Advance from salary: when to pay, how to calculate and how much. DMK

What is an advance payment as a method of payment when hiring?

An advance in labor relations involving new employees can be understood as:

- The first part of the employee’s monthly salary (the second, therefore, is called salary).

Salaries must be paid at least once every half month (Article 136 of the Labor Code of the Russian Federation). As a rule, Russian employers divide it into two parts:

- advance payment (usually paid from the 15th to the 30th of the billing month);

- salary (paid from the 1st to the 15th of the next month).

It is important that the advance and salary are approximately the same. In any case, the advance payment for half a month should not be less than the salary in proportion to the time worked (letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 No. 22-2-709). The same applies to salaries.

- Prepayment for work under an employment contract.

In general, a salary is given to an employee only upon completion of work. But it happens that the employer is forced to transfer an advance payment for labor before the end of the period for which it should be calculated. For example, this is possible if:

- It is accepted in the company that the advance for the reporting month is paid before the 25th day of a given month, salary - until the 10th day of the next;

- The reporting month is December, and in order for the salary to be accurately credited to employees, including newly hired ones, by January 10 - taking into account holidays and weekends, the accounting department transfers the salary in December as an advance payment.

- Vacation pay provided in advance.

Working full time, an employee is entitled to paid leave of 28 days (excluding northern and regional benefits that increase leave) after 1 year of work. But after 6 months of work, the employee has the right to request a vacation, and, moreover, paid for all 28 days - in advance (Article 122 of the Labor Code of the Russian Federation).

Advance as the first part of a new employee’s salary

So, the first scenario is to pay the new employee an advance, represented by the first part of the salary.

If the employer’s local regulations state, for example, that the advance payment is paid before the 25th of the reporting month, and the basic salary - until the 10th day of the next month, then a new employee who comes to work must receive either an advance payment or a salary - on depending on the start date of work.

For example, if a person started working on the 1st, then he will receive the first salary payment only on the 25th. Consequently, the requirement of Art. 136 of the Labor Code of the Russian Federation regarding the payment of wages every half month will not be fulfilled.

It is quite acceptable to issue advances to newly hired employees as separate interim payments - albeit later than the salary, but earlier than the advance “for everyone”, in order to comply with the rule on transferring wages for half a month. But such a payment should not discriminate against other employees (Article 136 of the Labor Code of the Russian Federation), and therefore the rules for its provision must be enshrined in local regulations.

Example

- The procedure for paying wages (Section 3 of the Regulations on Remuneration).

3.1. Salaries at Trading-Consulting LLC are paid:

- 25th day of the current month - for the 1st half of the month;

- On the 10th of the next month - for the 2nd half of the previous month.

3.2. Newly hired employees are paid:

- when starting a job from the 1st to the 14th - on the 15th of the corresponding month;

- for admission from the 15th to the 24th - on the 25th of the corresponding month;

- for admission from the 25th to the end of the month - on the 10th of the next month.

At the end of the first month of work, the employee ceases to be considered newly hired and receives wages in accordance with clause 3.1 of the Regulations.

Don't know your rights?

Advance payment as a prepayment to a newly hired employee

Payment of an advance in the form of prepayment for labor - as a method of calculation when hiring a new employee - for many legal reasons does not correspond to wages, because:

- In accordance with Art. 132 of the Labor Code of the Russian Federation, wages are set based on the “quantity and quality of labor expended.”

Obviously, the “quantity and quality” of work can only be assessed by the fact of its completion. In the case of the advance in question, such an assessment cannot be made.

- In accordance with Art. 136 of the Labor Code of the Russian Federation, when paying wages, the employer is obliged to issue pay slips to employees, which reflect the data on the basis of which wages are calculated. For example:

- number of hours worked;

- level of plan implementation;

- volume of work performed.

If the method of payment when hiring is an advance payment, then the employer will not have the specified information. They cannot be determined even approximately, in the absence of data on the previous performance of the new employee. Departments do not recommend calculating wages without taking into account data on actual time worked and volume of work (letter from the Ministry of Labor dated 08/10/2017 No. 14-1/B-725, Rostrud dated 09/26/2016 No. T3/5802-6-1).

Thus, it is legitimate to say that prepayment for labor is not a de jure salary. But we note that some courts take the opposite position. For example, the Saratov Regional Court, in a decision dated June 27, 2016 in case No. 21-396/2016, indicated that the employer has the right to pay employees earlier than the established deadlines. Moreover, according to the Saratov Regional Court, an advance payment is a privilege that improves the employee’s position in comparison with the provisions enshrined in the law and local regulations.

Advance as prepayment: what an employer needs to know

Taking into account the fact that an advance is still not a de jure salary, the employer should keep in mind that:

- Regardless of the amount of the advance payment, the employer will remain obligated to pay the wages themselves (advance or salary) within the time limits established by the employment contract.

If this is not done, then the Labor Inspectorate may initiate penalties against the employer in accordance with paragraphs. 6 and 7 art. 5.27 Code of Administrative Offenses of the Russian Federation.

- On the advance, which will not be considered as a type of salary de jure, personal income tax must nevertheless be paid.

- For large amounts or regular payments, advances may be assessed by the Federal Tax Service as interest-free loans to employees. Such loans generate material benefits from savings on interest, on which you need to pay personal income tax at a rate of 35%.

In this case, the Federal Tax Service and the court may not take into account the fact that the loan agreement is not drawn up by the parties. In this case, what matters, first of all, is the nature of the relationship between the employee and the employer, which may indicate their actual agreement on interest-free lending (ruling of the Fourth Arbitration Court of Appeal dated December 27, 2012 in case No. A58-4544/2012).

Vacation in advance for a new employee: nuances

Another interpretation of the concept of “advance” involves considering it as a type of vacation payment. It is assigned for the period that the employee has not worked by the time he goes on paid leave by agreement with the employer. For example, if an employee goes on vacation in the same month in which he comes to work.

When providing such a payment, the employer should keep in mind that he can recover vacation pay paid in advance only within 20% of subsequent labor payments to the employee (Article 138 of the Labor Code of the Russian Federation). Moreover, if an employee quits without paying the company for vacation pay, then the employer most likely will not be able to collect the debt from him (decision of the Supreme Court of the Russian Federation dated March 14, 2014 No. 19-KG13-18). The dismissal of an employee may also be due to reasons beyond his control. For example, conscription for military service.

In this scenario, the employer will only have to minimize financial losses by including the amount of the debt in non-operating expenses after recognizing it as hopeless (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation).

Advances to new and current employees: reinforcement in local regulations

The procedure for issuing the three types of advances we considered can be established in the employer’s local regulations, such as:

- vacation regulations;

Issuing an advance in the first month of work - as the first part of the salary - should not raise questions among the inspection authorities in principle, since it is directly intended to meet the requirements of the Labor Code of the Russian Federation for the payment of salaries in half a month. Here, local regulations are drawn up in a way that is convenient for the employer, taking into account the norms of the Labor Code of the Russian Federation, of course.

An advance to a new employee as a prepayment for work, as we noted above, can be classified by the Federal Tax Service and the courts as an interest-free loan. Therefore, when fixing the issuance of such amounts in local regulations, one should avoid formulations that give rise to talk about the systematic nature of such issuance. It can be stated that such advances are issued only in order to meet the requirements of the Labor Code of the Russian Federation for the payment of wages every half month during periods when there is a risk of being forced to violate such requirements. For example, during the New Year holidays, as in the scenario we discussed above.

Vacation pay in advance, which is essentially very similar to prepayment for work, may well become the object of close attention from the Federal Tax Service and, by the will of the department, are classified as the same interest-free loans. Therefore, issuing them systemically would not be the best solution here either. We need criteria that justify the possibility of providing vacation pay in advance depending on the situation, for example, for achieved results in work (confirmed by corporate award acts).

An advance in an employer’s relationship with a new employee (in many cases, with current employees) can be understood as an advance payment for work, the first part of the salary, vacation pay for the unworked period. The procedure for paying all types of advances is established in the employer’s local regulations.

At the DMK, workers protested against delays and non-payment of wages

Today, at about one o'clock in the afternoon, people began to gather in the square near the monument to Prometheus. It was the workers of several DMK workshops who were going to protest against wage delays.

The action was announced on social networks. According to those gathered, they expected at least more than two hundred people to come - at least, that’s how many users supported it. But only a little over ten arrived. Some came with children. Perhaps people were just afraid...

As one of the participants in the action, Evgeniy, an employee of the DMK long-rolling shop, told the correspondent (none of the participants in the action wanted to give their names), they were going to protest against the systematic delays in wages at the plant, which began in the middle of last year. The last time people were paid an advance was on December 28, today it is January 14, and there is still no salary for December, although it should have been paid before the 10th. And in a week they should already receive an advance payment for January.

People were also outraged that salaries began to be paid in installments. Either they will split it into two parts, or into three.

“I have a thousand hryvnia in advance and one and a half thousand in salary,” the woman, a blast furnace shop worker, was indignant. - So they split my pay into 4 parts. Is it normal?

But most of all, people were outraged by the fact that none of the managers explained to them the reasons for the delays.

Our workshop operates stably, products are shipped daily,” says Evgeniy. - So why are salaries not paid on time? They tell us that now is a difficult time, there is a war going on, and that’s why there is no money. Before the New Year, the plant received 250 million hryvnia in VAT. So this money was spent on the purchase of metal. How should we live? How to pay for bank loans and utilities? What to feed children, finally? Look, many workers are forced to walk to the plant - they save money. Therefore, we will now go to the plant management and demand a meeting with management. Let them answer clearly when we receive the money.

And the people went to the DMK plant management and asked the guards to call someone from the management. At first the guards refused, saying that it was the height of the working day and everyone was busy. And if people have complaints, let them put them in writing. According to one of the security guards, his salary is also being delayed. But he endures and is not indignant.

But then Konstantin Nesvet, director of production and supply of products, Anatoly Polivoda, director of personnel, and other managers left the plant management. According to them, the director of the DMK promised that the money would be paid next week. Fortunately, one of these days the receipt of money for metal is expected from exporters.

When asked how long the delays in wages would continue, the managers said that the company was now going through hard times due to the war and the crisis. That the state owes them 235 million to the plant, and it is unknown when it will return it. That all raw materials for the plant from the fall must be purchased only by prepayment. Therefore, there will be problems, although the management is trying, there are no large delays in salaries at DMK. They are even delaying the launch of the third blast furnace in order to pay people their salaries. As for information, from now on people will learn about all salary delays in a timely manner - at shift meetings, which will be regularly held at the plant starting from January 20. They also promised to help people in resolving issues of loan payments and utility bills.

Participants of the action also asked: are there any plans to lay off people at the plant? In any case, there are a lot of rumors about this. The managers reassured that there would be no layoffs. They also assured the protesters that none of them would be fired or persecuted.

That's where we parted ways. People were left with an ambivalent impression of the meeting: they seemed to promise money, but the prospects were still vague... And people also didn’t like the fact that their entire conversation with the management of the plant was filmed by a man.

Our Reporter

This article was automatically added from the community

Today there was a meeting between the management and the trade union activists of the enterprise.

The meeting was attended by General Director Vyacheslav Mospan, his first deputy Alexander Podkorytov, chairman of the Metallurgists trade union, city council deputy Oleg Nagorny, deputy head of the Metallists trade union Valery Sevastyanov, and other top officials of the plant. The city government was represented by the first vice-mayor Alexander Chernyshov.

Opening the meeting, Mospan explained the situation at the enterprise. The plant was stopped on March 30, then it was expected that in a matter of days the state would return the value added tax (VAT), after which it would start working again. However, VAT arrived only at the end of April, by which time the plant’s accounts were frozen, as debts had accumulated on taxes, energy, lawsuits, and so on. As of June 1, the state returned 1.3 billion hryvnia of VAT, but most of these funds were used to pay off the above-mentioned debts. Today, in order to put the plant into operation and not accumulate losses, it is necessary to operate 3 blast furnaces; funds in the amount of 100 to 150 million dollars are needed, Mospan noted. Now the shareholders of the enterprise are occupied with this problem, the issue will be resolved and the plant will start operating, although it is not yet known when this will happen, Mospan admitted. Therefore, the main thing today is to retain personnel, save equipment and be ready for launch, says the General Director.

As representatives of senior management reported, repairs and maintenance of equipment are currently being carried out; in order for the blast furnace shop to fully reach its design capacity, it will take at least 40 days. An alarming picture was voiced by HR Director Anatoly Polivoda: in recent months, about 750 people have left, and mostly competent, experienced specialists are leaving. There is a risk that this trend will continue, so Polivoda called on the heads of workshops and structural divisions, as well as the production committees of both trade unions, to decide who else might leave and report this to the personnel department. We are ready to hire both those who left earlier and new people, noted the HR director. He denied rumors that allegedly from August the entire team would be dismissed on vacation at their own expense. There was also good information in his speech - despite the difficulties, the shareholders decided not to close the children's camp “Forest Fairy Tale” (formerly “Dzerzhinets”), although it will accept only 2 shifts. Already on June 29, the first shift - 595 children of metallurgists - will come to rest, Polivoda assured.

Alexander Chernyshov noted that due to the shutdown, the financial situation in Dneprodzerzhinsk is really difficult: in order to prevent budget “failures,” the city in March took out a loan from the State Treasury in the amount of 6.6 million hryvnia, and will now take another one in the amount of 28 million. There is a threat that in a month there will be no money in the budget either for salaries of doctors and teachers, or for the repair of roads, schools and hospitals, or for social programs at all, Chernyshov noted. Therefore, on Friday a letter was sent to the owners, the Industrial Union of Donbass Corporation, and today or tomorrow a similar letter will be sent to Prime Minister Vladimir Groysman.

Summing up the meeting, Vyacheslav Mospan promised that, together with the city authorities, the directorate will solve the problem of temporary employment of metallurgists and relief in utility bills, and the directorate will also look for the possibility of additional payments for the lowest-income workers of the plant and transfers to trade union committees for the improvement of workers’ health. It was decided to hold a similar meeting next week, where the management will report on what has been done and discuss with trade union activists further measures to preserve the enterprise.

The procedure for paying salaries is determined by law. From this article we will learn how to calculate an advance and whether it is mandatory for an enterprise to pay an employee his earned money twice a month.

Currently, such parts of the salary are called advance payments. That is, the advance is the part paid before the end of the month, and the salary is the part paid at the end of the month.

How much salary advance should be established and within what period should it be paid?

There is an article of the Labor Code of the Russian Federation stating that salaries are paid every half month, that is, wages are paid in installments.

But not a single article of the Labor Code contains a definition of “advance”. Because this is the salary, only for the first half of the month. That is, the employee is given wages for the first half of the month, then for the remaining two weeks.

The rules for paying wages must be specified in limited documentation of the enterprise, for example:

- Labor regulations instructions.

- Collective agreement.

- Employment contract.

Dates of issue

Is it acceptable to calculate payroll, for example, four times a month? Many people say no. But this is actually not the case. Salaries can also be paid daily. The Labor Code defines only the minimum requirements, no less than twice a month. And there are enterprises where they issue two advances.

The year 2016 was significant for the introduction of an amendment to the Labor Code of the Russian Federation, which concerned the date of payment of wages.

What determines the payment date?

A specific date for the payment of earnings is provided for by the labor regulations of the enterprise, a collegial agreement or an employment contract, no later than fifteen calendar days from the end of the period for which it was accrued.

According to this amendment, the following conclusion can be drawn: the payment of the second part of the salary, that is, the final payment, must be no later than the fifteenth day of the coming month. For example, earnings for February must be paid no later than March fifteenth.

But this is the final calculation. According to the rules, salaries are paid no less than every two weeks of the month. Accordingly, the advance payment for the first half month is paid no later than the last day of the month.

It follows that the terms for payment of advance payments and wages as a result of recent changes in legislation are strictly approved. The period between these payments is approximately fifteen days, that is, half a month.

Labor legislation has not established specific payment dates. The Code only limited the deadlines and indicated that the date is set by the enterprise.

Why is it necessary to set deadlines for paying salaries?

Establishing deadlines for advance payment of wages protects both the rights of the employee and the rights of the employer, according to regulatory services and judicial practice. Employees of Rostrud advise in oral explanations to indicate the middle of the month, the fifteenth or sixteenth day.

But also, if you provide for a different date for issuing the advance, this is not considered an error. The main point here is the date on which the advance and salary are issued according to the internal documentation of the enterprise.

Opinions on the timing of advance payments

The opinion of the Ministry of Health and Social Development on the deadline for issuing an advance payment, which falls at the end of the month, contradicts the provisions of Article 136 of the Labor Code of the Russian Federation. In this case, how to calculate the advance? If the employee starts work on the first day, the first advance will be paid to him on the twenty-fifth of the current month. This means that the indication of the article of the Labor Code of the Russian Federation on the payment of wages no less than every two weeks of the month will not be observed. Such opposition was noted in one of the letters from the Russian Ministry of Health and Social Development.

Judges support similar opinions. In their opinion, the advance must be issued in the middle of the month; the fifteenth or sixteenth day will be optimal, depending on how many days there are in the month (thirty or thirty-one). There are court decisions at the regional level.

What should you pay attention to?

Please note that the dates for issuing advance payments and salaries are specific numbers, not periods of time. In one of the letters from the Ministry of Labor, officials examined a situation where an enterprise, in employment contracts or wage regulations, provided for intervals rather than specific dates for payment of wages.

For example, an advance is issued from the 15th to the 20th of each month, and wages are issued from the 1st to the 5th of the next month. According to the Ministry of Labor, these are incorrect definitions. Here the employer does not guarantee compliance with the frequency of half a month.

A similar provision is spelled out in a letter from Rostrud.

Documentation indicating the date of payment of wages

In what documentation should the dates of advance payment and salary be recorded? The Labor Code specifies instructions for internal labor regulations, collegial or employment contracts. Is it necessary to write down dates in each document or will it be enough to indicate them in one of them? Until 2016, there were two versions of this controversial issue:

- The days for the payment of earnings are established in the instructions of the labor regulations, collegial agreement (if any) or employment contracts with employees (letter of Rostrud 2014).

- The days for issuing wages for labor are allowed to be established in any of the specified documents (letter of Rostrud 2012). The most suitable document is considered to be the Internal Labor Regulations.

Advance calculation rules

According to the definition of the Labor Code of the Russian Federation, the concept of “advance” does not exist in labor legislation. This is the portion of the salary paid for the first half of the month.

Based on Article 423 of the Labor Code, regulatory decrees of the USSR are still used only if they do not contradict it. There is a decree of the Council of Ministers of those times in 1957 “On the procedure for paying wages to employees for the first half of the month.”

It will not contradict the Code. And it indicates what percentage of the advance payment is calculated on the employee’s salary for the first half of the month. It is provided for by agreement between the employer and the trade union and is specified in the collective agreement.

What should be the minimum advance amount?

The minimum amount of the advance cannot be lower than the employee’s established rate for actual hours worked.

Accordingly, the employer, when paying wages (advance) for the first two weeks of the month, must take this requirement into account and count the time actually worked.

The applicability of the requirement for current enterprises was highlighted by Rostrud in its letter in 2006, “Calculation of advances on wages,” which states how to calculate an advance.

There is also a letter from the Ministry of Health and Social Development from 2009, which notes that salary payments for every two weeks of the month should be approximately the same amounts.

The conclusions in this case will be as follows:

- The minimum amount of earnings for the first six months must be no less than the employee’s certain rate for the time actually worked.

- The amount of the salary advance is not calculated symbolically, but taking into account the actual time worked, so it will be necessary to write and fill out schedules half a month before the accrual.

What is 40% salary advance?

Let's answer the question about the advance - what percentage of the salary goes towards issuing it? Often the salary is a component of the salary. Therefore, when calculating the amount of the advance, it is necessary to take into account other parts of the monthly income: additional payment and allowance for working conditions, performance of additional work, combining positions, replacing a temporarily unemployed employee. It turns out that the employee worked for half a month and can demand similar payments.

Awards and incentives do not affect the amount of the advance. This is indicated in a letter from the Russian Ministry of Health and Social Development in 2009. As a rule, the results of the work performed are the basis for awards, and this becomes clear from the results for the month. This also applies to the percentage of wages.

So how to calculate an advance? Where does the famous 40% come from? The labor legislation does not stipulate the exact amount of the advance; therefore, the question of the percentage of the advance is awkward. However, you cannot pay less than 40%.

The Labor Code speaks specifically about the calculation of wages; accordingly, the amount of payment for the first weeks of the month should be equal to the employee’s effort. If we subtract 13% from the full salary of 100%, personal income tax will remain 87% of the salary. Half of this amount 43.5% with other allowances is allowed to be rounded to 40%.

If the employer sets the amount of the salary advance less, this is already a direct violation of labor laws.

Accounting for holidays

The advance can be calculated for the time worked, taking into account weekends and not taking them into account. This is the employer's choice.

If the manager decides not to take into account weekends and holidays, then the wages accrued for this time will need to be divided in half.

The formula for this calculation is:

A = (Ok + D/N) / 2,

here A will be an advance payment, Ok will be a salary, D/N will be the amount of additional payments and allowances.

And if the employer takes into account only working days, then:

A = (Ok + D/N) / NRVm × NRVp/m,

where НРВм - will be the standard working time established for a month of work; NRWp/m - standard working time established for half a month of work.

How to correctly calculate a salary advance?

In order to avoid risk, the amount of the salary advance is determined by the results of calculations, and is not a fixed percentage.

If an employee is hired from the second half of the month, during the period of payment of the advance (for example, the employee is hired on the eighteenth, and the advance is paid on the twentieth), this employee does not receive an advance, since he has not worked the first half of the month.

It is believed that employees have their own income, such as their salary in the latest monthly numbers. Accordingly, salary advances should be calculated only in timesheets. There are no accrual entries in accounting until the end of the month.

Calculation example

Suppose an employee receives a salary of 20 thousand rubles. There are 21 working days in October, and on October 9 and 10 he took 2 days off at his own expense. Based on the results of his work, he was awarded a bonus of 4,000 rubles.

Let's calculate the advance. It is necessary to analyze the time sheet from the 1st to the 15th. We get a total of 11 working days, of which two days were spent on time off. So, we divide the salary by working days. We get paid a day. Then we multiply this number by the ones actually worked. As a result: 20000/21 * 9 = 8571.43. This amount will be an advance payment. There are no taxes or fees.

Let's calculate the main part. 20000/21 * 19 = 18095.24-8571.43 (advance) = 9523.8 + 4000 (premium) = 13523.8. To calculate the tax: 13523.8 + 8571.43 = 22095.23 * 13% = 2872.32

The payout will be: 13523.8 - 2872.32 = 10651.42. When calculating, you need to remember standard tax deductions, if any.

Reflection of advance payment in accounting department

The postings when calculating the advance are similar to the postings when issuing salaries:

Debit 70 - Credit 50.51

That is, after an employee receives an advance on wages, this forms a receivable (debit 70), which is repaid during the period of receiving wages on the last days of the month.

Therefore, they do not issue pay slips for advance payments. Employees are given them once a month during the period of payment of salaries for the second half of the month.

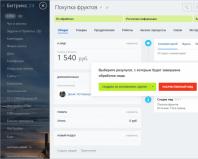

Calculation and payment of advance wages is carried out in the 1C program. The advance payment is not considered a tax accounting expense.

The payment of advance wages is documented with the same documentation as the issuance of the final payroll. The list of documentation that needs to be collected depends on the method of issuing funds:

Contribution and tax on salary advance

When paying an advance to employees in cash, a pay slip is drawn up in Form No. T-53 or an expense cash order in Form No. KO-2. Since it is paid for half the month, there is no need to prepare a payslip in form T-49. It is used to account for deductions, accruals and payments for a full month.

When an advance is credited to an employee’s bank card, the payment order indicates in the payment functions “Issue of salary for the initial half of the month.”

Since the advance is considered earnings for the first half month, the question arises: is it necessary to calculate and withhold personal income tax from it, and calculate and transfer the insurance premium? The Treasury explained this point in its 2008, 2012 and 2013 letters. There was a letter from the Federal Tax Service on this issue in 2014. There is also a Resolution of the Presidium of 2012.

Based on the article of the Tax Code of the Russian Federation, the date an employee receives a salary for a month is in fact the final day of the month for which it was accrued. Accordingly, during the period of payment of income for the first two weeks of the month there is no personal income tax.

A correspondent for the Znamya Dzerzhinki newspaper met with the victim, and this is what he said:

On February 17, my place of duty was the access turnstile in the plant management, in other words, checking the passes of all persons entering and leaving the building. I saw four people enter the lobby of the building, one girl and three men. They were talking about something with the senior inspector, the assistant head of the security department and the deputy head of the department. No words were heard, but with peripheral vision I saw that they were clearly annoyed and were behaving rudely. Then these visitors began to fill out some paperwork. After a while, one of them took out his mobile phone and began filming the faces of the plant workers with the phone’s video camera. Although filming on the territory of a sensitive facility (and the plant’s management building is the territory of the enterprise) without the consent of the plant’s management and without presenting the relevant documents is prohibited. Then the same man, taking some kind of ID out of his pocket, waving it and muttering something indistinctly, moved towards me. Behind him are two others. I had to keep them all in sight; I couldn’t be distracted by trying to see the document, and the visitor quickly hid the ID. Coming close to me, he began to demand that I let him through. I asked for a pass and explained that, according to the instructions, I did not have the right to let an unauthorized person through. Since the person who applied was clearly “in a cocked state,” just in case, I grabbed the turnstile posts with my hands, blocking the passage behind the fence with my body. As it turned out, it was just in time - he began to grab my hands, first the right, then the left, trying to tear them away from the turnstile post. Then he put his hands on my chest, trying to push me inside, over the fence. Blocking his path, I watched with my eyes the second visitor standing half a meter behind the attacker. I didn’t see the blow to my leg, but only felt a sharp pain in my knee, but since I’m not the timid type, I simply gritted my teeth and clenched my hands tighter on the turnstile. He continued to stand. And literally immediately I heard the attacker scream: “He hit me, he broke my leg!” Although everyone saw that I didn’t even move. That is, the visitor was clearly playing for the audience, seeing that the operator of the “Banner of Dzerzhinka” was videotaping what was happening. I responded by saying: “It wasn’t I who broke your leg, but you who injured my leg.”

Then he limped away and began calling the police. By the way, he left the building no longer limping, having apparently forgotten that he had a “broken leg.” In parallel with the police squad, an ambulance team arrived, which my colleagues called for me. And already at the city department, when I testified about the incident, the police reported that the attacker had filed a statement that I had seriously injured him.

Well, it’s quite obscenely staged on both sides... By the way, how interesting... Once upon a time, one of my friends was suspected of bringing alcohol into the territory of a factory, so five of them flew out of the back room!!! They screwed up great then... :sarcastic_hand: And here is the poor guy, one for three... A fairy tale and nothing more! By the way, what did the senior inspector and assistant head of the security department, together with the deputy head of the department, do? Have you looked at this circus? It's clearly a staged production.

The doctors’ diagnosis regarding the injury received by Vitaly Gorchak in the performance of his official duties is as follows: “Bruise of the left knee joint, hemorthrosis.”

I just don’t understand how they could inflict such an injury on him if he was standing behind the turnstile? And in theory, the lower part of the turnstile should have prevented both him from hitting and his opponent from inflicting any serious injury on him.

There is clearly overplay on both sides!

This involves serious treatment, temporary disability and as yet unpredictable consequences. Moreover, the next day, February 18, doctors discovered fluid in the joint capsule and were forced to perform a puncture.

According to treatment standards and clinical protocols,” commented the head of the plant’s medical and preventive work service, Viktor Karpenko, “treatment of such patients is carried out for 4-5 weeks, depending on complications.

Already on Friday, February 19, a meeting of the commission to investigate this accident was held at the metallurgical plant.

Since an employee of the plant was injured in the performance of his official duties, and injured with loss of ability to work, on the basis of the “Procedure for the investigation and recording of accidents, occupational diseases and accidents at work” at the plant, by order of the enterprise, an accident investigation commission was appointed, which within 3 days is obliged to consider all the circumstances, identify the causes and determine those responsible for what happened, - the chairman of the commission, head of the labor protection service Alexander Romanenko told the editorial board of ZD.

Having considered the circumstances of the incident, having studied the explanatory notes of witnesses and having read the testimony of the victim himself, the company’s standard regarding the list of persons who have the right to freely enter the territory, and the job description of the UOC inspector, the commission determined the cause of the accident to be “injury due to the unlawful actions of other persons.”

Based on the results of the accident investigation, the commission prescribed two measures:

Send the investigation materials for action to the Zavodsky regional department of the Ministry of Internal Affairs of the city of Dneprodzerzhinsk;

By order of the plant, familiarize the workers of the enterprise with the circumstances and causes of the accident.

Regarding the last point, members of the commission commented on the situation as follows: “For a long time, this is the first order based on the results of an investigation into an accident when we do not have the right to bring to justice those responsible for the incident. We think that the competent authorities will take care of this in the very near future.”

Anna Sidorova, based on materials from the newspaper “Znamya Dzerzhinki”

Hmmm... If some hard worker from the DMK received such an injury somewhere at the factory, 100% would try to hush it up and transfer it to a household injury or blame it on the worker.