Valuation of cash flows of invested capital. Cash flow models used in business valuation

Let's analyze the types of cash flows of an enterprise: the economic meaning of the indicators - net cash flow (NCF) and free cash flow, their construction formula and practical examples of calculation.

Net cash flow. Economic sense

Net cash flow (EnglishNetCashflow,NetValueNCF, present value) – is a key indicator of investment analysis and shows the difference between positive and negative cash flow for a selected period of time. This indicator determines the financial condition of the enterprise and the ability of the enterprise to increase its value and investment attractiveness. Net cash flow is the sum of the cash flow from the operating, financing and investing activities of an enterprise.

Consumers of the net cash flow indicator

Net cash flow is used by investors, owners and creditors to evaluate the effectiveness of an investment in an investment project/enterprise. The value of the net cash flow indicator is used in assessing the value of an enterprise or investment project. Since investment projects can have a long implementation period, all future cash flows lead to the value at the present time (discounted), resulting in the NPV indicator ( NetPresentValue). If the project is short-term, then discounting can be neglected when calculating the cost of the project based on cash flows.

Estimation of NCF indicator values

The higher the net cash flow value, the more investment attractive the project is in the eyes of the investor and lender.

Formula for calculating net cash flow

Let's consider two formulas for calculating net cash flow. So net cash flow is calculated as the sum of all cash flows and outflows of the enterprise. And the general formula can be represented as:

NCF – net cash flow;

C.I. (Cash Inflow) – incoming cash flow, which has a positive sign;

CO (Cash Outflow) – outgoing cash flow with a negative sign;

n – number of periods for assessing cash flows.

Let us describe in more detail the net cash flow by type of activity of the enterprise; as a result, the formula will take the following form:

![]() Where:

Where:

NCF – net cash flow;

CFO – cash flow from operating activities;

CFF – cash flow from financing activities;

Example calculation of net cash flow

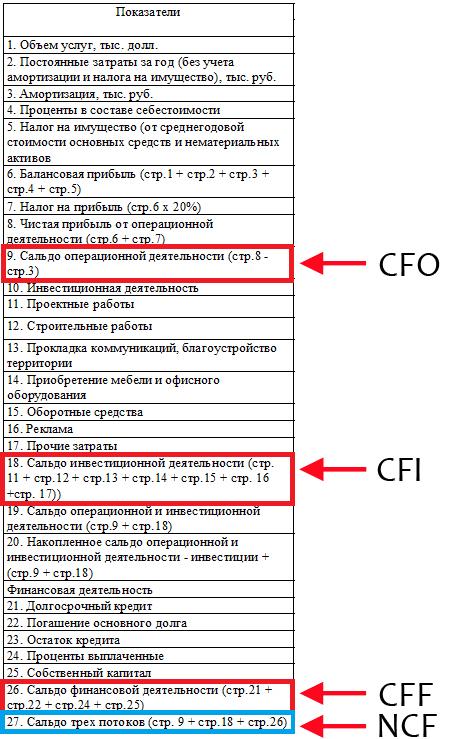

Let's look at a practical example of calculating net cash flow. The figure below shows the method of generating cash flows from operating, financing and investing activities.

Types of cash flows of an enterprise

All cash flows of an enterprise that form net cash flow can be divided into several groups. So, depending on the purpose of use, the appraiser distinguishes the following types of cash flows of an enterprise:

- FCFF is the free cash flow of the company (assets). Used in valuation models for investors and lenders;

- FCFE – free cash flow from capital. Used in models for assessing value by shareholders and owners of the enterprise.

Free cash flow of the company and capital FCFF, FCFE

A. Damodaran distinguishes two types of free cash flows of an enterprise:

- Free cash flow of the company (FreeCashFlowtoFirm,FCFFFCF) is the cash flow of an enterprise from its operating activities, excluding investments in fixed capital. A firm's free cash flow is often simply called free cash flow, i.e. FCF = FCFF. This type of cash flow shows how much cash the company has left after investing in capital assets. This flow is created by the assets of the enterprise and therefore in practice it is called free cash flow from assets. FCFF is used by the company's investors.

- Free cash flow to equity (FreeCashFlowtoEquity,FCFE) is the cash flow of an enterprise only from the equity capital of the enterprise. This cash flow is usually used by the company's shareholders.

A firm's free cash flow (FCFF) is used to assess enterprise value, while free cash flow to equity (FCFE) is used to assess shareholder value. The main difference is that FCFF evaluates all cash flows from both equity and debt, while FCFE evaluates cash flows from equity only.

The formula for calculating the free cash flow of a company (FCFF)

EBIT ( Earnings Before Interest and Taxes) – earnings before taxes and interest;

СNWC ( Change in Net Working Capital) – change in working capital, money spent on the acquisition of new assets;

Capital Expenditure) .

J. English (2001) proposes a variation of the formula for a firm's free cash flow, which is as follows:

CFO ( CashFlow from Operations)– cash flow from the operating activities of the enterprise;

Interest expensive – interest expenses;

Tax – interest rate of income tax;

CFI – cash flow from investment activities.

Formula for calculating free cash flow from capital (FCFE)

The formula for estimating free cash flow of capital is as follows:

NI ( Net Income) – net profit of the enterprise;

DA – depreciation of tangible and intangible assets;

∆WCR – net capital costs, also called Capex ( Capital Expenditure);

Investment – the amount of investments made;

Net borrowing is the difference between repaid and received loans.

The use of cash flows in various methods for assessing an investment project

Cash flows are used in investment analysis to evaluate various project performance indicators. Let's consider the main three groups of methods that are based on any type of cash flow (CF):

- Statistical methods for evaluating investment projects

- Payback period of the investment project (PP,PaybackPeriod)

- Profitability of an investment project (ARR, Accounting Rate of Return)

- Current value ( N.V.NetValue)

- Dynamic methods for evaluating investment projects

- Net present value (NPVNetPresentValue)

- Internal rate of return ( IRR, Internal Rate of Return)

- Profitability index (PI, Profitability index)

- Annual annuity equivalent (NUS, Net Uniform Series)

- Net rate of return ( NRR, Net Rate of Return)

- Net future value ( NFV,NetFutureValue)

- Discounted payback period (DPPDiscountedPayback Period)

- Methods that take into account discounting and reinvestment

- Modified net rate of return ( MNPV, Modified Net Rate of Return)

- Modified rate of return ( MIRR, Modified Internal Rate of Return)

- Modified net present value ( MNPV,ModifiedPresentValue)

All these models for assessing project performance are based on cash flows, on the basis of which conclusions are drawn about the degree of project effectiveness. Typically, investors use the firm's free cash flows (assets) to evaluate these ratios. The inclusion of free cash flows from equity in the formulas for calculating allows us to focus on assessing the attractiveness of the project/enterprise for shareholders.

Summary

In this article, we examined the economic meaning of net cash flow (NCF) and showed that this indicator allows us to judge the degree of investment attractiveness of the project. We examined various approaches to calculating free cash flows, which allow us to focus on valuation for both investors and shareholders of the enterprise. Increase the accuracy of the assessment of investment projects, Ivan Zhdanov was with you.

Analysis and forecasting of borrowed funds volumes

Forecasting the need for borrowed funds is carried out taking into account the needs of the company's operating and investment activities, as well as the possibilities of attracting new sources of funds, both through new loans and through the placement of new shares.

As part of this practical work, forecasting the volume of borrowed capital (LC) is not carried out; data on the volume of borrowed capital during the forecast period is given in the terms of individual assignments.

To calculate the amount of change in borrowed capital according to the individual assignment, we calculate changes in the amount of borrowed capital () for each year of the reporting and forecast periods.

million rubles (21)

Forecasting the volume of funds allocated for servicing borrowed capital

According to the terms of individual assignments, data on the volume of borrowings is given for the middle of the reporting and forecast years. The average annual cost of borrowed funds in the condition is also given for the middle of the reporting and forecast years.

Forecasting the cost of debt servicing is determined as the product of the interest rate and the amount of debt obligations:

Calculation of earnings before interest and taxes and net profit

Determining earnings before interest and taxes and net profit is necessary for subsequent calculations of cash flows for equity and invested capital.

To calculate net profit for each year of the forecast period, we calculate profit before interest and taxes.

To do this, subtract costs from revenue:

To calculate net profit (NP) for each year of the forecast period, we must use the data calculated above for the forecast period using the formula:

where t is the amount of income tax.

Calculation of cash flow to equity

Calculation of cash flow to equity capital is carried out in accordance with the formula:

Million rub. (25)

Calculation of cash flow per invested capital

Calculation of cash flow for all invested capital is carried out in accordance with the formula:

Million rubles (26)

If the obtained forecast values of cash flow are conditionally constant with stable growth rates, then the business value can be assessed using the capitalization method.

If the cash flow values differ, then it is advisable to value the business using the discounted cash flow method.

The growth rate of cash flow in (n+1) year relative to the base year may have a negative value due to the difference between the average for the reporting period and the specific value in the base year. In this case, it is recommended to exclude this value from consideration and calculate the average growth rate of cash flow for (t+2) and (t+3) years.

Calculation of the discount rate using the capital asset valuation model

The discount rate is one of the most important parameters of the discounted cash flow model, as it is a measure of the time value of money.

To assess equity capital, the capital asset pricing model (CAPM) is most often used, which reflects the cumulative impact of the investor's required rate of return (); risk-free rate of return (total return of the market as a whole (); small business premium (); company-specific risk premium; country risk () and beta, which is a measure of systematic risk associated with macroeconomic and political processes () .

The model looks like this:

The CAPM model is based on the analysis of stock market information arrays and is designed to measure the profitability of publicly traded shares. When using the model for closely held companies, it is necessary to make some adjustments associated with increased risk,

The yield rate on Eurobonds in force on the valuation date can be used as a real risk-free rate.

In world practice, the coefficient is calculated by analyzing statistical information of the stock market. This coefficient reflects the sensitivity of the return on securities of a particular company to changes in market (systematic) risk. With a coefficient of =1, the change in the return on the shares of the company being valued will coincide with the return on the entire stock market.

An additional premium for the risk of investing in a small enterprise is determined by the insufficient creditworthiness and financial instability of enterprises and can amount to up to 75% of the risk-free interest rate. The same applies to the value of the risk premium specific to an individual company.

The country coefficient () takes into account the risk inherent in the characteristics of a particular country. According to individual assignments, all enterprises are residents, so the value () is taken equal to zero.

If the cash flow parameters are predicted in nominal prices, i.e. do not take into account the impact of inflation, then the discount rate used to discount cash flows is also calculated in nominal terms, that is, without taking into account inflation.

To discount real cash flow, a real discount rate is used - a rate of return that takes into account future inflation expectations. The relationship between the nominal interest rate and the real interest rate, taking into account the level of inflation, is described by the expression (I. Fisher formula):

According to the assignments, the calculation of cash flow parameters is carried out in nominal prices, therefore, when completing course work, discount rates are calculated without taking into account inflation, that is, nominal discount rates.

The main goal of any enterprise is to make a profit. Subsequently, the profit indicator is reflected in a special tax report on financial results - it is this indicator that indicates how efficient the operation of the enterprise is. However, in reality, profit only partially reflects a company's performance and may not provide any insight into how much money the business actually makes. Complete information on this issue can only be obtained from the cash flow statement.

Net profit cannot reflect the funds received in real terms - the amounts on paper and the company's bank account are different things. For the most part, the data in the report is not always factual and is often purely nominal. For example, revaluation of exchange rate differences or depreciation charges do not bring in real cash, and funds for goods sold appear as profit, even if the money has not yet actually been received from the buyer of the goods.

It is also important that the company spends part of its profits on financing current activities, namely on the construction of new factory buildings, workshops, and retail outlets - in some cases, such expenses significantly exceed the company’s net profit. As a result of all this, the overall picture may be quite favorable and in terms of net profit the enterprise may be quite successful - but in reality the company will suffer serious losses and not receive the profit indicated on paper.

Free cash flow helps to make a correct assessment of a company's profitability and assess the real level of earnings (as well as better assess the capabilities of a future investor). Cash flow can be defined as the funds available to a company after all due expenses have been paid, or as the funds that can be withdrawn from the business without harming the business. You can obtain data for calculating cash flows from the company’s report under RAS or IFRS.

Types of Cash Flows

There are three types of cash flows, and each option has its own characteristics and calculation procedure. Free cash flow is:

from operating activities - shows the amount of cash that the company receives from its main activity. This indicator includes: depreciation (with a minus sign, although no funds are actually spent), changes in accounts receivable and credit, as well as inventory - and in addition other liabilities and assets, if present. The result is usually shown in the column “Net cash from core/operating activities.” Symbols: Cash Flow from operating activities, CFO or Operating Cash Flow, OCF. In addition, the same value is simply referred to as cash flow Cash Flow;

from investment activities - illustrates the cash flow aimed at developing and maintaining current activities. For example, this includes the modernization / purchase of equipment, workshops or buildings - therefore, for example, banks usually do not have this item. In English, this column is usually called Capital Expenditures (capital expenses, CAPEX), and investments can include not only investments “in oneself”, but also be aimed at purchasing assets of other companies, such as shares or bonds. Denoted as Cash Flows from investing activities, CFI;

from financial activities - allows you to analyze the turnover of financial receipts for all operations, such as receipt or repayment of debt, payment of dividends, issue or repurchase of shares. Those. This column reflects the company's business conduct. A negative value for debts (Net Borrowings) means their repayment by the company, a negative value for shares (Sale/Purchase of Stock) means they are being purchased. Both of these characterize the company from the good side. In foreign reporting: Cash Flows from financing activities, CFF

Separately, you can dwell on promotions. How is their value determined? Through three components: depending on their number, the company’s real profit and market sentiment towards it. An additional issue of shares leads to a fall in the price of each of them, since there are more shares, and the company's results most likely did not change or changed slightly during the issue. And vice versa - if a company buys back its shares, then their value will be distributed among a new (fewer) number of securities and the price of each of them will rise. Conventionally, if there were 100,000 shares at a price of $50 per share and the company bought back 10,000, then the remaining 90,000 shares should cost approximately $55.5. But the market is the market - revaluation may not occur immediately or by other amounts (for example, an article in a major publication about a company’s similar policy can cause its shares to rise by tens of percent).

The situation with debts is ambiguous. On the one hand, it’s good when a company reduces its debt. On the other hand, wisely spent credit funds can take the company to a new level - the main thing is that there is not too much debt. For example, the well-known company Magnit, which has been actively growing for several years in a row, had free cash flow positive only in 2014. The reason is development through loans. Perhaps, during your research, it is worth choosing for yourself some limit of maximum debt, when the risks of bankruptcy begin to outweigh the risk of successful development.

When summing up all three indicators, it is formed net cash flow - Net Cash Flow . Those. this is the difference between the inflow (receipt) of money into the company and its outflow (expense) in a certain period. If we are talking about negative free cash flow, then it is indicated in brackets and indicates that the company is losing money, not earning it. At the same time, to clarify the dynamics, it is better to compare the company’s annual rather than quarterly performance in order to avoid the seasonal factor.

How are cash flows used to value companies?

You don't need to consider Net Cash Flow to get an impression of a company. The amount of free cash flow also allows you to evaluate a business using two approaches:

based on the value of the company, taking into account equity and borrowed (loan) capital;

taking into account only equity capital.

In the first case, all cash flows reproduced by existing sources of borrowed or equity funds are discounted. In this case, the discount rate is taken as the cost of capital attracted (WACC).

The second option involves calculating the value not of the entire company, but only of its small part - equity capital. For this purpose, discounting of FCFE's equity is carried out after all the company's debts have been paid. Let's look at these approaches in more detail.

Free Cash Flow to Equity - FCFE

FCFE (free cash flow to equity) is a designation of the amount of money remaining from the profit received after paying taxes, all debts and expenses for the operating activities of the enterprise. The calculation of the indicator is carried out taking into account the net profit of the enterprise (Net Income), depreciation is added to this figure. Capital costs (arising from upgrades and/or purchase of new equipment) are then deducted. The final formula for calculating the indicator, determined after paying off loans and processing loans, is as follows:

FCFE = Net cash flow from operating activities – Capital expenditures – Loan repayments + New loan originations

The firm's free cash flow is FCFF.

FCFF (free cash flow to firm) refers to the funds that remain after paying taxes and deducting capital expenses, but before making payments on interest and total debt. To calculate the indicator, you must use the formula:

FCFF = Net Cash Flow from Operating Activities – Capital Expenditures

Therefore, FCFF, unlike FCFE, is calculated without taking into account all loans and advances issued. This is what is usually meant by free cash flow (FCF). As we have already noted, cash flows may well be negative.

Example of cash flow calculation

In order to independently calculate cash flows for a company, you need to use its financial statements. For example, the Gazprom company has it here: http://www.gazprom.ru/investors. Follow the link and select the “all reporting” sub-item at the bottom of the page, where you can see reports since 1998. We find the desired year (let it be 2016) and go to the “IFRS Consolidated Financial Statements” section. Below is an excerpt from the report:

1. Let's calculate free cash flow to capital.

FCFE = 1,571,323 - 1,369,052 - 653,092 - 110,291 + 548,623 + 124,783 = 112,294 million rubles remained at the company's disposal after paying taxes, all debts and capital expenses (costs).

2. Let's determine the free cash flow of the company.

FCFF = 1,571,323 - 1,369,052 = 202,271 million rubles - this indicator shows the amount minus taxes and capital expenses, but before payments on interest and total debt.

P.S. In the case of American companies, all data can usually be found on the website https://finance.yahoo.com. For example, here is the data from Yahoo itself in the “Financials” tab:

Conclusion

In general, cash flow can be understood as the company’s free funds and can be calculated both with and without debt capital. A company's positive cash flow indicates a profitable business, especially if it grows year over year. However, any growth cannot be endless and is subject to natural limitations. In turn, even stable companies (Lenta, Magnit) can have negative cash flow - it is usually based on large loans and capital expenditures, which, if used wisely, can, however, provide significant future profits.

Let us consider the content of the listed assessment stages. 1st stage. Determining the duration of the forecast period.Dividing the company's market capitalization by the company's free cash flow, we get P/FCF ratio . Market Cap is easy to find on Yahoo or Morningstar. A reading of less than 20 usually indicates a good business, although any figure should be compared to competitors and, if possible, to the industry as a whole.

If the business being valued may exist indefinitely. long, forecasting for a sufficiently long period even with a stable economy is difficult.

Therefore, the entire life of the company is divided into two periods: forecast, when the appraiser determines the dynamics of the company’s development with sufficient accuracy, and post-forecast (residual), when a certain average moderate growth rate is calculated.

It is important to correctly determine the duration of the forecast period, taking into account the possibility of drawing up a realistic cash flow forecast and the dynamics of income in the first years.

2nd stage. Selecting a cash flow model.

When valuing a business, either the cash flow model for equity or the cash flow model for invested capital is used.

Cash flow (CF) for equity is calculated as follows:

DP = Net profit + Depreciation + (-) Decrease (increase) in own working capital - Capital investments + (-) Increase (decrease) in long-term debt.

The calculation, which is based on cash flow for invested capital, allows us to determine the total market value of equity and long-term debt.

Cash flow for invested capital is determined by the formula

DP = Profit after tax + Depreciation + (-) Decrease (increase) in own working capital - Capital investments.

It should be noted that when calculating the cash flow for the entire capital, it is necessary to add interest on debt servicing, adjusted to the income tax rate, to the net profit, since the invested capital works not only to create profit, but also to pay interest on loans.

Cash flow can be forecast both on a nominal basis (in current prices) and taking into account the inflation factor.

3rd stage. Cash flow calculation for each forecast year.

At this stage, information is analyzed about management’s plans for the development of the company in the coming years and about the dynamics of the cost and natural indicators of the enterprise’s performance for two to four years preceding the valuation date. This information is compared with industry trends to determine the feasibility of plans and the stage of the company's life cycle.

There are two main approaches to cash flow forecasting: element-by-element and holistic. The element-by-element approach allows forecasting of each component of cash flow. A holistic approach involves calculating the amount of cash flow in a retrospective period and its further extrapolation, which can be carried out two to three years in advance.

The element-by-element approach is more complex, but gives more accurate results. Typically, the following methods can be used to determine the value of cash flow elements:

Fixation at a certain level;

Extrapolation with simple trend adjustment;

Element-by-element planning;

Linked to a specific financial indicator (amount of debt, revenue, etc.).

Cash flow forecasting can be carried out in different ways - it depends primarily on the amount of information that the appraiser has. Typically, with element-by-element planning, all elements of cash flow are closely interconnected: for example, the amount of profit is largely determined by the amount of depreciation charges and interest payments on loans; in turn, depreciation charges depend on the volume of capital investments; The cost of long-term loans depends on the size of long-term debt.

Thus, the compiled forecasts of revenue, cost, and depreciation make it possible to calculate the amount of balance sheet profit, which will be reduced by the income tax rate, and as a result, the appraiser will receive the amount of net profit.

Let's consider the procedure for assessing changes in own working capital. Own working capital is the amount of money invested in the working capital of an enterprise; it is defined as the difference between current assets and liabilities. The amount of current assets is largely determined by the size of the company's revenue and is directly dependent on it. In turn, the size of current liabilities to a certain extent depends on current assets, since they are used to purchase inventory and pay off accounts receivable. Consequently, both current assets and current liabilities depend on the amount of revenue, so the forecast value of own working capital can be determined as a percentage of revenue.

4th stage. Calculation of the discount rate.

The discount rate is the rate used to convert future earnings into present value (value at the valuation date). Its main purpose is to take into account possible risks that an investor may encounter when investing capital in the business being valued. Investment risk is understood as the probability that the actual income of an enterprise in the future will not coincide with the forecast. The methodology for calculating the discount rate is based on the identification and adequate assessment of the risks inherent in a particular business. At the same time, all risks are traditionally divided into systematic, or inherent in all elements of the economy (inflation, political and economic instability, etc.), and unsystematic, or inherent only in a specific type of business (for example, aluminum production is more dependent on electricity tariffs than growing potatoes).

The choice of discount rate is determined by the type of predicted cash flow.

When using cash flow for equity, the discount rate must be determined for equity

of public capital either according to the capital asset valuation model or the cumulative construction method. If a cash flow forecast is made for invested capital, the rate is determined by the weighted average cost of capital method.

The capital asset pricing model (CAPM) was developed on a number of assumptions, the main of which is the assumption of an efficient capital market and perfect competition among investors. The main premise of the model: an investor accepts risk only if in the future he will receive additional benefit on the invested capital compared to a risk-free investment.

The capital asset pricing model equation is as follows:

I = Yag + B (Yat - Ya) + Ya1 + 52 + C,

where L is the rate of return required by the investor; Ш - risk-free rate of return; P - beta coefficient; Kt - the total profitability of the market as a whole; ^ - premium for the risk of investing in a small company; ?2 - premium for risk specific to a particular company; C - premium for country risk.

The risk-free rate of return is calculated on investments with a guaranteed rate of return and a high degree of liquidity. Such investments usually include investments in government securities (debt obligations). In developed countries, these usually include government debt bonds with a maturity of 5-10 years.

In Russian practice, the risk-free rate is used, for example, the rate on foreign currency deposits of Sberbank, the yield on Eurobonds, or the risk-free rate of other countries with the addition of a premium for country risk.

Systematic risk arises as a result of the impact of macroeconomic and political factors on the company's activities and the stock market. These factors affect all economic entities, so their influence cannot be completely eliminated through diversification. The beta coefficient (P) allows us to take into account the systematic risk factor. This coefficient represents a measure of the sensitivity of the shares of the company in question to systematic risk, reflecting the volatility of the prices of the shares of this company relative to the movement of the stock market as a whole.

Typically, p is calculated based on historical stock market information over the past 5-10 years. However, the history of the Russian stock market (represented, for example, by the RTS) is only 5 years old, so when calculating p it is necessary

consider the dynamics of the stock market over the entire period of its existence.

It should be noted that there is a calculation of p based on fundamentals. At the same time, a set of risks is considered and determined: financial risk factors (liquidity, income stability, long-term and current debt, market share, diversification of clientele and products, territorial diversification), industry risk factors (government regulation, cyclical nature of production, barriers to entry into the industry ), general economic risk factors (inflation rate, interest rates, exchange rates, changes in government policy). The application of this method is largely subjective, dependent on the analyst using the method, and requires extensive knowledge and experience.

In cases where the stock market is not developed and an analogous enterprise is difficult to find, calculating the discount rate for cash flow for equity capital is possible based on the cumulative construction model. The model involves assessing certain factors that create the risk of not receiving planned income. The calculation is based on the risk-free rate of return, and then the total premium for the risks inherent in the business being valued is added to it.

Western theory has identified a list of main factors that must be analyzed by the appraiser: quality of management, company size, financial structure, industrial and territorial diversification, clientele diversification, income (profitability and predictability) and other special risks. For each risk factor, a premium is set in the amount of 0 to 5%.

The use of this model requires the appraiser to have extensive knowledge and experience, and the use of unreasonable values for risk factors can lead to erroneous conclusions.

If the basis for calculating the value of a company is the cash flows for invested capital, then the discount rate is calculated using the weighted average cost of capital model. The weighted average cost of capital is understood as the rate of return that covers the costs associated with attracting equity and borrowed capital. The weighted average profitability depends on both the costs per unit of attraction | valuable own and borrowed funds, and from the shares of these funds in the capital of the company. In its most general form, the formula for calculating the weighted average cost of capital (K) can be presented as follows:

where (1e is the share of equity in invested capital; / is the rate of return on equity; yk is the share of borrowed funds in invested capital; 1k is the cost of attracting borrowed capital (interest on long-term loans); Тт is the income tax rate.

The rate of return on equity capital is the discount rate calculated in the CAPM and cumulative models. The cost of borrowings is the average interest rate on all of a company's long-term borrowings.

5th stage. Calculation of residual value.

This cost (P^st) can be determined by the following basic methods, depending on the development prospects of the enterprise:

1) by the method of calculation based on liquidation value - if in the post-forecast period the possibility of liquidating the company with the subsequent sale of existing assets is considered;

2) methods for assessing an enterprise as an operating one:

Р^ is determined by the Gordon model - the ratio of the cash flow value in the post-forecast period to the capitalization rate, which, in turn, is defined as the difference between the discount rate and long-term growth rates;

Determined by the net asset method, which is focused on changes in the value of property. The size of net assets at the end of the forecast period is determined by adjusting the value of net assets at the beginning of the first year of the forecast period by the amount of cash flow received by the company for the entire forecast period. The use of this method is advisable for enterprises in capital-intensive industries;

The price of the proposed sale is predicted.

The most applicable is the Gordon model, which is based on the forecast of stable income in the remaining period and assumes that the values of depreciation and capital investment are equal.

The calculation formula is as follows:

where V is the cost in the post-forecast period; CP - cash flow of income for the first year of the post-forecast period; I is the discount rate; g is the long-term growth rate of cash flow.

6th stage. Calculation of the total discounted value of income.

The market value of a business using the discounted cash flow method can be represented by the following formula:

RU= 22 /„/(1 + K) where RU is the market value of the company; 1p - cash flow in the nth year of the forecast period; I is the discount rate; Y is the residual value of the company at the end of the forecast period; y is the last year of the forecast period.

It is necessary to note a feature of the process: discounting of the residual value is carried out at the end of the year; if the flow is concentrated on a different date, an adjustment must be made to the exponent p in the denominator of the fraction, for example, for the middle of the year the indicator will look like u - 0.5.

Models and methods for calculating cash flow (CF)

Cash flow (cash-flow) reflects the cash flow of the enterprise and the balance of funds on the current account of the enterprise in combination with cash.

When using the MDDP, you can operate with either the so-called equity cash flow or the non-debt cash flow.

Cash flow for equity capital reflects in its structure the planned method of financing investments that ensure the life cycle of the product (business line). It makes it possible to determine how much and on what terms borrowed funds will be raised. It takes into account the expected increase in the enterprise’s long-term debt, the decrease in the enterprise’s liabilities, and the payment of interest on loans for future periods.

Without debt, cash flow does not reflect the planned movement and cost of borrowed funds. If calculations operate with it, then discounting of expected cash flows should be carried out at a rate equal to the weighted average cost of capital of the given enterprise. In this case, the expected residual value of the enterprise obtained by summing discounted cash flows without debt will be an estimate of the value of all capital invested in the enterprise. To estimate the value of equity capital, it is necessary to subtract the long-term debt of the enterprise planned at the moment under consideration.

Selecting a cash flow model (CF)

When valuing a business, it is possible to use one of two cash flow models: DP - for equity capital or DP - for all invested capital. Using the first model, the market value of the enterprise's own (share) capital is calculated. Table 1 shows how the DP for equity is calculated.

Table 1. Cash flow model for equity capital

Within the framework of the cash flow model, the total cash flow is calculated for all invested capital, i.e. cash flow available to all investors.

Cash flow can be calculated both at current prices and taking into account inflation.

The choice of cash flow model depends on the capital structure of the enterprise. If the business is primarily self-financed and the business does not have significant debt, cash flow for equity is selected. If borrowed capital in the overall financing structure is more than 40-50%, the cash flow for the entire invested capital is selected.

The task of assessing the value of a business at different stages of its development does not lose its relevance. An enterprise is a long-term asset that generates income and has a certain investment attractiveness, so the question of its value is of interest to many, from owners and management to government agencies.

Most often, to assess the value of an enterprise, the income approach is used, because any investor invests money not just in buildings, equipment and other tangible and intangible assets, but in future income that can not only recoup the investment, but also generate profit, thereby increasing the investor's wealth.

The income method takes into account the main goal of the enterprise - making a profit. From these positions, it is most preferable for business assessment, as it reflects the development prospects of the enterprise and future expectations.

Despite all the undeniable advantages, this approach is not without controversial and negative aspects:

· it is quite labor-intensive;

· it is characterized by a high level of subjectivity when forecasting income;

· a high proportion of probabilities and conventions, as various assumptions and restrictions are established;

· the influence of various risk factors on the projected income is great;

· it is problematic to reliably determine the real income shown by the enterprise in its reporting, and it is possible that losses are deliberately reflected for various purposes, which is associated with the opacity of information from domestic enterprises;

· accounting of non-core and redundant assets is complicated;

· incorrect assessment of unprofitable enterprises.

It is imperative to pay special attention to the ability to reliably determine the future income streams of the enterprise and the development of the company's activities at the expected pace. The accuracy of the forecast is also greatly influenced by the stability of the external economic environment, which is important for the rather unstable Russian economic situation.

So, it is advisable to use the income approach to evaluate companies when:

· they have a positive income;

· it is possible to draw up a reliable forecast of income and expenses.

Calculating the value of a company using the income approach

Estimating the value of a business using the income approach begins with solving the following problems:

1) forecast of future income of the enterprise;

2) bringing the value of future income of the enterprise to the current moment.

In addition, it is imperative to take into account the factor of changes in the value of money over time - the same amount of income currently has a higher price than in a future period. The difficult question of the most acceptable timing for forecasting a company's income and expenses needs to be resolved. It is believed that to reflect the inherent cyclical nature of industries, in order to make a reasonable forecast, it is necessary to cover a period of at least 5 years. When considering this issue through a mathematical and statistical prism, there is a desire to lengthen the forecast period, assuming that a larger number of observations will give a more reasonable value of the company's market value. However, increasing the forecast period in proportion makes it more difficult to predict the values of income and expenses, inflation and cash flows. Some appraisers note that the most reliable forecast of income for 1-3 years will be, especially when there is instability in the economic environment, since as the forecast periods increase, the conditionality of the estimates increases. But this opinion is only true for sustainably operating enterprises.

In general terms, the value of an enterprise is determined by summing up the income streams from the activities of the enterprise during the forecast period, previously adjusted to the current price level, with the addition of the value of the business in the post-forecast period (terminal value).