If a person quits when the settlement is due. Calculation of severance

(in other words, at the initiative of the employee) is one of the most common grounds for termination of an employment contract. The initiative to terminate the employment relationship comes from the employee and does not imply its approval by the employer, because a person cannot be forced to work against his will. However, even when resigning at your own request, certain rules must be followed.

The procedure for dismissal at will

The procedure for dismissal at will involves, first of all, the employee writing a letter of resignation. The application indicates the date of dismissal and its basis (“at one’s own request”), it must be signed by the employee indicating the date of preparation.

Indicate in the application reason for voluntary resignation not necessary. However, if circumstances require you to resign, then the reason must be indicated, and HR employees may ask you to document it. In other cases, the phrase “I ask you to fire me at your own request on such and such a date” is sufficient.

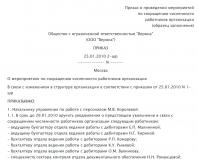

After the resignation letter has been submitted to the personnel service, a dismissal order. Typically, a unified form of such an order (), approved by Resolution of the State Statistics Committee of January 5, 2004 No. 1, is used. The order must make a reference to the Labor Code of the Russian Federation, as well as provide details of the employee’s application. The employee must be familiarized with the dismissal order against signature. If the order cannot be brought to the attention of the dismissed person (he is absent or refused to familiarize himself with the order), then a corresponding entry is made on the document.

Timing of voluntary dismissal

According to the general rule, enshrined in, the employee must notify the employer of the upcoming dismissal no later than two weeks in advance. This period begins the day after the employer receives the resignation letter.

However, the so-called two-week working period can be reduced by agreement between the employee and the employer. In addition, the law does not oblige the employee to be at the workplace during the period of notice of dismissal. He can go on vacation, sick leave, etc., while terms of dismissal will not change.

There are statutory exceptions to the general rule of two-week work. Thus, if you are dismissed during the probationary period, the notice period for dismissal is three days, and if the head of the organization is dismissed, it is one month.

Calculation upon dismissal at one's own request

Calculation upon dismissal at one's own request, as well as for other reasons, must be made on the day of dismissal, that is, on the last day of work. Calculation of severance involves the payment of all amounts due to the employee: wages, compensation for unused vacations, payments provided for by the collective and labor agreement. If the dismissed employee used vacation in advance, the paid vacation pay is recalculated, and the corresponding amount is deducted from the salary upon final payment.

If an employee was absent from work on the day of dismissal and was unable to receive a payment, he has the right to apply for it at any other time. The amount due to him must be paid no later than the next day after the application.

Dismissal at your own request during the vacation period

Resign at your own request during the vacation period the law does not prohibit. Such a prohibition is provided only for dismissal at the initiative of the employer. An employee has the right to write a letter of resignation while on vacation, or to include the date of proposed dismissal during the vacation period.

If an employee wants to submit a letter of resignation while on vacation, there is no need to recall him from vacation

An employee can also resign of his own free will after using his vacation. Please note that granting leave followed by dismissal is a right, not an obligation, of the employer. If such leave is granted, the day of dismissal is considered the last day of leave. However, for the purposes of settlements with the employee, the last day of work in this case is the day before the start of the vacation. On this day, the employee should be given a work book and all necessary payments should be made. This is a kind of exception to the general rule given, confirmed.

Dismissal at will while on sick leave

Quit voluntarily while on sick leave Can. prohibits such dismissal only at the initiative of the employer.

An employee has the right to apply for dismissal during a period of temporary incapacity for work. A situation may also arise when the previously agreed upon dismissal date falls on the sick leave period. In this case, the employer will formalize the dismissal on the day specified in the resignation letter, provided that the employee has not withdrawn this application. The employer does not have the right to independently change the date of dismissal.

On the last day of work, even if it falls on sick leave, the employer makes the final payment and issues a dismissal order, in which he makes a note about the employee’s absence and the impossibility of familiarizing him with the order. The employee will come for the work book after recovery or, with his consent, it will be sent to him by mail. All amounts due to the employee will be paid to him

The employment relationship ends sooner or later. By law, an employee has the right to resign at his own request and receive payment upon dismissal. And everyone wants to know what to expect when terminating an employment relationship, what benefits are available, and when they can be received. It would be useful to know and be able to calculate salaries and compensation for unused vacation days. Knowing that the employer will be punished for delaying payment will add confidence.

Mandatory payments when settling at your own request

If an employee decides to quit, the Labor Code of the Russian Federation obliges him to notify the employer about this two weeks in advance and write a letter of resignation. Dismissal at the initiative of an employee involves legal payments:

- salaries taking into account two weeks of work;

- compensation for unused vacation days;

- bonuses, allowances established by collective agreement, accrued for time worked;

- severance benefits provided for in the contract or additional agreement upon termination of the employment relationship.

The employee will receive calculated accruals on the last day worked. Along with them, he will be given a work book with a record of a personnel inspector, income certificates 2-NDFL, personalized reports to the Pension Fund of the Russian Federation (SZV-M), and a medical book.

The accounting department will recalculate unpaid wages and compensation for unused vacation days.

Accountants will calculate the amounts due upon dismissal, but it would be useful to double-check them

The procedure for calculating wages

The procedure for calculating wages upon dismissal is related to the number of days worked in the last month. The calculation algorithm looks like this: Salary = salary / number of working days in the month of dismissal x number of days worked in the month.

To make it easier to perceive and understand the calculation of wages upon termination of an employment relationship, let’s look at an example.

Sales department manager V.I. Sidorov with a salary of 25,000 rubles, quits on January 19, 2018. In January 2018, there are 17 working days. On the day of his departure, Sidorov had worked for 9 days. Thus, the salary will be: 25,000 / 17 x 9 = 13,235 rubles.

Organizations, when paying employees, use a formula supplemented by a regional coefficient, income tax, and other deductions. Salary = (salary / number of working days in the month of dismissal x number of days worked in the month of dismissal + bonuses) x regional coefficient - income tax (13%) - withholdings.

The regional coefficient in the regions varies in value from 1.15 to 2. In the regions of the Far North it reaches 30% and 100% of the salary. Applies to earnings before income tax.

Deductions include:

- amounts under writs of execution;

- child support;

- compensation for losses;

- loan repayment;

- voluntary pension insurance;

- amounts issued erroneously;

- amounts at the request of the employee.

Driver Ivanov A.K. worked in Tyumen at an automobile company with a salary of 35,000 rubles. The regional coefficient in the region is 1.15, income tax is 13%, the monthly bonus specified in the employment contract is 5,000 rubles. Pays alimony for her daughter 12,000 rubles. I decided to quit on January 31, 2018. There are 17 working days in January 2018. On the day of dismissal by Ivanov A.K. 17 working days worked. Let's calculate the salary: (35000 / 17 x 17 + 5000) x 1.15 - 13% - 12000 = 46000 - 5980 - 12000 = 28020 rubles.

Video: calculation when dismissing an employee in the 1C program

Calculation of compensation for unused vacation upon dismissal

If an employee quits, then you need to either use vacation days or take compensation in cash for days not taken off. The employee is required to take 14 vacation days. When leaving work, he may go on vacation followed by dismissal. In any case, labor legislation strictly regulates this process, which employers cannot circumvent.

In 2018, the algorithm for calculating compensation payments upon dismissal remained the same, no changes occurred. This means that when calculating vacation pay, the average daily earnings algorithm is used.

Reimbursement for unused vacation = number of unused days * average daily earnings.

If vacation is used prematurely, a recalculation is carried out and the paid amount of vacation pay is withheld from the employee’s salary upon dismissal.

Number of unused days

The number of unused days is calculated based on the period of work and vacation. Typically, an employee is entitled to 28 calendar days of vacation. But if he is entitled to longer or additional paid leave, this is reflected in the calculations.

The number of unused vacation days is calculated using the formula

The following are excluded from the employee's term of service at the enterprise:

- time spent on a business trip;

- time of paid or administrative leave;

- period of temporary disability (illness, caring for a loved one, pregnancy and childbirth);

- additional free days provided for caring for disabled children;

- downtime through no fault of the employee;

- a strike in which the employee did not take part, which interfered with the performance of his work duties;

- other cases when the employee was released from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation.

The work period is calculated not by days, but by months. If less than half a month is worked (up to 15 days), these days are not counted. If more than half, it is considered as a full month.

Average daily earnings

Average daily earnings = accruals for the billing period / number of billing days.

The accruals include the entire labor income of the employee: salary (taking into account the coefficient), bonuses, allowances, percentage and piece bonuses, etc. Social benefits are not considered income:

- material aid;

- compensation for travel and food;

- payment of tuition fees;

- funds issued for recreation and recovery;

- money for utilities, payment for kindergarten for employees’ children, etc.

The calculation period for vacation is usually 12 months preceding the month of dismissal. If this time is fully worked, the average daily earnings are calculated using the formula: actual accrued wages for the year / 12 months / 29.3 (average number of days in a month).

If an employee does not work for the entire year, the pay period is shortened. It must include all fully worked months and remaining days. We calculate the number of days in an incomplete month: 29.3 / number of calendar days in a month x number of calendar days before dismissal or after hiring.

A billing period of less than 12 months is indicated by the manager in the order.

The table will help you correctly determine the number of allotted vacation days for different billing periods.

Examples of calculating compensation for unused vacation

Example 1. Manager of the consulting department of a law firm E.M. Larionov. hired on 02/01/2018, fired on 02/28/2018. More than half a month has been worked, so upon dismissal, compensation will be for 1 month. Number of allotted vacation days = 2.33. Larionov's salary was 70,000 rubles. Let's calculate the average daily earnings: 70,000 / 29 = 2,413.79 rubles. Compensation is calculated = 2.33 x 2413.79 = 5624.13 rubles. An income tax of 13% (RUB 731.14) is withheld from her. Larionov will receive 4892.99 rubles.

Example 2. Supermarket sales floor cleaner A.N. Vabaeva hired on January 22, 2018, fired on February 26, 2018. Worked for 1 month and less than half of the second. Refunds are due for 1 month. The calculation of compensation will be similar.

Example 3. Matveev A.I. goes on vacation from February 3 to February 14, 2018. Salary for the month worked is 41,000 rubles. (rate - 39,700 rubles + bonus - 1,300 rubles). Working on his own car, he receives compensation for fuel and lubricants in the amount of 3,500 rubles, lunches paid for by the company are 3,000 rubles. In December 2017, an additional payment was paid for part-time work - 9,000 rubles. The year before the required vacation has been worked in full.

We calculate compensation:

- We determine the estimated time period: from 02/01/2017 to 01/31/2018.

- Let's calculate the average salary. To calculate, we take the rate and bonus - 41,000 rubles, without compensation charges. (39700 + 1300) x 12 = 492000 rub. (492000 + 9000): 12 = 41750 rubles.

- Let's calculate vacation pay: (41,750 / 29.3) x 11 (vacation days) = 15,674.06 rubles.

- We calculate compensation for unused vacation payable: 15674.06 – 13% = 13636.43 rubles.

Deadline for payment of the final payment upon dismissal at one's own request in accordance with the Labor Code of the Russian Federation

Labor legislation determines the timing of payment of settlement amounts to employees upon termination of the employment relationship. Thus, on the basis of Article 140 of the Labor Code of the Russian Federation, the employee receives the final payment and personal documents on the day of dismissal. This includes wages, compensation for unused vacation days, bonuses, and additional payments established by the collective agreement.

On the last working day, the quitter receives a paycheck and documents

There are only three options in which the payment cannot be issued on time according to the law:

- the employee’s absence from the workplace on the last day (of dismissal). He will receive the payment the next day after applying;

- dismissal immediately after vacation - payment is issued along with vacation pay;

- employee leaving while on sick leave. The payment will be received on the day the sick leave is presented. And the employee will receive sick pay separately, on the day the entire company receives wages.

In other cases, the employer does not have the legal right to delay the issuance of settlement payments for a single day. Otherwise, he will be held accountable for such acts under the articles of the Labor Code of the Russian Federation.

Responsibility of the employer for delay in payments when dismissing an employee at his own request

If an employer evades payment of the employee's salary upon dismissal within the time limits established by law, there is financial liability in the form of fines. An employee can file a complaint against an official with the Labor Inspectorate, which in turn conducts an unscheduled inspection, identifies a violation of labor rights and issues a verdict in the form of penalties. T So, a legal entity can be fined up to 50 thousand rubles, individual employers - up to 5 thousand rubles.

The employee will be paid the required settlement amounts and compensation for the delay, calculated in accordance with the Labor Code of the Russian Federation in the amount of 1/150 of the currently valid key rate of the Central Bank of Russia.

There are free online calculators available in the public domain, with which you can easily calculate the amount of compensation for delayed payments. Let’s say the amount of delayed payments was 37,000 rubles. The due date for issue is January 19, 2018. The actual disbursement of funds occurred on February 17, 2018. Compensation for the delay will be 550.68 rubles. The organization's accounting department is obliged to issue an appropriate statement of calculation indicating the dates and amount of compensation signed by the chief accountant.

Having considered the types and calculation of amounts due for payment upon dismissal on one’s own initiative, you can at the first stage protect yourself from unscrupulous employers. After all, in case of delay and incorrect calculation, they are liable according to the law. The expression “legally illiterate” cannot be applied to the situation of dismissal. The right to know what to expect upon termination of an employment relationship is legitimized by labor legislation.

If the employee decides to terminate the employment relationship, he needs to submit an application to the employer. At the end of the warning period, a record of termination of the contract is made in the work book. Also, on the last working day, the employee must receive the necessary payments, which include:

- payments for unclaimed days of rest;

- payment for actual days worked;

- bonuses and remuneration, if provided for by the internal regulations of the organization;

- severance pay in cases where this is provided for by labor legislation, a collective or labor agreement.

Counting order

The calculation is made by the accounting department on the basis of the order to terminate the contract () issued by the employer.

Calculation procedure for voluntary dismissal:

- salary is calculated for days worked;

- compensation for unclaimed leave is calculated;

- the amounts received are added up and transferred to the resigning employee.

Calculation of salary upon dismissal of one's own free will

The following rule applies here:

- if the worker has worked for a full month, he needs to be paid his salary in full;

- if a person has worked for less than a full month, then wages in this situation are calculated as follows: the average daily earnings are multiplied by the number of days worked. The received amount is to be issued.

Compensation for unused vacation

If the employee did not rest, he is given compensation. For this purpose, the average earnings for 1 working day are calculated. When calculating, bonuses and allowances should be taken into account. The resulting amount is multiplied by the number of days of rest required.

When calculating vacation pay, the following points should be taken into account:

- If an employee has already been on vacation this year (meaning that he has taken a full day off), then he is not entitled to compensation.

- If an employee has accumulated unclaimed days of rest over several years or over the last period, then only all unused days will be paid (including for previous years).

- If the employee took leave in advance, recalculation will be made and deductions will be made from the salary due to him.

In order to correctly calculate an employee’s resignation at his own request, there are various calculators that you can use.

An example of calculating dismissal at will

Commodity manager Zueva wrote and sent to the director an application for termination of the employment contract with a request to fire her on December 31, 2018.

According to the signed contract, her salary is 30,000 rubles per month.

There are 21 working days in December. The merchandise manager worked for 16 days in December. During these days she should receive funds. Salaries will be calculated as follows:

Divide 30,000 rubles by 21 working days and multiply by 16 days actually worked. The resulting figure - 22,857.15 rubles - must be paid.

Now let's look at how compensation for unclaimed vacation days is calculated when leaving at your own request.

Commodity manager Zueva got a job at the company on July 22, 2017 and took her entire vacation for the entire previous period from July 22, 2017 to July 21, 2018. She planned to quit on December 31, 2018. On the date of dismissal, the merchandiser will have 7 unused vacation days. Per year, merchandiser Zueva earns: 30,000 × 12 = 360,000 rubles. The average daily earnings will be 1023.89 rubles (360,000 / 12 / 29.3). Thus, the compensation will be 7167.23 rubles.

You can read more about calculating compensation for unused vacation in our.

We draw up a note-calculation

To make the final payment for an employee upon dismissal of his own free will, it is necessary to prepare a calculation note.

The note is drawn up in form No. T-61, approved. . Form T-61 is filled out on the basis of settlement and payment documents, statements that contain information on various charges to the employee (wages, bonuses, allowances, etc.). This is a two-sided form, the personnel officer and accountant are responsible for filling out. The front side, which is filled out by the personnel officer, reflects information about the organization, the employee and the employment contract in force between them. On the reverse side, which is filled out by the accountant, payments are calculated upon dismissal at one's own request.

We invite you to download a form for a notice of resignation upon dismissal. If necessary, you can use it at work in order to make the final payment upon dismissal of your own free will.

Payment nuances

Payments for voluntary dismissal upon termination of a contract are established by labor legislation. They are mentioned in Article 140 of the Labor Code of the Russian Federation. Funds must be issued on the last business day.

But the actual last working day and the day of termination of the contract do not always fall on the same date. If the day of termination of the contract falls on a weekend, it is necessary to prepare the necessary documents in advance, provide them to the employee for signature and make a payment, making a preliminary calculation upon dismissal at his own request 2019.

Full payment for voluntary dismissal and issuance of all documents occurs on the day the employee leaves the company. Exceptions can only be made in the following situations:

- if the employee is absent from the workplace on the last day, the money must be issued the next day after his request (this option does not apply to card payments);

- if an employee quits immediately after a vacation (on the last day of vacation and does not go to work), then the money is paid along with vacation pay (as a rule, or on the last working day before the vacation);

- the employee is on sick leave - in this case, the person will receive the sick leave after the fact; he will be paid for the sick leave after he brings it to his former job.

Responsibility for late payments

Failure to comply with payment deadlines is considered a violation of the law and entails bringing the employer to administrative or criminal liability (depending on the timing of the delay), as well as the imposition of penalties () in the amount of up to 50,000 rubles.

The company will also have to accrue interest to the dismissed citizen for the delay in funds (). Funds due to the employee in the event of a delay will be paid with an interest rate of no less than 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay.

When calculating upon dismissal at one's own request, the payment deadlines do not shift; all calculations occur on the last day of service.

If payment is not made after voluntary dismissal

If on the last day of work the employer did not make the payments due to the employee upon dismissal at his own request 2019 (in cash or by bank card - it does not matter), then justice can be restored as follows:

- contact the employer directly with a request for final payment (“In accordance with Art. 140 Labor Code of the Russian Federation, I ask you to make the final payment to me for “__”_______ 2019 in connection with my voluntary dismissal. The day of dismissal is considered “__”_______ 2019”). You must bring two copies of the application, give one to the employer, and get a mark on the second that the application has been received. If the manager refuses to accept the application, you can transfer it under the incoming number to the secretary or send it by mail;

- file a complaint with the State Labor Inspectorate. Please note that the complaint review period is 30 days, so you must submit your application as quickly as possible. This can be done through the inspection reception (under the incoming number), through an electronic service, or use postal services. The complaint must reflect your full name, address and telephone number, details of the organization, describe in detail the essence of the complaint and what measures were taken, the amount of due payments. If you have supporting documents (work book, applications, hiring and dismissal orders, a copy of the letter to the employer, etc.), attach them. The inspector will conduct an inspection, and you will receive a motivated response based on its results. If violations are detected, the employer receives an order to make payments after dismissal of his own free will within a specified period, and is also brought to administrative responsibility;

- write to the Prosecutor's Office at the location of the employer. The application procedure is the same as for the Labor Inspectorate. Since both of these government bodies often conduct joint inspections, you can immediately, without wasting time, write applications to both. The prosecutor's office can also order the employer to pay the withheld funds, but cannot force him to do so. The district (city) court has this right;

- go to court with a statement of claim or an application for a court order. The ability to go to court if an employee’s rights are violated has limitations: you can do this within three months from the date of violation of your rights, that is, from the last day of work. Therefore, your simultaneous appeal to three authorities at once will be most effective: the labor inspectorate, the Prosecutor's Office and the court. This is in no way prohibited by law. But comprehensive checks and a subpoena usually stimulate the employer to make a decision in your favor and charge a settlement upon dismissal of your own free will with subsequent payment.

Upon termination of the employment relationship, the organization or enterprise must calculate the salary upon dismissal with the employee. In connection with dismissal, employees are paid wages for days worked in the month of dismissal and compensation payments for unused vacation. Depending on the reasons for dismissal, the employee may also be given severance pay or compensation payments due to the termination of the working relationship, as well as retain the average monthly salary.

The basis for formalizing the dismissal of an employee, including the basis for calculating all payments that are due to him by law, is the Order to terminate the employment contract with the employee. This order is issued in a certain form of maintaining personnel documentation. It was approved by the State Statistics Committee (forms T-8, T-8a). As a general rule, upon dismissal, an employee is paid:

1. Salary for working days that were actually worked in the month of dismissal, for example, when an employee quits of his own free will.

2. Compensation payments for unused vacation.

3. Severance pay (in cases established by labor legislation).

– work book;

– upon written application of the employee, copies of documents related to work are issued: copies of orders for admission, dismissal, relocation; certificates of salary, accrued and actually paid insurance premiums, etc.

Example of salary calculation upon dismissal

Employee Sergey Nikolaevich Fedorov resigns on November 19, 2015 due to conscription for military service. Calculate final salary.

First, let’s calculate wages for less than a full month:

Based on the fact that the monthly salary is 25 thousand rubles. , That

Salary for November = monthly salary / number of working shifts x number of shifts worked

Salary for November = 25,000.00/20x13 = 16,250.00 rub.

At the time of dismissal from Fedorov S.N. two weeks of unused vacation, so he is entitled to compensation for unused vacation.

Vacation compensation (VA) = salary for 12 months/(12 *29.43)* number of vacation days

KO = 25000.00/29.43x14 = 11945.39 rubles.

Since Fedorov S.N. is drafted into the army, then according to the Labor Code of the Russian Federation he is entitled to two weeks of severance pay.

Severance pay (VP) = average daily earnings for the year x 10 work shifts

Average daily earnings: salary for the previous 12 months / 12 / 29.3

25000/29.3 = 853.24 rubles.

VP = 853.24 x 10 = 8532.40 rub.

This severance pay is not subject to personal income tax.

Final payment = ZP + KO + VP – (ZP + KO)x13%

On the day of dismissal Fedorov S.N. will receive a final settlement of RUB 35,448.85.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

Dismissal is an integral part of the employment relationship. Every citizen has gone through this procedure at least once in his life. It implies a complete cessation of work activities in the company, carried out for various reasons. Naturally, the process has a fairly large number of features, one of them is calculation.

basic information

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

According to the Labor Code of the Russian Federation, calculation upon dismissal is the accrual of all due payments to an employee upon termination of his employment contract.

In the process of its implementation, it is necessary to take into account the grounds on which the working relationship was terminated, since the amount of accrued wages and compensation directly depends on this parameter. It is worth considering this procedure in detail.

Definitions

Basic concepts and terms related to the topic under consideration and used in the article are presented in the table:

Legislation

Legislative acts governing and regulating the aspects discussed in the article are as follows:

- Art. Labor Code of the Russian Federation.

- Art. Labor Code of the Russian Federation.

- Art. Labor Code of the Russian Federation.

- Art. Code of Administrative Offenses of the Russian Federation.

Final settlement

According to the current legislative acts of the Russian Federation, the final payment is made on the day of dismissal of the employee. The employee must be paid wages and all required compensation.

Every employer must remember that if the regulated deadlines are not met, he faces liability. As judicial practice shows, in most such cases the court verdict is in favor of the employee.

Grounds

Article 140 of the Labor Code of the Russian Federation states that all due payments to an employee must be given to him directly on the last day of work. Depending on the reason for which the employment relationship is broken, the set of compensation due may differ.

Dismissal can occur at the citizen’s own request and at the initiative of the employer, as well as due to circumstances beyond the control of both parties. Most often, the procedure is carried out by mutual agreement. If there is an agreement, final payment to the employee can be made even after the day of termination of the employment relationship.

Documentation

In addition to paying the required remuneration, the manager of the dismissed employee is obliged to provide him with the following package of documentation:

- certificate of income received in the form;

- certificate of summarized income - used to calculate benefits;

- work book with a record of termination of the working relationship;

In addition, upon the corresponding application of the employee, he will also have to issue:

- a copy of the hiring and dismissal order;

- a certificate of wages received for a certain period of time;

- a certificate of contributions made to the pension insurance fund.

Mandatory payments and compensation

The final settlement involves the accrual and payment of:

- wages for the last month of work;

- compensation for unused annual paid leave;

- severance pay - the grounds for calculating this payment are specified in the second paragraph of the first part of Article 81 of the Labor Code of the Russian Federation.

Retention and issuance procedure

A certain amount of money may be withheld from some payments. In particular, this applies to annual leave on which the employee took part-time leave. In such a situation, a recalculation occurs, and compensation is paid only for unused rest days.

There is an exception in which vacation compensation is payable even if the employee went on vacation for a certain number of days.

This occurs in situations where the severance of employment relations with a citizen is carried out on the basis of a reduction in the number of employees or during the liquidation of the company.

Vacation pay

Compensation payment for unused vacation days is calculated as follows:

- Annual paid leave is 28 days. This value is divided by the number of months in the year and multiplied only by the number of months worked. For example, 5.

28 / 12 * 5 = 2.33 * 5 = 11.65 – unused vacation days

- The resulting value is multiplied by the employee’s average salary for one day. For example, it is one thousand rubles.

11.65 * 1000 = 11,650 rubles.

- Personal income tax is withheld from the compensation, and the amount received is given to the citizen as compensation.

11,650 * 0.87 (personal income tax - 13%) = 10,135.50 rubles.

Termination of TD, counting rules

If on the day of dismissal of an employee he was not paid the required remuneration, the employer will have to compensate for this. The fine is 1/300 of the refinancing rate established by the Central Bank of Russia.

Also, if the final amount of the final payment after calculating severance pay to the dismissed employee exceeds the amount of his salary three times, then income tax will be withheld from this amount.

Self-care

According to the Labor Code of the Russian Federation, payment upon dismissal at one’s own request implies payment to the citizen of the following remuneration:

- full salary for the last month of work;

- compensation payment for unused annual leave - in situations where the period was not fully worked by the employee, the employer has the right to withhold previously paid funds.

There is no deduction for vacation

Deduction from compensation for unused vacation, calculated by the actual period worked by the citizen, cannot be made if:

- Liquidation of the company.

- Reducing the number of employees.

- Severance of labor relations due to the impossibility of further work due to illness.

- Prizes for compulsory military service.

- In case of disability.

- Reinstatement to position based on a verdict of a judicial authority.

- Dismissal that occurs due to other circumstances beyond the control of either the employee or the employer.

Severance pay

This payment is issued to an employee in cases where dismissal occurs due to:

- due to illness that does not allow the citizen to continue working;

- upon refusal to transfer to another position;

- in case of disability;

- in case of changes in working conditions;

- when conscripted into the army;

- in a situation where dismissal is carried out due to layoffs or in connection with the liquidation of the company.

Size

The amount for all cases is equal to wages for two weeks of work. The exception is the liquidation of the company and reduction in the number of employees.

If the dismissal occurred for one of these reasons, then the severance pay will be for a month of work. Moreover, it will be paid again if the citizen has not been re-employed a month after dismissal.

Calculation

It is worth analyzing the final calculation process using an example. The conditional employee wrote a letter of resignation on April 20, and his average salary is 30 thousand rubles.

Respectively:

- The employee must be paid wages from April 1 to April 19. The number of working days in April is 22. Therefore:

30,000 / 22 * 18 * 0.87 (personal income tax) = 21,354.54 rubles – wages for 18 days.

- In this case, compensation for vacation is calculated for 4 months of work. Hence:

28 / 12 * 4 * (30,000 / 22) * 0.87 (personal income tax) = 2.33 * 4 * 1363.63 * 0.87 = 11,056 rubles

Final calculation of the Labor Code of the Russian Federation upon dismissal

As a result, the final settlement with the employee upon his dismissal must be made directly on the day of termination of the employment relationship.

Depending on the reason for the termination of the working relationship, it may include, in addition to the payment of wages, additional payments - compensation for vacation and severance pay.

Protection of rights

If the final payment was not made within the established time frame, then the dismissed citizen has the right to file an application against the employer with one of the following authorities:

- prosecutor's office;

- Labour Inspectorate.