Salaries by grade per year. The tariff rate is...

The tariff schedule is table with the ratio of ranks and wage rates. This system is used in commercial, government and budget organizations. With its help, rates and salaries are differentiated using tariff coefficients.

Definition, meaning, varieties

The tariff schedule is based on a comparison of the complexity of the work goals of different categories and groups of employees, their responsibilities, education and other circumstances. Together, these circumstances fully ensure the ability to evaluate the performance of personnel and determine the reality of using common positions for differentiating payment for their activities.

Thus, it is clear that the tariff schedule clearly shows how workers' salaries depend on their ranks. It can be stretched and compressed during the adjustment process. This pricing table is:

- Uniform, with the same inter-salary difference between the coefficients.

- Increasing or progressive, at which the inter-bit difference uniformly increases.

- Fading or regressive when the difference decreases.

- Rising-decaying, in which the difference first increases and then decreases.

The tariff coefficient consists of motivational And reproducing elements. It indicates how many times the basic salary for a specific qualification is higher than the first-class salary.

The tariff coefficient consists of motivational And reproducing elements. It indicates how many times the basic salary for a specific qualification is higher than the first-class salary.

A salary tariff table with the smallest number of categories and a small range of coefficients is not able to objectively assess the contribution and potential of personnel.

Because of this she has a negative effect to stimulate activity and poorly provides employees with normal relationships within the team. That's why it's like that it is important to be able to competently and correctly draw up tariff schedules for the formation of labor wages.

A normal tariff schedule should consist of a sufficient number of qualification groups with a range no less than 1 in 10. Acceptable ranges are considered 1:15 and above with the number of digits approaching 20.

Classification of ordinary workers and management employees

In institutions with a tariff schedule for employees, they use official salaries. To differentiate them, there are the following qualifications of workers, which are described in more detail in the unified tariff and qualification reference book (UTKS):

- specialist (initial stage);

- specialist of the third category;

- specialist of the second category;

- specialist of the first category;

- Leading Specialist.

Young specialists after university without experience or workers with secondary specialized education and experience belong to the initial stage of qualification. Workers with a certain amount of experience and performing moderately complex activities have the second or third category. The first category is assigned to specialists with five years of experience who perform the most complex work.

The tariff and qualification directory covers the characteristics of the main types of activities, their complexity and compliance with tariff categories, as well as standards and examples of certain works.

The directory contains sections describing areas of specific work. The characteristics of the activities are divided into a work characteristic and a section called “must know”.

Administrative and managerial level comprises:

- heads of institutions;

- heads of departments and services;

- deputies of the above;

- specialists performing economic and engineering work;

- specialists in reforestation, fish farming, zootechnical, and agricultural industries;

- specialists in art and culture, science, public education, medical care;

- specialists in international relations;

- legal specialists;

- technical contractors performing control and accounting;

- technical contractors for the preparation and execution of documents;

- maintenance technicians.

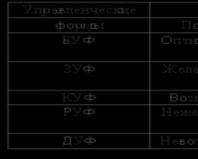

But there is also a newer edition of the classification of management employees, which divides them into managers, foremen, supervisors, chief specialists and, in fact, the head of the organization himself.

The category of technical performers now includes statisticians, stenographers and secretaries, collectors, freight forwarders, typists, cashiers, draftsmen, accountants, clerks, agents, bookkeepers, timekeepers, clerks, copyists and duty officers.

Each position contains the following qualification characteristics, How:

- official obligations, which lists the main job functions;

- must know– the requirements for special knowledge, regulations and standards are disclosed here;

- qualification requirements, which includes requirements for work experience and professional training.

More comprehensive information on management positions can be found in Unified Qualification Directory (USD).

Algorithm for assigning a new rank

The procedure for increasing rank in organizations next:

- The employee, after permission from management, draws up a statement and justifies his decision. After which a visa is affixed to this document by the council of the production team.

- Next, a commission of highly qualified workers, foremen, specialists, administrative and trade union representatives of the enterprise is assembled.

- The knowledge of an employee wishing to receive a promotion is monitored, based on a tariff and qualification reference book.

- Based on the results of the inspection, the rank is increased and this is confirmed by an order and protocol. It is also necessary to make a corresponding entry in the employee’s work book.

How to calculate

Employees' labor is priced according to an already drawn up tariff schedule. So, they take the salary of the first category, which should be equal to or greater than the minimum wage, and multiply it by the coefficient of the required category.

Regional coefficients should also be taken into account, which vary depending on the location of the enterprise on the geographical map. Thus, in European Russia this regional indicator is 1, in the Urals - from 1.15 to 1.4, in the Far East - 1.4-1.6, in the North - 1.6-1.8, and in the Far North – 1.8-2.

Advantages and disadvantages

The tariff payroll system motivates employees to constantly improve their skills, takes into account the responsibility and complexity of their activities, supplies any enterprise with personnel and encourages them to professional growth.

But the tariff system also has minuses, which include poor assessment of the quality of activities and focus on decent working conditions. In practice, these shortcomings are eliminated by developing and implementing additional payments and allowances.

Use in organizations in 2018

According to the norms of the Labor Code of the Russian Federation, the head of the enterprise sets out the tariff schedule for calculating the salaries of his subordinates. All positions in the organization have their own ranks, starting with the least qualified, first. For the following categories, tariff coefficients are established in order to finally form the tariff schedule itself.

Managers can use templates from industry agreements to create pricing tables. These documents were compiled by specialized management associations and agreed upon by the relevant trade unions. The minimum wage for 2018 is 9489 rubles. The salary of a first-class worker should be the same.

Current coefficients for employee categories for 2018:

Features for budgetary organizations, Ministry of Internal Affairs, individual entrepreneurs, etc.

Budgetary institutions use the following methods to calculate salaries for their employees: unified tariff schedule (UTS). This bit scale consists of 18 qualifications. Eight of them relate to the pricing of ordinary workers, the next four – to the assessment of highly qualified ones. The composition of managers, specialists and employees is charged from 2 to 18 categories.

The rate and salary in the public sector are now set by the head of the organization, taking into account the complexity of the activity performed and the qualification level of the employee. And the salaries of ordinary workers are interconnected with the earnings of management. In this case, the wage fund is distributed correctly among all employees.

The wages of public sector employees should consist of salary, length of service, rank or classification bonuses, bonuses and compensation. The tariff schedule is fixed by the collective agreement, regulations on wages and bonuses and other agreements. Employees of an organization can easily find out everything about their salary from these documents and the staffing table.

IP compiles a salary table for his employees himself. He does not have to strictly adhere to established standards from the state and can assign as many categories as he needs. At the same time, the working specifics of the company are realistically assessed and justified requirements are put forward for the activities of employees.

When developing the current tariff system, the head of the company will have to not only draw up a tariff schedule, but also fix the tariff rules. It is important that employee salaries are not less than the current minimum wage.

When charging, there should be no discrimination towards subordinates. The head of the company has the right to set salaries for his employees at his own discretion. Employees engaged in similar activities must be accrued the same coefficient.

The tariff schedule is being developed in the following way:

- first, all positions and specialties are determined by department of the company;

- then the functions are divided into categories;

- establish qualification coefficients;

- consolidate the resulting system with local regulations.

The company's earnings are justified by indicating bonuses and salary amounts in the staffing table.

To pay employees Ministry of Internal Affairs a single tariff scale approved by government agencies is also applied, but each rank is also paid its own compensations and allowances in a certain percentage. In addition, municipal authorities intend to annually raise salaries for categories of such employees by a specific percentage. At the moment it is 4%.

With a salary scale, the evaluation criteria for work become transparent, and salaries increase as both position and qualifications increase. If the administrator correctly creates favorable conditions in his enterprise, then it will constantly achieve all its goals and plans.

The differences between the tariff schedule and the grading system are presented in this seminar.

1. Unified tariff schedule for remuneration of public sector workers

The Unified Tariff Schedule (hereinafter referred to as the UTS) has been in effect in Russia in different versions since 1992. Even before, in Soviet times, the level of wages largely depended on similar principles. The tariff schedule divides all public sector workers into 18 categories. This system was convenient during times of high inflation in the country, as it made it possible to quickly index the salaries of all public sector employees. But the UTS also has negative sides - it is a very rigid structure, and if an increase occurs, then it is for everyone at the same time, regardless of the situation in each individual industry. Consequently, each indexation required serious budget expenditures. But most importantly, the ETS did not take into account the specifics of professions, equating the work of a school teacher with the work of a doctor at a district clinic or a circus performer. It is difficult to undertake an assessment of the complexity and usefulness of a particular profession, but one should adhere to an individual approach to the remuneration of public sector workers. There is an opinion about the obsolescence of the UTS, about the need to tariff salaries of public sector employees based on the objective realities of today.

Formally, since 2005, the constituent entities of the Russian Federation were invited to develop their own systems. However, it was not possible to get rid of the single grid: in fact, most regions, without bothering to develop differentiated payment schemes, continued to focus on the UTS and the salaries of regional public sector employees. The unified tariff schedule, which operated in a uniform manner throughout the country, did not take into account the peculiarities associated with the functioning of a particular industry.

_________________________

Egorsheva N., Rossiyskaya Gazeta. October 4, 2007.

According to Appendix No. 1 to Decree of the Government of the Russian Federation of October 14, 1992 No. 785 (repealed - Decree of the Government of the Russian Federation of February 27, 1995 No. 189), the size of the tariff rate (salary) of the first category is established by the Government of the Russian Federation. Rates (salaries) for employees of other categories of the Unified Tariff Schedule are established by multiplying the tariff rate (salary) of the first category by the corresponding tariff coefficient.

Workers' professions are charged in accordance with the Unified Tariff and Qualification Directory of Work and Professions of Workers from 1st to 8th categories of the Unified Tariff Schedule. Highly qualified workers engaged in important and responsible work and in particularly important and especially responsible work can be set tariff rates and salaries based on 9 - 12 categories of the Unified Tariff Schedule according to lists approved by ministries and departments of the Russian Federation and the Ministry of Labor of the Russian Federation.

The official salaries of deputies are set 10 to 20 percent below the salary of the corresponding manager.

Unified tariff schedule:

| Pay grades |

Tariff coefficients |

| 1 |

1,0 |

| 2 |

1,30 |

| 3 |

1,69 |

| 4 |

1,91 |

| 5 |

2,16 |

| 6 |

2,44 |

| 7 |

2,76 |

| 8 |

3,12 |

| 9 |

3,53 |

| 10 |

3,99 |

| 11 |

4,51 |

| 12 |

5,10 |

| 13 |

5,76 |

| 14 |

6,51 |

| 15 |

7,36 |

| 16 |

8,17 |

| 17 |

9,07 |

| 18 |

10,07 |

for general industry positions of employees

(Appendix 2 to the Decree of the Government of the Russian Federation

dated October 14, 1992 785):

| |

Range of digits |

| I.Technical performers |

|

|

Pass office officer on duty |

2 |

|

Copyist |

2 |

|

Contractor |

2 |

|

Timekeeper |

2 |

| 2 |

|

|

Forwarder |

2 |

| 3 |

|

|

Clerk |

3 |

|

Secretary |

3 |

|

Secretary-typist |

3 |

|

Accountant |

3 |

|

Draftsman |

3 |

|

Archivist |

3-4 |

|

Cashier (including senior) |

3-4 |

|

Typist |

3-4 |

|

Freight Forwarder |

3-4 |

|

Collector |

4 |

|

Secretary |

4 |

|

Statistician |

4 |

|

Stenographer |

4 |

| II. Specialists |

|

| Dispatcher (including senior) | 4-5 |

| Inspector (including senior) | 4-5 |

| Laboratory assistant (including senior) | 4-5 |

| Technicians of all specialties and types | 4-8 |

| Accountant | 5-11 |

| Engineers of various specialties and titles | 6-11 |

| Translator | 6-11 |

| Translator-dactylologist | 6-11 |

| Psychologist | 6-11 |

| Editor | 6-11 |

| Sociologist | 6-11 |

| Commodity expert | 6-11 |

| Physiologist | 6-11 |

| Artist | 6-11 |

| Economists of various specialties and titles | 6-11 |

| Legal Advisor | 6-11 |

| Architect | 6-13 |

| Constructor | 6-13 |

| Mathematician | 6-13 |

| Programmer | 6-13 |

| Technologist | 6-13 |

| Artist | 6-13 |

| Elektronik | 6-13 |

| Accountant-auditor | 6-13 |

| III. Managers |

|

|

Managers: |

|

|

storage room |

3 |

| 3-4 |

|

|

pass office |

3-4 |

|

copying bureau |

3-4 |

|

darkroom |

3-4 |

|

farming |

3-4 |

|

expedition |

3-4 |

|

office |

4-5 |

|

typing bureau |

4-5 |

| 4-6 |

|

|

Site foreman (including senior) |

6-11 |

| 7-8 |

|

|

Head of the section (shift) |

7-12 |

|

Work foreman (foreman), including |

8-11 |

|

Head of economic department |

7-8 |

|

Head of the section (shift) |

7-12 |

| Work foreman (foreman), including senior | 8-11 |

|

Department head |

11-14 |

|

Foreman |

11-14 |

|

Chief Specialist |

13-17 |

| Head of institution, organization, enterprise | 10-18 |

Wage categories of the unified wage scale

for the main positions of employees of public sector sectors

(Appendix 3 to the Decree of the Government of the Russian Federation

dated October 14, 1992 785):

| Categories and positions of employees |

Range of digits |

| SCIENCE AND SCIENTIFIC SERVICE |

|

|

Researcher |

8-17 |

| Managers |

|

| Chief specialists: in departments, divisions, laboratories, workshops | 12-14 |

| Chief engineer (designer, technologist, architect) of a scientific organization project | 13-15 |

| Head of the main structural unit, scientific secretary | 13-16 |

| Branch director (chief, manager) | 13-16 |

| Head of institution (organization) | 16-18 |

| EDUCATION |

|

| Teaching staff of public education institutions |

|

| Teachers of all specialties, teacher, teacher, accompanist |

7-14 |

|

Methodologist, industrial training master |

8-13 |

| Higher education institutions |

|

|

Teaching staff |

8-17 |

| Managers |

|

| Public education institutions |

|

|

Head of structural unit |

8-12 |

| Directors (heads): out-of-school institutions, preschool institutions, schools, boarding schools, orphanages, lyceums, gymnasiums, vocational and secondary specialized educational institutions, colleges, educational and industrial offices, etc. | 10-16 |

| Higher education institutions |

|

|

Head of the main structural unit |

13-16 |

|

Branch Manager |

16-17 |

| 17-18 |

< Раздел 1. ОТРАСЛЕВАЯ СИСТЕМА ОПЛАТЫ ТРУДА РАБОТНИКОВ СФЕРЫ ОБРАЗОВАНИЯ2. Принципы отраслевой системы оплаты труда >

on remuneration of employees of federal government institutions.

Inter-category coefficients are coefficients by which the rate of category 1 of the tariff schedule is multiplied to determine the rate of the corresponding category.

Tariff schedule by category for 2017-2018

For example, the 15th category rate is 6982.8 rubles. (RUB 2,300 h 3,036).

Tariff rates (salaries) for employees from categories 2 to 18 of the Unified Tariff Service for remuneration of employees of federal government institutions are determined by multiplying the tariff rate (salary) of category 1 by the corresponding inter-category tariff coefficient.

The tariff rate (salary) of a deputy manager is set one or two grades lower than the tariff rate (salary) of the corresponding manager.

In the period from September 1, 2007 to December 31, 2008, new remuneration systems will be introduced for employees of federal budgetary institutions and civilian personnel of military units, whose remuneration is carried out on the basis of the unified technical system, in accordance with Decree of the Government of the Russian Federation dated September 22, 2007 No. 605 “ On the introduction of new remuneration systems for employees of federal budgetary institutions and civilian personnel of military units, whose remuneration is carried out on the basis of the Unified tariff schedule for remuneration of employees of federal government institutions.”

In preparation for the introduction of new remuneration systems in order to create motivation to improve the quality and productivity of work, from September 1, 2007, all categories of employees of federal budgetary institutions and civilian personnel of military units were assigned incentive bonuses in the amount of 15% to the tariff rates (salaries) determined in accordance with the Decree of the Government of the Russian Federation dated April 29, 2006 No. 256 (Order of the Ministry of Health and Social Development of Russia dated October 19, 2007 No. 660 “On approval of the clarification on the increase from September 1, 2007 in wages for employees of federal budget institutions in which new wage systems have not been introduced”) .

download Selecting a tariff scale (this is a set of categories and its range). We determine the range of the discharge, what type of discharge will be, what the tariff coefficients will be.

For workers, a 6 or 8-bit tariff scale is most often used.

At one time, they used a tariff scale (18-bit) for budget organizations, recommended for other industries. It has its pros and cons.

What is the difference between a 6- and 8-bit grid and an 18-bit grid?

We are trying to introduce into the 18-bit grid all types of work for the enterprise, for the organization, including work of a physical, mental nature, and management.

In this case, trying to fit everything into one grid is not entirely correct.

Most often, where tariff schedules are used, the tariff schedules of workers (6-8 categories) are taken as a basis; for specialists and employees, their own tariff schedule, their own grade classes are developed (they can be called classes, whatever you like; for example, a first-class engineer; this can called a category; there is no difference, it is still an attempt to divide all workers according to a certain criterion, first of all, the characteristic is the complexity of the work performed by the employee, and the complexity of the work lies in determining the tariff schedule.

Industry tariff schedule, taking into account the specifics of the industry. It is most often developed by an industry tariff agreement. In this case, almost all enterprises in the industry use this particular mesh.

Regional tariff schedule: if we take the subsistence minimum as the 1st category rate, then we must take the subsistence minimum for the region.

Since the cost of living changes, the price level can also be different, in this case it turns out that the regional grid is a reflection of the specifics of the region. It is not a fact that it is used, it can be used.

The factory, company, tariff schedule is what is reflected in the collective agreement of the enterprise, where it is first of all fixed. Why can an enterprise have its own tariff schedule? It may have its own specifics. The differentiation of the complexity of work can be different. Multi-product enterprise. Specifics must be reflected.

Then the specifics of developing your own tariff schedule arise.

For some reason, enterprises prefer the grading system.

Tariffing of works. Before a tariff scale is introduced, the work at a given enterprise is rated. That is, we must describe all types of work carried out at a given enterprise and evaluate them according to the complexity of the work, taking some work as a standard. For a unit vector, and from it, charge the work.

To rate the work, you should use the analytical method for assessing the complexity of the work, which is based on assessing the complexity according to a certain set of factors using a point system, etc.

We arrange the works, analyze them, and rank them from the least simple. First, the work is charged, then only workers and employees.

We are building a table. Some work is taken on a unit vector.

| i1 | 1 | 1 | 1 | 1 | 1 | 1 |

| i2 | 1 | 2 | … | … | … | … |

Justification of the principle of increasing tariff coefficients absolutely and relatively:

- equal (uniform): 1, 1.05, 1, 1.1, 1.15, 1.2; 1.0, 1.05, 1.15, 1.45

- progressive-regressive (related to social protection); The tariff rate of the first category is so small that it is difficult to find a worker for the 1st and 2nd category. Examples: 1.0; 1.05; 1.1; 1.45; 1.9; 2.7. As the discharge increases, its growth rate increases. And vice versa: 1.0; 1.5; 1.9; 2.2.

The factory wage scale is developed primarily for workers, then for managers, specialists and employees.

Selecting forms of remuneration

The use of piecework and time-based forms of remuneration depends on production conditions, the quality of labor standards, and the possibilities for growth in production volumes (sales, services).

Two forms of remuneration. The choice of the form itself depends on production conditions, the quality of labor regulation, and the possibility of increasing production volume. In modern conditions, the use of only one form of remuneration is limited.

Typically, both forms of remuneration are used.

Net:

| 1 | 2 | 3 | 4 | 5 |

| 100 | 120 | 130 | 140 | 150 |

Average tariff rate: 135 rubles.

Average rank of workers: P(workers) = SUM(number of workers of this rank * rank number) / SUM(number)

Average category of work: P (work) = SUM (labor intensity of work * category number) / SUM (total complexity)

Average category of work: P (work) = Smaller and Larger Between Which There Is a Tariff Rate (m) + (Tariff Rate (average) - Tariff Rate (small)) / (Tariff Rate (large) - Tariff Rate (small))

Average category of work: P (work) = Smaller and Larger Between Which There Is a Tariff Rate (b) + (Tariff Rate (large) - Tariff Rate (average)) / (Tariff Rate (large) - Tariff Rate (small))

Work = 3 + (135-130)/(140-130)

You can also use odds, since knowing the bets, we can use the odds.

Average Tariff Rate = SUM(Tariff Rates * Number or Labor Intensity) / SUM(Number or Labor Intensity)

- K(s) = SUM(K*Number)/SUM(Number)

- K(c) = SUM(K*Labor Intensity)/SUM(Labor Intensity)

- K(c) = K(m) + (K(b)- K(m))/(P(s)- P(m))

- K(c) = K(b) + (K(b)- K(m))/(P(b)- P(s))

Tariff system of remuneration

Labor rationing is the establishment of scientifically based labor costs and its results: standards of time, number, controllability of service, output, standardized tasks.

The tariff system is a set of various regulatory materials with the help of which the enterprise establishes the level of salary of employees depending on their qualifications...

The main elements of the tariff system include:

- tariff schedules,

- tariff rates,

- tariff and qualification reference books,

- official salaries,

- tariff directories for employee positions,

Tariff rate is the absolute amount of wages expressed in monetary terms per unit of working time.

Based on the tariff schedule and the tariff rate of the first category, the tariff rates of each subsequent category are calculated. According to…

Daily and monthly rates are calculated:

[hourly rate] * [number of hours in a work shift - daily] * [average monthly number of hours worked per month - monthly]

Tariff and qualification reference books are normative documents with the help of...

Simple remuneration systems form the employee’s earnings depending on one indicator of recording labor results: working time (time-based remuneration systems) or the quantity of manufactured products (piece-rate remuneration systems).

A simple time-based system forms the employee’s earnings according to his tariff rate and the actual time worked. Accordingly, tariff rates are applied: hourly, daily and monthly. When applying hourly and daily tariff rates, the amount of an employee’s earnings is determined by the formula: Z(p) = C(t) * T(f).

What happens? For example, the number of hours an employee owes: 180 hours, for example. Hourly tariff rate = 20 rub. at one o'clock. The employee worked 150, respectively, we 150 * 20. Why are the salaries different?

This month: 20 working days, in another month: 22 working days. We will deliver the report: 20 tr. A specialist employee worked 15 days in the first month, and 20 in the second.

Employee's monthly wage rate:

Z(p) = (C(t) * T(f)) / T(rp)

We require: time sheets, tariff rates.

The size of the employee’s hourly tariff rate (the employee has a monthly salary of 10 thousand rubles)

Annual working time fund for 2006 with a 40-hour work week (1980 hours).

Average monthly number of working hours of an employee: 1980: 12 months. = 165 hours

Hourly wage rate for an employee: 10 thousand rubles. : 165 hours = 60,606 rubles.

During the month the employee actually worked 180 hours:

The salary according to the tariff was:

60606 rub. * 180 hours = 10,909.08 rubles.

Time-based bonus system:

Wages accrued for the time actually worked (month, quarter), supplemented by a percentage bonus (monthly or quarterly bonus)

(Tariff rate established for the employee; Timesheet for the use of working time; Regulations on remuneration (On bonuses))

Example 2: The terms of the collective agreement provide for the payment of a monthly bonus in the amount of 25% of the employee’s salary, subject to the organization’s fulfillment of the monthly production plan. The employee's salary is 10 thousand rubles. The employee worked all days as scheduled in the billing month.

Accrued to the employee:

Salary - 10 thousand rubles.

Prize - 10,000 rubles. * 25% = 2,500 rub.

Monthly salary amount: 10,000 + 2,500 = 12,500 rubles.

In the billing months, the employee worked 15 working days out of 20.

Accrual:

Salary - 10,000 rubles. : 20 days * 15 days = 7500.

Premium 7500 * 25% = 1,875 rubles.

Monthly salary amount: 7500 + 1875 = 9375.

The employee was required to work on weekends twice. Overtime work with time-based wages, their payment is prescribed in the collective agreement, although the Labor Code says that it must be calculated at an increased rate. Most often used: the first two hours at 1.5 rates; subsequent hours: double. The employee was accrued:

Salary: 10000: 20 days * 15 days = 7500

Payment for work on weekends: 10000: 20 days * 2 days * 2 = 2000

Bonus: (7500 + 2000) * 25% = 2375 rub.

Total amount: 7500 + 2000 + 2375 = 11875.

Simple piecework wages are structured in such a way that a worker’s earnings depend on the piecework rate, which is the amount of payment per unit of manufactured products (work performed), and on the number of products produced (work performed).

The amount of earnings is determined by the formula: З(сд) = R * q.

The piecework form of salary is characterized by a variety of methods for calculating piecework prices and methods for establishing...

In practice, the following piecework wage systems can be used:

- Individual:

- Simple piecework

- Piece-progressive

- Piecework regressive

- Piece-bonus

- Indirect piecework

- Collective (brigade)

- Chord

- Using the Labor Participation Rate.

The individual direct piece-rate wage system is characterized by the fact that a worker’s earnings are determined based on the results of his personal labor.

Unified tariff schedule

This is expressed in the number of products (parts) manufactured by the worker or the number of operations performed by him for a certain period. In this case, a direct, immediate connection is established between the costs and results of the worker’s labor and his earnings.

R = Average Tariff Rate / Output Norm or R = Average Tariff Rate * Time Norm

Change in price (DeltaR) in %% when changing the production rate (y):

DeltaR = (100 * y) / (100 + y) OR DeltaR(1) = (100 * y(1)) / (100 – y(1))

The direct individual piecework system is very simple and understandable for the worker and eliminates - with high quality rationing - equalization in pay.

Any remuneration system must be clear.

It is advisable where production conditions make it possible and justified...

Organization of individual piecework wages in conditions of multi-machine service: if a piecework worker works according to time standards on several machines, but within the limits of the service standard established for him, then piecework rates are determined by the formula:

R = (Average Tariff Rate / Number of Machines) * N(time)

If a piece worker works according to production standards on machines with different productivity or different types of work within the established service standard, then piece rates are determined for each machine separately:

R(i) = C(tr) / (n * N(exp; i))

R(k) = SUM from 1 to N(C(t; i) * (1 / (Crew production rate))

R(indirect) = C(int.) / NormVyotka(main)

If an employee performs different types of work:

ZP progressive = R(n(1)Ky(1) + … + n(L)Ky(L))

3Pregressive = R * (n(1) / K(1) + … + n(L) / K(L))

Progressive and regressive scales can be used: if we use a piece-rate bonus with a progressive bonus scale. What is meant? Either in the collective agreement or in the bonus provision: if the enterprise has fulfilled the monthly plan, then the employees are awarded a 25% bonus from the salary. If the team exceeded... If the team fulfilled the plan, then for fulfilling the plan he receives 25%, for each percentage of exceeding the plan - 5% of the salary. If the % of overfulfillment exceeds 10%¸ then an additional 3%.

qplan + exceeding the plan by 15% (15% q)

Salary = Salary + 25% of Salary + 5% * Salary_for_10% + 3% for 5%.

Collective forms of remuneration:

The lump sum form of remuneration assumes that payment is made for the entire volume of work at predetermined rates, taking into account the maximum period for completing the work. When using the lump-sum form of remuneration (with lump-sum contracting), the entire scope of work is determined, the deadline for completion and the amount of wages are established. There is no operating fee.

To increase interest in completing a chord task on time or even ahead of schedule, an additional bonus can be established.

The chord earnings, calculated based on the assessment of the chord task, are distributed on the conditions determined by the team:

- in proportion to the time worked;

- in accordance with the labor participation rate;

- in proportion to the qualifications of workers, depending on the complexity of the work performed;

- in other ways provided for in the collective agreement, regulations on remuneration, etc., or in the contract for the performance of work concluded with the employee.

We finished on slide 25.

download

See also:

For workers, a 6 or 8-bit tariff schedule is most often used

Local computer networks. Methods for connecting computers to each other

Generation of a surface triangular unstructured mesh based on the AeroShape3D computational mesh

Coding of text information. Ascii encoding. Basic Cyrillic encodings

Algebra lesson in 11th grade on the topic “Complex numbers”

8. Classification of building materials by purpose and performance characteristics 4

I. N. Kalinauskas

The article is classified in the sections: Teaching physics

Anaerobic infection

Preparation for ultrasound examinations

How the state is falling apart

Unified Transport System (UTS)- a technologically and economically balanced set of modes of transport performing non-urban transportation. The UTS includes rail, sea, river, road, air and pipeline transport. Various types of urban and industrial transport interact with the UTS. The development of modes of transport as components of the UTS allows for the fullest use of the technical and economic features of each of them and thereby provides the most effective solution to the country's transport problems. In 1990, in the total freight turnover and non-urban passenger turnover in Russia and the country as a whole, the largest share was accounted for by railway transport.

Railway Almost all types of products produced in the countries of the former USSR are transported by transport, but the main part of its cargo turnover consists of bulk cargo: coal and coke, oil cargo, minerals, construction materials, ferrous metals, timber cargo, ores. In the cargo turnover of maritime transport, external cargo predominates. trade. Most of them are transported by river transport. bulk cargo, primarily miner, construction materials, timber (on ships and in rafts), oil and petroleum products, coal. Road transport carries out transportation mainly in local traffic, as well as the delivery of goods and passengers to main routes of communication and the delivery of goods to places of consumption. In the transportation work of air transport St. 80% comes from pass and transportation. Crude oil is pumped through oil pipelines, and light oil products through petroleum products. The specified features of modes of transport determine cf. the range of transportation on them and their share in the UTS.

The total cargo turnover of the UTS of Russia and the USSR in 1990 amounted to 5.9 to 8.3 trillion, respectively. t-km net, non-urban passenger turnover - 9.7 and 1.19 trillion. pass.-km. The length of communication routes available to the transport systems in Russia and the USSR is given in Table. 1.

Table 1. - Structure of the transport network in 1990

The unity of the transport system requires the coordinated development of all types of transport, coordination of their operational activities, mutual coordination of certain parameters of rolling stock, coordination of tariffs and organizational measures. Until the end In 1991, this unity was based on national ownership of the means of production and was ensured by appropriate planning targets and centralized leadership. In market relations it is provided by transport. legislation providing for the creation of a single transport market. services, and economic levers.

A special feature of the Russian transport system is its high speed.

Tariff schedule and categories to it

the weight in it of railway transport, which provides most of the most important inter-regional connections, connects isolated sea and river basins, receives cargo from road and pipeline transport, and reserves other modes of transport if necessary. Direct railway communication is carried out between almost all regions of Russia, with the exception of the regions of the Asian north and northeast. Most inter-district routes have double-track lines.

Another significant feature of the Russian Unified Transport System is the high degree of concentration of traffic on highly equipped highways with a relatively low density of communication routes compared to other developed countries. The average freight density of the public railway in 1990 was 28.4 million t-km/km; on a significant part of the railway network, the average freight density was more than 50 million t-km/km. On a number of lines, the density of cargo movement in one direction exceeded 100 million net tons per year with large passenger traffic sizes. The average traffic load of main oil pipelines and the load of the largest of them are comparable to the given indicators of the railway. Multi-line systems of main gas pipelines pump up to 200 billion m3 of gas per year.

A significant concentration of traffic makes it possible to use advanced and high-performance vehicles and achieve greater efficiency in transportation. Increasing the transportation capabilities of the transport system, increasing speeds and reducing the cost of communications between different regions and points are factors contributing to the growth of business activity, increasing production efficiency, and improving the living conditions of the population. In this regard, it is necessary to systematically develop and improve the UTS, which must be balanced with the economic and social tasks being solved, and satisfy environmental, resource-saving and other requirements.

Much attention is paid to these issues in all industrialized countries with market economies. The transport policy of these countries is based, as a rule, on a rational separation of the functions of state transport management (through relevant legislation, taxes, subsidies, benefits and other economic levers) and the functions of direct transportation, carried out completely independently in their economic activities by transport companies and enterprises .

Schedule" Automated information and analytical system "obverse:

1 … 6 7 8 9 10 11 12 13 … 22

TarifficationTo draw up teacher tariffs you need:

Tariff managementControl PanelBilling management is performed using the buttons located on the control panel: Rice. Billing control panel Dialogue TarifficationTariffing includes additional data about teachers that is not used in scheduling. A dialog is used to enter this data Tariffication . The dialogue consists of two pages, Certification And Additional payments . To build a tariff table, it is not necessary to fill out all the fields on the dialogue pages. Below we will show you how to select the desired table columns. Consider the page Certification . Rice. DialogueTariffication, pageCertification Page Certification consists mainly of three groups of elements − Qualification , Teaching experience And Education and Position . Note. The date formats in the dialog match the format specified in the Control Panel of the computer operating system. You can change the format in Start/Settings/Control Panel/Date and Time. The date format in the examples is: year-month-day. If the length of service is calculated incorrectly, check the system date on your computer.

Let's move on to consider the second page of the dialogue - the page Additional payments . Rice. DialogueTariffication, pageAdditional payments

|

1. General Provisions

1.1. This Industry Tariff Agreement in the housing and communal services of the Russian Federation (hereinafter referred to as the Agreement or OTS) was concluded in accordance with the current legislation of the Russian Federation.

1.2. This Agreement is a legal act regulating social and labor relations and establishing general principles for regulating related economic relations between authorized representatives of workers and employers of Organizations covered by the Agreement, regardless of the form of ownership of the Organizations, general conditions of remuneration, labor guarantees and benefits for employees, as well as defining the rights, obligations and responsibilities of the parties to the social partnership. The agreement is aimed at improving the system of relationships and coordination of interests between employees, government bodies, local governments, employers on the regulation of social, labor and other related economic relations in the housing and communal spheres, as well as increasing the efficiency of work of housing and communal organizations economy (hereinafter referred to as the Organization), for the implementation of socio-economic, labor rights and legitimate interests of workers in this industry.

1.3. Housing and communal services is a type of economic activity aimed at ensuring the livelihoods of the population, creating comfortable living conditions for citizens in their homes and in landscaped areas; Housing and communal services include types of activities, services, works, named in the qualifying characteristics of types of activities in Order of the Ministry of Construction of Russia dated April 27, 2016 No. 286/pr. “On approval of collective classification groups of the housing and communal services industry” (A complete list of Organizations by type of economic activity, services and work in the housing and communal services sector is provided in and to this GTS).

1.4. Housing and communal services organizations are legal entities carrying out the types of economic activities, services, and work specified in and to this Agreement. These Housing and Communal Services Organizations are subject to the Agreement if they join the Agreement in the manner prescribed by current legislation and this Agreement.

1.5. Goals and objectives of the Agreement:

Promoting the reform and modernization of the country’s housing and communal services, maintaining social stability in industry organizations;

Establishment and implementation of social and labor guarantees for employees of Organizations; creating conditions and mechanisms that facilitate the implementation of labor legislation of the Russian Federation in Organizations;

Involvement of employees in the management of the Organization;

Increasing the competitiveness of the Organization, professionalism and qualifications of employees, securing a qualified workforce;

Development of social partnership, initiatives and competition in work teams of Organizations;

Ensuring the interests of the parties to social partnerships in the industry when setting tariffs for housing and communal services, as well as ensuring the interests of organizations carrying out unregulated activities.

In accordance with the social projects of the Russian Federation “Revenues of the state treasury”, “People’s control”, “Personnel for the national economy”, “Quality Mark “Made in Russia”, “For a high social standard”, “Care”, “For decent wages” ", as well as the requirements of the Federal Law "On Independent Assessment of Qualifications" No. 283-FZ of July 3, 2016. and Decree of the Government of the Russian Federation dated June 27, 2016 No. 584 “On the application of professional standards in terms of requirements mandatory for application by state extra-budgetary funds of the Russian Federation, state or municipal institutions, state or municipal unitary enterprises, as well as state corporations, state companies and business companies, more than fifty percent of the shares (shares) in the authorized capital of which are in state ownership or municipal ownership" The Parties to the Agreement participate in solving the following tasks:

Creation and development of an industry-wide system for assessing professional qualifications;

Implementation of professional and public accreditation of educational programs of educational institutions for compliance with their industry professional standards;

Formation of the optimal quality of the composition and number of labor resources necessary for the development of housing and communal services;

Creating conditions for increasing the level and quality of social guarantees for housing and communal services workers, including by attracting socially responsible businesses and other non-state sources of financing;

Increasing the efficiency of the functioning of industry organizations, including increasing labor productivity at the proper level of its quality, the effectiveness of management decisions made and implemented production and investment programs, which are the main factors in maintaining wages at a decent level and the possibility of their growth and guarantees of payment of compensation;

Raising the prestige of the industry, attracting and retaining qualified workers in accordance with the requirements of professional standards;

Formation of justified, transparent and understandable mechanisms for differentiating the levels of regulation of social and labor relations in various Organizations, taking into account their financial capabilities, the situation in regional labor markets, the degree of development of industrial relations in the system of social partnership at the local level; ensuring the interests of the parties to social partnership in Organizations when setting prices (tariffs) for products, works and services of Industry Organizations;

Promoting increased efficiency of Organizations' activities based on the implementation of current legislation and regulatory and technical requirements, the introduction of effective management systems.

1.6. This Agreement is concluded between employers and employees of Organizations represented by their authorized representatives (parties):

All-Russian industry association of employers in the sphere of life support "OOOR ZhKK", created in accordance with the norms of the federal law dated November 27, 2002 No. 156-FZ "On Employers' Associations" (as amended by Federal Laws dated July 2, 2013 No. 185-FZ, dated November 24, 2014 No. 358-FZ, dated November 28, 2015 No. 355-FZ), operating on the basis of the Charter of the LLC LLC ZhKK, OGRN No. 1167700069790 dated November 1, 2016 and registered by the Ministry of Justice of Russia (account No. 7714120011 dated November 9, 2016);

From workers - the All-Russian Trade Union of Life Support Workers (hereinafter referred to as the Life Support Trade Union), operating on the basis of the Federal Law of January 12, 1996 No. 10-FZ “On Trade Unions, Their Rights and Guarantees of Operations”, the Charter of the Life Support Trade Union (registered on August 26, 2010 with the Ministry of Justice Russia (account number 0012110145), certificate No. 278, state register No. 1037739338450 dated January 31, 2003).

1.7. Direct regulation of social and labor relations in Organizations is carried out on the basis of collective agreements concluded in accordance with this Agreement by the parties to the social partnership of the Organizations. If a collective agreement is concluded in the Organization on the basis of this Agreement, the provisions of the Agreement apply to the parties to the social partnership of the Organization in full. Collective agreements concluded in Organizations, as well as regional TSBs, must comply with the legislation of the Russian Federation and this Agreement.

1.8. The Agreement is mandatory for use when concluding collective agreements, regional industry agreements and individual employment contracts for the Organizations to which it applies. Collective agreements in Organizations cannot include conditions that worsen the situation of employees in comparison with the conditions provided for in this Agreement. This Agreement does not limit the rights of Organizations to expand social guarantees to employees at their own expense.

In the absence of a collective agreement in the Organization, this Agreement has direct effect.

1.9. In accordance with the legislation of the Russian Federation, the expenses of employers provided for by this Agreement are taken into account by the federal executive authorities of the Russian Federation, executive authorities of the constituent entities of the Russian Federation, including bodies in the field of state regulation of tariffs for water supply, gas supply, electricity, heat energy, local government bodies when establishing regulated tariffs for housing and communal services, as well as for corresponding services provided by organizations carrying out unregulated activities.

If regulatory authorities establish tariffs for water supply, gas supply, electricity and heat energy, and other housing and communal services without taking into account the expenses of employers provided for in this Agreement, employers have the right to adjust labor costs taking into account existing regional agreements, collective agreements and local regulations acts of Organizations. At the same time, the employer must ensure the level of minimum wage for an employee who has fully worked during this period of working hours and fulfilled labor standards (job duties) is not lower than the minimum wage established by the regional agreement on the minimum wage.

1.10. Organizations in accordance with this Agreement, in order to improve skills and protect the rights of workers in the Industry, organize the assessment and assignment of professional qualifications of workers in the manner established by the Council for Professional Qualifications in Housing and Communal Services, in accordance with the norms of the labor legislation of the Russian Federation, as well as the requirements of the Federal Law “On independent assessment of qualifications” No. 283-FZ dated July 3, 2016 and Decree of the Government of the Russian Federation dated June 27, 2016 No. 584 “On the application of professional standards in terms of requirements mandatory for application by state extra-budgetary funds of the Russian Federation, state or municipal institutions, state or municipal unitary enterprises, as well as state corporations, state companies and business entities, more than fifty percent of the shares (shares) in the authorized capital of which are in state or municipal ownership.”

1.11. Laws and other regulatory legal acts adopted during the period of validity of the Agreement that improve the socio-economic situation of workers complement the effect of the relevant provisions of the Agreement from the moment they enter into force.

1.12. In cases where several Agreements apply to employees at the same time, the terms of the Agreements that are most favorable for the employees are applied.

1.13. This Agreement comes into force on January 1, 2017 and is valid until December 31, 2019 inclusive.

2. Remuneration

2.1. The system of payment and incentives for labor, additional payments and bonuses of a compensatory nature (for work at night, weekends and non-working holidays, overtime work and in other cases) are established directly in the Organizations in accordance with agreements, collective agreements, and local regulations.

2.2. Employers provide:

a) remuneration of employees in accordance with professional qualifications, complexity of the work performed (professional standards), quantity and quality of labor expended, in accordance with this Agreement;

b) tariffication of work and assignment of professional qualifications to workers, specialists and employees according to the current Unified Tariff and Qualification Directory of Work and Professions of Workers, Tariff and Qualification Directory of Work and Professions of Workers in Housing and Communal Services, Qualification Directory of Positions of Managers, Specialists and Employees and/or professional standards, taking into account the qualification level of employees (The list of professional standards approved in accordance with current legislation is given in this Agreement).

c) adoption of local regulations relating to pay and working conditions, taking into account the opinion of the elected trade union body of employees of the Organizations, as well as timely provision of information to employees about the applicable conditions of remuneration;

d) timely conclusion of collective agreements, improvement of standardization and working conditions.

2.3. The minimum monthly wage rate for first-class workers who have fully worked their working hours and fulfilled their labor duties (labor standards) is established in accordance with this Agreement and cannot be less than the minimum wage established by current legislation.

2.3.1. In the event of a discrepancy between the date of establishment of the minimum monthly tariff rate for first-class workers provided for by this Agreement and the date of change in the actual level of tariffs for gas, electricity, heat energy, water supply and sanitation, in accordance with the decision of the Government of the Russian Federation, the employer has the right to synchronize the date of establishment of the minimum monthly tariff rate of a first-class worker with the date of change in the actual tariff level.

2.3.2. Depending on the financial and economic condition of the Organization, the employer has the right to establish a minimum monthly tariff rate in the Organization in an amount exceeding the amount provided for in this paragraph.

2.3.3. The size of the minimum monthly wage rate is the basis for the annual (quarterly) indexation of the wage fund and differentiation of wages for all professional and qualification groups of workers, taking into account the existing industry proportions in wage levels.

If the employer does not have funds to increase wages, the indexation of the wage fund is carried out from July 1 of this year simultaneously with an increase in tariffs for the services provided, based on the size of the minimum monthly tariff rate for a first-class worker, established according to the consumer price index for goods and services for the past quarter.

2.3.4. In order to improve qualifications and protect the rights of industry workers, the employer has the right to organize the assessment and assignment of professional qualifications of workers, as well as the determination of the appropriate tariffs in the manner established by the Council for Professional Qualifications in Housing and Communal Services, in accordance with the norms of labor legislation of the Russian Federation. At the request of the employer or primary trade union organization, any of the parties to the Agreement has the right to send recommendations on tariff schedules and tariff coefficients agreed upon by the parties. The recommended tariff schedule for grading the labor activity of employees and creating a remuneration system in the organization for 2017-2019 is given in.

2.4. The minimum monthly wage rate for a first-class worker is specified by the parties based on the results of the year and is established in accordance with the consumer price index in the Russian Federation based on data from the Federal State Statistics Service.

If regional agreements or collective agreements of Organizations provide for the indexation of the minimum monthly tariff rate for a first-class worker quarterly, then its size can be established in accordance with the recommendations of the Housing and Communal Services LLC and the Life Support Trade Union, adopted on the basis of consumer price indices for goods and services for the past quarter, determined by the Federal State Statistics Service.

If the amount of indexation of the minimum monthly tariff rate for workers of the first category, in tariffs for gas, electricity, heat energy, water supply and sanitation, is established, in accordance with the decision of the Government of the Russian Federation, in a different amount from the consumer price index in the Russian Federation, the employer has the right to challenge the level indexation at the level specified in the tariffs. If the Organization’s own funds are insufficient to fulfill such requirements, the elected trade union body and the employer protocolically approve the agreed upon deadline for the implementation of this provision of the JTC.

2.5. Organizations independently establish a system of bonuses for employees, which, as a rule, takes into account in aggregate:

a) production efficiency and improvement of financial and economic results;

b) absence of accidents and increase in incidents in the reporting year compared to the previous calendar year;

c) no increase in injuries in the reporting year compared to the previous calendar year;

d) absence of fatal accidents at work;

e) timely receipt of the Organization’s readiness passport for the autumn-winter period;

f) absence of violations of production discipline, labor protection and safety regulations;

g) participation in public work and management of the Organization (Article 52, Article 53, Article 46, Article 41, Article 165 of the Labor Code of the Russian Federation).

h) availability of a level of qualification confirmed by a Certificate of Professional Qualification;

i) participation in professional skills competitions.

At the same time, the average monthly salary and remuneration of managers should not exceed eight times the corresponding average monthly salary and benefits for the Organization’s employees.

2.6. Payment for downtime through no fault of the employee is made in the amount provided for by the legislation of the Russian Federation.

If there are financial opportunities, the Organization may provide for payment for downtime through no fault of the employee in the amount of his average monthly salary.

2.7. Employers' expenses for remuneration of employees and other expenses related to labor relations, for inclusion in tariffs, are formed taking into account:

a) expenses (funds) for labor costs;

b) other expenses associated with the production and sale of products and services;

c) costs associated with fulfilling the terms of this Agreement;

d) expenses provided for by other documents regulating relations between employers and employees.

2.8. Expenses (funds) allocated for wages are calculated based on the standard number of employees, taking into account the standard number of newly introduced facilities, and include:

2.8.1. The tariff component of expenses (funds) allocated for wages, which is calculated based on the amount of monthly tariff rates (official salaries).

2.8.2. Compensatory and incentive payments (compensations, bonuses for employees, additional payments, allowances and other payments) included in the funds for remuneration of employees are established by collective agreements, local regulations of the Organization and include:

2.8.2.1 additional payments (allowances) to tariff rates and official salaries of an stimulating and (or) compensating nature related to the work schedule and working conditions - in the amount of at least 12.5 percent of the tariff component of expenses (funds) allocated for wages. This category includes the following additional payments (allowances), payments and payments:

a) for night work - in the amount of 40 percent of the hourly tariff rate (official salary) for each hour of work;

b) for work with harmful and (or) dangerous working conditions - based on the results of a special assessment of working conditions, but not less than 4% of the employee’s rate (salary);

c) for work with a 40-hour work week for employees whose working conditions at their workplaces, based on the results of a special assessment of working conditions, are classified as hazardous working conditions of the 3rd or 4th degree or dangerous working conditions in the amount, manner and under the conditions established by the collective agreement of the Organization; compensation for additional paid leave in excess of 7 calendar days is made in amounts not lower than for days of unused leave;

d) for the traveling nature of the work;

e) for combining professions (positions), expanding service areas or increasing the volume of work performed (for high intensity and intensity of work), performing the duties of a temporarily absent employee without release from his main job are established by agreement of the parties to the employment contract, but not less than 20 percent of the tariff rates (official salary) for the main job;

f) for work on weekends and non-working holidays - no less than double the amount;

g) for overtime work - no less than double the amount or provision of additional rest time, but not less than the time worked overtime;

h) for the management of a team by foremen from among the workers, work producers who are not exempt from their main work - in an amount, depending on the number of people in the team, of at least 10% of the tariff rate (or a fixed amount);

i) additional payment for work according to a schedule with the shift divided into parts - in the amount of at least 30 percent of the tariff rate for the time worked in the shift;

j) in the case of cumulative accounting of working time, remuneration for work on a day off and a non-working holiday in excess of the work schedule of a particular employee is double the amount or, at the employee’s request, another day of rest is provided;

k) payment of time for shift acceptance by employees of Organizations working on equipment operated in non-stop mode;

The specific duration of time and the procedure for its payment are established directly in the Organizations;

l) other payments related to working hours and working conditions, provided for by local regulations, collective agreements, employment contracts, which the employer has the right to attribute to labor costs on the basis of the legislation of the Russian Federation;

2.8.2.2. Compensatory payments for work outside the place of permanent residence or in areas with special climatic conditions, carried out in accordance with the legislation of the Russian Federation:

a) allowances for shift work (in Organizations where it is used);

b) payments related to the provision of guarantees and compensation to employees working in the Far North and equivalent areas, including:

Payments according to regional coefficients and coefficients for work in difficult natural and climatic conditions in an amount not lower than that established by the legislation of the Russian Federation;

Percentage allowances on all wages for continuous work experience in the Far North and other areas with difficult natural and climatic conditions in an amount not lower than that established by the legislation of the Russian Federation;

Expenses for travel of employees and persons supported by these employees to the place of use of vacation on the territory of the Russian Federation and back (including expenses for transportation of luggage of employees of organizations located in the Far North and equivalent areas) in accordance with the procedure approved by the Organization;

Other compensation payments related to work in special climatic conditions and provided for by the legislation of the Russian Federation.

2.8.2.3 additional payments (allowances) of an incentive nature, the amount and procedure for establishing which are determined directly by the Organization, including:

a) personal bonuses to workers for professional skills, increased qualifications and high achievements in work;

b) personal bonuses for managers, specialists and employees (technical performers) for a high level of qualifications that meets the requirements of professional standards;

c) personal bonuses to employees on vacation for high achievements in public work;

d) other incentive payments provided for by collective agreements, local regulations, employment contracts, which the employer has the right to attribute to labor costs on the basis of the legislation of the Russian Federation;

2.8.2.4 bonuses for the main results of production and economic (financial and economic) activities - in the amount established by the collective agreement, local regulations within 50% of the tariff component of expenses (funds) allocated for wages. If there is financial opportunity, the employer can increase the amount of the bonus.

The bonus is calculated on the tariff rate (official salary), taking into account additional payments and allowances in accordance with current legislation, including in accordance with the Decree of the Government of the Russian Federation dated 02.21.90 No. 66/3-138 “On improving the organization of wages and introducing new tariff rates and official salaries workers at the expense of their own funds of enterprises and organizations of housing and communal services and consumer services."

2.8.2.5 based on the results of work for the year based on the results of activities in the reporting period, in accordance with the collective agreement, within 33% of the tariff component of expenses allocated for wages (3.96 official salary for the full year);

2.8.2.6 monthly remuneration for length of service, in accordance with the collective agreement, within 15% of the tariff component of expenses allocated for wages;

2.8.2.7 other types of bonuses for employees, including according to the indicators provided for in this Agreement;

2.9. Additional payments for class to drivers working in gas industry organizations, as well as in other housing and communal services organizations, are made in the following order: first class drivers - no less than 25%, second class drivers - no less than 10%.

2.10. Remuneration for managers, specialists and employees is made on the basis of official salaries established in accordance with the position and qualifications of the employee.

Remuneration for the work of the heads of Organizations is made in accordance with the current labor legislation and other regulatory legal acts containing labor law norms.

A change (increase) in the official salary of a manager is made simultaneously with an increase in the tariff rates of the Organization. Bonuses for the heads of organizations that do not have a profit can be made at the expense of funds for wages attributed to the cost of work (services).

The specific procedure and amount of bonuses are determined by the local regulations of the Organization.

2.11. Wages are paid every half month on the day established by the internal labor regulations of the Organization, the collective agreement, and the employment contract.

2.12. Delays in the payment of wages are not allowed and are a violation of the law, this Agreement and entail the responsibility of the employer in accordance with the legislation of the Russian Federation.

In case of delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until the delayed amount is paid. The time of suspension of work in case of delay in payment of wages for a period of more than 15 days is paid in the amount of average earnings.

It is not permitted to suspend work by employees whose job responsibilities include performing work directly related to ensuring the livelihoods of the population (energy supply, heating and heat supply, water supply, gas supply, solid waste removal), as well as servicing equipment, the shutdown of which poses an immediate threat to the life and health of people.

2.13. The introduction and revision of labor functions, norms and standards, the introduction of new or changes in wage conditions are carried out by the employer in agreement with the elected body of the primary trade union organization within the time limits provided for by collective agreements.

Employees must be notified of changes no later than two months in advance.

3. Working time and rest time

3.1. The schedule of working hours and rest time is established by the internal labor regulations of the Organization.

The normal working hours of employees cannot exceed 40 hours per week.

For employees whose working conditions at their workplaces, based on the results of a special assessment of working conditions, are classified as hazardous working conditions of the 3rd or 4th degree or hazardous working conditions, a reduced working time is established - no more than 36 hours per week.

Based on the collective agreement of the Organization, as well as the written consent of the employee, formalized by concluding a separate agreement to the employment contract, the working hours specified in this paragraph may be increased, but not more than up to 40 hours per week with payment to the employee of a separately established monetary compensation in the manner, amounts and conditions established by the collective agreement of the Organization.

With a five-day work week, employees are given two days off, and with a six-day week, employees are given one day off per week.

3.2. For workers engaged in work with harmful and (or) dangerous working conditions, where reduced working hours are established, the maximum permissible duration of daily work (shift) cannot exceed:

With a 36-hour work week - 8 hours;

For a 30-hour work week or less - 6 hours.

By the collective agreement of the Organization, as well as with the written consent of the employee, formalized by concluding a separate agreement to the employment contract, the maximum permissible duration of daily work (shift) for these employees may be increased, subject to compliance with the maximum weekly working hours established in accordance with parts one - third article 92 of the Labor Code of the Russian Federation:

With a 36-hour work week - up to 12 hours;

For a 30-hour work week or less - up to 8 hours.

The amount, procedure and conditions of compensation cannot be worsened or reduced in comparison with the procedure, conditions and amount of compensation measures actually implemented in relation to these employees as of the day of making changes based on the results of the special assessment (Article 15 of the Federal Law “On Special Assessment of Working Conditions”).

3.3. In Organizations, the suspension of work of which is impossible due to production and technical conditions or due to the need for constant continuous service to consumers of housing and communal services, days off are provided on different days of the week in turn to each group of workers according to shift schedules approved by the employer, taking into account the opinion of the elected body of the trade union organization.

3.4. When, due to the production (work) conditions of an individual entrepreneur, in an organization as a whole, or when performing certain types of work, the daily or weekly wages established for this category of workers (including workers engaged in work with harmful and (or) dangerous working conditions) cannot be met. duration of working hours, it is allowed to introduce summarized recording of working hours so that the duration of working hours for the accounting period (month, quarter and other periods) does not exceed the normal number of working hours. The accounting period cannot exceed one year, and for recording the working time of workers engaged in work with harmful and (or) dangerous working conditions - three months.

If, for reasons of a seasonal and (or) technological nature, for certain categories of workers engaged in work with harmful and (or) dangerous working conditions, the established working hours cannot be observed during an accounting period of three months, a collective agreement may provision should be made for an increase in the accounting period for recording the working time of such employees, but not more than one year.

The normal number of working hours for the accounting period is determined based on the weekly working hours established for this category of workers. For employees working part-time (shift) and (or) part-time week, the normal number of working hours for the accounting period is reduced accordingly.

The procedure for introducing summarized recording of working time is established by the internal labor regulations.

3.5. In addition to the annual additional paid leave provided for by the legislation of the Russian Federation, if financially feasible, employees are provided with additional paid leave on the following grounds:

a) birth of a child;

b) own wedding, children’s wedding;

c) death of a spouse, family members (children, parents, siblings).

The mother (father) or another person (guardian, trustee) raising a child - a student of primary school (grades 1 - 4) is granted an additional one-day paid leave on Knowledge Day (September 1).

The procedure and conditions for granting vacations provided for in this paragraph are established directly in the Organizations.

3.6. Annual additional paid leave is provided to employees whose working conditions at their workplaces, based on the results of a special assessment of working conditions, are classified as harmful working conditions of the 2nd, 3rd or 4th degree or hazardous working conditions.

The minimum duration of annual additional paid leave for the above-mentioned employees is 7 calendar days. Compensation for additional paid leave in excess of 7 calendar days is made in amounts not lower than for days of unused leave.

The duration of the annual additional paid leave of a particular employee is established by the employment contract on the basis of the collective agreement of the Organization, taking into account the results of a special assessment of working conditions.

Based on the collective agreement of the Organization, as well as the written consent of the employee, formalized by concluding a separate agreement to the employment contract, part of the annual additional paid leave exceeding 7 calendar days may be replaced by monetary compensation in the manner, in the amounts and on the terms established by the collective agreement Organizations.

The procedure for providing additional paid leave provided for in this paragraph is established directly in the Organizations.

3.7. Annual additional paid leave is provided to employees with irregular working hours. The duration of vacations is determined by a collective agreement or local regulations and is adopted taking into account the collective agreement and the opinion of the elected body of the primary trade union organization.

3.8. The duration of seasonal work in life support systems of the population is determined by the period of provision of the corresponding services. The peculiarity of such seasonal work is provided for by regional industry tariff agreements and collective agreements of Organizations.

This Agreement establishes a List of seasonal work, which can be carried out during a period (season), which includes:

a) production, transmission and sale of thermal energy (heating period);

b) ensuring the safety of property and equipment for the production, transmission and sale of thermal energy (non-heating period).

The heating period is approved by the executive authorities of the constituent entities of the Russian Federation. Non-heating period - a period of work outside the heating period.

3.9. Organizations celebrate professional days and holidays established by the legislation of the Russian Federation.

4. Labor protection

4.1. Employers provide in the field of labor protection: