Work instructions “Regulations on mentoring. How does the mentoring salary premium factor into labor costs? Work experience in the company, product knowledge

- The size of the bonus for mentoring in each specific case is determined taking into account the number of employees assigned to the mentor and the level of their professional training and is set as a percentage of the salary of the mentor employee, but in any case cannot be less than 10% of the salary.

- The establishment of the allowance is made in accordance with the order of the organization upon the proposal of the personnel department.

Please note that labor legislation does not oblige employers to adopt a special provision on mentoring. Nor is it required to include payments to mentors as “profitable” expenses. However, the need to adopt such local acts in some sectors of the economy is provided for in industry agreements (in particular, in the Industry Tariff Agreement in the Housing and Communal Services of the Russian Federation for 2008 - 2010<4>and the Industry Tariff Agreement for organizations and enterprises in the sphere of public services for the population for 2008 - 2010<5>). In organizations where mentoring is actively practiced, but which are not covered by such agreements, it is also advisable to adopt a local mentoring provision. After all, it can resolve such important issues:

— who can be appointed as a mentor (mentor selection criteria), for what period and in what order;

— the rights and obligations of the mentor and the employee assigned to him, in particular the right of the mentor to make proposals to management about encouraging the employee assigned to him or, on the contrary, about bringing him to disciplinary liability; the responsibility of this employee to carry out the professional adaptation plan developed by the mentor.

Therefore, the adoption of such a local provision will clarify many issues related to mentoring and simplify the paperwork when appointing mentors. When developing it, you can focus on similar provisions approved by regulatory legal acts and applicable to certain categories of employees, for example, the Regulations on mentoring in the Office of the Federal Bailiff Service in Moscow<6>.

<1>Article 135 of the Labor Code of the Russian Federation.

<2>Articles 8, 57, 135 of the Labor Code of the Russian Federation.

<3>Clauses 1.6, 1.7, 6.6.2 of the Industry Tariff Agreement in the Housing and Communal Services of the Russian Federation for 2008 - 2010, approved. Rosstroy 07/02/2007, All-Russian industry association of employers "Union of Utility Enterprises", All-Russian Trade Union of Essential Workers 06/22/2007.

<4>Approved by Rosstroy on 07/02/2007, by the All-Russian industry association of employers “Union of Utility Enterprises”, by the All-Russian Trade Union of Essential Workers on 06/22/2007.

<5>Approved by the Russian Association of Employers in the Consumer Services Sphere and Craftsmen "Rosbytsoyuz", the All-Russian Trade Union of Essential Workers on November 23, 2007.

<6>Approved by Order of the Office of the Federal Bailiff Service of Russia in Moscow dated September 24, 2008 N 1261.

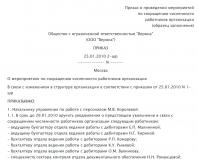

About assigning a mentor

I ORDER:

- To appoint senior foreman Sergei Aleksandrovich Mironov as a mentor to mechanic Dmitry Petrovich Gorelov for the period from December 1 to December 31, 2009 inclusive.

- Establish a salary bonus for senior master Sergei Aleksandrovich Mironov in the amount of 6,000 (six thousand) rubles. for the period specified in clause 1 of this Order.

Seal

General Director of Buinov LLC

LLC "Boomerang" "Boomerang" —————- /Buinov A.G./

(personal signature)

With the order of Mironov December 1, 2009

familiarized with: ——- /S.A. Mironov/ “———” —- Mr.

Gorelov December 1, 2009

——- /D.P. Gorelov/ “———” —- Mr.

If your organization does not have a collective agreement or local regulations on mentoring, then you can assign the duties of a mentor to a specific employee by concluding an additional agreement with him to the employment contract. Keep in mind that if you burden an employee with such duties without his written consent, and even if you do not pay extra for it, the employee may complain to the labor inspectorate. And the labor inspectorate, having come to you with an inspection based on a complaint and having established such a fact, for example, based on witness testimony, may regard your actions as a violation of labor laws<7>and fine<8>:

- the head of the organization in the amount of 1000 to 5000 rubles;

- organization in the amount of 30,000 to 50,000 rubles.

Write down in the additional agreement the specific responsibilities of the mentor, since your organization does not have a local act defining such responsibilities. It can be formatted, for example, like this.

Additional agreement to the employment contract dated January 21, 2004 N 35

Limited Liability Company "Boomerang" represented by General Director Buinov Alexander Grigorievich, hereinafter referred to as the "Employer", and the senior foreman of LLC "Boomerang" Mironov Sergey Aleksandrovich, hereinafter referred to as the "Mentor", have entered into this agreement as follows.

- The mentor assumes the following obligations for mentoring mechanic Dmitry Petrovich Gorelov (hereinafter referred to as the “Employee”), in connection with which he undertakes:

- provide practical assistance to the Employee in acquiring the skills necessary to perform job duties, monitor his work, promptly identify errors and shortcomings and take measures to eliminate them;

- Based on the results of mentoring, submit a review for approval to the head of the department, which should contain information about the Employee’s business qualities and his readiness to independently perform work duties.

- Mentoring is established for the period from December 1 to December 31, 2009.

- The mentor is given a salary increase in the amount of 6,000 (six thousand) rubles.

- This agreement was drawn up by the parties in two copies, one for each party, is an integral part of the employment contract dated January 21, 2004 No. 35 and comes into force from the date of its signing.

Employer Mentor

General Director Mironov S.A.

LLC "Boomerang"

Buynov A.G. Seal

OOO

Buynov "Boomerang" Mironov

——- ——-

signature<7>Article 60 of the Labor Code of the Russian Federation.

<8>Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

* * *

The mentoring bonus paid to employee mentors is included in “benefit” expenses as regular wages. The main thing is to correctly formalize the establishment of such a premium, and we told you how to do this.

<9>Article 25 255 Tax Code of the Russian Federation.

<10>Letter of the Ministry of Finance of Russia dated February 22, 2007 N 03-03-06/1/115.

<11>Subclause 23, clause 1, art. 264 Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated March 17, 2009 N 03-03-06/1/144.

<12>Subclause 6, clause 1, art. 208, art. 209 of the Tax Code of the Russian Federation.

<13>Clauses 1, 3 art. 236 Tax Code of the Russian Federation; clause 2 art. 10 of the Federal Law of December 15, 2001 N 167-FZ “On compulsory pension insurance in the Russian Federation.”

<14>Articles 7, 8 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds.”

<15>Subclause 2, clause 2, art. 17 Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”; List of payments for which insurance contributions to the Social Insurance Fund of the Russian Federation are not charged, approved. Decree of the Government of the Russian Federation dated July 7, 1999 N 765.

E.Yu.Zabramnaya

Regulatory regulation of the issue

Remuneration is a reward to an employee for his efforts, while the legislation guarantees to each worker such payments that fully compensate for his efforts.

The procedure for payment of monetary remuneration for work is regulated by the following legislative acts:

- Art. 133 of the Labor Code of the Russian Federation prohibits the employer from making payments to employees below the minimum established at the federal legislative level, namely below the minimum wage;

- Art. 143 of the Labor Code of the Russian Federation provides the employee with payments according to the tariff schedule or category;

- Art. 146 – 154 of the Labor Code of the Russian Federation indicates the employer’s obligation to compensate employees for improper working conditions, which are a violation of established standards;

- according to the Labor Code, the employer is obliged to calculate and pay wages;

- According to the Labor Code of the Russian Federation, the employer has the right to set a maximum amount of incentive payments.

The legislator obliges the employer to pay additional payments when cases arise; in addition, on his own initiative, he can pay additional bonuses to employees as an incentive.

It follows that:

- An additional payment is compensation for an increased volume of work or irregular work; its payments are mandatory if the employee works on a day off, a holiday, or above the norm.

- An allowance is an incentive that should stimulate an employee to great achievements, such as payments for long service or continuous service and others.

These payments have one thing in common – an increase in the employee’s basic income.

But they also have differences:

When and what type of allowances and additional payments to wages are possible?

When are they possible and what type?

Bonuses can be of a different nature; they can be set at any time in order to stimulate the employee, which affects their type:

- for mentoring young specialists, intended for employees who have been working at the enterprise for a long time;

- for highly qualified work - intended for top-class specialists;

- personal – paid for the purpose of retaining a valuable employee;

- for having an academic degree and title - academicians, professors, graduate students;

- if they have access to state secrets, diplomats, ambassadors and other persons receive such an allowance in order to ensure the safety of the secret;

- for knowledge of foreign languages - such specialists are needed at various enterprises with foreign partners.

In addition, there are bonuses that are paid without fail, taking into account the provisions of Art. 149 Labor Code of the Russian Federation:

- for work in difficult and dangerous conditions, in special climatic zones;

- when combining several positions or for going on the night shift;

- with special knowledge and skills.

There may also be other circumstances that are important to pay attention to immediately, since otherwise it will be problematic to challenge the signed employment contract.

Additional payments are paid in most cases for the following reasons:

- piece workers for increasing the production rate;

- young specialists receive one-time additional payments as incentives;

- for the rotational nature of work;

- for the transportation of dangerous goods;

- for overtime, irregular hours, and time spent outside of the shift;

- regional coefficient.

Important: all additional payments and allowances existing at the enterprise must be contained in local acts and the payslip of each employee.

How are bonuses and surcharges calculated?

In the process of their creation and inclusion in the internal regulatory document of the enterprise, agreement with the trade union takes place before signing. After signing the act, the employer will no longer be able to refuse to pay the funds or reduce the amount; only increases in favor of employees are allowed.

At the same time, compensation payments are provided for by law and, if appropriate conditions exist at the enterprise, they must be paid. If the bonus is a one-time bonus, it is paid based on the order of the manager.

Types of salary supplements

Rules and features

In order for additional incentive payments to occur, the employee must be faced with the following task:

- fulfillment of a given plan, while it must be realistic for implementation, and not with unattainable requirements, each employee must have a chance to prove himself;

- the bonus must have a significant amount, since otherwise the employee will have no interest in it;

- the employee must know the full list of possible additional payments and allowances at the enterprise;

- mandatory payment of compensation amounts.

If an employer regularly rewards its employees, in compliance with the rules, the enterprise as a whole will show excellent productivity results.

Calculation

Calculation of additional payments, for example, for overtime hours during a shift schedule, is carried out based on the following rules:

- recording working hours for a certain period, for example, a month, a quarter;

- working time standards for the same period based on the production calendar or accounting sheet;

- clock graphics.

Examples

A specialist at an enterprise works in shifts, his salary is 30,000 rubles, plus he receives an additional payment of 10% of the salary for length of service. The accounting period is a quarter for which, according to the schedule, each specialist must work the norm of 500 hours, but the employee worked 550 hours, which was 50 hours in excess of the norm.

To find out the amount of the bonus, you should initially calculate the employee’s average hourly earnings, for this: ((50,000 + 50,000 * 10%) * 3) / 500 = 330 rubles

It should be remembered that overtime, according to the law, is paid at one and a half times the first 2 hours, and for the rest of the time at double the rate. In addition, the specifics of payment for such a period may be described in the collective agreement. Following the legislative acts, the surcharge will be calculated as follows: 330 * 2 * 1.5 + 330 * 48 * 2 = 990 + 31,680 = 32,670 rubles

If not paid

In the case of incentive payments, the employer has the right to cancel them in whole or in part, for example, due to a difficult economic situation, but subject to the requirements for the cancellation procedure:

In the case of incentive payments, the employer has the right to cancel them in whole or in part, for example, due to a difficult economic situation, but subject to the requirements for the cancellation procedure:

- if they are specified in the employment contract, cancellation can only occur bilaterally;

- when specifying the terms of payments in the collective agreement, it is necessary to comply with the cancellation rules specified in the same document;

- if the terms of payment are specified in a local act, then the employer has the right to cancel it with a new document of higher power;

- in the case of an order for payment, it can be canceled with a new order.

If compensation payments provided for by law are not paid, the employer, as an official, bears all types of liability, including criminal liability, if a claim from employees is filed in court. In the case of an enterprise, it also bears administrative and material responsibility. If any of these requirements are violated, employees have the right to complain to the Labor Inspectorate, the prosecutor's office and the court.

Additional payments and bonuses are an excellent incentive to improve performance. An employer who wants to achieve high economic performance and occupy a competitive level in the market will systematically stimulate the working class with various bonuses and additional payments.

The video below will tell you how to make incentive payments in 1C:

On the territory of the Russian Federation, the position of mentor is not included in the classifier of professions. However, the mentoring institute is growing and developing. For many companies, the mentor-mentee relationship is part of the corporate culture. Being a mentor for specialists who have just arrived at a new workplace is prestigious, necessary and important.

Yes, recognition of one’s merits and assigned responsibility for the future generation of employees is a strong motivator. But the respect of your colleagues alone will not get you far. This should be remembered and understood. Holding the position of a mentor is a job, and often a person has to do it in his free time from his main job. To prevent your mentor from quickly burning out, consider paying separately for his work with his mentees. In the end, it largely depends on him how well the company’s recruits will be trained. At first, even more than from the director.

Is the salary of a mentor regulated by the Labor Code of the Russian Federation?

Unfortunately, mentoring is not mentioned either in the Labor Code or in other federal laws. However, this does not mean that the duties of a mentor are performed for free. There are two different situations:

1. When applying for a job, we discussed with the person the question about the position of a mentor. He was informed that mentoring was part of his job description. The candidate heard, understood, agreed, and went to work. In this case, the size of his salary does not depend on whether he is currently performing the functions of a mentor or not.

2. When applying for a job, nothing was said about mentoring. In this case, the employee may simply refuse to take on these obligations. If he agrees to become a mentor, of course, it is better to pay for this hard work. This issue can be regulated either by an article on internal part-time work (Article 60.1 of the Labor Code of the Russian Federation) or on combination (Article 60.2 of the Labor Code of the Russian Federation).

What to do if there is no law, but you need to register the activities and salary of a mentor?

To properly formalize the position of a mentor in an organization, it is not at all necessary to wait for the relevant laws to be issued. In the business sphere, each company has the right to independently come up with and prescribe Regulations that regulate this activity of employees. Everything needs to be written down: goals and objectives, rights and responsibilities of mentors, time frames for additional work activities, indicators for assessing work and the amount of payment for additional work. The document is developed jointly by the HR department, accounting department and lawyers. The finished document is agreed upon with the head of the company.

The path of a properly registered mentor in a nutshell: the accounting department issues an employee an allowance for mentoring, and then a specific employee is assigned by order to the role of a mentor.

What should you consider when assigning a bonus to a mentor?

If you are confused by the question “How much will he pay in the end?”, then here are a couple of tips:

1. The amount of the bonus can be set as a fixed amount or as a percentage of the salary.

2. The size of the bonus for mentoring in each specific case is determined taking into account the number of workers assigned to the mentor and the level of their professional training and is set as a percentage of the salary of the mentor employee, but in any case cannot be less than 10% of the salary.

Motivated mentors to you!

In a transport company, when hiring drivers, driver-mentors conduct an internship. How to properly document additional payments to these mentors. Perhaps you have samples of the required documents.

Answer

Answer to the question:

First of all, it should be noted that the employer does not have the right to demand that the employee perform work not provided for by his employment contract (Article 60 of the Labor Code of the Russian Federation).

And the employee has the right to timely and full payment of wages in accordance with his qualifications, complexity of work, quantity and quality of work performed (Part 1 of Article 21 of the Labor Code of the Russian Federation).

Since mentoring involves expanding the responsibilities and increasing the volume of work of an experienced employee, the additional work of the mentor should be paid.

Additional payment for mentoring can be set at a fixed amount or as a percentage of the mentor's salary. The specific amount of additional payment for mentoring is not regulated by law and is determined by each organization independently, based on the mentor’s task plan, by agreement of the parties.

When combining professions, an employee does additional work during his regular working day. In this case, additional work is subject to payment and is possible only with the written consent of the employee. Such rules are established in Article 60.2 of the Labor Code of the Russian Federation.

By expanding service areas and increasing the volume of work performed, we mean performing, along with one’s main work stipulated by an employment contract, an additional volume of work in the same profession or position ().

In this case, the assignment of additional work to an employee for additional payment should be formalized by the employee and the employer signing an additional agreement to the employment contract, which will determine both the content and volume and duration of future work, as well as additional payment for its implementation (Article , Labor Code of the Russian Federation).

Based on the additional agreement to the employment contract, issue an order assigning the employee the appropriate work and establishing additional payment. Submit a copy of the order to the accounting department for calculation and payment of additional payments to the employee.

Information on combining professions, expanding service areas, increasing the volume of work, performing the duties of a temporarily absent employee without release from work specified in the employment contract does not need to be entered into the employee’s work book and personal card (, clause, Rules approved, Instructions approved) .

Question from practice: is it necessary to draw up an additional agreement to the employment contract each time or is it enough to conclude once if the employee’s workload periodically increases

An additional agreement must be drawn up for each case of an increase in the scope of work.

An increase in the volume of work performed means performing, along with one’s main work stipulated by an employment contract, an additional volume of work in the same profession or position (). At the same time, it is necessary to distinguish an increase in the volume of work from the temporary performance of duties in another position (profession, specialty), when the employee’s work function partially (or completely) changes. Such work cannot be recognized as an increase in the volume of work. With a temporary increase in the volume of work, the employee, due to the intensity of work, increases the volume of output (services provided, work performed, etc.), and the intensive work itself is temporary.

To formalize an increase in the scope of work, it is necessary to conclude an additional agreement to the employment contract. Such an agreement determines not only the content, volume, amount of additional payment for the established increase, but also the period of future work (Article, Labor Code of the Russian Federation). Therefore, it is necessary to draw up an additional agreement to the employment contract every time there is a need to increase the employee’s workload.

Question from practice: is a change in the job function an expansion of responsibilities within the employee’s position?

Combination term

Question from practice: for what maximum period can a combination be established?

The Labor Code of the Russian Federation does not establish the maximum duration of the combination period (). Therefore, the parties have the right to establish combination for any period determined by them independently.

The combination period can be specified:

- specific date;

- event: “before the main employee returns to work.”

If combination is established for an employee with a fixed-term employment contract, then in order to avoid a controversial situation and recognition of the contract as indefinite, the term of combination should not exceed the term of the employment contract itself, and it is better to immediately fix it in the agreement on combination. Otherwise, the employer will have to monitor the deadline additionally in order to warn the employee about the termination of the combination no later than three days before the end of the fixed-term employment contract ().

Limitation on combined positions

Can an employee combine positions of the same name?

An employee cannot combine positions and professions of the same name. Combination means additional work in another profession or position. This differs from the temporary performance of the duties of an absent employee. When performing temporary duties, an employee can perform duties for both the same and different positions. This follows from the provisions of Article 60.2 of the Labor Code of the Russian Federation.

In addition, restrictions on combining positions are provided for the head of the organization. Namely:

- the manager should not be a member of the bodies exercising control and supervision functions in this organization. That is, he cannot combine the duties of an auditor, auditor, etc.;

- the manager cannot combine the position of chief accountant. This restriction does not apply to small and medium-sized enterprises, provided that they are not credit organizations. The head of a credit institution is prohibited from holding the position of chief accountant in all cases.

This procedure is provided for in Article 276 of the Labor Code of the Russian Federation, as well as Law of December 6, 2011 No. 402-FZ.

Question from practice: can an employee combine more than two positions in the same organization?

Yes maybe.

In labor legislation there are no restrictions on the number of positions that the same employee can hold (). Therefore, employees have the right to combine more than two positions in the same organization.

The exception is when . For example, the head of an organization cannot combine the position of chief accountant in a credit organization (,).

Question from practice: is it possible for a part-time worker to work in combination mode?

It should be remembered that the part-time worker will perform part-time work for the time specified in his employment contract. And the work time of a part-time worker can be no more than four hours a day and no more than half the monthly working time for one month (another accounting period) ().

Registration of a combination for a beginner

How to establish a combination for a new employee

There is no need to draw up a separate employment contract for a combination of jobs with an employee.

If a combination of jobs is established for a new employee upon hiring, then in the employment contract with him or her, reflect both the conditions for performing the main job and the conditions for performing the part-time job. Based on the contract and indicate in it the combination of professions (positions).

Question from practice: how to reflect the condition of combining professions in an employment order

In the line “Conditions of employment, nature of work” of the order, indicate: “Under the conditions of combining with the position (name of position).” The employment order form has been approved.

Registration of a combination for an already working employee

How to establish a combination of professions (positions) for an already working employee

If the combination is established for an employee already working in the organization, be sure to obtain his consent to the combination (). Formalize the consent of the parties in the form (). Indicate in it:

- the work (position) that the employee will perform additionally, its content and volume;

- the period during which the employee will perform additional work;

Such requirements for registration of combinations are provided for in Article 60.2 of the Labor Code of the Russian Federation.

Based on the concluded agreement, issue a combination order. There is no standard form for the document, so compile it in .

Entry into the work book

Question from practice: is it necessary to enter information about combinations into the employee’s work book?

No no need.

In the work book, the employer enters information about the employee, the main work he performs, transfers to another permanent job, dismissal, as well as information about awards (, Rules, approved, Instructions, approved).

Additional payment for combination

How to pay for a combination

When combining professions (positions), the employee receives an additional supplement to his earnings.

Cancel Registration

How to undo a combination

The employee has the right to refuse to perform additional work ahead of schedule, and the employer has the right to cancel the order to perform it ahead of schedule. The employee must be notified of early termination of part-time work no later than three working days in advance. If an employee wants to prematurely refuse to perform additional work, he must also notify the employer three working days in advance by submitting a notice. This procedure is provided for in Article 60.2 of the Labor Code of the Russian Federation.

Regardless of who initiated the termination of additional work based on the notification issued or the application received from the employee, issue an order to cancel the combination. There is no standard form for the order, so write it in . The order will confirm that both parties are aware of the cancellation of the combination and will fix its date, as well as inform all interested parties about this change. In particular, the order will become the basis for the accounting department to stop.

It is possible, but not necessary, to enter into a separate additional agreement to the employment contract to cancel the combination. In this case, the parties do not agree on anything. Cancellation occurs unilaterally by notification without the need to obtain the consent of the other party. A similar approach is applied in the event of dismissal. Upon dismissal, the parties enter into an agreement to the employment contract only if it is necessary to stipulate special termination conditions, for example, a special period of dismissal or payment of additional compensation. If an employee notifies of dismissal (cessation of work) in the general manner two weeks in advance and the employer does not plan to negotiate special conditions, then based on the application, an organizational order for dismissal is issued without drawing up any additional agreements.

Question from practice: is it necessary to formalize a dismissal or transfer if an employee needs to cancel his/her job?

No no need.

In this case, there is no talk of dismissal or transfer. When combining, a separate employment contract is not concluded and an entry is not made in the employee’s work book (Instructions, approved). for a certain period by agreement of the parties with the issuance of an order from the manager. After this period, the employee stops working in the combined profession (position) and continues to perform only the work provided for in the employment contract. Both the organization and the employee have the right to notify the other party of this in writing no later than three working days. This procedure is established by the Labor Code of the Russian Federation.

Ivan Shklovets,

Deputy Head of the Federal Service for Labor and Employment

3. Shapes:Order to appoint a mentor

|

Closed Joint Stock Company "Alfa" ORDER No. 56-k Moscow 10/18/2011 For the purpose of mentoring and in accordance with Regulations on remuneration I ORDER: 1. Assign senior cashier Valentina Nikolaevna Zaitseva mentor cashier Dezhneva 2. Install V.N. Zaitseva salary supplement in the amount 2300

(Two thousand three hundred) rub. on 3. I reserve control over the execution of this order. Base: memo from the head of the HR department E.E. Thunderous№ There is not a single mention of job descriptions in the Labor Code. But HR officers simply need this optional document. In the magazine “Personnel Affairs” you will find the latest job description for a personnel officer, taking into account the requirements of the professional standard. Check your PVTR for relevance. Due to changes in 2019, provisions in your document may violate the law. If the State Tax Inspectorate finds outdated formulations, it will fine you. Read what rules to remove from the PVTR and what to add in the “Personnel Affairs” magazine. In the Personnel Business magazine you will find an up-to-date plan on how to create a safe vacation schedule for 2020. The article contains all the innovations in laws and practice that now need to be taken into account. For you - ready-made solutions to situations that four out of five companies encounter when preparing a schedule. Get ready, the Ministry of Labor is changing the Labor Code again. There are six amendments in total. Find out how the amendments will affect your work and what to do now so that the changes do not take you by surprise, you will learn from the article. |

Experience in any field of professional activity does not appear suddenly. It comes as the worker masters the specialty and grows in his qualifications in the process of his work. Even a high theoretical level of specialist training may be insufficient in real business conditions. There are also certain types of work activities that can only be learned in the process of work. And in this case, specialists with sufficient practical experience can come to the rescue, allowing a new employee to adapt to “field” conditions.

The concept of “mentoring” is not enshrined in current labor legislation. Therefore, each organization, if necessary, determines for itself the tasks and methods of mentoring.

The main goal of the mentoring institute is to help the employee adapt to new conditions, as well as master practical skills for a specific job. The following definition of mentoring is given: personnel technology, which involves the transfer of knowledge and skills from more qualified persons to less qualified ones, as well as assistance in ensuring their professional formation and development (draft Order of the Ministry of Labor “On approval of the Regulations on mentoring in the Ministry of Labor and Social Protection of the Russian Federation”) .

Typically, mentoring is most common in manufacturing companies. For these purposes, organizations can develop Regulations on Mentoring, which disclose the principles of mentoring, the rights and obligations of the parties, and payment terms. In furtherance of the adopted Regulations, employee mentoring plans and programs can be developed that define the goals set for specific employees within the framework of mentoring and the time frame for their achievement.

Mentoring usually involves highly qualified specialists and experienced workers who can help new employees, interns or students.

The procedure for remunerating mentors in organizations depends on the method of formalizing mentoring. If the duties of a mentor in relation to a particular employee were provided for by his employment contract or job description, then the performance of such duties will be considered as the performance of a specified job function and will not be subject to additional payment.

Otherwise, mentoring is subject to payment in accordance with the accepted remuneration system in the organization, depending on whether the employee, along with mentoring, performs work in his main profession or position and how this work and mentoring are combined with each other. For example, an employee is involved in mentoring at a time other than his main job (for example, after its completion), or simultaneously with it. In the first case, we will talk about internal part-time work (Article 60.1 of the Labor Code of the Russian Federation), in the second - about combination (Article 60.2 of the Labor Code of the Russian Federation).

| | | next lecture ==> | |

How do I apply for additional payment for mentoring?

Answer

Answer to the question:

Mentors can be used during internships for workers, students, and in other cases. So, it is one of the adaptation tools. Each organization determines for itself the need to implement a mentoring system.

The mentoring system is a specific list of actions for each mentoring participant and contains rules and regulations for the implementation of these actions.

Mentoring participants are:

- a new employee (trainee) assigned to a mentor;

- the new employee's immediate supervisor;

- HR service specialist overseeing the mentoring process.

For extra During work, the employee is entitled to an additional payment, the amount of which is determined by agreement of the parties (Article 151 of the Labor Code of the Russian Federation). For more information on establishing surcharges, see additional information. materials.

Each organization determines the need to introduce a mentoring system as one of the adaptation tools for itself and enshrines it in its local regulations or collective agreement.

If the employer does not plan to develop mentoring and assigning a mentor to new employees is of a one-time nature, then it is not necessary to develop a local mentoring document. In this case, mentoring can be established in a simplified manner: when it becomes necessary to appoint a mentor, all the main conditions for mentoring (term, amount of additional payment, rights and obligations of the mentor, etc.) are indicated in the additional agreement to the employment contract.

Details in the materials of the Personnel System:

1. Answer: How to establish an additional payment for combining professions or temporarily performing the duties of an absent employee

Attracting additional work

In what ways can an employee be temporarily assigned the duties of another absent employee?

You can engage one employee to perform work for another temporarily absent employee by filing:

Documenting

What documents should I use to establish additional payments for combining professions or performing the duties of a temporarily absent employee?

The general procedure for establishing additional payments for combining professions (positions) can be prescribed in another local document (Article and Labor Code of the Russian Federation). Fix the specific amount of the additional payment in the additional agreement to the employment contract, taking into account the general provisions provided for in the local acts of the organization, as well as the content and volume of additional work. Moreover, if the employee’s responsibilities initially include replacing an absent employee, then.

A similar procedure applies to additional payments for temporary replacement, if the employee is not released from his main job during the period of such replacement.

If an employee, with his consent, is invited to perform additional duties by a separate order from the manager and is concluded, then he must be paid an additional payment for performing such work. Its size is determined by agreement between the employer and employee, taking into account the general provisions of the organization’s local acts. This procedure is provided for in the articles of the Labor Code of the Russian Federation.

Question from practice: how to set the amount of additional payment for part-time work for an internal part-time worker

The surcharge in such a situation should be established in .

The organization may, with the written consent of the employee, assign him additional work in accordance with the procedure. For performing such additional work, the employer must pay the employee (). Combining positions involves an employee performing additional work during the assigned working hours (). At the same time, the legislation does not provide restrictions for combining positions with internal part-time workers.

The specific amount of additional payment for combined work is established in the employment contract, taking into account the content and volume of additional work (). As a general rule, a part-time worker is paid a salary for the time he worked (). However, the legislation does not establish a rule on proportional payment for work performed by a part-time worker in the order of combining positions (). Therefore, the amount of such additional payment can be any, based on the actual circumstances and the value of the work.

An example of determining the amount of additional payment for combining positions for an internal part-time worker

N.I. Korovin, at his main place of work, Alpha LLC, also works part-time as an internal part-time salesperson. The “full” monthly salary for a sales position is 50,000 rubles, but Korovina, who works part-time, is paid proportionally, that is, in the amount of 25,000 rubles.

With Korovina’s consent, she was also assigned to combine the position of secretary. The salary for the position of secretary of Alpha LLC is 30,000 rubles. In the additional agreement on combining the position of the parties, by mutual agreement, Korovina established a “disproportionate” additional payment for combining the position of secretary in the amount of 23,000 rubles.

Question from practice: is it necessary to notify the tax office about the temporary assignment of the duties of the chief accountant to another employee of the organization?

No no need.

Information about the chief accountant is not included in the state register - Unified State Register of Legal Entities. It contains only information about employees who can act on behalf of the organization without a power of attorney - the general director, president of the organization, etc. (). And if the chief accountant is not one of such employees, there is no need to submit a special application to the inspectorate to make changes to the Unified State Register of Legal Entities, as when changing the head.

Previously, the tax department was guided and required to submit a copy of the order to change (temporarily assign duties) to the chief accountant. However, now his position has changed. This is evidenced by. It follows from this that there is no need to notify the tax office about the temporary assignment of the duties of the chief accountant to another employee. Since no other procedure has been established, the position of the tax department remains relevant today.

Nina Kovyazina,

Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health

With respect and wishes for comfortable work, Svetlana Gorshneva,

HR System expert

Current personnel changes

-

Inspectors from the State Tax Inspectorate are already working according to the new regulations. Find out in the magazine “Personnel Affairs” what rights employers and personnel officers have acquired since October 22 and for what mistakes they will no longer be able to punish you. -

There is not a single mention of job descriptions in the Labor Code. But HR officers simply need this optional document. In the magazine “Personnel Affairs” you will find the latest job description for a personnel officer, taking into account the requirements of the professional standard. -

Check your PVTR for relevance. Due to changes in 2019, provisions in your document may violate the law. If the State Tax Inspectorate finds outdated formulations, it will fine you. Read what rules to remove from the PVTR and what to add in the “Personnel Affairs” magazine. -

In the Personnel Business magazine you will find an up-to-date plan on how to create a safe vacation schedule for 2020. The article contains all the innovations in laws and practice that now need to be taken into account. For you - ready-made solutions to situations that four out of five companies encounter when preparing a schedule. -

Get ready, the Ministry of Labor is changing the Labor Code again. There are six amendments in total. Find out how the amendments will affect your work and what to do now so that the changes do not take you by surprise, you will learn from the article.