subcontractors;

- the presence or absence of the company’s implementation of technological, managerial or marketing innovations.

In section 3 forms MP-SP reflected:

- the cost of tangible, intangible fixed assets of the company (as of the beginning, end of 2015);

- the volume of the company's investment in OS;

- the presence or absence of the company’s use of its own, leased, rented or hired drivers’ vehicles as of the end of 2015.

In section 4 forms MP-SP indicates the presence or absence of the company receiving support from government agencies or municipal structures in the form of:

- Money;

- consultations;

- information;

- property;

- support in employee training.

Also in the section under consideration, a note is made whether the owner of the company or the person authorized to fill out forms MP-SP person about existing business support programs.

Where to download the Rosstat MP-SP form, intended for submission in 2016

Download MP-SP statistics form for 2015, which firms should have sent to Rosstat before April 1, 2016, you can do on our portal.

Question

Procedure for filling out the MP-SP form for 2015

Answer

Before April 1, 2016, small companies must submit the MP-SP form - Information on the main performance indicators of a small enterprise for 2015, and entrepreneurs must submit the 1-entrepreneur form (Information on the activities of an entrepreneur for 2015).

Rosstat, by order No. 263 dated June 9, 2015, approved instructions for filling out new reporting forms. For small companies - instructions for filling out the MP-SP form (Information on the main indicators of the activities of a small enterprise for 2015), for individual entrepreneurs - form 1-entrepreneur (Information on the activities of an individual entrepreneur for 2015).

Let us name a number of key features that are important to consider.

- In section 1.1. “date of commencement of production of goods and provision of services (line 01)” indicate the date of commencement of business activity

- In section 1.3. “the number of months during which the organization carried out business activities in 2015” - the number of months in 2015 during which the company carried out activities. It is also necessary to take into account those months during which the company operated at least one full working day

- To section 2.1. p.12 record the number of employees of the organization and accrued wages. It is calculated as the sum of the average number of employees, the average number of external part-time workers and the average number of employees performing work under civil contracts

- In Section 2, page 13, it is not necessary to include in the average number of employees: - women who are on maternity leave:

- employees who are on leave in connection with the adoption of a newborn child directly from the maternity hospital, as well as on parental leave

— employees who are undergoing training in educational institutions (additional leave without pay was issued), and also enter educational institutions (additional leave without pay was issued to take entrance exams)

- In section 2, page 17, fill in the actual purchase price (excluding VAT, excise taxes and similar mandatory payments), including the amount of non-refundable taxes. That is, it is necessary to reflect goods purchased specifically for resale and accounted for on Credit account 41

- Section 2 page 18 To fill out this section, you need to take data on Credit accounts 10, 11, 15, 16 and Debit cost accounts 20, 23, 25, 26, 29, 44

- Section 2 p. 28 “total for all types of economic activity.” If the organization is on OSNO, fill out the data in accordance with Article 249 of the Tax Code of the Russian Federation. The amount must be equal to line 010 (page 040 of Appendix 1 to sheet 02) of sheet 02 of the tax return for corporate income tax.

If the company is on the simplified tax system - in accordance with Article 346.24 of the Tax Code. The amount must be equal to line 113 of section 2.1 (object of taxation - income), line 213 of section 2.2 (object of taxation - income reduced by the amount of expenses) of the tax return for the tax paid in connection with the application of the simplification.

If the organization is on the Unified Agricultural Tax - in accordance with paragraphs 1 and 8 of Article 346.5 of the Code. The amount must be equal to line 010 of section 2 of the tax return for the unified agricultural tax.

If the organization is on UTII - indicate the cost of products sold, goods, works and services provided in the reporting year based on primary documents, that is, according to accounting data

- In section 3, page 35, “availability of fixed assets at the beginning of 2015 at full accounting value,” the data is filled in based on the original value of fixed assets, taking into account its changes as a result of revaluation, completion, modernization, additional equipment, reconstruction and partial liquidation

Related questions:

-

The building is depreciated at its cadastral value. and the remaining fixed assets at residual value. The question is, is depreciation of the building included in section 2? should the building be included in the calculation based on...... -

Is it possible to partially write off a loss from car theft and how to show all this in the declaration?

✒ For accounting purposes, theft (hijacking) of a car is recognized as a disposal of a fixed asset item. IN…... -

When filling out OS1, do I need to reflect the details of the transmitting party?

✒ Form N OS-1 contains section. 1 “Information on the condition of the fixed asset item on the date of transfer.” Section 1 is completed on...... -

Please tell me: 1) should the withheld tax from the March salary be taken into account in line 070 of section 1 of the 6-NDFL report, if the payment itself will be in the month of April? those. what are the latest recommendations?...

The MP-SP form is a new report, all small companies must submit it by April 1, 2016 (Rosstat letter No. 03-03-1/1-SMI dated January 14, 2016). We have compiled a sample MP-SP form for 2015 and explained in detail how to fill it out.

Filling out the MP-SP Form for 2015

The MP-sp form was approved by Rosstat order No. 263 dated June 09, 2015. The procedure for filling out is presented in the instructions for filling out the form No. MP-sp “Information on the main performance indicators of a small enterprise for 2015.” Let us name a number of key features that are important to consider.

1.In section 1.1.“date of commencement of production of goods and provision of services (line 01)” indicate the date of commencement of business activity

2.In section 1.3.“the number of months during which the organization carried out business activities in 2015” - the number of months in 2015 during which the company carried out activities. It is also necessary to take into account those months during which the company operated at least one full working day

3.To section 2.1. p.12 record the number of employees of the organization and accrued wages. It is calculated as the sum of the average number of employees, the average number of external part-time workers and the average number of employees performing work under civil contracts

4.To section 2 page 13 It is not necessary to include in the average number of employees: - women who are on maternity leave:

- employees who are on leave in connection with the adoption of a newborn child directly from the maternity hospital, as well as on parental leave

- employees who are undergoing training in educational institutions (additional leave without pay was issued), and also enroll in educational institutions (additional leave without pay was issued to take entrance exams)

5. In section 2 page 17 fill in the actual purchase price (excluding VAT, excise taxes and similar mandatory payments), including the amount of non-refundable taxes. That is, it is necessary to reflect goods purchased specifically for resale and accounted for on Credit account 41

6. Section 2 page 18 To fill out this section, you need to take data on Credit accounts 10, 11, 15, 16 and Debit expense accounts 20, 23, 25, 26, 29, 44

7.Section 2 page 28“total for all types of economic activity.” If the organization is on OSNO, fill out the data in accordance with Article 249 of the Tax Code of the Russian Federation. The amount must be equal to line 010 (page 040 of Appendix 1 to sheet 02) of sheet 02 of the tax return for corporate income tax.

If the company is on the simplified tax system - in accordance with Article 346.24 of the Tax Code. The amount must be equal to line 113 of section 2.1 (object of taxation - income), line 213 of section 2.2 (object of taxation - income reduced by the amount of expenses) of the tax return for the tax paid in connection with the application of the simplification.

If the organization is on the Unified Agricultural Tax - in accordance with paragraphs 1 and 8 of Article 346.5 of the Code. The amount must be equal to line 010 of section 2 of the tax return for the unified agricultural tax.

If the organization is on UTII - indicate the cost of products sold, goods, works and services provided in the reporting year based on primary documents, that is, according to accounting data

8. In section 3, page 35 “availability of fixed assets at the beginning of 2015 at full accounting value,” the data is filled in based on the original value of fixed assets, taking into account its changes as a result of revaluation, completion, modernization, additional equipment, reconstruction and partial liquidation

MP-SP form for 2015

Forms of the MP-SP form (Information on the main indicators of the activities of a small enterprise for 2015) for companies and form No. 1-entrepreneur (Information on the activities of an entrepreneur for 2015) for individual entrepreneurs were approved by Rosstat order No. 263 dated 06/09/15. Information that will be required fill in: address, type of activity, fixed assets, revenue and expenses, staff, payroll, etc. Reports can be submitted both on paper and electronically. Below we have provided Sample of filling out the MP-SP form for 2015.

Fine for failure to submit the MP-SP form in 2016

For late submission or failure to submit a report, a fine is possible under Article 13.19 of the Code of Administrative Offenses of the Russian Federation. For organizations from 20 to 70 thousand rubles, for entrepreneurs and directors - from 10 to 20 thousand rubles. Therefore, it is risky to be late with reporting.

MP-SP form for 2015 sample filling

Entrepreneurs submit a similar report, but fill it out using the “1-entrepreneur” form, approved by Rosstat order No. 263 dated 06/09/2015. The deadline for submitting the form is no later than April 1, 2016. You can download the new form on our website, to do this, go to.

On our website for accountants you can buy any books on accounting and financial accounting. Our online resource BestBookshop is intended for both the novice accountant and the chief accountant of the organization. Our accounting books contain the most relevant and high-quality information for absolutely any accountant. From us you can buy the best magazine for accountants “Successful Accountant” and also purchase various books on doing business. Thanks to our company's accounting press, a young and inexperienced accountant can easily learn and use the intricacies of accounting. accounting, and an experienced accountant will be able to learn new techniques and facts about accounting, which will allow him to successfully conduct accounting and move up the career ladder to the proud title of chief accountant of a company. We have collected the best books for accounting. Here you can buy books on accounting cheap. In our best online store for accountants, we are always glad to see all our visitors and clients! Our site is specially created for accountants, auditors, tax consultants, and HR professionals. Taxation and accounting, forms and reporting forms, accounting announcements and news, accounting and taxation in practice. With us you can expand your knowledge about accounting and taxation, how to correctly conduct accounting, prepare reports, use a chart of accounts, and prepare accounting entries. On our website for accountants you can find a huge amount of relevant materials related to the use of tax legislation on the topics: simplified tax system, corporate income tax, UTII, state tax. duty, VAT and much more. It is also possible that in addition to this, the bestbookshop website presents fundamental documents, including PBUs, federal laws, orders, decrees and numerous clarifications from regulatory authorities. The main area of our website for accountants is bookkeeping and taxation for beginner accountants. We also contain a large amount of free information for chief accountants and professional experienced accountants. You will certainly find all our accounting news and books on bookkeeping very useful. You will find such a large selection of accounting publications and accounting press only on our website! Accountants choose the best.