Application for registration of individual entrepreneurs. Form P21001

- Form P21001 Download the form for free

- Form P21001 Download sample filling

- Form P21001

Form P21001 (application for registration of an individual entrepreneur) submitted to the state tax authority to open an individual entrepreneur. The requirements for filling out P21001 are specified in Appendix No. 20 to Order No. ММВ-7-6/25@ dated 01/25/2012 and the form must fully comply with them.

Registration will be quick and the first time if you follow simple recommendations:

- The application can be filled out either on the computer or by hand with a black pen.

- P21001 is notarized only if an individual submits documents under a power of attorney from the applicant.

- Application P21001 is not stitched.

- Form P21001 contains 5 sheets, but for a citizen of the Russian Federation only 4 are filled out.

Form No. P21001 doc is not officially distributed online, because has a table format: the document is divided into many fields to be filled out. Most often, you will find the P21001 form in exl files (opened by MS Excel) or in pdf (to be filled out manually).

We looked at how the P21001 form looks and is filled out; you can download the form and sample for free in this article. If you have any questions, ask them in the comments: we don’t delay in answering! Thank you, and don't forget to follow our new posts:

Application for registration of an individual entrepreneur as an individual entrepreneur in the form P21001, updated in connection with the transition of the tax inspectorate to the new OKVED classifier.

The application can be downloaded from the link below and filled out on a computer, or printed and filled out with a pen and black ink. A sample of filling out an application for individual entrepreneur registration is attached, we also recommend that you read .

- Download the application for registration of individual entrepreneurs, form No. P21001

- Download a sample of filling out form No. Р21001

- Download the application for transition to a simplified taxation system

- Download a sample of filling out a notice of transition to a simplified system

Requirements for filling out an application using the new form No. P21001 for state registration of individual entrepreneurs

- In section 1 “Last name, first name, patronymic of an individual,” paragraph 1.1 is filled out both in relation to a citizen of the Russian Federation and in relation to a foreign citizen or stateless person. In this case, in relation to a foreign citizen or stateless person, the section is filled out in accordance with the residence permit or temporary residence permit. Clause 1.2 is filled out in addition to clause 1.1 by a foreign citizen or stateless person if the relevant information is available in the identity document in accordance with the legislation of the Russian Federation. For citizens of the Russian Federation, paragraph 1.2 cannot be filled out.

- Section 2 "TIN" is filled out if you have a TIN. If you have not assigned a TIN number, leave this item blank; the tax office will automatically assign you a TIN.

- In section 3 “Gender”, in the field consisting of one familiar place, the corresponding digital value 1 or 2 is entered.

- Section 4 “Birth Information” indicates the date and place of birth of an individual; clause 4.2 is filled out strictly as indicated in the passport.

- In section 5 “Citizenship” for citizens of the Russian Federation we put in field 1. For foreign citizens we indicate the value 2 and fill out paragraph 5.1, which indicates the digital code of the country according to the All-Russian Classifier of Countries of the World OK-025-2001.

- Section 6 “Address of residence (stay) in the Russian Federation” provides information about the address of residence in the Russian Federation.

- In clauses 6.3 - 6.6, the type of address object is indicated using an abbreviation as required.

- For the cities of Moscow and St. Petersburg, subparagraphs 6.3 - 6.5 are not filled in, exceptions: Zelenograd, Troitsk, etc.

- In paragraphs 6.7 - 6.9, the type of address object (house, apartment, building, building, etc.) is indicated in full

- In section 7 “Identity document data” for citizens of the Russian Federation, put code 21 in paragraph 7.1 and then fill in according to the passport. Clause 7.4. fill out strictly as indicated in the passport.

- Sheet A “Information on codes according to the All-Russian Classifier of Economic Activities” should be filled out using the codes of the new OKVED-2 classifier. In section 1 “Code of the main type of activity” and 2 “Codes of additional types of activity” at least four digital characters are indicated. Codes for additional activities are indicated in ascending order from left to right.

- In Sheet B, fill in contact information (telephone and E-mail), you also need to indicate the method of obtaining documents by indicating the appropriate value from 1 to 3. You must indicate the full name and signature of the applicant in pen when submitting documents, directly to the inspector or in front of a notary.

Assistance in registering individual entrepreneurs

The rules for registering an individual entrepreneur are simple at first glance, but there are a large number of subtleties in the preparation of documents, without which the registration authority will refuse registration. As a result of refusal, the state duty is lost, the documents are not returned and the wasted time is lost.

To save personal time and money spent on paying state fees, contact the professionals at BUKHprofi for help. The company’s employees will quickly prepare the required documents, register you turnkey and with a guarantee as an individual entrepreneur, make a seal, complete the folder with the required documents and open a current account in one of the partner banks on favorable terms. The cost of registering an individual entrepreneur in Moscow on a turnkey basis, including state fees, printing and opening a current account in partner banks is - 4,800 rubles.

To register you need download the form , fill out and send to us. Next, employees will select the required OKVED codes, fill out an application for registration and an application for simplification, agree on all the details and arrange a meeting.

A taxation system such as the unified tax on imputed income (UTII) presupposes a form of tax regime where tax is paid on the amount of imputed income established by a formula, and not on actual profit.

You should send an application for registration under UTII for individual entrepreneurs for 2020 when registering no later than 5 working days from the moment the taxation procedure begins to be applied to a newly registered individual. This fact must be notified to the tax authority territorially authorized to carry out actions at the place of residence of the individual entrepreneur within the specified time frame, otherwise the individual entrepreneur will be assigned a general tax regime.

The tax authority, within the established five-day period from the date of receipt of the application from the individual entrepreneur, issues a notice of registration as a UTII tax payer. The start date of the UTII taxation system is the date recorded in the application for registration.

Limitations when choosing UTII as a taxation system for individual entrepreneurs

In the listed cases, the entrepreneur does not have the legal grounds provided for by the Tax Code of the Russian Federation (based on Article 346.26) to submit an application to register an individual entrepreneur as a UTII taxpayer:

- The working district in the territorial affiliation of the registration of the applicant running a business does not support the maintenance of a tax reporting system for UTII at the legislative level for the declared type of activity;

- The company's staff exceeds 100 people;

- Providing rental services for the transfer of gas or gas filling stations;

- Carrying out work under a partnership agreement or under an agreement for trust management of property;

- An individual entrepreneur working in the field of service and catering has a customer service hall area that exceeds the permissible indication - 150 sq. m.;

- An individual entrepreneur engaged in transportation of passengers and cargo has more than 20 vehicles on staff;

- An individual entrepreneur, carrying out work activities for the accommodation of guests and the accommodation of tenants, provides for rental use real estate, the area of each of which is more than the permissible 500 square meters. m.

Non-compliance with the conditions for assigning UTII for the entire period of work may serve as a valid reason for filing a claim with a judicial authority for deliberate violation of legal actions in the taxation system from a regulatory authority on the basis of an external inspection.

Other restrictions on work activities under the UTII taxation system are imposed on the management structures of municipal, city and federal districts. The current restrictions are specified in local legal acts, which can be found on the official website of the Federal Tax Service.

Transition to UTII when registering an individual entrepreneur

Submission of an application from a potential taxpayer for registration under the UTII system is carried out on the basis of a certificate of state registration of a new individual entrepreneur. A one-time choice of the UTII taxation system with the submission of documents for registration of individual entrepreneurs is not correct and is subject to refusal.

Before switching to UTII when registering an individual entrepreneur, it is necessary to fully prepare the working platform, not just on the basis of the title documentation assigned at the time of the official start of work, but also with the stipulated organization of work on the basis of a rental agreement for premises or a contract for hiring the first employee. These events certify the fact of the start of business activity.

Peculiarities of conducting business as an individual entrepreneur in the imputed taxation system

If the activities of the individual entrepreneur are already carried out, then It is possible to switch from another taxation system to UTII only on January 1 of each accounting year. There is no requirement to notify the tax authority of your intentions in advance.

With the UTII system, it is possible to register a combination of taxation regimes when conducting an additional type of activity that is not subject to imputation registration on the basis of the Tax Code of the Russian Federation.

In parallel, it is recommended to register tax accounting using the second system - the simplified tax system, the notification of assignment of which is submitted in a separate manner, along with the application for the transition to imputation. In the future, this operation will relieve the burden of submitting general reporting, but if an additional type of activity generates income, otherwise, it will be enough to limit yourself, within the framework of correct taxation, to submitting an annual zero declaration under the simplified tax system for the accounting period along with a declaration under the imputed system. Two combined types of taxation serve to simplify the process of filing tax reports.

Filling out an application for UTII for individual entrepreneurs

The application form for approval of tax registration of an individual entrepreneur as a payer of a single imputed tax is established by the federal tax inspectorate.

Based on acts of the Tax Code of the Russian Federation, the use of the imputed income taxation system is established until January 1, 2018. The legislative act on extending the use of the UTII taxation system came into force until 2021, which is evidence of the absence of changes on this issue. But this fact does not exclude the possibility of changes to the application form for registration under the imputed system (UTII-2) and the format for filling out the application itself.

All adjustments introduced by the tax law system should be monitored.

The registration copy of the entry must be completed in the strictly specified form. It is suggested to follow the links below to familiarize yourself more thoroughly with the material:

Sample of filling out the UTII-2 form for individual entrepreneurs

Application for state registration of an individual as an individual entrepreneur.

Service for preparing documents for registering LLCs and individual entrepreneurs,

as well as the documents themselvesare provided absolutely

free in any quantity and without any restrictions

Form P21001

The new form P21001 of the application for state registration of an individual as an individual entrepreneur was introduced by order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/25@ and came into force on July 4, 2013.

A sample of filling out an application for registration of an individual entrepreneur can be found below.

Requirements for registration and completion of the new form 21001

Please note: from April 29, 2018, the applicant must indicate his email address in the registration application. Documents confirming the fact of registration (USRIP or Unified State Register of Legal Entities, charter with a mark from the Federal Tax Service, tax registration certificate) are sent by the inspectorate not in paper form, as before, but electronically. Paper documents, in addition to electronic ones, will be available only upon request of the applicant.

Among all the innovations introduced into Form 21001, the following should be noted:

- The new form 21001 is focused on machine readability, therefore:

- all letters and numbers are written in special cells

- all letters must be capitalized

- the size, type and color of the font for filling out form 21001 are strictly regulated

- rules for abbreviations for documents, regions, location names, countries, etc. are specified.

- Re-filling of previously entered data is minimized

- barcodes added

- the rules for filling in gaps, hyphens, and lines are strictly defined

- rules for aligning letters and numbers for all fields are defined

- OKVED codes are entered into the new form starting with 4-digit numbers, and unlike the old form 21001, the names of the codes are no longer indicated

- TIN of individuals, if available, must be indicated

- a field has been introduced into the new form to indicate the method of receiving documents on state registration: in person by the applicant, by the applicant or an authorized representative, by mail

You can find a complete list of innovations in the article "".

Examples of filling out form 21001

Sample of filling out an application for state registration of individual entrepreneurs you can find it by following the links:

- Sample of filling out form P21001(PDF)

Taking into account the innovations in the new application form, we recommend that you fill out the application either in special software or using our service:

Service for preparing documents for registering LLCs and individual entrepreneurs, as well as the documents themselves

are provided absolutely free of charge in any quantity and without any restrictions

In any case, check your documents with the sample application for individual entrepreneurs. And to reduce the possibility of error to zero, our users can now use the service free document verification for business registration by 1C specialists:

Since 2019, applicants who submit documents for individual entrepreneur registration through the Federal Tax Service website or the government services portal are exempt from paying state fees (Article 333.35 of the Tax Code of the Russian Federation). However, this is only possible with an enhanced qualified electronic signature.

A notice of registration of an individual entrepreneur is a document confirming the fact of registration of an individual with the tax authority as an individual entrepreneur. A sample is presented in image 1. It is compiled by the Federal Tax Service according to form 2-3-Accounting, approved by the Ministry of Finance of the Russian Federation. The document indicates the person’s full name, registration address, TIN, date of registration, OGRNIP.

From the date specified in the notification, the person becomes an individual entrepreneur taxpayer.

What changes after this? Citizens of the Russian Federation do not calculate the amount of taxes. When paying personal income tax, all calculations are made by employers. They also prepare and submit all reports to the tax authorities. For land, transport and property taxes, the Federal Tax Service determines the amounts to be paid and sends out notices to people demanding that they make mandatory payments.

After a citizen has become an individual entrepreneur, all income tax calculations are carried out by the entrepreneur himself, and also submits reports to the Federal Tax Service within the time limits regulated by current legislation.

A businessman must register not only with the tax authorities, but also with the Pension Fund and the Social Insurance Fund. If an individual entrepreneur hires at least one employee, then he is obliged to calculate and withhold personal income tax for him and pay contributions to extra-budgetary funds.

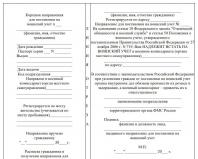

Image 1. Sample notification of registration.

In this case, it is required to register with the Pension Fund and the Social Insurance Fund as an employer. The composition of taxes for individual entrepreneurs differs from the list of mandatory payments to the state for a citizen.

If a person has not previously been registered with the tax authority, the Federal Tax Service must register him and assign him a TIN. Then the inspectorate sends not only a notification to the person who has become an individual entrepreneur, but also a certificate of registration (Image 2).

Federal Tax Service employees send these documents by mail or hand them over to the entrepreneur.

How to become an individual entrepreneur

Registering as an individual entrepreneur is easy. If you don’t want to do this yourself, then there are many companies that will create a package of documents for creating an individual entrepreneur. But it will be much more expensive than doing everything yourself and taking it or sending it to the tax office.

First of all, you need to fill out an application in the established form P21001. Information can be entered by hand or electronically. The codes are in the All-Russian Classifier of Economic Activities.

After this, you must submit to the Federal Tax Service at the citizen’s place of registration an application, a document confirming payment of the state duty, a photocopy of the passport and a certificate of registration with the tax authority (TIN). You can submit a package of documents in person, by mail or through an intermediary authorized to represent the interests of the citizen.

Image 2. Certificate of registration.

If an individual who wishes to become an individual entrepreneur personally submits documents to the Federal Tax Service, then he does not need to have a copy of his passport and application P21001 certified by a notary.

Registration of an individual entrepreneur takes 3 working days. After this period, the citizen can come to the tax office with a passport and a receipt for acceptance of the package of documents.

Federal Tax Service employees will issue him a certificate of state registration of an individual entrepreneur, an extract from the Unified State Register of Individual Entrepreneurs and a notice of registration of an individual entrepreneur.

Return to contents

What taxes does an individual entrepreneur pay?

An individual entrepreneur can use the following types of taxation:

- general mode;

- according to a simplified system;

- A single tax on imputed income;

- patent system;

- Unified agricultural tax.

An entrepreneur working on the Basic Taxation System pays personal income tax to the budget on his profits, VAT and property tax applied in the process of commercial activities.

An individual entrepreneur using the simplified tax system pays the state 6% of income or 15% of income minus expenses.

An individual entrepreneur who can work for UTII pays a tax calculated on the basis of basic profitability and physical indicators, depending on the industry of activity.

The patent tax system assumes that an individual entrepreneur pays a patent fee to the budget depending on the amount of possible income.

A businessman using the Unified Agricultural Tax makes a mandatory payment to the treasury in the amount of 6% of income minus expenses.

All individual entrepreneurs pay land and transport taxes, as well as property tax, if the tax base for it is determined as the cadastral value.