How to correctly reflect the additional payment for length of service in the staffing table. Is it necessary to indicate the amount of the monthly bonus in the staffing table? Additional payments in the staffing table

If the staffing table provides for an allowance, for example, for increased complexity of work, in the amount of 10,000 rubles, is it possible to pay the employee an amount of less than 10,000 rubles? Or is it still necessary to pay exactly 10,000 rubles?

In contrast to the premium, the amount of which is indicated in local regulations as a maximum (and, therefore, varies from zero to the established maximum), the amount of the allowance in the staffing table is clearly and specifically indicated. Moreover, depending on the criteria for establishing the premium, it can be installed employee for a definite or indefinite period or not to be established. And if a bonus is established for the employee, then it should be paid exactly in the amount in which it is indicated in the staffing table, and during the period for which it is established.

Let us add that, according to Part 2 of Art. 57 of the Labor Code of the Russian Federation, the condition for the payment of allowances (as well as additional payments and bonuses) is a mandatory condition of the employment contract (in cases where the organization’s staffing schedule or local regulations provide for these components of wages). The condition could be like direct(the name and amount of the bonus is indicated directly in the employment contract), and referential(the employment contract states that the employee can be installed allowances according with local regulations and the employer’s staffing table).

According to Part 1 of Art. 129 of the Labor Code of the Russian Federation, wages (employee remuneration) means remuneration for work depending on the qualifications of the employee, the complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in territories exposed to radioactive pollution, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

In accordance with Part 1 of Art. 135 Labor Code of the Russian Federation the employee's salary is established by the employment contract in accordance with the current employer’s remuneration systems.

At the same time, wage systems systems of additional payments and bonuses of an incentive nature and bonus systems are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing labor law standards (Part 2 of Article 135 of the Labor Code of the Russian Federation).

Note!

Conditions, procedure and criteria for payment of incentive bonuses are determined in local regulations(regulations on remuneration, regulations on bonuses and material incentives, collective agreement, etc.).

If there is a representative body of employees, local regulations establishing remuneration systems are adopted by the employer taking into account the opinion of this body (Part 4 of Article 135 of the Labor Code of the Russian Federation).

According to the explanations of Rostrud, given in letter No. 5275-61 dated December 24, 2007, the amount of remuneration (tariff rate or salary) should be indicated in the employment contract in numerical terms. At the same time, additional payments, allowances and incentive payments due to an employee may be directly indicated in the employment contract, or it may make reference to the relevant local regulation or collective agreement, which provides the grounds and conditions for their payment. In the latter case, Rostrud indicated, the employee must be familiar with the content of local regulations and the collective agreement against signature.

Extraction

from the letter of Rostrud dated December 24, 2007 No. 5275-61

According to Article 135 of the Labor Code of the Russian Federation, an employee’s wages are established by an employment contract in accordance with the wage systems in force for a given employer.

Remuneration systems, including tariff rates, salaries (official salaries), additional payments, compensatory allowances, including for work in conditions deviating from normal, systems of additional payments and incentive allowances and bonus systems, are established by collective agreements, agreements, local regulatory acts in accordance with labor legislation and other regulatory legal acts containing labor law norms.

The basic concepts and definitions used in organizing the remuneration of workers are enshrined in Article 129 of the Code. Based on these definitions, the tariff rate, as well as the salary (official salary), have a fixed amount of remuneration.

Article 57 of the Code includes among the conditions mandatory for inclusion in an employment contract the terms of remuneration (including the amount of the tariff rate and salary (official salary) of the employee, additional payments, allowances and incentive payments).

All of the above allows us to say thatwhen stipulating the terms of remuneration of an employee in an employment contract, the amount of payment (tariff rate or salary) should be indicated.in numerical terms.

As for additional payments, allowances and incentive payments due to the employee, they may be directly indicated in the employment contract or it may make reference to the relevant local regulation or collective agreement, providing the grounds and conditions for their payment. In the latter case the employee must be familiar with the content of local regulations and the collective agreement against signature.

The amount of allowances can be reduced, but only if the employment contract itself or the employer’s local regulations establish the conditions under which the employee can count on payment in full, as well as criteria that allow reducing the amount of allowances. If these conditions and criteria are not included in the employment contract, but are specified in a local regulatory act, the employee must be familiarized with it upon signature.

Note that an employee who has not worked the entire period for which a fixed incentive bonus is accrued, which, in particular, includes an allowance for increased complexity or intensity of work, is usually paid for the time actually worked in the accounting period.

CONCLUSION FIRST. Incentive payments must be specified in the employment contract with an employee. In this case, their fixed amount may be indicated (in ruble terms or in other units of measurement) or a reference may be made to a local regulatory act (or collective agreement) that provides the grounds and conditions for their payment.

For example. The employee is given a bonus for the complexity and intensity of the work, the amount, grounds and terms of payment of which are regulated by the Regulations on remuneration and bonuses.

The employee may be given bonuses in accordance with local regulations and the employer’s staffing schedule.

If the fixed amount of the bonus is specified in the employment contract, and the employer considers it necessary to reduce its size, it is necessary to notify the employee at least two months in advance, against signature, about the change in the terms of the employment contract (Parts 1, 2, Article 74 of the Labor Code of the Russian Federation) and draw up an additional agreement to employment contract with the employee.

Extraction

From the Labor Code of the Russian Federation

Article 74. Changes in the terms of the employment contract determined by the parties for reasons related to changes in organizational or technological working conditions

In the event that, for reasons related to changes in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, other reasons), the terms of the employment contract determined by the parties cannot be preserved, they may be changed at the initiative of the employer, with the exception of changes in the employee’s labor function.

The employer is obliged to notify the employee in writing of the terms of the employment contract determined by the parties, as well as the reasons that necessitated such changes, in writing no later than two months, unless otherwise provided by this Code.

[...]

If the fixed amount of the bonus is specified in a local regulatory act, then before reducing its size, it is necessary to make changes to this local act and, two months before the changes enter into force, familiarize the employee with them against signature.

CONCLUSION TWO. The employer is extremely unprofitable establish in employment contracts and local regulations a fixed amount of incentive payments without specifying the conditions for their payment, since in this case the employer is obliged to pay all specified amounts monthly under any circumstances, and the need for any changes will require compliance with the procedure prescribed by Art. 74 Labor Code of the Russian Federation.

ARBITRAGE PRACTICE

The St. Petersburg City Court, in Ruling No. 12202 dated September 15, 2009, came to the conclusion that, given that the parties at the conclusion of the contract determined the amount of the premium in the form of a fixed amount, its payment is not dependent on any conditions and is mandatory , the presence in the company of other systems of additional payments and bonuses of an incentive nature and bonus systems does not indicate a violation of legal requirements when concluding an agreement with the plaintiff.

Approximate wording of the conditions for payment of an incentive bonus in a local regulatory act is given in the example.

Example

Approximate wording of the conditions for payment of incentive bonuses

in the local regulatory act of the employer

7. Conditions of remuneration for the employee:

7.1. The employee is given a salary of 20,000 rubles. per month.

7.2. The employee is given a bonus for the complexity and intensity of the work in the amount of 10,000 rubles. per month (hereinafter referred to as the allowance). The bonus is paid monthly if the following conditions are met:

Full completion of the monthly working hours. If the monthly working time limit is not fully worked out, the bonus is paid in proportion to the time worked;

Timely, conscientious and high-quality performance of work duties;

7.3. The bonus is paid in the amount of 5,000 rubles. per month in cases:

A one-time violation of internal labor regulations without applying disciplinary action to the employee;

7.3. The bonus is not paid in the following cases:

A single violation of internal labor regulations, which resulted in the application of a disciplinary sanction to the employee, or repeated violations of internal labor regulations within a month;

Failure to perform or improper performance of duties provided for in the job description;

Violations of safety regulations and labor protection requirements;

Failure to comply with orders and instructions from management;

ARBITRAGE PRACTICE

The Leningrad Regional Court, in Ruling No. 33-5015/2010 dated October 14, 2010, noted that information about the employee’s familiarization with the Regulations on remuneration and bonuses by the employer was not provided, in addition, with the newly introduced Regulations, the employer actually unilaterally changed the terms of remuneration of the employee, since no written agreement was signed between the parties. Under such circumstances, the court concluded that the defendant unlawfully stopped paying the plaintiff the monthly bonus established by the employment contract.

On the form and content of the staffing table. The staffing table is used to formalize the structure, staffing and staffing levels of an organization in accordance with its Charter (Regulations).

If your organization uses the unified form No. T-3, approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms of primary accounting documentation for accounting labor and its payment,” then, according to the Instructions for the use and completion of forms, primary accounting documentation for the accounting of labor and its payment, given in the specified Resolution, in columns 6-8 “Allowances” incentive and compensation payments (bonuses, allowances, additional payments, incentive payments) established by the current legislation of the Russian Federation are shown (for example, northern allowances, allowances for an academic degree, etc.), as well as those introduced at the discretion of the organization (for example, related to the regime or working conditions).

Columns 5-9 are filled out in ruble terms or, when using other remuneration systems (tariff-free, mixed, etc.), in the appropriate units of measurement (for example, percentages, coefficients, etc.).

The staffing table is approved by order (instruction) signed by the head of the organization or a person authorized by him to do so.

The staffing table is an organizational and administrative document and, after approval, becomes binding.

Note!

The Labor Code of the Russian Federation and other regulations in force on the territory of the Russian Federation do not limit the right of the employer, jointly or taking into account the opinion of the representative body of employees (if such a body has been created at the enterprise), to choose the method and procedure for additional material incentives for the employee, determining the amount of additional payments and allowances ( Determination of the St. Petersburg City Court dated September 14, 2010 No. 33-12682).

From 01/01/2013, the forms of primary accounting documents contained in the albums of unified forms of primary accounting documentation are not mandatory for use, including the staffing form. Therefore, a non-governmental organization can develop a local form of staffing, in which, in particular, there are no columns for indicating allowances and other additional payments.

Let us note that the employer is obliged to comply with the terms of remuneration established and approved by him in the staffing table. Undoubtedly, the employer has every right to revise the amount of the bonus for the complexity and intensity of work, but this must be done without violating the employee’s labor rights. Typically, the criteria for reducing the premium are prescribed in local regulations.

Thus, before reducing the fixed amount of the bonus established in the staffing table, you must first make changes to the staffing table and notify the employee of the change in the terms of remuneration in compliance with the requirements of Part 2 of Art. 74 Labor Code of the Russian Federation.

For more than two years now, a single form of staffing has been used in Russia. Before the enactment of the Resolution of the State Statistics Committee of Russia dated 04/06/2001 No. 26, each organization compiled this local regulatory act in its own way. Until 2001, there was no legal act at the federal level that would have established the form and procedure for drawing up the staffing table for all organizations without exception. For a long time, the mandatory nature of staffing, especially for small and medium-sized companies, has been generally questioned.

In April 2001, personnel officers finally received an official answer to the question of what the staffing schedule should be. And with the adoption of the Labor Code of the Russian Federation, doubts about the binding nature of this document for the organization completely disappeared.

Let's try to figure out together how to properly draw up a staffing schedule and work with it.

What is meant by “staff” and “staffing”?

Staff is the composition of an organization’s employees, determined by management for a certain period.

Various sources give different definitions to the concept of “staffing table”, but, in principle, their essence boils down to the following: the staffing table is an organizational and administrative document that reflects the structure of the organization, contains a list of positions indicating their number and salary levels. The staffing table1 also reflects the amount of allowances and additional payments that exist in a given organization in relation to specific positions.

Who should draw up the SR and make changes to it?

There is still no clarity on this issue. In different organizations, the functions of compiling staffing tables are performed by different structural units. When assigning responsibility for the formation of staffing to employees of any structural unit, management is often based on the size of the organization. Today in Russia there are both large organizations with a staff of over 500 people, and small enterprises with no more than 50 employees. There are also entrepreneurs without a legal entity who employ employees. Since most small businesses and individual entrepreneurs do not have either personnel departments or departments for organizing and remunerating labor, accounting staff, managers or the entrepreneurs themselves are responsible for drawing up the staffing table. In medium-sized enterprises (from 100 people), as a rule, there is a personnel department or personnel service and, accordingly, the functions of drawing up and making changes to the staffing table are transferred to them (but there are often cases when accounting staff are again involved in drawing up and changing the staffing table).

In large companies that include both human resources departments or personnel services, as well as labor organization and remuneration departments, the above-mentioned divisions are responsible for developing the staffing table.

It should be noted that the formation of a staffing table is a rather complex process, consisting of several stages and requiring the involvement of not only HR specialists, but also economists.

Where does the preparation of the ShR begin?

Before you begin drawing up a staffing table, you need to decide on the organizational structure of the enterprise. An organizational structure is a schematic representation of structural divisions. This document reflects all divisions of the organization and schematically outlines the order of their subordination. The organizational structure can also reflect both vertical and horizontal connections between departments.

It is problematic to clearly indicate where the boundaries of responsibility for drawing up the staffing table lie, but we will try to delimit some stages of drawing up the HR, and at the same time fill out the unified form No. T-3.

Where to start filling out the unified form?

Filling out the unified form T-3 “Staffing table” should begin with the name of the organization - it must be indicated in strict accordance with the name that appears in the constituent documents. In the case where an organization has both a full and an abbreviated name, the use of any name is allowed. In order to avoid questions and controversial situations, it is advisable to establish the rules for filling out details in a local regulatory act on documentation and document flow (regulations, instructions).

Next is the document number. For organizations where the staffing table is often subject to changes, it is advisable to introduce a separate numbering for the staffing table with a letter designation (for example, “shr”).

The date of the document is entered in a specially designated column in the form “dd.mm.yyyy.” The date of the staffing table does not always coincide with the start time of its validity, therefore, the unified form contains the column “Staffing table for “____”_______ 20, i.e. on a certain date from which the staffing table comes into effect.

The resolution of the State Statistics Committee of Russia, which introduced the unified form No. T-3, provides for the approval of the staffing table by order of the head of the organization. To do this, the date and number of the order, the number of staff units and the monthly payroll are entered in a separate column.

What is the name of the structural unit?

The first column of the unified form is called “Name of the structural unit.” If we are talking about a commercial organization, then, as a rule, there are no restrictions in the names of structural divisions, except for the requirements for terminology and generally accepted concepts and definitions (it is undesirable to name structural divisions with poorly understood foreign words).

Enter the site

However, there are organizations in which a number of benefits provided to employees upon retirement depend on the name of the structural unit indicated in the staffing table (for example, medical and educational institutions, enterprises that include production facilities with hazardous working conditions). Therefore, the task of correctly reflecting the names of structural units in the staffing table falls on the HR department or the organization and remuneration department. To facilitate work in this direction, there are industry classifiers of hazardous industries or nomenclature of names of structural divisions, as well as tariff and qualification reference books, all-Russian classifiers, List No. 1 of industries, works, professions, positions and indicators in underground work, in work with particularly hazardous and especially hazardous difficult working conditions, employment in which gives the right to an old-age pension (old age) on preferential terms and List No. 2 of industries, jobs, professions, positions and indicators with harmful and difficult working conditions, employment in which gives the right to an old-age pension ( old age) on preferential terms.

The names of departments are indicated by groups:

- management or administrative part (such divisions include the directorate, accounting, personnel department, etc.);

- production units;

- auxiliary or service units.

As a rule, the location of the names of structural units in most organizations corresponds to this order. The exception is for enterprises whose main business is trade. In such companies there are no production departments, but there are sales departments or commercial departments that are closely related to logistics departments (the latter in this case are service departments).

Supporting departments usually include the supply department, repair services, etc.

What is a “structural unit code”?

The structural unit code usually indicates the location of the structural unit in the hierarchical structure of the organization. It is also assigned for the convenience of document management (especially for large enterprises). By means of coding, the place of smaller units in the structure of large ones is indicated. For example, within departments there are directorates, within departments there are divisions, within departments there are groups. If a department is designated by the digital code 01, then the department within the department will, accordingly, be numbered 01.01. Departments and groups are designated in the same way.

How to fill out the “Profession (position)” column?

This column is filled out in strict accordance with tariff and qualification reference books and the All-Russian Classifier of Employee Positions and Worker Professions. The sequence of filling out this column for each structural unit is individual, taking into account the specifics of a particular organization. As a rule, the positions of the head of a structural unit, his deputies are located first, then leading and chief specialists, then the positions of performers. If a structural unit includes both engineering and technical personnel and workers, it is necessary to allocate engineers first, then workers.

What is a “staffing unit”?

A staffing unit is an official or working unit provided for by the staffing table of an enterprise. As a rule, the number of staff units of organizations financed from the federal or regional budget is determined by higher-level organizations.

The number of staffing units of a commercial enterprise is determined by its needs for certain types of work, the degree of urgency of their implementation and economic feasibility.

How to set the salary (tariff rate)?

In accordance with Article 129 of the Labor Code of the Russian Federation, salary (tariff rate) is understood as a fixed amount of remuneration for an employee for fulfilling a standard of work (labor duties) of a certain complexity (qualification) per unit of time.

Tariff rates are a tool for tariffication of employee remuneration in organizations financed from the federal budget in accordance with the Unified Tariff Schedule. Commercial organizations set salaries based on their financial capabilities.

It should be noted here that the salary or tariff rate in accordance with Article 133 of the Labor Code of the Russian Federation cannot be lower than the legally established minimum wage. It should also be taken into account that the minimum wage does not include additional payments and allowances, bonuses and other incentive payments, payments for work in conditions deviating from normal, for work in special climatic conditions and in territories exposed to radioactive contamination, other compensation and social payments.

When establishing official salaries or tariff rates, it is necessary to remember that the staffing table can only reflect the size of the salary or tariff rate, therefore it is completely impossible to take into account the wage fund. This is due to the fact that in enterprises with a shift work schedule, the wages of workers receiving an official salary are increased by the amount of additional payments for night work, and the labor of workers whose wages are calculated based on the tariff rate is paid depending on the number of hours worked at night. specific month and varies. In most organizations, the size of the monthly wage fund for reflection in the staffing table is calculated from the average number of working hours and is assumed to be conditionally equal to 166 hours per month.

For workers whose work is paid according to the piece-rate system, the ShR, as a rule, sets a tariff rate or salary, which, depending on the specifics of the organization, is calculated using certain methods.

When setting a salary, one should be guided by the requirements contained in acts of labor legislation, as well as local regulations - Regulations on remuneration in the organization, Regulations on bonuses and others.

What are “allowances and surcharges”?

In the unified form No. T-3 there are several columns united by the common name “Allowance”. The current Labor Code of the Russian Federation does not contain clear definitions of the concepts of “allowance” and “additional payment”.

Guided by generally accepted guidelines, we can define additional payments as payments accrued to employees in addition to salaries (tariff rates) for special working conditions or working hours. Additional payments are made to employees engaged in heavy work, work with harmful and (or) dangerous and other special working conditions. The specific amount of the additional payment is established by the employer taking into account the opinion of the representative body of employees or by a collective agreement or is stipulated in the employment contract. Currently, many budgetary organizations have industry-specific regulatory legal documents that regulate the amount of wage increases for industry workers.

Wage bonuses are incentive payments in excess of the established official salary, which encourage employees to achieve higher production indicators, improve professional skills and labor productivity. As a rule, bonuses are established based on the results of employee certification by decision of a qualification or certification commission.

Until definitions for the concepts of “allowance” and “additional payment” are introduced at the legislative level, it is difficult to distinguish or systematize this type of payment. The main thing that needs to be taken into account when creating a staffing table is the two main forms of payment of allowances and additional payments. The first form - percentage - is set as a percentage of the official salary, and in the event of a revision of the salary (rate), the size of the bonus (additional payment) automatically changes. The second form of payment is an allowance or surcharge, set as a fixed amount. Such payment may remain constant even if the salary (rate) changes, unless otherwise provided by a collective agreement, employment contract or local regulation. When additional payments or allowances are established in the staffing table, a note is made in the corresponding column about the amount and for what this allowance (addition) is established.

One of the most frequently asked questions is how to ensure that employees occupying the same positions receive a salary that corresponds to their level of qualifications, while at the same time observing the principles of equality laid down in the Labor Code of the Russian Federation? The solutions to this problem may be different - it all depends on the professionalism of the management team. When looking for your own solution, it is necessary to evaluate the existing remuneration system at the enterprise. But, basically, this problem is solved by establishing a “standard” salary for all employees working in a given position or profession, and remuneration for more qualified workers is made by establishing personal allowances for a certain period. When the employee confirms his qualifications by order of the head of the enterprise, the bonus is established for the next period.

What is “monthly payroll”?

The monthly wage fund is the total funds that are provided for by the staffing table and payment system in force at the enterprise for payment to employees.

When are changes made to the SR?

Changes to the staffing table are made when the number or staff of employees is reduced. When reducing the number of employees, individual units are excluded, and when reducing staff, individual units are excluded. At the same time, employees filling reduced positions or working in reduced professions are subject to dismissal under the relevant articles of the Labor Code of the Russian Federation.

Is it possible to make changes to the unified form No. T-3?

As stated in the resolution of the Goskomstat of Russia dated March 24, 1999 “On approval of the procedure for using unified forms of primary accounting documentation,” the organization can, if necessary, enter additional details into the unified forms of primary accounting documentation (except for forms for recording cash transactions) approved by the Goskomstat of Russia. In this case, all details of the approved forms remain unchanged (including code, form number, document name); Removing individual details from unified forms is not allowed.

Changes made must be documented in the relevant organizational and administrative document of the company.

The formats of the forms indicated in the albums of unified forms of primary accounting documentation are recommended and are subject to change.

When producing blank products based on unified forms of primary accounting documentation, it is allowed to make changes in terms of expanding and narrowing columns and lines, taking into account the significance of indicators, including additional lines (including free ones) and loose sheets for the convenience of placing and processing the necessary information.

Question: Can the staffing table not indicate a specific salary amount?

Lawyer's answer:

The legislation does not establish a mandatory form of staffing for commercial organizations.

If it is impossible to indicate the exact amount of remuneration, it is recommended to provide a link in the note to a local regulatory act that defines the procedure for establishing remuneration, as well as its amount for a certain standard of production.

Legal basis:

The staffing table is an organizational and administrative document in which the structure, staffing and number of the organization, a list of job titles, professions indicating qualifications and salaries, as well as possible allowances for each position are drawn up.

For the convenience of drawing up a staffing table by a legal entity or an individual who is an individual entrepreneur, a unified form N T-3 is provided (approved by Resolution of the State Statistics Committee of the Russian Federation “On approval of unified forms of primary accounting documentation for the accounting of labor and its payment” dated 01/05/2004 N 1) .

STAFF SCHEDULE, CHANGE PROCEDURE

This form is not mandatory for use, but is only advisory. Despite this, it is recommended to use this form in your work, since it contains all the necessary details.

At the same time, it must be borne in mind that many control bodies, when carrying out inspections or requests, require the submission of a staffing table (for example, paragraph 91 of the Methodological Instructions on the procedure for appointing, conducting documentary on-site inspections of policyholders for compulsory social insurance and taking measures based on their results, approved by Resolution of the Federal Tax Service of the Russian Federation dated 04/07/2008 N 81).

When conducting documentary checks by territorial bodies of the Pension Fund of the Russian Federation, it is also possible to request the provision of a staffing table (Methodological recommendations for organizing and conducting documentary verification of the reliability of individual information provided by policyholders on the length of service and earnings (remuneration), income of insured persons in the state pension insurance system (approved. Resolution of the Board of the Pension Fund of the Russian Federation dated January 30, 2002 N 11p)).

In addition to the listed bodies, tax inspectorates often include in the list of documents required for a comprehensive audit the staffing table as a document confirming the application of tax benefits.

Also, the staffing table serves as a document that summarizes data on wage costs, as well as the number of employees of the organization.

Thus, if an organization uses standard form No. T-3 of the staffing table, it must also take into account the Instructions for the use and completion of primary documentation forms, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1, according to which, in column 5 “Tariff rate (salary ) etc.” the monthly salary is indicated in ruble terms according to the tariff rate (salary), tariff schedule, percentage of revenue, share or percentage of profit, labor participation coefficient (KTU), distribution coefficient, etc., depending on the remuneration system adopted in the organization in in accordance with the current legislation of the Russian Federation, collective agreements, employment contracts, agreements and local regulations of the organization.

Columns 6 - 8 “Bonuses” show incentive and compensation payments (bonuses, allowances, additional payments, incentive payments) established by the current legislation of the Russian Federation (for example, northern bonuses, bonuses for an academic degree, etc.), as well as those introduced at the discretion of the organization (for example, related to the regime or working conditions).

If it is impossible for an organization to fill out columns 5 - 9 in ruble terms due to the use of other remuneration systems in accordance with the current legislation of the Russian Federation (tariff-free, mixed, etc.), these columns are filled in in the appropriate units of measurement (for example, percentages, coefficients, etc. .).

Reflection of information in this column has its own characteristics. Thus, for some workers who work on a piece-rate wage system, it is impossible to determine the exact amount of salary, since it depends on the results of the work performed. In this case, in column 10 “Note” it is advisable to indicate the following: “Piece-piece payment/Piece-piece bonus payment”. Next, it is advisable to provide a link to the local regulatory act that determines the procedure for establishing wages, as well as its amount for a certain standard of production.

It should be remembered that the so-called “fork” for salaries cannot be indicated in the staffing table, since, according to Art. 22 of the Labor Code of the Russian Federation, payment must be equal for equal work. Therefore, if in one department there are two staff positions for the position “specialist”, then opposite each such position in this column the same salary should be indicated.

The opportunity to pay wages (and not official salary) in a larger amount to one of the employees can be realized by establishing allowances or other additional payments for him (letter of Rostrud dated 04/27/2011 N 1111-6-1).

The answer was prepared by Dmitry Stikhin, senior lawyer

Hello! Have you ever heard of such a document as the “Staffing Schedule of an Organization”? But this is a document on the basis of which wages are calculated, as well as employees are hired and fired. Now we will try to talk in detail about what functions the SR performs and how to compose it correctly.

What is “Staffing Schedule”

Each of you has been to the HR department of some enterprise at least once in your life. You've probably seen countless folders and personal files of employees. Surely many were interested in how the employees of this department collect and remember information about all positions, employees, etc.

And everything is quite simple. They have a document called a staffing table.

Staffing table (SH)- this is a regulatory document that provides information about all positions of the enterprise, the number of full-time employees, the size of their tariff rates and the amount of allowances.

In other words, this is a document that contains generalized information about the number of employees of the enterprise and available positions. In addition, the staffing table indicates the salary for each position, taking into account all applicable allowances.

Very often, this document helps enterprise managers during legal proceedings. For example, due to a forced reduction in staff, a worker was fired and he sued the former managers. In this case, the ShR is direct evidence of the legality of the defendant’s actions.

Due to the importance of this document, all pages are numbered, laced and sealed.

- Download a sample order for approval of the staffing table

- Download Staffing Form N T-3

Staffing functions

Like any document, the ShR performs a number of functions. The main ones are:

- Possibility of organizing staff working hours;

- Calculation of monthly salaries for employees;

- Official registration of newly hired employees;

- Remaining the rules of the daily routine;

- Transfer of registered employees from one position to another, etc.

Staffing table is a mandatory document

Every enterprise has a large amount of documentation. There are documents that are maintained without fail, and there are those that are created out of necessity. To the question “Is the ShR a mandatory document?” it is impossible to give a definite answer.

This is due to the fact that the labor code does not require the presence of a labor force at an enterprise. But if we consider this issue based on the requirements of Roskomstat, it turns out that this document is necessary, because it is the primary documentation for accounting for wage payments.

Although the legislation does not stipulate clear rules anywhere, most organizations maintain this type of documentation. After all, the main part of government inspections begins with the study of SR.

In fact, the presence of this document makes life easier not only for inspectors, but also for managers, human resources and accounting departments.

What is the validity period of the staffing table?

No official document indicates the exact validity period of the ShR. The manager himself has the right to indicate the period at which this document is drawn up. Most often, it is redone every year and put into effect on January 1. When drawing up the ShR, the date of its validity is indicated. But if you do not specify a date, then the document is considered unlimited and does not need to be redone.

How much and where is the staffing table stored?

Based on the decree of the Federal Archive, ShR, after expiration, must be stored at the enterprise for 3 years. And the shelf life of staff arrangements is 75 years.

Staffing arrangement– an optional document for each enterprise, which is created on the basis of the staffing table. It is a mobile version of the HR and includes more detailed information about the company’s employees (the workers’ full names, disability group, etc. are indicated).

Who makes up

Before starting to create a document, the manager issues an order to change the staffing table, where he appoints an employee who will draw it up.

This can be absolutely any employee of the organization. But most often such work is entrusted to employees of the personnel department, accounting department or labor standards engineer.

How many copies of ShR should be in production?

When compiling a SR, one copy is made. Thus, the original and a copy must be kept in the HR and accounting department.

Change of staffing

Sometimes it is necessary to make changes to the existing SR. This is done in several cases:

- If there is a reorganization of the company;

- If it is necessary to optimize and improve the work activity of the management apparatus;

- If changes made to legislation require mandatory amendments to the ShR;

- In case of changes in staffing positions ;

- Changes in position in the staffing table;

- Changes in salary in the staffing table.

If the changes are minor and do not require the creation of a new HR, then the manager issues an order to amend the staffing table. After which the responsible employee makes amendments to the current document.

When making changes to the staffing table, management is not required to notify employees in writing.

The second way to make amendments is to create a new ShR.

For any changes to the SR, amendments must be made to the work books and personal cards of employees. Before doing this, you must obtain written permission for this action from employees.

For example, if the wording of a job title changes slightly, the employee must be notified in writing. Only after this are changes made to his work book.

If changes concern the amount of salaries, in this case the employee is notified in writing 2 months in advance. These amendments are simultaneously made to the employment contract.

Is there a mandatory staffing form?

To compile the SR, the unified one is most often used. It is a form - a table into which you need to enter data.

Most organizations take the T-3 form as a basis and “customize” it to fit their enterprise. This is permitted, i.e. the unified form of this document is not mandatory.

In cases where the enterprise has a state form of management, then the staffing table is drawn up according to all the rules.

Structure of the organization's staffing table

The SR consists of a “header”, a table and data of the people who signed this document.

The first part of the documents contains the following information:

- Name of the organization, according to the constituent documents;

- The start date of the ShR, its number and validity period. Numbering can be assigned arbitrarily.

- Date and number of the order approving the staffing table;

- Total staff.

The second part is a collection of data for all positions. We'll look at it a little later.

The third part contains the names and positions of the people who signed this document. Most often this is the head of the personnel department and the chief accountant.

How to create a staffing schedule

We hope that no one had any questions when filling out the “header”, so let’s move on to filling out the table itself.

1 column . Name of the structural unit. They should be listed in order of subordination. For example, administration, secretariat, financial department, accounting, etc.;

2 counts. Department code. We number the divisions from top to bottom (01,02,03, etc.);

3 counts. Job title. Data must be entered in the nominative case without abbreviations, in the singular, guided by qualification and tariff directories;

4 counts . Number of staff units. This column indicates how many people of one position the enterprise needs. This value can be either an integer or a fraction. For example, 2.5 could mean that 2 employees will work full time and one part time;

5th Earl . The amount of salary, tariff rate or bonuses. Indicated in rubles for each position. If, for example, there are 2 accountants working, but the manager pays them different salaries, then a single salary is indicated in the staffing table, and additional payments are indicated in the allowance column. That is, the salary of workers in the same position should be the same;

6, 7, 8 columns . Allowances for special working conditions. They may not exist, then dashes are placed in the columns. But if an employee works at night, on holidays, or cleans the bathroom. knots, etc., then by law he must be paid certain compensation;

9th Earl. In just a month. The data in columns 5,6,7,8 is summed up, and then multiplied by the number of staff units for each position;

10th Earl . Note. A local regulatory act may be indicated on the basis of which wages are paid;

After entering the data, you need to summarize the results 4 And 9 column. Thus, we find out the number of staff units in the staffing table and the monthly wage fund.

Approval of staffing

According to the rules for approving the staffing table, after compiling and checking all the data, the HR is signed by the manager, chief accountant and head of the personnel department. After which the head of the enterprise issues an order to put this document into effect.

Conclusion

SR is not mandatory, but a very important document for any organization. Based on it, you can either accept a new one. In addition, with its help, wages are calculated for the company's employees.

This document is not strictly regulated, so it can be “customized” for each organization and altered if necessary. This is a lifesaver for a manager during inspections by government agencies.

"Personnel Department", 2008, N 1

We draw up a staffing schedule

The staffing table is an important personnel document for any organization. But here’s the question: are employers, regardless of their organizational and legal form, required to have a staffing table, and if so, how to draw it up correctly and how are changes made to it?

The staffing table is the primary document for personnel records. Its unified form N T-3 was approved by Resolution of the State Statistics Committee of Russia dated 01/05/2004 N 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment.” According to this Resolution, unified forms for personnel records must be used by legal entities of all organizational and legal forms. The staffing table contains a list of structural units, positions, specialties, professions, information on the number of staff units, official salaries, allowances and monthly payroll. It can be drawn up both as a single document for the organization as a whole and for its individual structural divisions. The staffing table is signed by the head of the personnel service and the chief accountant; if necessary, it can be signed by the heads of structural divisions. The staffing table is approved by order of the head of the organization or a person authorized by him and is the main document defining the organizational structure and fixing the official and numerical composition of the organization.

What do we mean by staffing?

There are many different definitions of the concept of “staffing table”, from which it follows that this is an organizational and administrative document that reflects the structure of the organization. It contains a list of positions, indicating their number and salaries. The staffing table also reflects the amount of allowances and additional payments that exist in a given organization in relation to specific positions.

Often, managers of various organizations do not know who exactly should draw up the staffing table and make changes to it. In large organizations where the number of employees exceeds 500 people, there is either a personnel service or a personnel department, which deals with issues of personnel records management. But in small enterprises or individual entrepreneurs without the formation of a legal entity, the number of employees of which does not exceed 50 people, both the accounting staff and the manager or entrepreneur himself can draw up the staffing table. In organizations with a staff of 100 or more people, the manager delegates the functions of personnel records management to either the office manager or the legal adviser. Currently, such organizations prefer to hire a lawyer with the functions of a personnel employee, thereby “killing two birds with one stone.” But in any case, the process of forming a staffing table is quite complex and consists of several stages, and therefore requires the involvement of not only personnel service workers, but also economists.

Stages of drawing up staffing schedules

Before starting to draw up a staffing table, it is necessary to determine the organizational structure of the organization, that is, to schematically display the structural divisions, as well as the order of their subordination and connections among themselves. Then we move on to the next stage - drawing up the staffing table and bringing it into proper form according to the unified form N T-3 “Staffing table”. It is not difficult to fill out, but there are some points to consider. For example, the name of the organization is indicated in exact accordance with the name that appears in the constituent documents. If an organization has both a full and an abbreviated name, it is allowed to use either of them. Filling out the date and document number columns is unlikely to cause any difficulties, but for large organizations where changes are often made to the staffing table, it is advisable to introduce separate numbering for the staffing table.

The date of the staffing table does not always coincide with the start time of its validity, therefore, the unified form contains the column “Staffing table for the period ______ from “___” ________ 20__”, that is, a certain date from which the staffing table comes into effect.

Also, in a unified form, the date and number of the manager’s order to approve the staffing table are entered in a separate column. Please note: the staffing table can be approved once and remain valid indefinitely. In this case, to work with the document, you should take into account all the changes and additions made by the instructions (orders) of the manager, which in practice is not always convenient. Due to the fact that there are no restrictions on the number of changes to the staffing table for commercial organizations, it is better to introduce a new staffing table with each change.

Now let's look at the "Structural division" column. Commercial organizations, as a rule, determine the names of structural units independently, guided by generally accepted concepts and definitions (it is undesirable to name structural units with obscure foreign words). But there are organizations in which a number of benefits provided to employees depend on the name of the structural unit indicated in the staffing table (for example, medical and educational institutions, enterprises that include production facilities with hazardous working conditions). In this case, correct reflection of the names of structural units in the staffing table is very important. To facilitate work in designating structural units, there are industry classifiers of hazardous industries or nomenclature of names of structural units, as well as tariff and qualification reference books, all-Russian classifiers, a List of industries, workshops, professions and positions, approved by Resolution of the State Committee of Labor of the USSR and the Presidium of the All-Russian Central Council of Trade Unions dated October 25, 1974 N 298 /P-22, employment in which gives the right to an old-age pension on preferential terms.

As a rule, the structural divisions of the administration are indicated first (directorate, accounting, personnel department, etc.), then production divisions, and finally service and auxiliary divisions (supply department, repair services, etc.).

Column No. 3 “Position (specialty, profession), rank, class (category) of qualifications” is filled out in strict accordance with tariff and qualification reference books and the All-Russian Classifier of Employee Positions and Worker Professions. When determining the names of positions included in the organization's staffing table, one should be guided by the All-Russian Classifier of worker professions, employee positions and tariff categories OK 016-94, approved by Resolution of the State Standard of Russia of December 26, 1994 N 367. In the said Classifier, in particular, the positions of employees are given in in accordance with the Qualification Directory of Positions of Managers, Specialists and Other Employees (approved by Resolution of the Ministry of Labor of Russia dated August 21, 1998 N 37).

The sequence of filling out this column for each structural unit is individual, taking into account the specifics of a particular organization. Usually, the positions of the head of a structural unit, his deputies, then leading and chief specialists, then performers are located first. If a structural unit includes both engineering and technical personnel and workers, it is necessary to allocate first engineers and then workers.

Questions may arise regarding the procedure for filling out column 4 “Number of staff units”. The number of staff units of organizations financed from the federal or regional budget is determined by higher-level organizations. The number of staffing units of a commercial enterprise is determined by its needs for certain types of work, the degree of urgency of their implementation and economic feasibility. If the organization provides for the maintenance of an incomplete staff unit, when filling out column 4, the number of incomplete staff units is indicated in the appropriate shares, for example 0.25 (Instructions for the use and completion of primary accounting documentation forms, approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1).

How to set the salary (tariff rate)?

In accordance with Art. 129 of the Labor Code of the Russian Federation, salary (tariff rate) is understood as a fixed amount of remuneration for an employee for fulfilling a standard of work (job duties) of a certain complexity (qualification) per unit of time.

Tariff rates are a tool for tariffication of employee remuneration in budgetary organizations in accordance with the Unified Tariff Schedule. But it should be noted that the Government of the Russian Federation issued Resolution No. 605 dated September 22, 2007 “On approval of the Regulations on the establishment of remuneration systems for employees of federal government institutions and civilian personnel,” which defined the basis for the transition to new remuneration systems and gave budgetary institutions the authority to independently establish salaries, compensation and other payments. Commercial organizations set their own salaries based on their financial capabilities. It should be noted here that the amount of salary or tariff rate in accordance with Art. 133 of the Labor Code of the Russian Federation cannot be lower than the legally established minimum wage.

In the unified form N T-3 there are several columns (N N 6, 7, 8), united by the common name “Allowance”. The current Labor Code does not have a clear definition of the concept of “allowance”.

The main thing that needs to be taken into account when forming a staffing table is the two main forms of payment of bonuses: 1) percentage - set as a percentage of the official salary, and if the size of the salary (rate) changes, the size of the bonus automatically changes; 2) in the form of a fixed amount - can remain constant even if the salary (rate) changes.

If the employer is not able to fill out these columns in rubles, for example, due to the fact that bonuses are set for the employee in percentages or coefficients, it is allowed to indicate percentages (coefficients) in the corresponding columns. If the size of the latter changes, you can put dashes in the corresponding columns, and in column 10 “Note” make a link to the document that governs this change. For example, the percentage bonus for workers in the Far North varies depending on the length of their “northern” work experience. Therefore, when filling out the staffing table, you can put dashes in the “Additional payments” columns (in the absence of other allowances), and in column 10 make a reference to the relevant regulatory legal act that regulates the establishment of percentage increases in wages for employees of the Far North. Other incentive payments other than allowances are not shown in the staffing table, that is, there is no need to reflect, for example, bonuses in the unified form N T-3.

One of the most frequently asked questions is how to ensure that employees occupying the same positions receive a salary that corresponds to their level of qualifications, while respecting the principles of equality defined in the Labor Code? There may be several answers, but basically the problem is solved by establishing a “standard” salary for all employees working in a given position or profession, and paying more qualified employees by establishing personal allowances for a certain period. When the employee confirms his qualifications by order of the manager, the bonus is established for the next period.

When are changes made to the staffing table?

Changes to the staffing table are made when the number or staff of employees is reduced. When reducing numbers, individual units are excluded, and when reducing staff, individual units are excluded. At the same time, employees filling reduced positions or working in reduced professions are subject to dismissal under the relevant articles of the Labor Code. If it is necessary to introduce new positions or structural units in connection with organizational events, the staffing table is also subject to change.

How to make changes to the staffing table?

Let's start with the fact that the formats of the forms indicated in the albums of unified forms of primary accounting documentation are recommended and can be changed (Resolution of the State Statistics Committee of Russia dated March 24, 1999 N 20 "On approval of the Procedure for using unified forms of primary accounting documentation"), but the code remains unchanged form number, document name. Removing individual details from unified forms is not allowed.

The changes made must be formalized by the relevant organizational and administrative document of the company - an order (instruction) of the head of the organization or a person authorized by him.

The employer can change the staffing table as often as desired. In the event of a dispute regarding the dismissal of employees due to staff reduction, the advisability of changing the staffing table is not considered by the courts. But, if the employer does not have a staffing table, he is deprived of the opportunity to reduce the number or staff of employees. More precisely, he will not be able to document the legality of these actions in the event of a dispute.

Let us give examples of an order to approve the staffing table and an order to make changes to the staffing table.

│ Order N 01 │

│On approval of the staffing table │

│In order to determine the organizational structure, positions and numbers│

│composition and approval of the monthly payroll of Zvezdochka LLC│

│ I ORDER: │

│2. Entrust control over the execution of this order to the chief│

│accountant A.I. Ivanov. │

│ Petrov │

┌─────────────────────────────────────────────────────────────────────────┐

│ Limited Liability Company "Zvezdochka" │

│ Order No. 12 │

│About changes to the staffing table │

│In order to rationalize the staffing structure of positions at Zvezdochka LLC │

│ I ORDER: │

│Make the following changes to the staffing table: │

│office manager position (Administration division), in number│

│1 units, salary - 9000 rub. 00 kop. │

│(division "Transport department") in the amount of 3 units, salary -│

│8000 rub. 00 kop. │

The new staffing schedule is not in effect. │

│5. Entrust control over the execution of this order to the chief│

│accountant A.I. Ivanov. │

│Attachment: staffing table on 1 sheet. │

│ Petrov │

│General Director of Zvezdochka LLC ------ A.A. Petrov │

│The order has been reviewed by: Ivanova │

│chief accountant ------- A.I. Ivanova │

└─────────────────────────────────────────────────────────────────────────┘

In many organizations, it is common to draw up a staff list - arrangement. This document is very convenient for a HR specialist. The staffing list allows you to quickly determine the number of vacant and occupied places in the organization, as well as the size and types of allowances. To create such a document, you don’t need to “invent a wheel.” You can take the staffing table form and add the “Employee’s full name” column to it. Thus, it will be clear in which department a particular employee works, what position he occupies, and what allowances he is entitled to.

Journal expert

"Human Resources Department"

Signed for seal

From this article you will learn:

- what types of payments are considered bonuses?

- how to register allowances in the staffing table

- Is it possible to indicate in the staffing table a link to the document establishing the amount of the allowance?

- Is it necessary to set the exact amounts of allowances in the staffing table?

I encountered the following problem. The Regulations on Remuneration provide for about 14 increasing coefficients for salary (grade, qualification, rank, degree, awards, for continuous experience in healthcare). Question. If all these are allowances, then accordingly I must register them all in the staffing table. But if I enter 14 extra. I won’t put the count in the allowances in A4. What to do?

Answer

An allowance is a cash payment systematically accrued to employees in excess of their rates (salaries) in cases provided for by the Labor Code of the Russian Federation and local regulations of the enterprise (institution). As a rule, in these cases, the employee is not assigned any additional labor functions.

Additional payments to wages should be distinguished from allowances. These are cash payments that compensate for the additional labor costs of workers and employees.

What you are writing about relates to salary supplements or tariff rates. It’s just not clear about the awards; they definitely don’t relate to bonuses.

According to general rules, allowances are included in the staffing table. But if the organization has a Regulation that specifies the amount of allowances (or their percentage ratio) and allowances are set for employees by personnel order, then it makes no sense to enter an additional 14 columns into the staffing table. The actual wage fund must be calculated by an economist.

An increasing coefficient to the salary if you have the honorary title “Honored Doctor”.

All that remains is to somehow justify it at the legislative level. We have a regulation on remuneration where all increasing coefficients are spelled out. All employees upon hiring are familiarized with this provision. Plus, when accepting and receiving documents to increase official salary, we issue an order. But here's the staffing issue. Previously, they simply did Position, how many bets. That's all. Now the planners have rebelled and are demanding that they compile it according to the form. I know that there are two opinions about the mandatory nature of the staffing table. But okay, it’s not a problem to fit in salaries. The problem with allowances. The regulations on remuneration say that increasing coefficients can be established for employee salaries:

1. increasing coefficient to the salary for the position held,

2. increasing coefficient to the salary at the institution,

3. increasing coefficient to the salary for the qualification category, the presence of an academic degree, title, for class

For a more detailed explanation, see the video:

The staff may include only an increasing coefficient to the salary of the institution.

And increase. The coefficient for the salary for the position held should be included immediately in the salary.

And don’t write the third one at all. But how can we explain it?

As far as I know, salary increases are set for a certain period of time during the relevant calendar year. The amount of payments for them is determined by multiplying the employee’s salary by an increasing factor. At the same time, these coefficients do not form a new salary for employees and are not taken into account when calculating incentive and compensation payments. Increase factors should not be included in the salary. But what is the coefficient for the position held? Is it different or the same for each employee in the same position?

The situation, for example, with the length of service of employees changes during the calendar year and this is not reflected in the staffing table. Maybe your planners need a report on the actual ratios set at the end of the reporting period? To calculate the wage fund? You can offer such a report if all your increasing coefficients are set by orders.

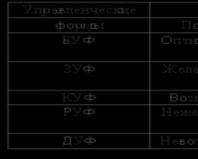

I am sending extracts from the Regulations on remuneration.

Consultant + writes in the article Guide to HR Issues. Staffing schedule.

When the amount of the bonus as a percentage changes, for example, depending on length of service, it is possible not to indicate it in the staffing table, but in column 10 make a link to the document establishing the bonus, which allows you not to change the staffing table every time it changes.

On the other side.

Columns 6 - 8 "Additions" reflect incentive and compensation payments (bonuses, allowances, additional payments, incentive payments) established by the current legislation of the Russian Federation (northern allowances, allowances for an academic degree, etc.), as well as those introduced at the discretion of the organization (for example, allowances related to the regime or working conditions).

If columns 5 - 9 cannot be filled in in ruble terms due to the use of other remuneration systems in the organization (tariff-free, mixed, etc.), they are filled in in the appropriate units of measurement (for example, percentages, coefficients, etc.).

Considering the above, we recommend filling out the staffing table as follows:

- column 5 indicates the tariff rate or salary without taking into account the regional coefficient (for example, 15,000);

- in one of the columns “Additions” interest is entered without calculating a specific amount in rubles;

- in column 9 there is a dash;

- Column 10 provides a link to the local regulatory act regulating the remuneration system (for example, to the Regulation on remuneration dated September 15, 2010 N 17-od).

Filling out the staffing table in this way allows you to reflect the main types of payments and their amounts, as well as avoid incorrect calculation of the employee’s wages.

And so. It’s still not clear what to write? Your organization has a huge number of types of salary increases and various types of bonuses. If you fill out the form in a unified form, then the Consultant quite correctly advises putting a dash in column 9, in the note there is a link to the Regulations. I would write in one column of allowances - “increasing coefficients for salary”, in another “personal increasing coefficient”, or “incentive payments”, then “increase for length of continuous work” or “Other”. I wouldn’t put any amounts anywhere, since these are entire groups of allowances. This is quite reasonable, since employees with different length of service (different job titles or academic degrees) can be hired, which means they will receive different bonuses.

It is clear that your planners want to print a staff position where opposite each position you can see not only the salary, but also all existing additional payments. But to do this, you can draw up separate documents for structural divisions (institutions) or professional groups (whichever is more convenient) indicating only those allowances that are established for specific groups. In any case, this should be proposed to the head of the planning department, an economist. They must understand the feasibility of your proposal. Based on discussion materials from site visitors