If the organization does not have a cashier position. Can the chief accountant perform the duties of a cashier? Delegation of cashier duties to an accountant

An order to assign duties to an employee has recently become commonplace in almost any enterprise. It is not difficult to draw up such a document. You just need to strictly follow a certain sequence of actions and not violate the Labor Code.

Reasons for issuing the order

There are situations when one of the employees is absent from the workplace for one reason or another. But the enterprise should not change its usual rhythm of work or stop altogether during this time. The way out of this situation would be an order to assign the duties of this employee to someone else. But before this, the employer must decide by whom and in what way these duties will be performed. There are three completely different options:

- You can temporarily transfer one of your colleagues to the position of a currently absent employee.

- Assign his duties to another employee, and he must also do his job.

- Invite someone from outside. He will temporarily replace the main employee.

The choice must be made by the management of the enterprise, and only after that an order on the assignment of responsibilities must be drawn up. Only two factors can influence the decision: labor resources (availability of employees who can perform additional functions) and material capabilities (make partial or full payment).

Step-by-step instruction

There are several reasons why an employer decides that a certain range of responsibilities will be performed by another employee in the future:

- The main employee is currently absent for a valid reason (vacation, business trip, etc.).

- It is necessary to perform duties corresponding to a position (profession) that is not in the staffing table.

- The employee combines work in different professions.

In each of these cases, the following actions must be performed in turn:

- The head of the unit must draw up a memo addressed to the director of the enterprise, which sets out in detail the reasons that prompted him to make the appropriate decision.

- Coordinate the issue with the management.

- Obtain the employee's consent in writing.

- The personnel service issues an appropriate order assigning duties to a specific employee.

To resolve such an issue without creating conflicts, it is necessary to follow a strict sequence of these actions.

Necessary measure

Quite often, a different kind of situation arises at enterprises. For example, the company’s staffing table does not include one or another unit (or the staff is very small), but the duties that correspond to this specialty must be performed. What to do in this case? How to legitimize the situation? This issue is easily resolved. You just need to have a sample order on assignment of duties on hand. It is compiled, in principle, in an arbitrary manner. The title of the order already indicates the position whose duties will need to be performed. Next comes the stating part, which explains the main reason. After this, the administrative part sets out the essence of the issue. For example:

RUSSIAN FEDERATION

LIMITED LIABILITY COMPANY "VETER"

Samara city

On assigning the duties of a mechanic

Due to the absence of the position of chief mechanic in the staffing table of the enterprise

I order:

- Assign the duties of the chief mechanic to the chief engineer Timofeev A.V.

- I reserve control over the execution of this order.

Director of Veter LLC Karpov I. I.

I have read the order:

Chief engineer __________ Timofeev A.V.

Date Signature

If a certain additional payment is established for the performance of duties, then this fact is reflected in the order as a separate paragraph.

Cashier responsibilities

If the state does not have a cashier unit, then the order may look similar. But there are often situations when there is a vacant position, but management is in no hurry to hire an individual employee for it. In this case, a slightly different order is drawn up to assign cashier duties to another specialist (accountant). In fact, this will be a combination of professions (Article 60.2 of the Labor Code of the Russian Federation), so the sequence of actions should be as follows:

- The employer offers in writing to a specific specialist to additionally perform the work of a cashier and receives written consent from him.

- An appropriate order is issued indicating the amount of payment.

- An additional agreement to the previously concluded employment contract (agreement) is drawn up.

- The employee gets acquainted with the job description of the cashier and enters into an agreement on full financial responsibility.

It is worth remembering that in no case can the duties of a cashier be performed by a chief accountant, since the “Regulations on Chief Accountants” do not allow these specialists to combine with their main work responsibilities related to personal responsibility for funds and material assets available at the enterprise.

Someone else's work for a while

If one of the employees is absent from the workplace for some time, then his duties for this period are assigned to another member of the team. This usually occurs due to illness, vacation or business trip. There are two possible solutions to this issue:

- Temporary transfer to the position being replaced. The employee is set a salary for the new profession with all additional payments retained (with the exception of personal allowances). As a result, the amount should in no case be lower than his average salary at his previous place of work.

- Temporary performance of duties along with the performance of their main work. In this case, the amount of payment is determined as a percentage of the salary for the new specialty.

In both the first and second cases, an order on the temporary assignment of duties (or transfer) must be drawn up, which specifies in detail the following information: the period for performing additional duties, the payment due for this work, and the reason for the absence of the main employee.

About signing cash documents if the company does not have a cashier position on its staff. Can the head of an organization sign cash register documents for a cashier if there is no cashier position on the staff? If the company does not have a cashier position on staff, but has a manager and chief accountant, who can sign cash documents?

The company does not have a cashier position on staff. Assignment of cashier duties to the manager or chief accountant. Documenting.

Question: Can the head of an organization sign cash register documents for a cashier if there is no cashier position on staff? If the company does not have a cashier position on staff, but has a manager and chief accountant, who can sign cash documents?

Answer:

Yes maybe. If the functions of a cashier are performed by a manager, then he must sign cash documents. Assign the right to sign cash documents for the cashier to the manager by order in free form. In the order, for example, indicate: Due to the lack of a cashier position, I assign the responsibility and duties of a cashier to myself.

The head of the organization can also grant the right to sign cash documents for the cashier to another employee (employees) on the basis of a power of attorney or order. The manager himself must appoint a list of people who have the right to sign primary accounting documents (clause 14 of the Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n,). In this case, the transcript of the signatures in the PKO and RKO must belong to these persons so that those who signed can be identified.

Rationale

How to draw up an incoming and outgoing cash order, a journal for registering incoming and outgoing cash documents

Who signs the receipt

The cash receipt order must be signed by the chief accountant or accountant. And also a cashier.

Instead of an accountant, cash documents can be signed by another employee of the organization. To do this, the head of the organization (entrepreneur) must draw up an administrative document appointing a person in charge. The candidacy of such an employee is approved by the manager with the chief accountant (if there is one in the organization).

If there is no accountant in the organization at all, then the order is signed by the head of the organization (entrepreneur) and the cashier.

Does the organization have neither an accountant nor a cashier? Then all cash documents are signed personally by the manager (entrepreneur). Such rules are established by the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U.

If the organization does not have an accountant, then the manager must endorse the expense document in any case. Even when he put his signature on the attachments to the cash order. This follows from the instructions of the Bank of Russia dated March 11, 2014 No. 3210-U.

At the same time, the manager can grant the right to sign documents, including cash registers, to one of the organization’s employees. For example, during your absence. To do this, it is enough to issue a power of attorney ().

How to organize document flow in accounting

The manager himself must appoint a list of people who have the right to sign primary accounting documents (clause 14 of the regulation approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n,). These can be employees of the organization (cashier, manager, etc.), as well as representatives of a third-party organization that does accounting.

The right to sign bank documents can be transferred to full-time employees, as well as to persons providing accounting services (clause 7.5 of Bank of Russia Instruction No. 153-I dated May 30, 2014). Thus, in addition to the head of the organization, bank documents can be signed by an employee of the organization or the head of a third-party organization that keeps records.

At the same time, the head of the organization himself cannot sign for the chief accountant. The fact is that, since the organization is not a small (medium) enterprise, the manager cannot take over the accounting. This conclusion follows from Part 3 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Ten new rules by which cash transactions must be completed

Who in the company can draw up cash documents and work with cash in the cash register

| Employee | Do I have the right to register receipts and consumables? | Do receipts and consumables have the right to sign? | Do I have the right to accept and issue cash at the cash desk? |

| Chief Accountant | Yes | Yes | Yes* |

| Director | Yes, if there is no chief accountant and accountant | Yes | |

| Accountant or other full-time employee | Yes* | Yes* | Yes* |

| A private accountant or an employee of an organization, if an accounting service agreement has been concluded | Yes | No | No |

| Cashier | Yes* | Yes* | Yes |

*Based on the director's order.

From July 1, 2016, companies are required to apply professional standards if the Labor Code of the Russian Federation, other federal laws, and other regulations establish requirements for the qualifications necessary for an employee to perform a certain job function. The law does not establish requirements for the chief accountant or ordinary accountant in limited liability companies. At the same time, an LLC can take the standard (approved by Order of the Ministry of Labor dated December 22, 2014 No. 1061n) as a basis to determine the requirements for the qualifications of employees. The accountant's professional standard also specifies labor functions. They do not provide for responsibilities for maintaining a cash register, accepting and issuing cash. Although in practice these functions are often performed by an accountant. In this situation, questions arise:

- Does the company have the right to write down the duties of a cashier in the accountant's job description?

- Is the company required to pay an accountant separately for part-time work if he manages the cash register, but there is no cashier position in the staffing table?

The Ministry of Labor believes that in this situation the employer is obliged to pay the accountant extra. Let's explain why.

Article 60.2 of the Labor Code establishes that, with the written consent of the employee, he can be entrusted with performing additional work along with the main one during the established duration of the working day (shift) for additional payment (Article 151 of the Labor Code of the Russian Federation).

The period during which the employee will perform additional work, its content and volume are established by the employer with the written consent of the employee.

The employee has the right to refuse additional work ahead of schedule, and the employer has the right to cancel the order to complete it ahead of schedule, warning the other party about this in writing no later than three working days.

According to Art. 151 of the Labor Code of the Russian Federation, when combining professions (positions), expanding service areas, increasing the volume of work, or performing the duties of a temporarily absent employee without release from the main job, an additional payment is made.

The amount of the increase is established by agreement of the parties, taking into account the content and (or) volume of additional work (Article 60.2 of the Labor Code of the Russian Federation).

Therefore, for an accountant’s responsibilities to include cash management, the employer must:

1) conclude an agreement with him on combining positions and familiarize him with the cashier’s job description against signature. The agreement must establish:

- amount of additional payment for combination:

- term of combination - for example, during the cashier’s vacation period or until the employee is hired as a cashier;

2) issue an order to assign the employee the duties of a cashier in order to combine positions;

3) arrange the acceptance and transfer of the cash register.

EDITOR'S NOTE:

The legislation does not provide for a procedure for determining the amount of additional payment for additional work. It should be remembered that the provisions of paragraph. 6 hours 2 tbsp. 22 of the Labor Code of the Russian Federation establishes that an employer must provide its employees with equal pay for work of equal value. .

Payment can be set:

- in the form of a specific amount;

- as a percentage of the salary for the position (profession) for which the work is performed.

Let us note that Rostrud previously explained that if the employee’s employment contract or job description stipulates the obligation to combine his position with the position of a temporarily absent employee with a similar job function, then the employer has the right not to pay for additional work. The fact is that in this case such a combination is recognized as performing work under an employment contract, and the employee is not entitled to additional payment (letter of Rostrud dated May 24, 2011 No. 1412-6-1).

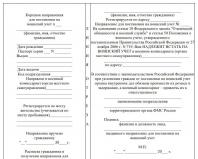

If the cashier in the institution is absent for good reasons (vacation, illness) or such a position is not provided at all, since the enterprise is still small, then the duties of this employee can be assigned to the accountant. To do this, a corresponding document must be prepared and signed. It is called “Order on assigning cashier duties to an accountant.”

FILES

In addition, to comply with all the nuances, some changes will be required in the job description and employment contract. One or two papers must indicate the amount that the employee is entitled to for the additional workload.

Attention! It should not be less than the amount of additional payments prescribed in the Labor Code (in particular, Article 151).

Why do you need an order to assign cashier duties to an accountant?

If there is a need to carry out transactions with cash and draw up cash receipts and debit orders, the bank with which the institution cooperates will definitely inquire about the order.

Can the chief accountant be responsible for the cash register?

In accordance with the law, if there are several accountants in an institution, then the duties of a cash desk employee can be assigned to anyone except the chief accountant.

In the case where the chief accountant is the only one in the organization (and this most often happens), then these functions can be assigned directly to him.

What will you need besides the order?

Paper alone is not enough for the full legality of ongoing processes.

There are several options that the head of an organization can resort to if it is necessary to perform the duties of one employee by another.

First option. An order is drawn up, signed, and then an agreement on full swearing is concluded with the employee. responsibility, is certified, then changes are made to the employment contract of the accountant (or the chief accounting specialist in the organization, depending on the circumstances), which provide for him to perform all the functions of a cashier. This option is more logical.

Second option. An order and an agreement are formed and signed, as in the first option, plus amendments to the acting status are made. cashier in .

Algorithm for drawing up a document

At the top of the paper there is a header in which the name of the document and the date of its preparation are written. Then, after the title, the reasons for the absence of the employee as such are indicated. These reasons may be:

- dismissal of a previous employee;

- going on leave (to care for a child, etc.);

- business trip of the main employee;

- the enterprise is small, and the position itself is not provided, and other reasons.

This is what it should look like:

After the introductory part, the wording (as in any other order) “I order” is required, followed by a colon. Then comes a list of what needs to be done: authorize an employee (with full indication of full name and position) to perform work with one of the types of cash registers.

In this case, the model of the cash register must be clearly stated. It could be:

- AMC 100K – if the organization sells food products;

- autonomous cash registers with fiscal memory such as ORION-100K or MERCURY-180K;

- mobile payment terminals with a modem and battery type YARUS C2100;

- printers that do not work without a computer or terminal (they are called fiscal registrars) like FPrint -5200PTK and the like;

- receipt printers (they do not have built-in memory, which means they do not need to be registered with the tax office) of the types Shtrikh 600, MPRINT R58 USB, etc.

In short, regardless of the model, the cash register must be registered.

In addition to appointments, the order prescribes the employee’s authority to keep a journal, draw up the necessary reports, and sign cash documents from the official “cashier” or “administrator.”

The text should also contain information about the employee’s familiarization with such a document as the Procedure for Conducting Cash Transactions. This review will require an additional signature of the employee who assumes the rights and responsibilities of the cashier.

Footnote to the agreement on mat. responsibility will also be useful. Without it, the order will also be valid, but it will need to be supplemented with an annex in the form of this agreement.

At the end of the text of the document there must be at least two signatures: the accountant-cashier and his manager. The date is already at the beginning.

What else may be contained in the document?

If it is not planned to make changes to the job description of an accountant (or chief accountant) regarding the performance of the duties of a cashier, then the Order must contain a line (at the end of the first paragraph on the appointment) “with an additional payment in the amount of XXX.” This condition guarantees full compliance with labor laws.

Is it necessary to compile

Important! Even if the staffing table does not include the position of a cash register employee and there is a single job description indicating that all cashier functionality is included in the accountant’s list, an order assigning duties is required.

This is due to the fact that the vast majority of banks licensed in the Russian Federation clearly state the terms of interaction with individual entrepreneurs, LLCs or other legal entities. Under these conditions, cash transactions cannot be carried out by anyone other than a cashier, who is selected from the existing staff or hired separately.

In large organizations

If we are talking about an individual entrepreneur, then the employee’s written consent to assign duties is not required. If the company has a separate manager and he makes a decision on such a personnel change, then he is obliged to inform the superior manager about this in writing.

An employee who is preparing to perform new duties gives written consent that he has nothing against changing the job description, issuing an order and concluding a liability agreement.

Usually there is no difficulty with this, since the remuneration of such an employee increases in accordance with the Labor Code of the Russian Federation.

Russian Federation. Clause 1.6 of Regulation No. 373-P states that cash transactions are carried out by a legal entity, individual entrepreneur, by a cashier or other employee determined by the head of the organization from among his employees (hereinafter referred to as the cashier), with the establishment of corresponding official rights and responsibilities with which The cashier must review it against signature. It follows from this that any employee of the organization, including the chief accountant, can be appointed by the manager to perform the duties of a cashier. This is especially typical for small enterprises, where there is no one else except the chief accountant, or there is only the position of chief accountant and cashier, but the cashier is temporarily absent - for example, on maternity leave until the child reaches the age of three years. In this case, it would be logical to entrust the chief accountant with the duties of a cashier.

Is it necessary to create a cashier position?

But since the Labor Code of the Russian Federation is higher in legal status than the resolution, then in case of contradictions, the provisions of the Labor Code of the Russian Federation are applied. There is another document that partially answers the question posed.

We are talking about the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation, approved. Bank of Russia October 12, 2011 No. 373-P (hereinafter referred to as Regulation No. 373-P).

There is no doubt regarding the legal application of this document, because according to Art. 7 of the Federal Law of July 10, 2002 No. 86-FZ “On the Central Bank of the Russian Federation (Bank of Russia)”, the Bank of Russia on issues within its competence issues in the form of guidelines, regulations and instructions mandatory for ..... all legal entities and individuals. To the functions of the Bank of Russia, according to Art.

How to correctly arrange the combination of the positions of chief accountant and cashier

Additional agreement and order Combining the position of chief accountant with the duties of a cashier must be formalized:

- — agreement of the parties to the employment contract (sample 1 below);

- - by order (instruction) of the manager to assign cashier duties to the chief accountant on a combination basis (sample 2 below).

Please note: in the agreement on combining positions, you can include a separate clause on the employee’s full individual financial responsibility: “The employee bears full individual financial responsibility for the shortage of the property entrusted to him in accordance with the Agreement on full individual financial responsibility No. 10/PMO dated 02.11.2015.”

How to arrange for the chief accountant to combine the position of cashier?

Important

An example of such damage is the amount of the fine for late submission of reports, provided that: - the delay was caused by the fault of the chief accountant; — compilation and presentation of reports is the job responsibilities of the chief accountant. The chief accountant, in the absence of a separate agreement on financial responsibility concluded with him as a cashier, should not be responsible for the lack of money, even if his employment contract, along with the chief accountant’s responsibilities, also stipulates cashier duties.

After all, money and other material assets were not entrusted to him on the basis of a liability agreement. * * * Proper registration of combining the positions of chief accountant and cashier is also beneficial for you. It immediately becomes clear what you are responsible for.

Can an employee combine two positions: cashier and chief accountant?

- - the position of cashier is vacant or another employee performs only part of the duties for this position;

- — the chief accountant signed an agreement to combine the position of cashier;

- — the agreement establishes the duration of the combination, the responsibilities assigned to the employee in the position of cashier, and determines the additional payment for the combination;

- — the chief accountant performs the duties of a cashier during the established working hours without release from the main job.

Additional payment for combining the position of a cashier. Additional payment for combining the position of a cashier can be established:

- - in a fixed amount;

- - as a percentage of the tariff rate (salary) or wages of an employee for a part-time or main position.

The Labor Code does not establish any minimum or maximum amounts of additional payment for combining positions.

Combining the position of chief accountant and cashier

- Themes:

- Part-time job

- Combination

- Part-timers

Question The organization’s staffing table does not include the position of accountant-cashier. The manager assigned the duties of the cashier to the chief accountant.

Is it possible to formalize the performance of the duties of a cashier by the chief accountant in such a way as not to impose an additional payment on him, for example, to include the duties of a cashier in the job description of the chief accountant? If so, is it necessary to issue an order assigning cashier duties to the chief accountant? Answer In this case, it is necessary to formalize the combination of the cashier position (with its introduction into the staffing table) and with the establishment of an additional payment by agreement of the parties to the employment contract. The Labor Code of the Russian Federation Federal Law No. 402-FZ dated December 6, 2011 “On Accounting” does not contain a ban on the chief accountant combining the position of cashier.

For more information about this, see the addendum.

The employee undertakes to perform additional work as a cashier during the established working day, along with the work specified in the employment contract. 2. For additional work performed under this agreement as a cashier, the Employee receives an additional payment in the amount of 15,000 (Fifteen thousand) rubles per month.

3. This additional agreement comes into force from the moment it is signed by both Parties. 6. This additional agreement is drawn up and signed in two copies having equal legal force, one of which is kept by the Employer, the other is transferred to the Employee.

Signatures of the parties Employer: Employee: Step 2. You need to print an order on combining positions indicating the amount of additional payment and have it signed by the manager. This order is the basis for accounting to charge the established surcharge.

Let's give an example of such an order.

Who cannot combine the position of cashier

At the same time, neither the Labor Code of the Russian Federation nor other federal laws or regulations contain norms that would prohibit the chief accountant or cashier from performing additional work in other positions in a combination manner. Previously, Resolution of the Council of Ministers of the USSR dated December 4, 1981 N 1145 “On the procedure and conditions for combining professions (positions)” did not allow the combination of positions, including by heads of organizations, their deputies and assistants, chief specialists, and heads of structural divisions. However, it was declared invalid on the territory of Russia (clause 3 of the Decree of the Government of the Russian Federation of March 10, 2009 N 216 “On amending and invalidating certain acts of the Government of the Russian Federation”).

Home — Articles Often, when hiring a chief accountant, the manager initially stipulates with him that he will also perform cashier duties, and stipulates them in the chief accountant’s employment contract. Combining positions means that an employee of an organization, along with work in his main position specified in the employment contract, also performs additional work in another position.

Moreover, he does this within the limits of his normal working day (and not beyond that) due to the intensity (condensation) of work during the day. But other situations also occur. Sometimes the managers of small companies, in which cash transactions are carried out infrequently, having lost a cashier for some reason (went on maternity leave, quit, etc.), prefer not to hire a new person for this position. They offer the chief accountant to perform the function of a cashier for additional money.

Attention! Even if an agreement on full financial liability is concluded, but the amount of “cashier’s damage” exceeds your “combined” average monthly earnings, then the damage caused can only be recovered from you through the court. In addition, without concluding an agreement on full financial cashier responsibility, the manager does not have the right to allow the chief accountant to work as a cashier.

And banks monitor this when checking cash discipline. Thus, the existence of an agreement on cashier liability will allow the employer to reimburse the entire amount of the shortfall, even if it exceeds the employee’s average monthly earnings.

In addition, if the damage compensation case goes to court, then the employee himself will have to prove his innocence.