How do you get paid for working on holidays? How is work on weekends and holidays paid according to the Labor Code of the Russian Federation? How is work paid on a non-working holiday when working hours are calculated together?

Each worker is guaranteed the right to employment only within the limits of the work regime established at the enterprise, but there are also emergency situations, for example, accidents, submission of reports or completion of an urgent project.

It is for such situations that the law, as an exception, allows employees to be involved in performing duties on weekends, but only with a guarantee of compensation for the time worked.

Legislative regulation of the issue

In accordance with Article 56 of the Labor Code of the Russian Federation, labor relations arise between the company and the employee only after the conclusion of an employment contract or the employee’s permission to perform duties with the subsequent formalization of the relationship.

In turn, in the agreement on mutual cooperation in pursuance of Article 57 of the Labor Code of the Russian Federation working conditions are stipulated, which include not only the responsibilities and location of the place of work, but also the employment regime.

So, in particular, in accordance with Article 102 of the Labor Code of the Russian Federation, an employee can be employed in a flexible time mode or, on the basis of Article 103 of the Labor Code of the Russian Federation, have a shift nature of work or work only five days a week, but at the same time in accordance with Article 91 of the Labor Code of the Russian Federation the length of his working week should not exceed 40 hours, which implies periods for rest, that is, the same weekends and holidays.

So, in particular, in accordance with Article 102 of the Labor Code of the Russian Federation, an employee can be employed in a flexible time mode or, on the basis of Article 103 of the Labor Code of the Russian Federation, have a shift nature of work or work only five days a week, but at the same time in accordance with Article 91 of the Labor Code of the Russian Federation the length of his working week should not exceed 40 hours, which implies periods for rest, that is, the same weekends and holidays.

But the production process does not always imply stability, given that equipment can break down and create an emergency situation in the institution, or a worker can get sick, and the conveyor cannot be stopped. It is for situations like these that the law allows workers to be involved in their immediate duties on weekends.

Thus, Article 113 of the Labor Code of the Russian Federation states that in the event of unforeseen work, workers Possible to work on weekends in order to prevent damage to the enterprise or eliminate the consequences of an accident, under the conditions approved by law. In particular, obliging workers to begin work on a day off is possible only with their consent, for example, in the absence of the main employee, and in the event of an accident, without consent, but with mandatory compensation established by law.

That is, in accordance with Article 153 of the Labor Code of the Russian Federation, employment on a day off must be rewarded with double payment or single payment, but with the provision of another day of rest in accordance with the employee’s choice. Also, Article 153 of the Labor Code of the Russian Federation states that a collective agreement or other local acts may provide for a different amount of compensation for additional labor with the only condition specified in Article 8 of the Labor Code of the Russian Federation.

In particular, the company’s management is given the right, due to the financial capabilities of the enterprise, to remunerate workers in an amount not lower than that established by law, which implies compensation for work on weekends and more than double the amount, or the right of the employee to choose an additional day for rest at his own discretion.

Procedure for calculating wages

The production process in each institution has its own characteristics, which leads to payment in several ways.

In particular, labor can be paid:

Salary system in accordance with Article 129 of the Labor Code of the Russian Federation, it involves the payment of a fixed amount for the norm of hours worked monthly, regardless of the number of days off and the presence of holidays. At the core hourly rate The opposite principle applies, that is, only all hours worked are subject to payment at a predetermined rate.

That is, in the case of setting a salary, the employee will receive the same amount every month, while at an hourly rate the salary will be different, given that in each month the number of working days is not the same. And when piece rates wages will depend on the quantity of products produced over a certain period, which again implies a non-fixed monthly amount.

During normal operation

Most government agencies, as well as banks and companies, as a rule, work on a five-day schedule, which implies a 40-hour workload during weekdays and wages on a salary system. That is, no matter how many working days there are in a month, 20 or 22, the employee will receive his salary in any case, minus, of course.

That is why when calculating payment There are no special difficulties for working on a weekend at double the rate, which is confirmed by Letter of the Ministry of Labor No. 14-2/B-943. After all, first you need to calculate the wage per hour, and multiply the resulting amount by the number of hours worked on a day off in double the amount.

For example, a storekeeper’s salary was 15,000 rubles and he worked 20 days, 8 hours each.

For example, a storekeeper’s salary was 15,000 rubles and he worked 20 days, 8 hours each.

15 000 / 20 / 8 = 93,75 rubles is the wage per hour.

The employee worked 8 hours on a day off.

8 * 93.75 = 750 rubles

Considering that, in accordance with Article 153 of the Labor Code of the Russian Federation, work on a day off is subject to double payment: 750 * 2 = 1500 rubles.

Thus, the employee must receive wages in the amount of:

15,000 + 1500 = 16,500 rubles.

Also, Article 153 of the Labor Code of the Russian Federation states that a worker has the right to refuse double payment in favor of providing another day of rest. In such a situation, payment for employment on a day off is made in the standard amount and the employee receives a day off at another convenient time.

In particular, the calculation of monthly wages in such a situation will look like this:

- 15000 / 20 / 8 = 93.75 rubles.

- 8 *93.75 = 750 rubles.

- 15,000 + 750 = 15,750 rubles.

Shift work mode

In accordance with Article 91 of the Labor Code of the Russian Federation normal working hours It is considered 40 hours per week, which is relevant for a regime such as a five-day or six-day week with fixed days off.

In accordance with Article 91 of the Labor Code of the Russian Federation normal working hours It is considered 40 hours per week, which is relevant for a regime such as a five-day or six-day week with fixed days off.

But in enterprises with a shift work schedule, it is impossible to maintain a 40-hour work week due to the nature of production, given that the schedule consists of a series of shifts and rotating days off, which during one week can amount to more than 40 working hours, and during another less specified norms.

In such a situation, in accordance with Article 104 of the Labor Code of the Russian Federation, for institutions with a specified schedule, the law provides possibility of summarized accounting, which involves adding up the hours worked for a certain period, for example, a quarter, in order to comply with the legal norm of hours already in a monthly equivalent, that is, say, 160.

This form of recording time worked is naturally reflected in the procedure for calculating wages, which directly depends on the time worked and determines different amounts in each month. Naturally, with this procedure for calculating wages, calculating double pay for work on weekends also causes some difficulties.

In particular, State Committee Resolution No. 465/P-21 states that work on holidays should be included in the monthly rate and paid accordingly. For example, a packer has a salary of 12,000 rubles and works according to a railway schedule, that is, day, night, 48 days off, while the shift duration is 12 hours.

The standard monthly hours are 192 hours based on 16 12-hour shifts; the employee worked 17 shifts because he was called to work due to the illness of his colleague for one shift.

Then the calculation will be made in the following order:

- 12,000 / 192 = 62.5 rubles.

- 12 * 2 = 24 hours.

- 62.5 * 24 = 1500 rubles.

- 12,000 + 1500 = 13,500 rubles.

If, when recording time together, wages are calculated not in the salary system, but in the hourly wage rate, the calculation of pay on weekends will look quite simple. The hourly wage, for example, 62.5 rubles, will need to be multiplied by the number of hours worked on a day off and by two.

62.5 * 12 * 2 = 1500 rubles.

Procedure for registering to go to work on a day off

When hiring a worker, even at the stage of formalizing legal relations, the salary or hourly rate is established in the employment contract or in local acts, in accordance with which payment is automatically made. But it is initially assumed that the employee will work off the work quota monthly, and not work beyond it.

When hiring a worker, even at the stage of formalizing legal relations, the salary or hourly rate is established in the employment contract or in local acts, in accordance with which payment is automatically made. But it is initially assumed that the employee will work off the work quota monthly, and not work beyond it.

That is why any involvement in work beyond the norm must additionally reflected in administrative documentation.

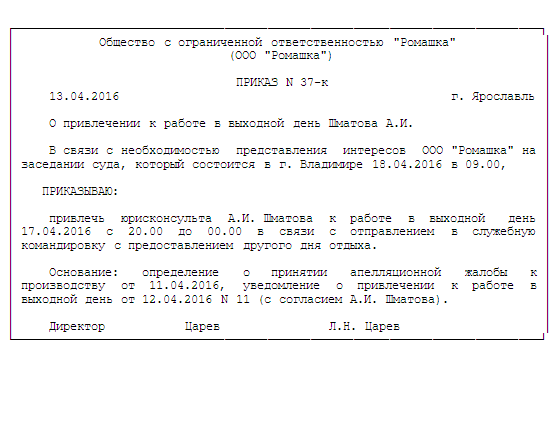

In particular, in anticipation of an additional call to work, the head of the department submits report or memo addressed to the director about the need to carry out certain work on a day off and with a request to involve an employee in their execution. Based on the report and after imposing a resolution an order is issued to recruit indicating the reason for the call, the date and time during which additional work is planned.

The order also stipulates conditions for compensation for additional labor and the signature of the hired worker is affixed, who thus becomes familiar with the order and expresses his consent to being hired to work on a legal day off. In addition to the order, an additional exit is also reflected in the output sheet, where in the column corresponding to the day off it is not “B”, but the number of hours worked, for example, 8 or 12. That is, payment for the time worked on a day off is made to the employee on the basis of an order and a time sheet.

Features of payment on a business trip

The procedure for granting business trips, as well as their progress and payment, is regulated by Government Decree No. 749, which in particular states that, on instructions from the employer, an employee can be sent to another enterprise in the course of production activities.

The procedure for granting business trips, as well as their progress and payment, is regulated by Government Decree No. 749, which in particular states that, on instructions from the employer, an employee can be sent to another enterprise in the course of production activities.

At the same time, the employee will be busy while on a business trip in accordance with the working hours, which is installed in the host company. If, due to production needs, an employee is forced to go to work on a day off according to the work schedule of another enterprise, his employment will be paid double in accordance with Article 153 of the Labor Code of the Russian Federation.

The stipulated norm also states that duration of business trip is calculated not from the moment of arrival at the posted organization, but from the moment of departure from the worker’s hometown, which assumes the likelihood of being on the road just during legal holidays. In such a situation, in accordance with paragraph 5 of Resolution No. 749, travel days will also be paid in double amount or compensated through single payment with the provision of another day of rest.

The procedure for paying for work on weekends and holidays is described in the following video tutorial:

The Constitution of the Russian Federation states the human right to work and rest. More specifically, the rules for their practical implementation are deciphered in the paragraphs of the Labor Code (LC). The law regulates the relationship between the employer and employees in certain situations. Thus, work on weekends according to the Labor Code is possible only with the consent of the parties to the contract.

How to apply for work on a holiday or official day off

Rest for workers is provided within the framework of paragraph 113 of the Labor Code. The text of the regulatory act contains a prohibition on involving the bulk of employees in the performance of official duties on such days:

- free from work (Saturday and Sunday);

- holidays (given in paragraph 112).

However, in the process of work, issues often arise that cannot be resolved without the involvement of hired workers. They are also provided for in paragraphs of the Labor Code. The rules for involving employees in production activities on weekends are quite strict.

They are:

- It is possible to load a worker on his legal day of rest only with his consent:

- provided in writing;

- drawn up and signed personally;

- recruitment must be formalized by an administrative document:

- on the eve of the specified days off from work;

- indicating the method of compensation:

- additional payment;

- time off;

- The employee must be familiarized with the order in advance.

Important: it is prohibited to declare entry to workers for the following categories of citizens:

- pregnant women;

- minors (except for some professions).

Financial compensation

The law establishes a general rule for compensating employees for extracurricular work. They should be paid double for their work. A more specific calculation method depends on the rate used at the enterprise:

- salary;

- hourly;

- piecework.

Fundamentally, the methodology for determining a specific amount when using different rates has only one common point - the use of a double tariff:

- in the salary system, the average hourly earnings are calculated and multiplied by two;

- if hourly, the tariff rate doubles, and the final amount is proportional to the hours worked;

- with piecework pricing, the rate for one item (product) also increases.

Attention: the final amount is formed in different ways:

- in the salary system it does not depend on labor productivity and working time;

- and when using the other two methods, it is closely related to the listed factors.

Do you need information on this issue? and our lawyers will contact you shortly.

Providing time off

An alternative option for compensating for off-hour participation in the production process is to provide time off. This is written down in the third part of paragraph 153 of the Labor Code. Moreover, the text of the article contains the following rules:

- work outside of school hours is paid as a regular day;

- for work outside of normal hours, rest is provided equal to the time of employment (one to one);

- time off is not financed by the employer (no earnings are accrued).

Rostrud issued a letter explaining the time off for workers. In particular, the document points out that the time of actual employment during the holiday period is unimportant. That is, an employee can perform his duties not for eight hours, but only for three. He still gets a day off.

Attention: the choice of the day of rest is up to the worker. He is obliged to perform the following actions:

- notify management that you will not come to work in advance in writing;

- familiarize yourself with the relevant order on granting time off.

Which compensation option to choose?

In practice, experienced administrators try to organize work so as not to have problems with inspection bodies. At privately owned enterprises, double payment is issued. But in the public sector this is rarely practiced. Employees working on holidays are given days off or an additional day for their next vacation.

In practice, experienced administrators try to organize work so as not to have problems with inspection bodies. At privately owned enterprises, double payment is issued. But in the public sector this is rarely practiced. Employees working on holidays are given days off or an additional day for their next vacation.

Attention: the conditions for compensation for extracurricular participation in work activities are prescribed in a local act - a collective agreement. If such a clause is introduced, it is advisable not to deviate from its text.

The law recognizes both forms of compensation as equivalent (there are exceptions). Therefore, the employee is given the right to choose any one at his own discretion.

We arrange work on weekends and holidays

Documentary evidence of the employee’s consent should not raise doubts among regulatory authorities. Registration of work on a holiday begins with receiving a person’s application.

Documentary evidence of the employee’s consent should not raise doubts among regulatory authorities. Registration of work on a holiday begins with receiving a person’s application.

Consent must go through all the stages of a regular personnel application:

- receive a resolution from the boss: “To the order”;

- go to the personnel department to prepare a draft administrative document;

- return to the manager for signature;

- register in the appropriate journal;

- copies of the document are sent to:

- to accounting;

- into the employee's personal file.

In addition to the usual, the administrative document contains the following data:

- the reason for attracting the employee to work after hours;

- list of specialists in the format:

- job title;

- date of entry into service;

- compensation conditions:

- double pay;

- or providing time off at a convenient time;

- base:

- consent of the worker;

- collective agreement (if there is a corresponding clause);

- permission of the trade union organization;

- warning about the possibility of refusal (for some categories).

Procedure for calculating wages

The accountant is obliged to strictly adhere to the instructions of the manager. This means that he calculates the payment based on the order:

- If compensation is paid on time off, then the calculation method for a regular working day is used.

- If double payment is indicated, then it is necessary to proceed from the tariff method used for this employee.

Standard operating mode

If employee earnings are calculated based on a rate, then the following actions must be performed:

If employee earnings are calculated based on a rate, then the following actions must be performed:

- determine the average hourly wage based on the data of the current month;

- calculate the weekend salary using:

- double the rate;

- a set number of hours of participation in the production process.

Example

The storekeeper is involved in servicing factory workers on their days off. To calculate the payment amount, the following data should be taken into account:

- salary 18,000.0 rub.;

- number of working days in a month - 20.

The calculation is:

- We determine the average earnings per hour:

- RUB 18,000.0 / 20 days / 8 hours = 112.5 rub.

- Credits for Saturday service:

- 112.5 rub. x 2×8 hours = 1,800.0 rub.

Shift work schedule

Calculation difficulties for shift workers lie in the fact that they work an unequal number of hours on normal days. This fact should be taken into account when determining the amount of compensation.

Calculation difficulties for shift workers lie in the fact that they work an unequal number of hours on normal days. This fact should be taken into account when determining the amount of compensation.

The accountant should perform the following operations:

- determine the number of hours of employment per month of work outside of school hours;

- calculate the average hourly rate;

- apply it for the period of after-hours employment, doubling it.

Example

A packer working 12-hour shifts (every two days) had to be brought in to replace a sick colleague. When determining compensation, the following data was used:

- salary - 15,000.0 rub.;

- the number of hours of work in the current month is 192.

Calculation order:

- hourly payment:

- RUB 15,000.0 / 192 hours = 78,125 rubles;

- double rate:

- RUR 78,125 x 2 = 156.25 rub.;

- Earned for extracurricular shifts:

- 156.25 rub. x 12 hours = 1,875.0 rub.;

- monthly earnings:

- 15000.0 rub. + 1,875.0 rub. = 16,875.0 rub.

The nuances of payment on a business trip

When arranging a worker’s business trip, the following features should be taken into account as set out in government decree No. 749:

When arranging a worker’s business trip, the following features should be taken into account as set out in government decree No. 749:

- The administrative document must indicate that the employee is subject to the work regime of the receiving party.

- Travel allowances are calculated from the date of departure. If the travel time falls on the weekend, then a double rate is applied or time off is provided.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers of our site.

Who should not be hired to work on holidays/weekends?

The Labor Code contains a list of persons who are prohibited from being involved in performing duties outside of school hours. These include:

The Labor Code contains a list of persons who are prohibited from being involved in performing duties outside of school hours. These include:

- pregnant women;

- minors.

Such a prohibition means that these employees cannot be involved even if their consent is obtained. Consequently, they will have to be replaced by colleagues.

In addition, the legislation provides a list of persons for whom a slightly different procedure is applied. These include:

All of the above-mentioned persons must be warned about the possibility of refusing to work on days off (paragraphs 153 and 259 of the Labor Code). This is done in writing:

- It is necessary to prepare a notification form indicating:

- Full name and position of the employee;

- the opportunity to refuse to go to work outside of school hours with reference to articles of legislation;

- familiarize the employee with the document and sign it.

The legislation specifies situations in the event of which employees cannot refuse employment during off-hour periods (3rd part of paragraph 113 of the Labor Code). They are:

- the need to take action to prevent a disaster;

- liquidation of consequences of accidents, accidents;

Working on a weekend or holiday is prohibited by law. But sometimes managers have to call employees to urgently complete work during this period.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

How is payroll calculated in this case? What should a HR specialist know? You will find out the answers to these questions in the publication.

Regulatory documents:

- Labor Code of the Russian Federation, articles: 99, 153, 112, 153, 164;

- Order of the Ministry of Health and Social Development of Russia N 588n;

- Letter of the Ministry of Finance of Russia dated N 03-04-06-01/174.

Documents can be downloaded on our website:

What does Russian legislation say?

The Labor Code states that overtime work is activity carried out by order of the manager outside the standard time.

Involvement is possible only upon receipt of the employee’s written consent and compliance with two conditions:

- duration does not exceed 4 hours/day and 120 hours/year (for each employee);

- payment is made at an increased rate, rates and nuances are specified in local documentation.

By law, all employees are entitled to rest at the following intervals:

- 2 days/week – with a five-day working week;

- 1 day/week – with a six-day work schedule.

Sunday is considered a general day off, and the second day is determined by the organization. Usually they follow one after another.

This point must be specified in local documents.

The Labor Code classifies non-working days and holidays as:

- New Year holidays and Christmas, falling during the period from January 1-8;

- Defender of the Fatherland Day;

- International Women's Day;

- Spring and Labor Day - May 1;

- Victory Day – May 9;

- Russia Day – June 12;

- National Unity Day – November 4th.

Sometimes it happens that a holiday falls on a weekend. Then the rest is transferred to weekdays.

If employees did not fulfill their duties during this period, they are paid financial compensation.

In practice, there are various situations that force managers to call their subordinates after hours.

The reason may be:

- The need to complete work that was interrupted due to technical problems.

- Malfunction or breakdown of equipment that negatively affects the activities of a large number of employees.

- In shift work, if the performance of the employee’s duties does not allow for a break.

Consent to perform overtime work is not required if:

- it is necessary to immediately eliminate the consequences of emergency incidents or prevent the likelihood of their occurrence;

- it is necessary to carry out restoration work to ensure gas, water, body supply, communications or lighting systems;

- Another situation arose that threatened the life and normal living conditions of the population.

How is an employee's return to work processed?

To avoid conflicts, including the calculation of payments, all documents should be completed correctly.

The personnel officer must prepare:

- Notice of involvement in overtime work, which specifies all the tasks and requirements. For certain categories of citizens, it is necessary to remind about the right to refuse recycling.

- An order to involve an employee in fulfilling obligations during non-working hours. The form of the document can be free, but you will need to indicate the reasons for the decision, overtime hours, form of compensation, amount of additional payment and other information.

- Record the fact of overtime work in the time sheet. If it is necessary to note attendance/absenteeism for work, overtime is reflected in a separate column. In the corresponding cells the code “I” is entered with the duration of work according to the standards (8 hours), and the duration is indicated in the “Overtime” column.

Examples of documents:

How is work on weekdays “weekends” paid?

The table shows the specifics of wages on weekends and non-working days for different categories of employees. This information is regulated by the Labor Code.

At the request of the employee, monetary remuneration can be replaced with an additional day of rest.

It is not paid and is not taken into account when determining the duration.

In such a situation, “Weekend” weekdays are reimbursed in a single amount.

Procedure for calculation and accrual

The amount of remuneration depends on the category of employee.

Let's look at how income is calculated for those who work on a salary basis:

Salary out = (Salary/Chr) x Ch (neg.) x 2

- ZPout. – additional funds;

- Chr. – number of working hours in the billing period;

- Chotr. – additional time worked (in hours).

For hourly workers, the calculation procedure is simpler:

Salary out = TARIFF x Chotr. x 2

The cost of one day of work is determined as follows:

Salary out=(Salary/Dr.p.)*Dotr*2

- Dr.p. – number of days in the billing period;

- Dr. – days worked on a weekend or holiday.

Example:

Due to the occurrence of an unforeseen incident at the Sokol company, engineer N.V. Streltsov was involved in performing his duties on a day off - June 26, 2019. The work was carried out in excess of the norm established for the month. Duration was 7 hours, salary 42,000 rubles.

The cash reward for Sunday will be:

An employee’s increased salary is taken into account when determining the tax base required for deduction of income tax.

According to the financial department, such a salary is not compensation from the employer, therefore it is subject to and also subject to insurance contributions.

What nuances need to be taken into account when paying for labor?

Federal executive authorities have established the length of time that is the norm. The limit is 40 hours per week.

If the indicator is exceeded, the employer pays overtime.

Example:

The company Coral LLC keeps summarized records of working hours. In Electronic engineer G.V. Kutepov worked 170 hours in June. According to the production calendar, the norm is 168 hours. This means that the employee overworked 2 hours, for which the employer is obliged to pay overtime.

Pay for night shifts (from 22:00 to 06:00) is always increased, especially on non-working days or holidays. Cash reward is provided in double amount.

Additional payments included in the collective agreement are also made. When an employee goes on a business trip, the requirements are similar.

Workers' Compensation

Working on holidays or weekends is associated with a reduction in rest time and increased effort.

Article 153 of the Labor Code of the Russian Federation with comments and amendments for 2016-2017.

Commentary on Article 153 of the Labor Code of the Russian Federation:

1. Article 153 of the Labor Code of the Russian Federation provides that specific amounts of remuneration for work on weekends and non-working holidays are established in a collective agreement, a local regulatory act, or an employment contract. This provision emphasizes that the dimensions established by the commented article are minimal. They can be increased by agreement of the parties to the social partnership or the parties to the employment contract. This can also be done in a local regulatory act, which in this case should be adopted taking into account the opinion of the representative body of workers.

2. Work on a day off or a non-working holiday (see commentary to Article 113) must be compensated. At the employee’s choice, this can be either increased pay in the amount provided for by the collective agreement, local regulations, employment contract (and if this issue is not resolved in them, in the amount specified in the article), or the provision of an additional day of rest.

3. As a general rule, a day of rest is not subject to payment, however, a collective agreement, a local regulatory act, or an employment contract may establish more favorable rules for employees.

The time of use of the rest day is determined by agreement of the parties.

4. It is generally accepted that special rules for payment for work on weekends and non-working holidays are established for creative workers and professional athletes, but this is not entirely true. Part one of Article 153 of the Labor Code of the Russian Federation establishes the minimum amount of payment, which under no circumstances can be reduced. Part two for all employees establishes the same procedure for determining specific amounts of remuneration for work on a non-working day as for creative workers - in a collective agreement, local regulation, or employment contract. The only difference is that for all workers, except creative ones, the local normative act is adopted taking into account the representative body of workers, if it is created (Article 8 of the Labor Code), and for creative workers - solely by the employer.

The list of professions for creative workers has not yet been approved.

Work breaks. Weekends and non-working holidays

Article 113. Prohibition of work on weekends and non-working holidays. Exceptional cases of attracting employees to work on weekends and non-working holidays

See Encyclopedias and other comments to Article 113 of the Labor Code of the Russian Federation

Work on weekends and non-working holidays is prohibited, except as provided for by this Code.

Involvement of employees to work on weekends and non-working holidays is carried out with their written consent if it is necessary to perform unforeseen work, on the urgent implementation of which the normal work of the organization as a whole or its individual structural divisions or an individual entrepreneur depends in the future.

Involving employees to work on weekends and non-working holidays without their consent is permitted in the following cases:

Read also: Is it possible to fire an employee who is on parental leave?

1) to prevent a catastrophe, industrial accident or eliminate the consequences of a catastrophe, industrial accident or natural disaster;

2) to prevent accidents, destruction or damage to the employer’s property, state or municipal property;

3) to perform work the need for which is due to the introduction of a state of emergency or martial law, as well as urgent work in emergency circumstances, that is, in the event of a disaster or threat of disaster (fires, floods, famine, earthquakes, epidemics or epizootics) and in other cases, threatening the life or normal living conditions of the entire population or part of it.

Involvement in work on weekends and non-working holidays of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in in accordance with the lists of jobs, professions, positions of these workers, approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, is permitted in the manner established by the collective agreement, local regulations, or employment contract.

In other cases, involvement in work on weekends and non-working holidays is permitted with the written consent of the employee and taking into account the opinion of the elected body of the primary trade union organization.

On non-working holidays, it is allowed to carry out work, the suspension of which is impossible due to production and technical conditions (continuously operating organizations), work caused by the need to serve the population, as well as urgent repair and loading and unloading work.

Involvement of disabled people and women with children under three years of age to work on weekends and non-working holidays is permitted only if this is not prohibited for them due to health reasons in accordance with a medical report issued in the manner established by federal laws and other regulations legal acts of the Russian Federation. At the same time, disabled people and women with children under three years of age must be informed, against signature, of their right to refuse to work on a day off or a non-working holiday.

Employees are invited to work on weekends and non-working holidays by written order of the employer.

Work on a weekend or a non-working holiday is paid at least double the amount:

for piece workers - no less than double piece rates;

employees whose work is paid at daily and hourly tariff rates - in the amount of at least double the daily or hourly tariff rate;

for employees receiving a salary (official salary) - in the amount of at least a single daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if work on a day off or a non-working holiday was carried out within monthly standard working time, and in an amount of no less than double the daily or hourly rate (part of the salary (official salary) for a day or hour of work) in excess of the salary (official salary), if the work was performed in excess of the monthly standard working time.

Specific amounts of payment for work on a day off or a non-working holiday may be established by a collective agreement, a local regulatory act adopted taking into account the opinion of the representative body of employees, or an employment contract.

At the request of an employee who worked on a day off or a non-working holiday, he may be given another day of rest. In this case, work on a weekend or a non-working holiday is paid in a single amount, and a day of rest is not subject to payment.

Remuneration for work on weekends and non-working holidays of creative workers of the media, cinematography organizations, television and video crews, theaters, theatrical and concert organizations, circuses and other persons involved in the creation and (or) performance (exhibition) of works, in accordance with lists of jobs, professions, positions of these workers, approved by the Government of the Russian Federation, taking into account the opinion of the Russian Tripartite Commission for the Regulation of Social and Labor Relations, can be determined on the basis of a collective agreement, a local regulatory act, or an employment contract.

(as amended by Federal Law No. 13-FZ dated February 28, 2008)

(see text in the previous edition)

Registration and payment for work on weekends and non-working holidays

Activities on non-working days are prohibited by Russian law. But every rule contains exceptions.

It is possible to involve citizens in the labor process on weekends with their written consent in the event that the organization has previously unforeseen work, the failure of which may adversely affect future activities.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem— contact a consultant:

It's fast and for free !

Nuances according to the Labor Code of the Russian Federation

Without the consent of employees, they can be recruited to work in 3 cases:

- To prevent accidents and natural disasters.

- To eliminate accidents and destruction of the employer’s property.

- For work in conditions of emergency or martial law, etc.

Read also: Certificate of arrears of wages

Servants of creative professions are recruited to work on weekends in accordance with the list approved by the Government of the Russian Federation.

Article 113 of the Labor Code prohibits the use of such labor by disabled people and women with children under 3 years of age whose health condition is unsatisfactory (according to a doctor’s opinion). Therefore, these categories of persons must be notified of the possibility of refusing the obligation to work on non-working days.

The Labor Code establishes the employer's obligation to pay double the amount of severance work. in particular:

- piecework workers - according to double standards;

- persons whose wages are calculated by hours and days - at double tariff rates;

- employees whose salary is calculated based on the established salary - no less than the daily norm (in the case of work performed within the monthly standard) and no less than twice the daily norm (in case of labor activity exceeding the monthly standard).

The Labor Code of the Russian Federation provides for the establishment of certain remuneration amounts for the conditions under consideration by collective and labor agreements. as well as other local acts of the organization.

Upon written request from an employee who worked on the weekend, the employer may provide him with extra day off. Remuneration in this case is paid according to the following scheme: the amount of payment for a non-working day worked is calculated in the usual amount, and the rest day is not paid.

You can learn more about all the nuances of this process from the following video:

Calculation of compensation

With piecework payment

Driver Nikolaev N. receives 150 rubles for each trip. In the reporting month, he made 190 trips. Nikolaev was brought to work on 2 days off, during which he made 20 trips. Let us determine the amount of his salary for the past month:

- (190-20)*150=25,500 rubles;

- 20*150*2=6,000 rubles.

In total, Nikolaev’s salary will be 31,500 rubles.

For hourly wages

Mechanic Kirillov G. worked 130 hours in a month, including 8 hours on Sunday. The hourly rate of a mechanic is 250 rubles. Let us determine the amount of Kirillov’s salary for the past month:

The total salary will be 34,500 rubles.

At daily rate

Painter Stepanov P. worked 20 working days in a month, including 2 days on holidays. The daily rate is 2000 rubles. Let's determine the amount of wages for the past month:

The amount to be paid to Stepanov is 44,000 rubles.

With a salary system (exceeding the established working hours)

Watchman Kopylov L. worked 150 hours, including 5 hours on a day off. His salary is 20,000 rubles. Taking into account that the standard working time in this case is 143 hours, and based on the conditions it is exceeded, compensation for a day off must be paid in double amount.

Let's determine the hourly tariff rate. There are 3 ways to calculate it:

- the ratio of salary to standard working hours according to the production calendar;

- the ratio of salary to standard working hours according to the employee’s schedule;

- the ratio of 12 salaries to the standard working time for the year.

The legislation does not clearly regulate the method of calculation. We use method 3. There are 1974 hours in a 40-hour workweek in 2016, so:

- (20,000 rubles*12 months)/1974 hours=121.58 rubles/hour.

The additional payment for a day off will be:

With a salary system (no excess of the established norm)

Technician Mashkina G. worked 143 hours, including 2 hours on a day off. Her salary is 15,000 rubles. Taking into account that the standard working time in this case is 143 hours, and based on the conditions it does not exceed the standard, then labor compensation for a day off must be paid in the usual amount.

First you need to determine your hourly rate. It is calculated similarly to example 4:

- 15,000 rubles*12 months/1974 hours=91.19 rubles/hour.

What is an act of permission to carry out work - see this article.

How to correctly draw up an application for connection to electronic document management - read here.

Registration procedure

- It is necessary to exclude persons who, in accordance with the Labor Code, cannot be involved in the output work process. These include:

- pregnant women;

- minors under the age of 18 (with the exception of creative workers, whose categories are approved by the Government of the Russian Federation, as well as athletes).

- Notifying employees in writing. It must contain information about the dates of entry to work of a certain person, indicating his full name, position, as well as the name of the structural unit in which the citizen will be recruited to work.

The letter is being drafted in 2 copies– one for the employer with a note from the employee about familiarization, the other – for the employee himself. This document is subject to recording in the notification log. If a person refuses to familiarize himself, a report is drawn up. - Obtaining the employee’s consent to be hired, which is documented in writing. This paper is not regulated by law, so it can be drawn up in simple written form.

- Drawing up a draft order with its subsequent coordination with the primary trade union organization. It is important to note that exactly the order is the main document that serves as the basis for involving employees in such work. Therefore, it must contain information about the employee, the days he went to work, as well as information about his familiarization with the document. The acquaintance details are located at the bottom of the order. The citizen puts his signature and date.

To avoid further disputes, it is recommended to include in the text of the paper information about the possibility of refusing such work. If you refuse to familiarize yourself with the document, it is recommended to record this fact in the act. - Registration of paper in the register of orders for personnel with further familiarization to all employees of the organization.

- Marking work data on the timesheet. The information in the time sheet is entered as follows: in the corresponding column opposite the citizen’s last name, the code “BP” or “03” is indicated, and the number of hours worked is entered.

- Compensation for the corresponding work with monetary compensation or the provision of a day of rest.

Quite often, managers are forced, due to certain circumstances, to involve employees in work on their legal rest days, including weekends and holidays. In order to avoid any further claims against the employer and to avoid various unpleasant stories involving people not going to work, it is necessary to document all the nuances of payment for work on a day off, making it legally correct. If this is not done, then in the future this may lead to conflict situations with company employees, which, in turn, will cause litigation.

When to celebrate is decided from above

The legislation provides for an officially approved schedule of holidays, which are non-working days in our country. The list of days off is approved annually. If an employee needs to work on one of the holidays or weekends during a five-day work week prescribed in the contract, then the employee has the right to receive extraordinary paid time off or pay for work at a double rate.

How is work on a day off paid? Let's explore the topic in more detail.

Recruitment to work on non-working days

In order for an employee to go to work on an official day off, you must obtain his written consent to perform this action in advance. A prerequisite is that consent must be in writing, and not just verbal. This point is provided for in Article 113 of the Labor Code. Among other things, this consent will ensure the content of the order to attract the employee to work on a day off.

When is a positive response not required?

There are situations provided for by law when his consent is not required to involve an employee in work unscheduled. These types of circumstances include:

1. Preventing the occurrence of a disaster or eliminating the consequences of an accident that has already occurred.

2. Prevention of accidents at work.

3. The need to carry out urgent work, the need for which arose due to the declaration of martial law or a state of emergency in a certain area.

Obviously, these circumstances are few and far between and, fortunately, occur quite rarely. Therefore, in most cases, it will be necessary to obtain the voluntary consent of the employee to involve him in work on a legal day off or holiday.

Ways to notify about work activity

How is work on a day off paid? This depends on a number of circumstances.

The organization has the right to independently determine the form in which the employee will be notified of the need to work on a day off. The most common form is a proposal or notice. The notification document must specify the reasons for going to work, time and date, and compensation options. After reviewing the document, the employee endorses the document with his signature. If necessary, you can specify the chosen method of payment for work on a day off. If the choice falls on an additional day off, but the employee cannot specifically indicate the date, then in the future he will write another application.

Who has the right to refuse?

There are categories of citizens, including disabled people, minors, single mothers raising children with disabilities, who should be highlighted in a separate column, since, in addition to signing the consent to pay for work on weekends and non-working holidays, they also confirm their awareness of the possibility refuse to go to work at this time in principle.

Making an order

Having received the employee’s written consent to be hired to work on a day off, the employer can issue a corresponding order. There is no general form for it. Sometimes an employer may decide that it is not necessary to issue an order. This occurs due to the employer’s reluctance to keep double records of work on a day off or provide him with an additional day off. However, this practice is quite destructive and fraught with unpredictable consequences.

In judicial practice, the vast majority of such conflicts are resolved not in favor of the employer. As a rule, it is not difficult for an employee to prove the fact of working on a legal day off. The evidence base can be witness testimony, documents, oral instructions from the employer, etc.

Resolving such conflicts in court in favor of the employee is fraught with certain consequences for the employer in the form of large fines. To avoid such consequences, you should complete all necessary documents in a timely and correct manner.

Financial compensation

The Law on Working on Weekends stipulates that if the employee is off during this time, compensation must be guaranteed, since such circumstances violate his rights to legal rest as prescribed in the Constitution. Compensation, as mentioned above, can be either monetary (double the amount) or in the form of paid time off.

How is work on a day off paid? We'll talk about this further. Legislation will serve as our basis.

Article 153 of the Labor Code of the Russian Federation suggests that for going to the workplace on a day off you should be rewarded twice as much. Thus:

1. Piece-rate employees receive double pay for the time worked.

2. Hourly employees receive double pay for working on a weekend or holiday.

If an employee works for a fixed monthly salary, then two payment methods are possible in accordance with Article 153 of the Labor Code of the Russian Federation:

1. If the standard hours in the current month are not exceeded, then compensation is calculated based on one daily fixed rate, which is paid in excess of the established salary.

2. If the monthly norm is exceeded, the amount of compensation will not be lower than double the fixed rate.

A statement will not be superfluous

If an employee expresses a desire to take time off as compensation, but cannot specify the exact date, then he will need to write a statement. It is believed that additional statements are not needed to receive compensation, but they will not be superfluous and will help avoid misunderstandings with the employer. More often than not, monetary compensation turns out to be more profitable than additional time off. It is important, however, that the amount of compensation is calculated correctly, especially if we are talking about hourly wages. The issue of working on days off with a shift schedule is also a pressing issue.

The easiest way to calculate compensation is for those employees who did not go on sick leave or go on business trips during the month of work. In this case, the working norm is not exceeded; accordingly, the employee will definitely have the right to receive a monetary reward for going on a day off. Many people are interested in information about working on a day off on a business trip.

Time off compensation

How is work on a day off paid, other than monetary remuneration?

Not all employees who are given the opportunity to choose between compensation and extraordinary time off choose the former. There are also those who would prefer an additional day of rest at any time convenient for them.

As mentioned above, an employee has the right to indicate a convenient date for time off already at the stage of reviewing and signing consent to be hired to work on a weekend or holiday. In this case, when filling out the order, the employer will include a clause stating that the compensation will be additional free time on a certain date. If the employee is not ready to name a specific number of days off, then before the required day he will write a corresponding application for a day off as compensation. The application must be signed by the employer.

Article 153 of the Labor Code states that no matter how many hours an employee works on a weekend or holiday, he is still entitled to a full day of leave. Rostrud also adheres to this policy. The employee must be familiarized with the order to provide an additional day off by signature.

Despite the fact that the employee will be absent from work on an additional day off, this day is paid in accordance with the Labor Code. This additional day is compensation for when the employee worked outside of work hours. If this rule were different and the pay was not maintained, it could not be considered compensation, since it would be considered leave at one's own expense.

It is especially important how the employer marks the day of absence of the employee in the time sheet. The corresponding note is made in a special program or report card. Otherwise, an incorrectly documented absence of an employee may cause unpleasant consequences for the employer.

When to take time off?

You can take time off either in the current month, when you went out on a free day, or at any other time. The law does not provide strict restrictions in this regard. Let's give an example: an employee worked one working Saturday in August, but in the same month he did not go on vacation. In this case, his earnings will be equal to his full salary plus one day of compensation. If an employee expresses a desire to take time off in September, then in both August and September he will have his full salary without any deductions.

All of the above calculations are made based on actual time worked. If the standard has not been worked out, then the calculation is made according to the Labor Code, taking into account each specific case.

Time off or compensation?

In practice, it turns out that employers have many problems with providing an additional day off and paying the employee for the month. For many companies, it is easier to maintain solidarity with Rostrud and pay a single rate per working day plus additional time off while maintaining wages. In some cases, the employer pays for a day off at double the rate.

Such a policy will help the organization avoid disputes with employees and their filing lawsuits. The most problems with compensation payments arise with employees from budget support. For unknown reasons, such organizations prefer to give time off rather than pay for work on a day off at double the rate. Most often, compensatory time off is added to annual leave or given to the employee upon request.

Sometimes a collective agreement prescribes a certain procedure for providing compensation, and the employee does not have the right to demand any other option. If such rules are not provided, then the choice remains with the employee. The situation in the economy now is such that, whenever possible, employees prefer to take double pay for going to work on a free day.

It is important to clearly understand your rights and responsibilities and ensure that your work activities are properly formalized and regulated. Only if you comply with all legal rules and regulations can you claim compensation for working on a day off.

Summarizing all of the above, we can conclude that the employer has the right to invite an employee to work on a day off only with his written consent or in exceptional cases described in the law. That is, the employee has the right to refuse to comply with this condition. This is especially true for the categories of citizens listed above who have preferential working conditions. The choice of compensation is also the prerogative of the employee, unless otherwise provided by the terms of the contract with the employer.