Permanent representative office of a foreign organization. Representative offices of foreign organizations from the point of view of civil and tax legislation Activities of a foreign organization without representation

A foreign organization must pay and/or calculate tax when conducting activities in Russia through its permanent representative office or when carrying out activities that involve receiving profit from Russian sources. However, the term permanent establishment» according to the rules of tax law, is not associated with the representative office of a foreign company in the civil sense, since in the tax sense, neither the provisions on the representative office nor accreditation are needed for the establishment of a permanent establishment.

According to paragraph 2 of article 306 of the Russian Tax Code, permanent representative office of a foreign company– a representative office, branch, bureau, department, agency, office, other separate division, or place of business through which this company constantly conducts its business in Russia.

In accordance with paragraph 5 of article 306 of the Russian Tax Code, the fact of its ownership of shares in the capital of Russian organizations, securities and/or property on the territory of the Russian Federation does not lead to the formation of a permanent representative office in the Russian Federation of a foreign company, provided that there are no signs of a permanent representative office. Paragraph 4 of the same article states that the conduct of auxiliary or preparatory activities by a foreign organization does not entail the establishment of a permanent establishment.

Signs of the establishment of a permanent representative office of a foreign company in Russia:

- A separate division or place of business.

- Regular conduct of activities in accordance with subclause 1.1 of clause 2 of the Regulations on the peculiarities of accounting by tax authorities of foreign organizations, which is Appendix No. 1 to the Order of the Ministry of Taxes of the Russian Federation of April 7, 2000 No. AP-3-06/124(hereinafter simply the Regulations), which states that this concept means conducting activities for more than 30 days a year.

- The activity is of an entrepreneurial nature. This feature is disclosed in paragraph 3 of paragraph 1 of article 2 of the Civil Code of Russia, where it is said that this is an activity that meets a number of criteria:

- Independent activity.

- Activities carried out at your own risk.

- Activities that are aimed at generating income from the sale of goods, the use of property and the performance of work and provision of services.

To establish a permanent establishment, a foreign company is not required to operate with its employees. In accordance with paragraph 9 of article 306 of the Tax Code, a foreign company has a permanent establishment if this company operates through a person representing it in Russia on the basis of contractual relations with it, acts in Russia on behalf of this company, regularly uses its powers to conclude contracts or agree on their main conditions on behalf of the company, while creating consequences for the foreign company (i.e. dependent agent).

According to subclause 1 of clause 2 of the Regulations, the emergence of an obligation to register with the tax authorities of Russia is possible if two criteria: place of activity, plus, regularity of activity. This is due to the fact that the regulatory act does not in any way link registration and the occurrence of tax obligations in the Russian Federation.

If a foreign company has an account with a bank in Russia, then this also does not entail the establishment of a permanent establishment, but indicates the need to register the foreign company with the Russian tax authority at the place of registration of the banking institution where the company has an account. The procedure for registering a foreign company for tax purposes to open an account with a Russian bank is given in subparagraph 1 of paragraph 3 of the Order of the Ministry of Taxes of Russia dated April 7, 2000 No. AP-3-06/124 “On approval of the Regulations on the specifics of accounting for foreign organizations by tax authorities”. Based on this, it can also be noted that managing an account through Internet banking does not affect the establishment of a permanent establishment.

Conclusions:

- When using offshore companies or foreign companies, you need to be very careful so that these companies do not “accidentally” have a permanent representative office in Russia.

- In order to use foreign and offshore companies when optimizing taxation in Russia in particular and in the CIS countries in general, you need to consult both with professionals in the field of international taxation and with local tax consultants in Russia and the CIS. Our consultations can provide you with invaluable ideas that you can implement with the help of your accountant and local tax advisor.

· Selected options for accounting and evaluation of accounting objects;

· System of accounting registers;

· Accounting reporting forms;

· The procedure for conducting an inventory of assets and liabilities;

· Document flow rules and technology for processing accounting information;

· Procedure for control over business operations;

· Other solutions necessary for organizing accounting and tax accounting.

The accounting policies adopted by the representative office of a foreign organization are applied consistently from one reporting year to another (assuming consistency in the application of accounting policies).

The accounting policy of a representative office of a foreign organization must ensure:

· completeness of reflection in the accounting records of all factors of the economic activity of a foreign organization on the territory of the Russian Federation, carried out directly by the representative office of this organization (completeness requirement);

· timely reflection of the facts of economic activity in accounting and financial statements (timeliness requirement);

· the identity of analytical accounting data with the turnover and balances of synthetic accounting accounts on the last calendar day of each month (consistency requirement).

The accounting policy adopted by the representative office of a foreign organization is subject to registration with the relevant organizational and administrative documentation (orders, instructions, etc.).

The accounting policy adopted by the newly created representative office of a foreign organization is considered to be applied from the date of state registration of this representative office on the territory of the Russian Federation.

Working chart of accounts of a representative office of a foreign organization

If the representative office of a foreign organization has chosen a method of maintaining accounting records in accordance with Russian standards, then the working chart of accounts is formed on the basis of the Chart of Accounts for accounting financial and economic activities of organizations and instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n.

Working chart of accounts of a representative office of a foreign organization operating on the territory of the Russian Federation.

| Account name | Account number | Subaccount number and name | |

| 1 | 2 | 3 | |

| Non-negotiableassets | |||

| Fixed assets | 01 | 1. Receipt of fixed assets | |

| 2. Disposal of fixed assets | |||

| Depreciation of fixed assets | 02 | 1. Receipt of intangible assets | |

| Intangible assets | 04 | 2. Disposal of intangible assets | |

| Amortization of intangible assets | 05 | ||

| Investments in non-current assets | 08 | 1. Acquisition of land plots | |

| 4. Acquisition of individual fixed assets | |||

| 5. Acquisition of intangible assets | |||

| Reserves | |||

| Materials | 10 | 1. Raw materials and supplies | |

| 3. Fuel | |||

| 6. Other materials | |||

| 9. Inventory and household supplies | |||

| Value added tax on purchased assets | 19 | 1. VAT on the acquisition of fixed assets | |

| 2. VAT on the acquisition of intangible assets | |||

| 3. VAT on purchased inventories | |||

| Expenses | |||

| Primary production | 20 | ||

| General production expenses | 25 | ||

| General running costs | 26 | ||

| Finished products and goods | |||

| Output | 40 | ||

| Goods | 41 | By type of goods | |

| Finished products | 43 | ||

| Cash | |||

| Cash register | 50 | 1. Cash desk in rubles | |

| 3. Cash documents | |||

| 4. Cash desk in foreign currency | |||

| Checking account | 51 | ||

| Foreign currency account | 52 | 1. Foreign currency accounts on the territory of the Russian Federation | |

| Special bank accounts | 55 | 1. Letters of credit | |

| 2. Checkbooks | |||

| 3. Deposit accounts | |||

| Transfers on the way | 57 | 1. Transfers in rubles | |

| 2. Transfers in foreign currency | |||

| Financial investments | 58 | 1. Units and shares | |

| 2. Debt securities | |||

| 3. Loans provided | |||

| 4. Deposits under a simple partnership agreement | |||

| Calculations | |||

| Settlements with suppliers and contractors | 60 | ||

| Settlements with buyers and customers | 62 | ||

| Calculations for taxes and fees | 68 | By type of taxes and fees | |

| Calculations for social insurance and security | 1. Social insurance calculations | ||

| 2. Pension calculations | |||

| 3. Calculations for compulsory health insurance | |||

| Payments to personnel regarding wages | 70 | ||

| Calculations with accountable persons | 71 | ||

| Settlements with personnel for other operations | 73 | 1. Calculations for loans provided | |

| 2. Calculations for compensation for material damage | |||

| Settlements with various debtors and creditors | 76 | 1. Calculations for property and personal insurance | |

| 2. Claims settlements | |||

| 3. Calculations of due dividends and other income | |||

| 4. Settlements on deposited amounts | |||

| Capital | |||

| Extra capital | 83 | ||

| Special-purpose financing | 86 | ||

| Financial results | |||

| Sales | 90 | 1. Revenue | |

| 2. Cost of sales | |||

| 3. Value added tax | |||

| 4. Excise taxes | |||

| 9. Profit/loss from sales | |||

| Other expenses and income | 91 | 1. Other income | |

| 2. Other expenses | |||

| 9. Balance of other income and expenses | |||

| Shortages from loss and damage to valuables | 94 | ||

| Future expenses | 97 | By type of expense | |

| revenue of the future periods | 98 | 1. Income received for deferred periods | |

|

2. Free receipts |

|||

|

3. Upcoming receipts of debt for shortfalls identified in previous years |

|||

|

4. The difference between the amount to be recovered from the guilty parties and the book value for shortages of valuables |

|||

|

Profit and loss |

|||

Using the example of a representative office of a foreign organization that does not carry out business activities on the territory of the Russian Federation, let us consider the procedure for recording individual transactions related to the activities of this representative office in the accounting accounts.

Example 1. A representative office of a foreign company operates in the Russian Federation to establish partnerships between the parent company and Russian organizations. This type of activity does not lead to the formation of a permanent representative office in Russia. The representative office carries out all expenses through funding received from the parent company monthly in the amount of $50,000.

Let's assume that the dollar exchange rate at the time of crediting funds to the foreign exchange account was 31.01 rubles. On the last day of the same month, by transfer from a foreign currency account, the representative office paid the invoice for the rental of office space issued by the landlord for the current month in the amount of 35,000 US dollars. The dollar exchange rate at the time of payment is 31.10 rubles.

The representative office maintains accounting records of financial and economic activities according to Russian standards, in accordance with the requirements of the Federal Law of the Russian Federation of November 21, 1996 No. 129-FZ “On Accounting”.

To reflect in the accounting of the representative office information on the receipt of funds from the head office for the maintenance of the representative office and the expenditure of these funds, account 86 “Targeted financing” can be used.

The value of assets and liabilities expressed in foreign currency, in accordance with the Accounting Regulations “Accounting for assets and liabilities, the value of which is expressed in foreign currency” PBU 3/2000, approved by Order of the Ministry of Finance of Russia dated January 10, 2000 N 2n, for reflection in accounting and financial statements are subject to conversion into rubles at the rate of the Central Bank of the Russian Federation for this foreign currency in relation to the ruble. For accounting purposes, this conversion into rubles is made at the rate of the Central Bank of the Russian Federation in effect on the date of the transaction in foreign currency. According to the List of dates for performing individual transactions in foreign currency, given in the Appendix to PBU 3/2000, the date of banking transactions on foreign currency accounts is the date of crediting funds to a foreign currency account or debiting them from a foreign currency account with a credit institution.

Thus, the receipt by the representative office of foreign currency funds from the head office in accordance with the Chart of Accounts can be reflected in the debit of the “Currency Accounts” account in correspondence with account 86 “Targeted Financing”.

When recognizing rental expenses, their amount is reflected in accounting at the exchange rate of the Central Bank of the Russian Federation effective on the date of the transaction in foreign currency. The date of recognition of expenses in our example is the last day of the month for which the invoice is received, i.e. when the conditions necessary to recognize expenses are met.

In accordance with PBU 3/2000, the recalculation of the value of foreign currency funds in accounts with credit institutions and funds in settlements is carried out on the date of preparation of the financial statements and on the date of the transaction in foreign currency.

Accounting and financial statements must also reflect exchange rate differences arising from operations for full or partial repayment of receivables or payables denominated in foreign currency, if the exchange rate of the Central Bank of the Russian Federation on the date of fulfillment of payment obligations differed from its exchange rate on the date acceptance of this receivable or payable for accounting in the reporting period or from the exchange rate as of the reporting date of the financial statements for the reporting period in which this receivable or was recalculated for the last time.

According to PBU 3/2000, the exchange rate difference is subject to credit to the financial results of the organization as non-operating income or non-operating expenses as it is accepted for accounting.

A business transaction for calculating rent can be reflected in the accounting of a representative office of a foreign organization that does not carry out entrepreneurial activities by debiting account 86 “Targeted financing” in correspondence with account 60 “Settlements with suppliers and contractors”.

According to clause 1 of Article 149 of the Tax Code of the Russian Federation, the sale on the territory of the Russian Federation of services for leasing office premises provided to foreign organizations accredited in the Russian Federation, if such a benefit is established by the national legislation of a foreign state and applies to citizens and legal entities of the Russian Federation, exempt from VAT.

| Contents of operations | Debit | Credit | Amount, rub. |

| The foreign currency account received funds from the head office for the maintenance of the representative office according to the bank statement on the foreign currency account (50,000 * 31.01) | 52 | 86 | 1 550 500 |

| Accounting entries for the last day of the reporting period | |||

| The exchange rate difference is reflected in account 86 “Targeted financing” (50,000 * (31.10 - 31.01)) | 91 | 86 | 4 500 |

| Rent accrued for the current month according to the rental invoice (35,000 * 31.10) | 86 | 60 | 1 088 500 |

| The exchange rate difference on the foreign currency account is reflected (50,000 * (31.10 – 31.01)) | 52 | 91 | 4 500 |

| Rent was paid for the past month (35,000 * 31.10) | 60 | 52 | 1 088 500 |

The organization of accounting in Russian representative offices of foreign companies is of a specific nature. The procedure and features of maintaining various areas of accounting will be discussed further in subsequent articles.

In this article we will try to help accountants deal with the following interesting and complex issues:

1) the concept of “permanent establishment” for the purpose of calculating income tax;

2) in what cases does foreign organizations become obligated to pay income tax on the territory of the Russian Federation;

3) what legislative acts must be used in matters of tax regulation of foreign organizations.

Publication

Foreign organizations receive income from business activities on the territory of the Russian Federation through permanent representative offices established by them, as well as from sources in the Russian Federation (without carrying out activities through permanent representative offices). In the first case, the foreign organization pays income tax in the same manner as the Russian one; in the second, the tax is withheld and paid by the tax agent. At the same time, certain types of income may not be subject to income tax at all.

With a permanent establishment, a foreign organization becomes obligated to pay income tax on the territory of the Russian Federation.

A permanent representative office of a foreign organization in the Russian Federation means a branch, representative office, department, bureau, office, agency, any other separate division or other place of business of a foreign organization through which the organization regularly carries out business activities on the territory of the Russian Federation related to:

use of subsoil and (or) use of other natural resources;

carrying out work stipulated by contracts for the construction, installation, installation, assembly, adjustment, maintenance and operation of equipment;

sale of goods from warehouses located on the territory of the Russian Federation and owned or leased by this organization;

carrying out other work, providing services, conducting other activities (except for preparatory and auxiliary activities).

The following criteria for the establishment of a permanent representative office on the territory of the Russian Federation have been identified:

carrying out activities through a branch, representative office or other place of business;

carrying out the activities of a foreign organization on a regular basis;

carrying out business activities, i.e. The activities of a foreign organization are aimed at systematically generating profit from the use of property, sale of goods, performance of work, and provision of services.

The activities of a foreign organization can be recognized as a permanent establishment only if all three criteria are present, and not on the basis of any one of them.

Carrying out activities through a branch, representative office or other place of business

Construction site. A construction site of a foreign organization on Russian territory is understood to mean:

the place of construction of new, as well as reconstruction, expansion, technical re-equipment and (or) repair of existing real estate objects (with the exception of aircraft and sea vessels, inland navigation vessels and space objects);

place of construction and (or) installation, repair, reconstruction, expansion and (or) technical re-equipment of structures, including floating and drilling rigs, as well as machinery and equipment, the normal functioning of which requires rigid attachment to the foundation or to the structural elements of buildings and structures or floating structures.

International agreements establish specific periods during which construction and installation activities will not lead to the formation of a permanent establishment. Exceeding the deadline will lead to the formation of such a representative office.

In the absence of international agreements, Russian legislation should be followed. If a foreign organization carries out or intends to carry out activities in the Russian Federation through a branch for a period exceeding 30 calendar days a year (continuously or cumulatively), then it is obliged to register with the tax authority at the place of carrying out its activities no later than 30 days from the date of its activities. started in accordance with clause 2.1.1 of the Regulations on the specifics of accounting for foreign organizations with tax authorities. If such period of activity of a foreign organization does not exceed 30 calendar days per year, then accounting is carried out in accordance with Section 4 of the said Regulations.

Dependent Agent. A foreign company can acquire the status of a permanent establishment by acting through a dependent agent.

To do this, the dependent agent must:

act on behalf of a foreign organization on the basis of an agreement;

have and use the authority to conclude on behalf of the organization or to agree on their essential terms (for example, prices, terms, volumes of supplies);

by their actions create legal consequences for a foreign organization.

In this case, the agent’s activities should not be his main activity.

The activity of an organization is the main (ordinary) activity if it is established in the constituent documents and (or) in the license, as well as in another permit from the competent government body. Income from such activities must constitute a predominant part of the gross profit (income) of such a broker, commission agent, or participant in the securities market.

Russian organizations that are dependent agents of a foreign organization must notify the tax authority of this fact.

It should be noted that the activities of foreign companies through a broker, commission agent, professional participant in the Russian securities market or another person acting as part of their main activity does not lead to the establishment of a permanent establishment.

Regularity of activities and moment of establishment of a permanent representative office

A permanent representative office of a foreign organization is considered established from the beginning of regular business activities through its branch.

The concept of regularity is not disclosed in the Tax Code of the Russian Federation. In particular, the activities of separate divisions of foreign organizations that have registered or are required to register with the tax authorities are regular. Such an obligation arises if a foreign organization carries out or intends to carry out activities in the Russian Federation through a branch for more than 30 calendar days a year (continuously or in aggregate).

In other cases, compliance with the “regular activity” criterion is determined based on an analysis of the actual activities of the foreign organization itself. At the same time, isolated facts of performing any transactions in Russia cannot be considered as “regular activity.”

Example

A French engineering company provides equipment repair and maintenance services for a Russian company on the territory of the Russian Federation. In fact, equipment repairs are carried out 5-10 times a year by specialists who come on a business trip for 2-3 days to Russia. Let's consider whether this activity of the French company leads to the formation of a permanent representative office on the territory of the Russian Federation.

The French company provides the Russian enterprise with repair and maintenance services for equipment several times a year, i.e., regular activities are carried out to provide services in Russia. Thus, the activities of a French company in Russia lead to the formation of a permanent representative office.

For special cases, the Tax Code of the Russian Federation directly establishes the moment of formation of a permanent representative office.

A) when using subsoil and (or) using other natural resources, a permanent representative office in accordance with clause 3 of Art. 306 of the Tax Code of the Russian Federation is considered formed from the earlier of the following dates:

the date of entry into force of the license (permit) certifying the organization’s right to carry out the relevant activity;

date of actual commencement of such activity;

b) the beginning of the existence of the construction site is considered to be the earlier of the following dates:

the date of signing the act on the transfer of the site to the contractor (the act on the admission of the subcontractor’s personnel to perform its part of the total work object);

date of actual start of work.

Example

A Russian organization entered into an agreement with a Turkish company (subcontractor) to carry out construction work for 12, 18 and 21 months. Will a foreign company have an obligation to pay income tax in Russia, and will a permanent establishment arise?

In accordance with the Agreement between the Government of the Russian Federation and the Government of the Republic of Turkey for the avoidance of double taxation with respect to taxes on income, a construction site, construction, installation or assembly project or supervisory activities related to them constitute a permanent establishment only if the duration of the related work exceeds 18 months (letter of the Ministry of Finance of Russia dated March 12, 2009 No. 03-08-05).

During the period established by the Agreement, when the existence of a construction site does not yet lead to the formation of a permanent establishment, the foreign organization does not calculate or pay income tax.

The calculation of tax liabilities for income tax is carried out for the first reporting period occurring after such an excess, based on the total volume of work performed since the beginning of the construction site's existence. If the construction sites are not interconnected, then a permanent representative office is formed only at the site where the contract is concluded for 21 months, as well as at the site whose activities are specified for 18 months, if construction work at this site exceeds the period specified in the Agreement, at least by one day.

The calculation of the first income tax payment should be made based on the total volume of work performed since the beginning of the construction site. That is, when determining the tax base, income and expenses associated with activities on a construction site include the amounts of income (expenses) received (produced) from the beginning of work on the construction site.

For all other cases of activity by a foreign organization, a permanent representative office is considered established from the beginning of its regular implementation.

Entrepreneurial activity

If a branch of a foreign organization carries out only representative functions and does not conduct business activities, then the foreign organization is not a payer of income tax.

Activities of foreign organizations that do not lead to the formation of a permanent representative office

The activities of a foreign organization of a preparatory and auxiliary nature do not lead to the formation of a permanent representative office:

use of facilities solely for the purpose of storing, displaying and/or delivering goods owned by that foreign organization prior to the commencement of such delivery;

holding inventories of goods owned by that foreign company solely for the purpose of storing, displaying and/or delivering goods prior to the commencement of such delivery;

maintaining a permanent place of business solely for the purpose of purchasing goods from that foreign company;

maintaining a permanent place of business solely for the collection, processing and (or) dissemination of information, accounting, marketing, advertising or market research for goods (works, services) sold by a foreign organization, if such activity is not the main (usual) activity of this organization;

maintaining a place of business solely for the purpose of simply signing contracts on behalf of that organization, if the signing of contracts occurs in accordance with the detailed written instructions of the foreign organization.

If a foreign organization carries out preparatory and (or) auxiliary activities on the territory of the Russian Federation in the interests of third parties, which corresponds to the definition of a permanent establishment, then such activities may be considered as leading to the formation of a permanent establishment.

In order for the activities of a foreign company of a preparatory or auxiliary nature not to lead to the establishment of a permanent establishment, it is necessary that such activities be carried out for the benefit of the foreign organization itself, and not for the benefit of other persons, and if such activities are carried out for the benefit of other persons, then they should not be carried out on a regular basis.

The activities of a foreign organization within the framework of a simple partnership agreement (another agreement on joint activities) on the territory of Russia do not lead to the creation of a permanent representative office, if the organization does not carry out other business activities in Russia.

Income in the form of distribution of profit under such agreements is taxed at the source of payment (letters of the Ministry of Finance of Russia dated 08/19/09 No. 03-08-05, 05.06.05 No. 03-08-02).

The fact of providing personnel of a foreign organization to work on the territory of Russia in another organization cannot be considered in itself as leading to the formation of a permanent representative office. To ensure that the provision of personnel does not lead to the formation of a permanent establishment, the following conditions must be met:

A) the personnel must remain on the staff of the foreign company;

B) the foreign organization does not assume responsibilities for providing services other than sending specialists of a certain qualification to Russia;

C) personnel act on behalf and in the interests of the organization to which they were sent;

D) a foreign organization is not responsible for the timeliness and quality of work performed by specialists;

D) documents confirming the provision of services are:

acts (or other documents) on the provision of personnel, but not acts on the provision of services,

issued invoices providing for compensation of expenses of foreign organizations (salary expenses, expenses for renting premises and travel expenses);

f) payment for the provided personnel is set at a predetermined fixed rate and depends only on the time actually worked by the personnel;

G) the amount of remuneration of a foreign organization that is transferred for the provided personnel should not exceed 10% of the amount of wages (including compensation payments) of the personnel themselves, otherwise the company’s activities will be considered for the formation of a permanent representative office in the Russian Federation.

The implementation by a foreign organization of operations for the import and export of goods, including within the framework of foreign trade contracts, cannot be considered as leading to a permanent establishment.

If employees are involved in marketing, agreeing on essential terms, signing contracts, ensuring their implementation (customs clearance, escorting or facilitating the delivery of goods to buyers and engaging in other activities related to these contracts), then such activities can be considered as leading to the formation of a permanent establishment of a foreign organizations.

The fact that a foreign organization owns securities, shares in the capital of Russian organizations, as well as other property on the territory of Russia also cannot be considered as leading to the formation of a permanent representative office.

The developing Russian market is quite attractive for foreign enterprises whose goal is development and expansion outside their country. Therefore, it is not unusual for management to decide to open a branch or representative office of a foreign company in Russia. At the same time, one of the effective tools that can improve the economic situation of any state is the policy of attracting foreign investment into its economy. But in order to carry out commercial activities in our country and invest their capital, foreign organizations need appropriate guarantees, including the scope of taxation. Legal status of separate divisions of a foreign organization

The Russian state continues to work to improve the system of legal regulation of taxation, trying to take into account the interests of the budget and the interests of foreign organizations operating in Russia.

The creation of a representative office or branch of a company in Russia presupposes the independent active conduct of business by a foreign company - this approach should not be confused with passive investment in Russian organizations.

Control of the functioning of separate divisions of foreign companies in Russia is carried out in accordance with the provisions of the Federal Law “On Foreign Investments in the Russian Federation” dated 07/09/1999 No. 160-FZ. More precisely, the law applies exclusively to branches of foreign organizations.

It talks about the opening of (commercial companies with) and branches in Russia, but nothing is said about the establishment of representative offices (because nothing is invested in the Russian economy). Accordingly, there is no definition of representation in the text of the law, and no legal regime has been established for it, even in the case of accreditation.

Both a representative office and a branch are a separate division of a legal entity that is located outside its location, only the duties of the first include representing the interests (and protecting them) of this legal entity, the task of the second is to carry out the functions of this legal entity (or only a certain part of them) ) and its representatives.

Neither form is in itself a legal entity and has no legal capacity: their legal status will be governed by the law of the state in which the head office was registered. Separate divisions manage the property of the legal entity that founded them and operate in accordance with the regulations approved by it.

In other words, despite being located on the territory of the Russian Federation, representative offices and branches of foreign companies will be subject to the laws of the country where the parent organization is located in relation to:

- creation process,

- rights and obligations,

- schemes of work and its completion,

- rules for the appointment of management and the scope of its powers, etc.

However, before the unit begins to function at all, it will need to obtain permission from the Russian authorities, that is, undergo accreditation. When representative offices or branches are accredited, they also need to be registered with the Federal Tax Service in order to control the tax contributions they make to the Russian budget.

The legal status of a branch of a foreign company in the Russian Federation regulates all the most important issues related to this division. It should reflect basic data on the features of the functioning of the branch in Russia, which do not contradict the laws of the Russian Federation:

- full name (of the foreign parent company and the branch itself);

- organizational and legal form of business;

- branch location address;

- legal address of the head office;

- the goals pursued by the branch management;

- activities;

- size, composition and timing of capital investment;

- management rules.

Information about both representative offices and branches of foreign organizations must be entered into the Consolidated State Register of representative offices and branches of foreign companies accredited in the Russian Federation. Proof of inclusion in the register is the presence of a company division with an appropriate certificate as a guarantee of confirmation of the official status of a foreign company at the federal level, since without it it will be impossible to open a bank account, carry out transportation through customs, etc.

The optimal form of doing business for a foreign company in Russia

The forms of doing business in Russia by foreign organizations can be different. A foreign management company must have a representative office or branch in Russia or do without it, for example, by hiring an individual resident of the Russian Federation, signing contracts directly with counterparties from Russia, etc.

There is also the option of opening a resident subsidiary and conducting business through it. A competent choice of the form of business organization will help to avoid losses associated with the payment of taxes, the amounts of which could be lower, or the payment of which could be completely avoided.

General characteristics of branches and representative offices of foreign organizations in the Russian Federation are:

- exist in the form of a separate division separate from the parent company and operate in accordance with its standards;

- the parent company is financially responsible for their actions;

- management is vested with powers by the foreign parent company to the extent specified in the power of attorney issued to them;

- use a share of the parent company’s property, accounted for separately from the company;

- do not have independent legal capacity, are not recognized as legal entities and perform actions on behalf of the parent company;

- are created and liquidated by decision of the head office;

- are not required to prepare financial statements.

Despite a large number of common points, a representative office and a branch are not the same thing. A branch of a foreign company has a broader list of functions compared to a representative office, since it has the authority not only to represent the interests of the company and protect them, but also to carry out the same business activities as the foreign founder.

We will conduct a comparative analysis of the taxation of various forms of activity of a foreign organization.

| Form of activity | VAT | Income tax | UST | Property tax |

|---|---|---|---|---|

| Subsidiary | Calculated on a general basis, you can choose the simplified taxation system. | 24% (you can choose simplified tax system – 6%, 15%). The object of taxation is income received through branches in Russia (you can take into account revenue and expenses that arose abroad, but are related to the work of the branch), minus the costs of these branches | Calculated on a general basis, you can choose the simplified taxation system | |

| Permanent establishment (branch, division, bureau, agency, office, etc.) | Calculated on a general basis, there are nuances regarding the taxation of services | 0.24 | Calculated on a general basis | |

| No permanent establishment | Incoming is withheld by the tax agent from VAT taxable income. Outgoing – 0% | There is no deduction from business proceeds. In other cases, it is withheld by the tax agent (up to 20%) | No (the company is not a taxpayer) | |

So, when choosing the optimal operating mode, a foreign company should pay attention to the following points:

- Resident subsidiaries pay all taxes at standard rates, but they are entitled to apply a special tax regime. They also have the opportunity to take advantage of international tax planning opportunities.

- Doing business without establishing a permanent representative office in Russia is suitable only for those companies whose work in the Russian Federation is occasional, since this form of activity has a limited scope, although it involves a small tax burden.

- The creation of a permanent representative office is not beneficial in terms of taxation due to the fact that it will have to pay all taxes approved by the tax legislation of the Russian Federation without the right to switch to a special regime for their payment.

If you choose between a branch and a representative office, you need to decide for what purpose a separate division is created - to conduct full-fledged activities and perform all the same functions as the parent organization abroad, or only to represent and protect the interests of the head office. In the second case, it will be enough to establish a representative office, but in the first case, one cannot do without opening a branch on the territory of the Russian Federation.

Features of opening a branch of a foreign company in Russia

A branch is sometimes called a permanent establishment; these are identical concepts, but the key word here is “permanent”. This is recognized as a representative office that regularly conducts business activities in the Russian Federation related to:

- to the sale of goods from our own warehouses located in Russia;

- to carry out work on construction, installation, installation, adjustment, assembly, operation, maintenance of equipment in accordance with concluded agreements (equipment can also be understood as slot machines);

- to the exploitation of subsoil and/or other natural resources;

- to perform any other work other than those listed in clause 4 of Art. 306 of the Tax Code of the Russian Federation.

Branches of foreign organizations that have been accredited in Russia are characterized by the following features of their activities:

- Branches have the right to engage in business activities.

- Branches as non-legal entities:

- are not liquidated due to bankruptcy;

- do not have an authorized capital;

- do not prepare financial statements;

- do not pay VAT on the rental of residential and office premises without furniture and equipment;

- do not consolidate tax returns.

- The branch is not a resident from the point of view of currency legislation.

Some areas of activity of foreign organizations are controlled by the Russian authorities in a special way. An example is the work of foreign insurers in Russia.

The operating conditions for branches of foreign insurance companies seem to be more stringent compared to other types of activities due to the desire of the Russian authorities to preserve and develop the national insurance market, and this requires strict regulation of the integration of foreign capital into this area.

The total quota for foreign capital participation in the authorized capital of insurance companies is 25%, and the share of foreign investors in the authorized capital of Russian insurers cannot exceed 49%.

In addition, foreign companies are prohibited from engaging in:

- life insurance;

- compulsory insurance (including state insurance);

- insurance of property related to government supplies and contract work for government purposes;

- insurance of property interests of municipal and state enterprises.

9 years after Russia’s accession to the WTO (August 22, 2012), foreign organizations will be able to create direct branches in Russia if the company’s assets as a whole are more than $5 billion as of the end of the year before filing an application to establish a branch.

Many people are also concerned about whether a branch of a foreign company can be a declarant. The Customs Code recognizes, among others, as declarants:

- foreign legal entities if they are official representative offices of foreign states or transport certain goods (in accordance with international agreements of the Russian Federation);

- foreign companies that have established a representative office on the territory of the Customs Union and import certain goods for the personal needs of the representative office.

Features of opening a representative office of a foreign company in Russia

A representative office is engaged in representing the interests of a legal entity and protecting them, but the answer to the question of whether a legal entity is a representative office of a foreign company will be negative.

Typically, the purpose of a representative office is:

- facilitating the work of the company’s head office in the Russian Federation;

- preparation of contracts with clients in Russia for the head office;

- advertising and promotion of goods, works, services of a foreign organization;

- marketing research;

- dissemination of information about the head office;

- searching for clients among Russians;

- development of business contacts;

- conflict resolution.

Representative offices of foreign organizations in Russia have limited goals: they cannot conduct foreign trade or economic activities and do not conclude transactions on their own.

The active development of representative offices in the Russian Federation is explained by a number of advantages inherent in this form of doing business by foreign companies in Russia:

- Availability of VAT benefits for rental premises (if the benefit is mentioned in an international agreement).

- Accounting is kept only to calculate tax liabilities, nothing more.

- Exemption from certain customs duties - during the period of accreditation in the Russian Federation, no fee is charged for the import of property required for the operation of the representative office.

- Simplified procedure for registering foreign labor - representative offices are not required to obtain permission to hire accredited foreign workers.

Work of a foreign organization in Russia without representation

Any representative of a foreign business, however, not only foreign, working in another country, strives to minimize his costs, so it is extremely important for him to know whether a foreign company can operate in Russia without a representative office. After all, even without establishing a representative office in Russia, foreign companies can derive income from activities on its territory, for example, by concluding contracts with domestic organizations directly. ![]()

The Russian authorities are very well aware of this, so they have taken measures to indirectly tax the activities of foreign companies. Although they do not pay taxes (for example, Unified Agricultural Tax and property tax) as registered taxpayers, the Russian company with which they cooperate does this for them. In this situation, she will be the tax agent of the foreign partner.

A list of income of foreign companies from which taxes are paid through the source of payments has been compiled:

- Funds after division of property.

- Dividends from participation in Russian joint stock companies.

- Interest on debts of third parties.

- Profit from the sale of shares.

- Funds from the use of intellectual property on the territory of the Russian Federation (foreign films in Russian cinemas, for example).

- Revenue from international transportation (if there is at least one acceptance and dispatch point in Russia).

- Remittances from the sale or rental of personal property (the property must be the property of the company and be located in Russia).

One of the ways to reduce costs in such a situation is to register an individual entrepreneur instead of representing a foreign company by a resident of Russia, who will perform representative functions.

This is often more profitable in terms of taxation and is definitely simpler in terms of documentation. An agency agreement or a contract agreement is concluded with an individual entrepreneur, after which, according to the terms of the agreement, he begins to represent the interests of a foreign organization, receiving remuneration for this.

Where to register a separate division of a foreign company in Russia

Let's look at how to register a representative office of a foreign company in Russia. The registration procedure must certainly precede the start of activities of a foreign company. To do this, you need to contact MIFTS RF No. 47 for the city of Moscow: since 2015, it has been authorized to carry out accreditation of branches and representative offices of foreign companies on the territory of the Russian Federation.

If a separate division of a foreign company intends to carry out activities in the field of civil aviation, it should apply for accreditation to the Federal Air Transport Agency.

Representative offices of foreign credit companies must be accredited by the Bank of Russia (the Federal Tax Service of Russia, however, is responsible for issuing a certificate of entry into the state register of accredited representative offices).

Both in the case of aviation and credit companies, personal accreditation is required for foreigners planning to work in a branch or representative office established on the territory of the Russian Federation. This issue is dealt with by the Chamber of Commerce and Industry of the Russian Federation.

If a foreign firm (company) is going to open a representative office in Moscow, then this procedure, unlike that in other regions of the country, does not require the preliminary execution of a document confirming the approval of the location of a separate division on the territory of a constituent entity of the Russian Federation with local authorities.

Main stages of creating a foreign representative office in the Russian Federation

The procedure for registering credit institutions with foreign investments in Russia seems to be quite long and complex and consists of the following stages:

- preparation of necessary documentation;

- applying to the body that has the authority to accredit companies with the chosen line of activity, submitting documents (the procedure includes certification of the number of foreign personnel by the Chamber of Commerce and Industry);

- waiting for the issuance of permission to establish a representative office and a certificate of inclusion in the Consolidated State Register of Accredited Representative Offices;

- printing production;

- contacting the tax authorities for registration (for example, to open a representative office in Moscow, you need to contact the Moscow Tax Inspectorate No. 47);

- obtaining a document on registration in the statistical register of Rosstat;

- registration with extra-budgetary funds;

- opening a bank account and notifying the tax service about it.

Accreditation of foreign companies in Russia

Registration of a representative office or branch of foreign legal entities on the territory of the Russian Federation is impossible without first undergoing accreditation.

Accreditation is recognition and confirmation of the legal status of a separate division of a foreign organization.

Today in Russia there is no single body that would deal with accreditation, and therefore this responsibility is delegated to various government agencies, depending on the field of activity of the foreign company.

Until 2015, accreditation of foreign representative offices and branches was carried out by:

- Chamber of Commerce and Industry of the Russian Federation.

- State Registration Chamber under the Ministry of Justice of the Russian Federation.

- Ministry of Justice of the Russian Federation.

- Ministry of Foreign Affairs of the Russian Federation.

- Bank of Russia.

- Federal Aviation Service of the Russian Federation.

Since 2015, the functions of the accrediting body have been transferred to the Federal Tax Service (MIFTS No. 47).

Registration of representative offices of foreign companies for tax registration

Any corporate entities, including representative offices, branches and organizations themselves, legally capable and established under the laws of foreign states, are recognized as legal entities for tax purposes. The creation of a permanent representative office is not considered a corporate form of division: it can be recognized for tax accounting purposes as a branch, representative office, commercial enterprise of legal entities or individuals working on behalf and in the interests of a foreign company.

A separate division of the company, which will operate on the territory of Russia, is required to register with the registering tax authorities within 30 days. This procedure was approved by the Ministry of Finance of the Russian Federation, but its violation does not provide for punishment, including a fine.

Without exception, all branches and representative offices of foreign companies are required to register with the tax service of the region of the Russian Federation in which its activities are actually carried out or vehicles and real estate are located.

If work is carried out in several areas at once, in each of them you need to be registered with the local Federal Tax Service inspectorate.

Changing the legal address of a representative office of a foreign company involves adjusting the registration data: Federal Tax Service employees must be notified of this in a timely manner. If we are talking about transferring a company to the territory of another constituent entity of the Russian Federation, it will have to be removed from tax registration and re-registered with the Federal Tax Service of the region that the company has chosen to carry out commercial activities.

Important: if the representative office/branch or the foreign company itself has changed or will change the information that is included in the Consolidated Register, the management of the separate division is obliged to notify the registration authority about this and make changes to the register no later than 15 calendar days from the date the relevant information ceases to be relevant.

It should be noted that the basis for registration with the Federal Tax Service of Russia is not only the opening of a branch of a foreign company in the Russian Federation, this can include the purchase of real estate or vehicles in Russia, including those imported into the country, opening accounts in Russian banks and making profit from sources In Russian federation. ![]()

During the registration process, the tax authority assigns a foreign company both an INN and a KPP, but sometimes the KIO (foreign organization code) is indicated instead of the INN. Both codes are indicated in the certificate issued upon completion of the registration procedure (in Form 2401IMD).

Registering a representative office of a foreign company with extra-budgetary funds

After a foreign company has opened its representative office in the Russian Federation and settled all relations with the tax service, it must register with extra-budgetary funds - the Pension Fund and the Social Insurance Fund, for which the law allows 30 days from the date of completion of registration.

The registration procedure takes 5 days, but if any of the required documents are not submitted, the process will drag on for a longer period due to the necessary information request in such a situation from the Federal Tax Service and the Rosstat branch.

Upon request, a representative office/branch is assigned, like all legal entities in Russia, statistics codes:

- OKPO,

- OKOGU,

- OKATO,

- OKVED,

- OXF,

- OKOPF.

There is no need to submit any documents to the Compulsory Health Insurance Fund (MHIF) yourself: information about the branch/division will be provided by the Pension Fund.

Making a seal for a branch/representative office of a foreign organization in the Russian Federation

The seal of a representative office of a foreign company cannot be made on the basis of the preferences and decisions of the founders or heads of separate divisions on the territory of the Russian Federation. A sketch of the seal of the branch or representative office being created must first be registered with the MIFTS of the Russian Federation, for which the following set of documents will need to be prepared:

- Application for production of a seal.

- Document approving the sketch (for example, an order from the head of a separate division).

- A notarized copy of the permission to establish a representative office.

- A notarized copy of the certificate confirming the entry of information about a division of a foreign company into the Consolidated Register of Accredited Institutions.

- Regulations on the branch or representative office (notarized copy).

- A copy of the head of the department.

- Power of attorney issued to the head of a separate division.

The production of the seal will begin only after it has been assigned a number in the City Register of Stamps (issued, as a rule, by the manufacturer - an organization accredited by the Moscow Registration Chamber). You will need to present two notarized copies:

- Permission to establish a separate division of a foreign company.

- Certificate of inclusion in the Consolidated State Register.

The entire procedure for assigning a number and making a seal takes no more than 3 days. The minimum cost of such a service is 100 rubles and depends on the equipment, method and urgency of printing.

Opening a current account in a Russian bank

To complete the procedure for registering a branch or representative office of a foreign company in Russia, it is necessary to open a current account in a Russian bank. Authorized banks open accounts on the basis of concluded bank account agreements on behalf of accredited representative offices. ![]()

Opening bank accounts for the purpose of carrying out fiscal operations by separate divisions of foreign organizations requires the submission of additional documents:

- regulations on branch/representative office;

- power of attorney issued to the head of a separate division.

In addition to the papers listed above, to open a bank account, a foreign legal entity will also need to collect a standard set of documents. The authority to open accounts (ruble and foreign currency) is with the head of a separate division of a foreign company.

To find out about the complete set of necessary documents for opening an account for a division of a foreign company in a Russian bank, read the information about.

Necessary documents for opening a representative office of a foreign company in Russia

A separate division of a foreign company can begin its activities only after submitting the required package of documents to the Federal Tax Service (MIFTS No. 47) - for accreditation, to the tax authorities - for tax registration and to extra-budgetary funds - also for registration.

Documents to be collected for opening a branch of a foreign legal entity:

- An extract from the register of legal entities of the state in whose territory the organization is registered, a certificate of incorporation (or another document that contains information about the registration number, date, place of registration, registration authority and is issued in a foreign state upon registration).

- The decision to establish a branch/representative office or a copy of the agreement on the basis of which work is carried out on the territory of Russia (signed by the head of the branch or other authorized representative).

- A power of attorney issued to the appointed head of a new branch/representative office, giving him the appropriate powers (usually we are talking about a general power of attorney, which abroad is unlimited, but by the Russian authorities it is recognized as valid for only 1 year).

- An ordinary power of attorney for a representative of a foreign company who submits and receives documents (if he is not the head of a branch).

Additional set of papers for presentation to the accrediting body:

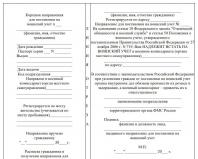

- Application in writing to MIFNS No. 47 for Moscow (Form 15AFP) signed by the head of the branch/representative office or a person authorized to certify documents.

- Constituent documents (charter) of a foreign organization.

- A certificate received from the authorized body of the state in which the head office of the foreign company is opened regarding the registration of the organization as a tax payer (must contain the taxpayer code or its equivalent).

- A copy of the identity card and certificate of registration with the tax authority (TIN, if available) of the head of the representative office or branch.

- Card of information about a representative office or branch of a foreign organization.

- Letters of recommendation from Russian business partners (minimum 2).

- A document proving that the location of a branch/representative office of a foreign company outside the borders of Moscow has been agreed upon with local executive authorities.

An additional set of documents to be presented to the registration authorities for registration with the tax authority:

- Application form for registration of a foreign organization with the tax authorities (2001I).

- Regulations on the branch or representative office.

- Charter of the foreign parent company.

- A certificate from the tax service of the state in which the head office of the foreign company is located, stating that the company in question pays taxes. Must contain the taxpayer code or an analogue that replaces it (no more than six months should pass from the moment of its issuance until presentation to the Federal Tax Service of Russia).

- Permission to establish a branch or representative office.

- Certificate of inclusion in the Consolidated Register of Accredited Representative Offices.

Russian tax authorities have no right to demand other documents.

An additional set of papers for submission to extra-budgetary funds:

- Application for registration with extra-budgetary funds.

- Regulations on the branch/representative office.

- A copy of the certificate of registration with the tax service in Russia (certified by a notary).

- Permission to establish a branch/representative office in the Russian Federation.

- Certificate of entry of information about the branch/representative office into the Consolidated Register of Accredited Representative Offices.

- Statistics codes assigned to a division of a foreign company.

- Documents confirming information about the legal address (usually a letter of guarantee).

- An order appointing an accountant or a certificate confirming the absence of an accountant in a department of a foreign organization.

Documents provided by foreign companies to Russian government agencies are valid for 12 months from the date of issue.

The documents must indicate the following information about the foreign company and its divisions established on the territory of the Russian Federation (if such information is not in the papers, they must provide it to the government services of the Russian Federation in the form of additional data):

- direction of activity of the organization and its divisions;

- location of the foreign company;

- contact details of the company itself and its divisions located in Russia (e-mail, Internet resource address, telephone);

- information about the head of the organization, the founder of the head office (as an individual or legal entity - registration number, day of registration, name and address of the registering authority, tax payer code), head of the representative office or branch (passport details, registration address, date and place of birth, TIN );

- full name of the servicing banking institution, current account number, SWIFT code;

- size of the authorized capital;

- the number of employees and the planned number of foreign employees of the branch/representative office in Russia;

- income for the previous year;

- Russian business partners.

Legalization and translation of documents of foreign companies

Each foreign document must have an apostille or a genuine mark of legalization at a consular office abroad.

All papers are submitted to Russian government agencies translated into Russian, and the translation must be made by an organization accredited for this purpose, and then certified by a notary or the consulate of the country of origin.

Powers of attorney and decisions must be notarized for the signatures and powers of the signatories contained therein.

Russia has entered into agreements with some states that abolish the legalization of documents. If the country of incorporation is a party to such an agreement, it does not need to legalize papers when doing business in the Russian Federation.

Cost and timing of the procedure for registering a foreign representative office in the Russian Federation

For the accreditation of each branch opened in Russia, the head office of a foreign organization will have to pay a state fee, the amount of which is 120 thousand rubles for any period of accreditation. There is no fee for accreditation of a representative office.

The processing time for documents will be:

- 18 working days at the State Registration Chamber;

- 5-10 working days at the Chamber of Commerce and Industry.

The additional payment to the State Registration Chamber for urgency (readiness of the certificate within 5 days) is 15 thousand rubles; the Chamber of Commerce and Industry does not carry out urgent procedures.

In addition, the services of the State Registration Chamber for issuing a certificate of accreditation of a branch or representative office of a foreign company are paid, the amount of payment varies depending on the period of accreditation:

| Cost of issuing an accreditation certificate (thousand rubles) | ||

|---|---|---|

| Fees for the State Registration Chamber | ||

| Duration of accreditation (years) | Branch | Representation |

| 1 | 20 | 35 |

| 2 | 35 | 65 |

| 3 | 50 | 80 |

| 5 | 75 | - |

| Chamber of Commerce and Industry fees | ||

| 1 | - | about 90 ($1500) |

| 2 | - | about 150 ($2500) |

| 3 | - | about 210 ($3500) |

The Russian tax authorities register a foreign company as a taxpayer within 5 working days.

The process of obtaining permits to hire foreign labor by a branch of a foreign company can take 3-12 weeks. The deadlines depend on the type of work permit.

Head of a foreign separate division, his rights and obligations

A foreign citizen may be appointed to the position of head of a branch or representative office of a foreign organization located in Russia only after. It is also necessary to obtain a special permit to attract foreign personnel to work in a branch of a foreign company (can be issued only after completion of the accreditation procedure).

Representing the interests of a foreign legal entity, protecting them, executing orders from the head office, ensuring the functioning of a separate division on the territory of Russia are the main tasks of the head of a branch/representative office of a foreign company.

The executive body (general director) of the head office must issue an order appointing an individual to the position of manager, with whom an employment contract is concluded and the terms of remuneration for the work are negotiated.

The salary of the head of a representative office of a foreign company will depend on the size of the foreign founding organization and the scope of responsibilities assigned to him.

The head of a separate division of a foreign company performs any actions on the basis of the power of attorney issued to him and the regulations on the branch/representative office on behalf of the founding organization.

The text of the regulations on the branch/representative office, approved by the management body of the foreign company, sets out the procedure for managing the branch/representative office, describing:

- control procedure in detail;

- the method, rules and timing of communicating orders from company managers to department heads;

- clear instructions about who the manager reports to and to whom he reports;

- procedure for checking the work of managers.

The power of attorney is issued personally to the head, and not to the department as a whole, and it states:

- date of registration;

- list of powers of the manager;

- his right to resolve issues that arise in the process of operational and ongoing work;

- his right to sign contracts, make transactions (the amounts of contracts may be limited, restrictions on the subject of the agreement may be declared, etc.);

- the right of the manager to open a current account in a banking institution (ruble or foreign currency), manage money;

- his right to issue powers of attorney and transfer his powers in case of unforeseen situations, the conditions for such actions.

The change of the head of the representative office is not a personal decision of the founders of the head office; the Russian structures that control the activities of the division must be notified about this event. Information about this must be documented; on its basis, appropriate changes will be made to the Consolidated Register of Accredited Units. ![]()

Accounting and reporting of foreign representative offices

After registration, a separate division of a foreign organization is required to maintain accounting records, namely, prepare internal reports for the head office. It is prepared in the language and in the manner prescribed by the laws of the state in which the parent company is established.

Closing a foreign representative office or branch in Russia

Liquidation of a representative office or branch of a foreign company is a procedure aimed at terminating the activities of a division and deregistering it from the tax service.

The closure of a representative office of a foreign organization in Russia must take place according to the rules provided for by the current legislation of the Russian Federation. ![]()

The grounds for terminating the work of a representative office may include:

- Expiration of accreditation, the renewal of which was not taken care of in time.

- Closing the head office in the state where it was registered.

- Systematic violations of Russian laws by divisions of a foreign organization and the subsequent decision of the accreditation body to liquidate them.

- Termination of an international agreement between Russia and the state where the company that opened a representative office in the Russian Federation on the basis of this agreement is registered.

- The decision to close a representative office made by the founders of the parent company.

Before starting the procedure for closing a separate division of a foreign organization, you must:

- Write an application for liquidation (Form 15PFP), which is certified by the signature of the head of the branch or an authorized person and which contains the following information:

- reasons for termination of business activities;

- registration number;

- day of accreditation;

- validity period of the permit.

- Fill out an application in form 11SN-Accounting.

- Make a notarized copy of the official minutes of the meeting’s decision to close the separate division.

- Prepare constituent documents and company charter.

- Take up the minutes of all meetings during which it was decided to open a branch/representative office and appoint a manager.

- Issue a certificate confirming the closure of a current account at a banking institution.

- Issue a power of attorney for the head of the branch/representative office.

- Execute a power of attorney for the foreign firm's attorneys, who will be entrusted with carrying out the liquidation procedure on behalf of the head office.

- Raise the previously received certificate of registration of the unit in Russia indicating:

- changes made;

- Taxpayer numbers.

To deregister with the Pension Fund you will additionally need:

- application in the form of the Pension Fund of Russia;

- all reports to the Pension Fund on the closing day (2 copies of originals and copies in electronic format);

- an extract or information sheet from the tax office;

- notification of deregistration with the Federal Tax Service.

To deregister with the Social Insurance Fund, you will additionally need:

- application in the form approved by order No. 576 n dated October 25, 2013;

- liquidation report (Form 4 FSS);

- notification of the amount of insurance premiums;

- insurance certificate (or notice);

- a letter of refusal of the remaining funds in the account in favor of the Russian treasury (if the money is not withdrawn to the company’s account).

To deregister with Rosstat you must provide:

- notification with OKTEI codes;

- a letter requesting that the unit be deregistered.

Step-by-step instructions for liquidating a branch of a foreign company located in Russia:

- Organizing a meeting of the founders of the parent company and making a decision on liquidation.

- Preparation of all required documents, including income declaration and calculation of the full tax amount.

- Notification of interested parties, including employees.

- Conducting personnel events.

- Sending a notification to MIFTS No. 47 about deregistration and termination of the division’s operation (within no more than 15 days from the date of the decision on liquidation).

- Notification of the regional branch of the Pension Fund about the closure of a branch/division (within 15 days from the date of the decision).

- Notification of the local unit of the Social Insurance Fund about closure (within the same time frame as MIFTS, Pension Fund).

- Passing the reconciliation process at MIFTS:

- in the input department (with presentation of an income statement);

- in the department of desk audits (with presentation of an extract on transactions on the current account);

- in the department for working with taxpayers and the debt settlement department (with presentation of a register of information on the income of the department’s employees and reconciliation of tax payments);

- Submitting an application to the MIFTS to complete the closure procedure.

- Deregistration with the Pension Fund of Russia.

- Deregistration from the Social Insurance Fund.

- Receiving notification of deregistration from Rosstat.

- Closing a bank current account.

It takes 14 days to review documents and applications for closing a separate division from the date of submitting a set of papers to the tax authorities; the total liquidation period is approximately 30 days.

If inspections are necessary, the process is delayed until their final completion and lasts about 3 months.

The Pension Fund announces its decision within 10 days, the Social Insurance Fund only needs a week.

In general, the entire process of closing a branch or representative office, starting with the preparation of documents and ending with the issuance of a decision by tax authorities and extra-budgetary funds, takes about six months.

How a foreign company can open a representative office or create a branch in Russia: Video

Publication

To carry out activities in another country, a company needs to be constantly “present” in the territory where its counterparties and potential clients are located, where the most favorable conditions have been formed for the sale of the company’s products. The need for such a presence necessitates the creation of business divisions of legal entities on the territory of other states. The opening of such units and their activities are regulated by the internal law of the state where they are located, and they are also subject to the law

the state where the legal entity is created and registered.

To carry out business activities in the Russian Federation, a foreign organization requires registration in the form of a branch, representative office or department (Fig. 1). In this case, preference is given to the branch, since a branch, unlike a representative office, can engage in commercial activities and make a profit. As a rule, a representative office is created when a foreign company enters the Russian market for the first time or conducts marketing research, as well as in order to provide access to the parent organization located abroad for Russian clients.

Both the branch and the representative office are subject to accreditation and are registered with the State Registration Chamber. The department is not accredited, but it is also a taxpayer. A branch of a foreign organization has the right to carry out business activities on the territory of the Russian Federation from the moment it receives accreditation. Foreign organizations are subject to registration with the tax authorities of the Russian Federation in accordance with current legislation 1.