Sample order to approve the regulations on business trips. Sample order for approval of travel regulations

Question

Good afternoon.

We have made changes to the business travel regulations. Is it necessary to make changes to employees’ employment contracts and familiarize the team with the application upon signature?

Answer

The regulation on business trips is a local regulatory act.

Thus, the employer - a commercial organization has the right to set the amount of daily allowance at its discretion.

Article 8 of the Labor Code of the Russian Federation establishes that employers, with the exception of employers - individuals who are not individual entrepreneurs, adopt local regulations containing labor law norms, within their competence in accordance with labor legislation and other normative legal acts containing labor law norms , collective agreements, agreements.

In accordance with Art. 22 of the Labor Code of the Russian Federation, the employer is obliged to familiarize employees against signature with the adopted local regulations, not directly related to their work activities.

The labor legislation of the Russian Federation does not prohibit making changes to local regulations.

Consequently, the employer has the right to amend the regulations on business trips by changing the amount of daily allowance. In this case, the employer must familiarize the employees with the changes made against signature, but the employees’ consent is not required.

Related questions:

-

The organization has established the daily allowance for foreign business trips in the amount of 2,500 rubles. How much do you need to pay per diem when traveling abroad at the expense of the host country? Is it possible to install in the internal position...... -

What minimum package of documents (instructions, regulations, regulations, etc.) should be present in the company in terms of personnel documentation and labor protection? (Staff 14 people)

✒ The organization must register...... -

Please clarify the question regarding positions. An employee (Lawyer) goes on parental leave to care for a child up to 3 years old. Management plans to replace her position with another one (specialist in...... -

Please clarify what features exist when concluding an agreement with an external part-time worker.

✒ When concluding an employment contract with a part-time worker, the same rules apply as when hiring an employee for the main......

Decree of the Government of the Russian Federation

No. 771 dated July 29, 2015

On introducing amendments to the Regulations on the specifics of sending employees on business trips and invalidating subparagraph “b” of paragraph 72 of the changes that are being made to the acts of the Government of the Russian Federation on the activities of the Ministry of Labor and Social Protection of the Russian Federation, approved by the Decree of the Government of the Russian Federation dated March 25 2013 No. 257

The Government of the Russian Federation decides:

1. Approve the attached changes that are being made to the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 “On the specifics of sending employees on business trips” (Collected Legislation of the Russian Federation, 2008, No. 42, Art. . 4821; 2015, no. 3, art.

2. Recognize as invalid subparagraph "b" of paragraph 72 of the amendments that are made to the acts of the Government of the Russian Federation on the activities of the Ministry of Labor and Social Protection of the Russian Federation, approved by Decree of the Government of the Russian Federation of March 25, 2013 No. 257 "On amendments and recognition as invalid of some acts of the Government of the Russian Federation on the activities of the Ministry of Labor and Social Protection of the Russian Federation" (Collected Legislation of the Russian Federation, 2013, No. 13, Art. 1559).

Approved

resolution

Government of the Russian Federation

dated July 29, 2015 No. 771

CHANGES,

WHICH ARE INTRODUCED TO THE REGULATIONS ON THE FEATURES OF THE DIRECTION

EMPLOYEES ON BUSINESS TRAVEL

1. Paragraph two of paragraph 3 should be stated as follows:

"Employees are sent on business trips on the basis of a written decision of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work. The trip of an employee sent on a business trip on the basis of a written decision of the employer to a separate unit of the sending organization (representative office, branch) located outside the place of permanent work, is also considered a business trip."

2. Clause 7 should be stated as follows:

"7. The actual length of stay of an employee on a business trip is determined by travel documents presented by the employee upon returning from a business trip.

If an employee travels on the basis of a written decision of the employer to the place of business trip and (or) back to the place of work on official transport, on transport owned by the employee or owned by third parties (by power of attorney), the actual period of stay at the place of business trip is indicated in the official document. a note that is submitted by the employee upon returning from a business trip to the employer with the attachment of documents confirming the use of the specified transport for travel to the place of business and back (waybill, route sheet, invoices, receipts, cash receipts and other documents confirming the transport route).

In the absence of travel documents, the employee confirms the actual length of stay of the employee on a business trip with documents for renting residential premises at the place of business trip. When staying in a hotel, the specified period of stay is confirmed by a receipt (coupon) or other document confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, containing information provided for by the Rules for the provision of hotel services in the Russian Federation, approved by the Decree of the Government of the Russian Federation of April 25, 1997. No. 490 "On approval of the Rules for the provision of hotel services in the Russian Federation."

In the absence of travel documents, documents for the rental of residential premises or other documents confirming the conclusion of an agreement for the provision of hotel services at the place of business trip, in order to confirm the actual period of stay at the place of business trip, the employee must submit a memo and (or) another document about the actual period of stay of the employee in business trip, containing confirmation of the party receiving the employee (organization or official) about the date of arrival (departure) of the employee to the place of business trip (from the place of business trip).

3. Clause 8 is declared invalid.

Chairman of the Government of the Russian Federation D.A. Medvedev

On January 8, 2015, changes introduced by Decree of the Government of the Russian Federation dated December 29, 2014 No. 1595 to the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, came into force: the concepts of “travel certificate” were excluded from the text of the Regulations , “official assignment” and “report on work performed on a business trip.”

Similar changes were made by Decree of the President of the Russian Federation of December 12, 2014 No. 765 to the Procedure and conditions for the secondment of federal civil servants, approved by Decree of the President of the Russian Federation of July 18, 2005 No. 813 (the changes entered into force on February 1, 2015).

In addition, by order of the Ministry of Finance of Russia No. 147n, the Ministry of Labor of Russia No. 1044 dated December 15, 2014, Instruction of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Russian Central Council of Trade Unions dated April 7, 1988 No. 62 “On official business trips within the USSR” was canceled.

How will these changes affect travel arrangements for employees?

We are introducing changes to the regulations on business trips for employees

Each organization whose employees are sent on business trips must have a local regulatory act approved by the head of the organization or a person authorized by him (for example, Regulations on business trips of employees), regulating the procedure for processing business trips, the timing of business trips, the procedure and amount of compensation for expenses associated with business trips, and other travel-related issues.

Now it is necessary to make appropriate changes to this document or approve its new edition.

Note!

In order to bring regulatory legal acts into compliance with the current legislation of the Russian Federation, Instruction of the Ministry of Finance of the USSR, the State Committee for Labor of the USSR and the All-Union Central Council of Trade Unions dated 04/07/1988 No. 62 “On official business trips within the USSR” declared inactive on the territory of the Russian Federation (Order of the Ministry of Finance No. 147n, Ministry of Labor of Russia No. 1044 of December 15, 2014).

Grounds for sending an employee on a business trip

According to the new edition of paragraph. 2 clause 3 of the Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as the Regulations on Business Travel), employees are sent on business trips based on the decision of the employer for a certain period of time to carry out an official assignment outside their place of permanent work . A trip by an employee sent on a business trip by decision of the employer to a separate unit of the sending organization (representative office, branch) located outside the place of permanent work is also recognized as a business trip.

However, the Travel Regulations are silent on whether the employer's decision must be in writing. In this regard, we note that if previously the period for which the employer sends an employee on a business trip was indicated in three documents - the official assignment for sending on a business trip, the order for sending on a business trip and the travel certificate, now, after the cancellation of the travel certificate and official assignment , the only document defining the duration of a business trip is the order to send the employee on a business trip, and it can only be written. Therefore, in a local regulatory act, we recommend formulating this provision, for example, like this:

By the way

The Tax Service has repeatedly expressed the opinion that the presence and execution of an order to send an employee on a business trip, an official assignment for sending on a business trip and a report on its implementation are determined by the internal document flow of the organization, and for documentary confirmation for the purpose of taxing the profits of organizations, these documents are not mandatory (see. , for example, letters of the Federal Tax Service of Russia dated November 25, 2009 No. MN-22-3/890@ and dated August 18, 2009 No. 3-2-06/90, letter of the Federal Tax Service for Moscow dated October 28, 2010 No. 16-15/113462@ ).

However, in accordance with paragraph. 4 paragraphs 1 art. 252 of the Tax Code of the Russian Federation, documented expenses mean expenses confirmed, in particular, by documents indirectly confirming expenses incurred, incl. business trip order and travel documents.

We believe that the tax service now recognizes both the obligation to issue an order to go on a business trip and the possibility of confirming the period of stay on a business trip with travel documents without issuing a travel certificate.

We determine the actual length of stay of the employee on a business trip

Before changes were made to the Business Travel Regulations, the document confirming the actual duration of the employee’s stay on a business trip, in accordance with clause 7 of the Business Travel Regulations, was a travel certificate. But in some cases, it was impossible to mark the arrival at the business trip points and departure from them, and the Ministry of Finance of Russia, in a letter dated August 16, 2011 No. 03-03-06/3/7, explained that in such situations the fact of being at the business trip place on the established time can be confirmed by other documents, in particular:

- an order (instruction) to send an employee on a business trip;

- official assignment for sending on a business trip and a report on its implementation;

- travel documents, which indicate the dates of arrival and departure from the destination;

- hotel invoice confirming the period of stay at the place of business trip.

Note!

According to the new edition of clause 7 of the Business Travel Regulations, the actual period of stay of the employee at the place of business trip is determined according to travel documents, represented by the employee upon return from a business trip.

And this is quite logical, because... the order confirms only planned term business trips, official assignment cancelled, hotel bill confirms only length of stay, and travel tickets are confirmed the entire duration of your stay on a business trip, including round trip travel and accommodation at the place of business trip.

There is an exit!

The Ministry of Finance of Russia, in letter dated 02/05/2010 No. 03-03-05/18, explained that in case of loss of original travel documents, a duplicate of the travel document or a copy of a copy of the ticket remaining at the disposal of the transport organization that transported the individual, or a certificate from transport organization indicating details allowing to identify an individual, his travel route, ticket price and date of travel.

According to para. 2 clause 9 of the Procedure and conditions for secondment of federal state civil servants, approved by Decree of the President of the Russian Federation dated July 18, 2005 No. 813 (as amended on December 12, 2014; hereinafter referred to as the Procedure and conditions for secondment), in the absence of travel documents (tickets), the actual length of stay a civil servant on a business trip is determined by other documents confirming the period of his stay on a business trip, the list of which is approved by the Ministry of Finance of the Russian Federation.

We believe that this list will be useful not only to federal government agencies, state extra-budgetary funds of the Russian Federation and federal government agencies, but also to other organizations not related to the budgetary sector.

Employees often travel on business trips using their own vehicles. According to the new - second - paragraph of clause 7 of the Regulations on business trips, in the case of an employee traveling to the place of business trip and (or) back to the place of work by personal transport (car, motorcycle) the actual length of stay at the place of business trip is indicated in the memo, which is presented by the employee upon returning from a business trip to the employer along with supporting documents confirming the use of the specified transport for travel to the place of business trip and back (waybills, invoices, receipts, cash receipts, etc.).

The memo is drawn up in any form, but if in organizing business trips on personal transport it is a fairly common occurrence, we recommend developing a special form that will allow the employee to indicate all the necessary information and avoid mistakes.

The form of the memo and an example of how to fill it out (Example 1) can be found in the appendix to the Regulations on business trips of employees.

Office notes, along with documents confirming the use of the car (waybills, cash receipts for gasoline, receipts for parking and travel on toll roads, etc.), together with an advance report, are transferred to the accounting department.

How to confirm visits to multiple business travel destinations?

Previously, it was possible to put notes on the travel document about arrival at and departure from each business trip point. In the new edition of the Business Travel Regulations, there are no rules on how to indicate several places that an employee must visit during a business trip. You can, of course, to confirm travel expenses, list all the business trip points visited by the employee in a memo with attached travel documents confirming the employee’s movement from one business trip point to another.

However, since the new edition of the Regulations on Business Travel does not mention the obligation to indicate in the memo all the places visited by the employee on a business trip, we believe that the presentation of travel documents will be sufficient.

It should be noted that in budgetary organizations, in accordance with clause 21.1 of the Procedure and Conditions of Secondment, reimbursement of expenses associated with the use of personal transport by a civil servant to travel to the place of assignment and back - to the permanent place of federal state civil service is carried out in the manner determined by the Government Russian Federation.

In addition, in accordance with clause 22 of the Procedure and Conditions for Business Travel, in the absence of travel documents (tickets) or documents issued by transport organizations and confirming the information contained in travel documents (tickets), no fare payment is made, with the exception of reimbursement of expenses associated with the use of personal transport for travel to and from a business trip.

Foreign business trip

Clause 15 of the Regulations on Business Travel has lost force, therefore, travel certificates do not need to be issued in the case of a business trip to the member states of the Commonwealth of Independent States with which intergovernmental agreements have been concluded, on the basis of which in documents for entry and exit border authorities do not make notes about crossing the state borders.

In accordance with the new edition of clause 19 of the Regulations on Business Travel, the date of crossing the state border of the Russian Federation when traveling from the territory of the Russian Federation and to the territory of the Russian Federation is determined by travel documents (tickets).

The new edition of the Business Travel Regulations does not say anything about ways to confirm the date of border crossing if the employee went on a business trip, for example, in a company car. We believe that the dates of crossing the state border should be indicated in the memo.

We issue an order to send an employee on a business trip

If your organization has decided to use standardized forms No. T-9 “Order on sending an employee on a business trip” and T-9a “Order on sending employees on a business trip”, approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1, you must comply with the Procedure for using the standardized forms of primary accounting documentation, approved by Decree of the State Statistics Committee of Russia dated March 24, 1999 No. 20 (hereinafter referred to as the Procedure for the Application of Unified Forms).

According to parts two and three of the Procedure for the Application of Unified Forms, all details of unified forms approved by the State Statistics Committee of Russia remain unchanged (including code, form number, document name); deleting individual details from unified forms is not allowed.

The line for indicating the basis of the order in unified forms No. T-9 and T-9a is not a separate attribute, but only part of the “Text” attribute, drawn up in tabular form, but we advise you not to change the interlinear wording - to delete the words “official assignment” we can, despite the fact that these words have completely lost their relevance.

If the organization has approved local unified forms of orders for sending an employee (workers) on a business trip (Examples 2 and 3), everything is simplified, because nothing prevents you from making the necessary changes to the local form and re-approving it. The line to indicate the basis of the order might look like this:

Base: ___________________________________________________

name, date and document number

What is now the basis for issuing the order? An employer can send an employee on a business trip for various reasons, for example:

- if business trips are provided for in an agreement on the performance of work (rendering services) or an agreement on joint activities, this agreement is indicated as the basis for issuing the order;

- if a business trip is necessary for the purpose of agreeing and/or signing documents, the basis may be an internal memo from the head of the department;

- if the organization has an approved plan for business trips of employees for a quarter, half a year or a whole year, the basis for issuing an order will be this plan;

- if there is a need to solve specific problems of production, economic, financial and other activities, the basis may also be an official (report) note, or an action plan, or an invitation within the framework of joint activities;

- if an organization has received an invitation to take part in a conference, meeting, seminar or other event for the purpose of studying, summarizing and disseminating experience, new forms and methods of work, and the employer considers such participation useful, this invitation is indicated as the basis for issuing an order.

How to issue an official assignment?

According to the new edition of paragraph. 2 clause 3 of the Business Travel Regulations, employees are sent on business trips based on the employer’s decision for a certain period of time to carry out an official assignment outside the place of permanent work. At the same time, in Art. 166 of the Labor Code of the Russian Federation talks about at the disposal employer.

The Regulations on Business Travel do not say anything about the need to formalize such an order in writing. Consequently, the organization itself must decide whether it is necessary to formalize official assignments in writing, what form to choose for this and who will sign them, as well as how the employee can confirm the fulfillment of official assignments.

Note that in most cases, a separate written form of official assignment is not needed, since the assignment (purpose) is formulated in the order, and the result of the trip is confirmed by the documents brought by the employee. For example, an employee was instructed to go on a business trip, the purpose of which is to meet with the counterparty and obtain his signature on the contract. After returning from a business trip, the employee submits a signed contract to management.

In such cases, formalizing a business assignment in writing is simply unnecessary paperwork, as is a report on the work performed on a business trip.

However, there are often cases when the assignment given to a posted worker is quite complex, consisting of several tasks, sometimes unrelated, replete with numerical data, i.e. one that is impossible, on the one hand, to remember, and on the other, to prove that there was just such an order. Of course, in such cases, the official assignment requires written form.

In the Regulations on business trips of employees of the organization, the relevant points can be formulated as follows:

There is another way to formalize an official assignment. In local unified forms of orders to send an employee (workers) on a business trip, instead of the lines “for the purpose” (in a single-subject form) and “purpose” (in a multi-subject form), you can provide the lines “Official assignment”, in which you indicate a brief content of the official assignment (see Examples 2 and 3).

Note: clause 6 of the Business Travel Regulations, which stated about the purpose of the trip, which should have been indicated in the job description, has become invalid.

If the scope of the official assignment is large, it can be stated not in the order itself, but in an appendix to it (Example 4), not forgetting to indicate in the order that there is an appendix.

If the organization uses unified forms No. T-9 and T-9a, you can also insert additional lines into them to indicate an official assignment or draw up a loose leaf “Official assignment”, because according to part five of the Procedure for using unified forms in the production of blank products based on unified forms of primary accounting documentation, it is allowed to make changes in terms of expanding and narrowing columns and lines, taking into account the significance of indicators, inclusion of additional lines (including free ones) and loose sheets for the convenience of placing and processing the necessary information.

Instead of a loose leaf, you can issue a service order in the form of an appendix to the order.

How to report on work performed on a business trip?

Paragraph 2 of clause 26 of the Business Travel Regulations, according to which the employee, upon returning from a business trip, was obliged to submit to the employer within three working days a written report on the work performed on a business trip, agreed upon with the head of the employer’s structural unit, has become invalid since January 8 of this year.

The following conclusion can be drawn: as in the issue of official assignment, the organization must independently decide whether such a report is needed, in what form it should be submitted and who should sign it, and, if the organization considers it necessary, agree and/or approve it.

By the way

According to sub. “b” clause 35 of the Procedure and conditions for business trips upon returning from a business trip, a civil servant is obliged to submit to the state body within three working days report on the work performed during the period of stay on a business trip, agreed upon with the head of the structural unit in which he holds the position of the federal state civil service.

In the Regulations on business trips of employees of the organization, the relevant points can be formulated as follows:

Note that in some cases there is no need to provide a report. For example, if an employee was sent on a business trip to purchase spare parts, after returning from a business trip he only needs to hand them over to the warehouse and submit the documents for these spare parts to the accounting department. Similar cases can be provided for in the Regulations on business trips of employees, for example:

Accounting for employees traveling and arriving on business trips

According to clause 8 of the Regulations, the procedure and forms for recording workers leaving on business trips from the sending organization and arriving at the organization to which they are sent are determined by the Ministry of Labor and Social Protection of the Russian Federation.

The procedure and forms for recording employees leaving on business trips from the sending organization and arriving at the organization to which they are seconded are approved by Order of the Ministry of Health and Social Development dated September 11, 2009 No. 739n (hereinafter referred to as Order No. 739n).

In the form of the logbook for employees leaving on business trips from the sending organization, given in Appendix No. 2 to Order No. 739n, a column is provided for indicating the date and number of the travel certificate. Before changes are made to Order No. 739n, you can put a dash in this column.

Our advice

A dash (em dash) is produced by pressing three keys simultaneously: Ctrl +

Alt + «-»

on the numeric keypad.

The form of the logbook for employees who arrived at the organization to which they are seconded, given in Appendix No. 3 to Order No. 739n, provides for indicating the name of the organization that issued the travel certificate. In this column you must indicate the name of the sending organization.

As for federal government civil servants, clause 10 of the Procedure and Conditions for Secondment provided that government bodies keep records of civil servants going and arriving on business trips in special journals using forms, the approval procedure for which is determined by the Government of the Russian Federation. The representative of the employer or a person authorized by him by his order (instruction) appoints a civil servant responsible for maintaining these logs and making notes on travel certificates.

Thus, at the time of publication of this article, the issue of recording civil servants traveling and arriving on business trips has not been resolved.

In conclusion, we would like to draw your attention to the fact that the exclusion from the text of the Regulations on Business Travel of such concepts as “purpose of business trip”, “job assignment”, “travel certificate”, “report on work performed on a business trip” does not mean that that the employer does not have to formulate the purpose of the business trip, and does not impose a ban on the use of the listed documents. Therefore, if an organization considers it advisable to use a travel certificate and other documents in a format that is familiar and convenient for it, we recommend indicating this in the Regulations on business trips of employees of the organization.

However, one cannot ignore the fact that in this case a problem is possible: the receiving party may categorically refuse to mark the arrival at the place of business trip and departure from it, referring to the new edition of the Regulations.

Resolution of Rosstat dated December 23, 2005 No. 107 approved unified forms No. TK-1 (state) “Registration journal by the federal state body of workers traveling on business trips” and No. TK-2 (state) “Registration log by the federal state body of workers coming on official business trips.” business trips".

If there are some changes at the enterprise, in order to make them into a local document, it is necessary to issue an order. A regulation is developed specifically for this purpose and a document is created in the form of an order. To make it easier, you will need a sample and a form.

Regulations on the specifics of sending employees on business trips

The current situation in 2018 determines the specifics of sending employees on business trips both within the country and abroad. Employees who have entered into employment contracts with the employer are sent on official assignments.

According to the local document, a permanent place of work is considered to be the place in whose organization the employer has concluded an employment contract. In this case, seconded workers go on a trip based on signed decisions of the director for a specified period. While at the appointed place, they must complete the task, return to their permanent place of work and provide a report on the work done. An ordinary trip aimed at fulfilling official purposes outside the company’s territory is also considered official.

If an employee’s work involves constant travel or is carried out while on the move, it is not recognized as a business trip. In this case, the period of time during which the employee must be on task is determined by the employer himself.

How to make changes to the business travel regulations?

To make changes to the local document on business trips, a repeat order is issued. It reflects the following information:

- Information about the personnel order that is subject to change. This includes number, date, name;

- Reasons why changes are being made;

- Instructions that are provided to officials for subsequent implementation;

- Measures taken to ensure control over the execution of the relevant order.

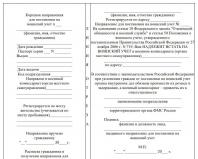

Order approving the regulations on business trips

To ensure that employees go on business trips in accordance with the rules, each company must draw up a local regulation on business trips. To approve it, the employer or authorized representative creates an order approving the current provisions. The document has several components:

- Introduction. It notes the authorized person who created the order;

- Target;

- Main part. This paragraph states what needs to be done. Formulations are used in the form: how to familiarize, approve, assign control. It is also noted here on what date the order comes into force. If this is not specified, the legal effect of the order is formed from the moment the manager signs it.

Regulations on business trips in budgetary institutions - sample in 2018

Due to business needs, budgetary organizations often send their employees on business trips. Sometimes it only takes one day, and even then the flight can be done by air. The main provision on business trips in budgetary institutions states that an advance for expenses is not provided to an employee in budgetary organizations. Legislation confirms that all expenses are reimbursed upon arrival. Provide a report to the accounting department, and also attach additional documents upon return.

If an employee orders an air transport ticket via the Internet, then along with the advance report, the employee provides an electronic ticket, which is printed by a specific employee by email. In this case, there is no boarding pass.

In general, in a budget organization the basic conditions are similar to those of commercial companies. As it says, a business trip means the departure of an employee by order of the employer for a specified period. This is necessary in order to complete a work assignment outside the company territory.

It states that if an employee goes on a business trip, the manager is obliged to reimburse all travel expenses.

A local provision may exempt an organization from reimbursement of expenses if an employee is unable to provide documents to pay for a hotel room or loses them. However, personal income tax will still be assessed, excluding daily allowance in the amount of 700 rubles per day for business trips within the country and 2,500 rubles for foreign business trips.

The Regulations of a budgetary organization can also take into account how the costs of business class tickets, mobile calls, the price of meals and additional services are paid.

In labor legislation, a business trip is understood as a trip by an employee of an organization for a period established by the employer for official reasons. The purpose of this trip is performance of work duties away from his workplace.

The main issues of organizing such trips are regulated by local regulations - Regulations on business trips.

Modern labor legislation does not have strict regulation on the form and content of this document. In connection with this circumstance, the management of enterprises and organizations independently develops and adopts such a document as the Regulations on Business Travel, taking into account the specifics of their work.

Modern labor legislation does not have strict regulation on the form and content of this document. In connection with this circumstance, the management of enterprises and organizations independently develops and adopts such a document as the Regulations on Business Travel, taking into account the specifics of their work.

At the same time, the main requirement for it is strict compliance with current labor legislation.

In the process of developing this regulatory act, it is necessary to adhere to the following laws and regulations:

- Decree of the Government of the Russian Federation No. 749 of October 13, 2008. It regulates some features taken into account when sending employees on business trips. The corresponding Regulations are attached to it.

Purpose of registration

The regulations on business trips in the organization are drawn up for the purpose of streamlining the process of accounting for business trips in it, as well as for normalization of document flow.

As a result, a number of issues directly related to sending employees on one-time and permanent business trips are regulated. Thus, the employer insures himself against errors in documenting this process, and also saves money on travel expenses.

In addition, correct document flow in this area allows you to easily report to the tax service for the increased amount of expenses for these needs.

Since Russian legislation does not oblige the owner of the organization to accept the Regulations in question without fail, he decides on his own: to do it or not.

Since Russian legislation does not oblige the owner of the organization to accept the Regulations in question without fail, he decides on his own: to do it or not.

Typically, this document is adopted when travel for service needs is a frequent occurrence in the company. In this case it makes sense to adopt a single document regulating this area of labor relations.

Then, when such a trip is an isolated phenomenon, this large-scale document does not need to be developed, but each specific case is recorded with an organization order.

Requirements for the document and the person responsible for its preparation

The document under consideration is being prepared HR department of the organization. In the event that it contains items related to documenting cash costs, the Regulations must be agreed upon with the company's accounting department.

The local legal act itself is approved by its head by issuing the appropriate order. In this case, the document must meet certain requirements.

For example, it should define daily allowance standards, establish standards for the allocation of funds for the rental of residential premises, and also regulate the rules for maintaining records both by accounting employees and by the company employee himself sent on a trip.

Main sections

The regulations on business trips do not have an officially approved standard sample, but it must necessarily contain seven sections:

- general provisions;

- the procedure for sending an employee of an organization on a business trip;

- documenting;

- terms and mode;

- cases of temporary disability of a posted employee;

- nuances of business trips outside the Russian Federation;

- concept and procedure for paying travel allowances;

- provision of reporting on business trips, guarantees provided to the employee in connection with it.

In the general section of the Regulations the term itself is deciphered "business trip", the purpose of the document is determined, the tasks that are set for the employee before the trip are formulated.

Directly myself procedure for sending an employee organization into it is defined in the next section. The conditions of the business trip, as well as the procedure for replacing the employee during his departure, are also indicated here.

The section devoted to the procedure for registering work trips in the organization should contain documentation algorithm this process, the procedure for drawing up and documenting the job assignment.

The section devoted to the procedure for registering work trips in the organization should contain documentation algorithm this process, the procedure for drawing up and documenting the job assignment.

From it you can also find out in what order an order is issued to send employees on a business trip. In addition, it contains provisions for the registration of documents in this area, as well as the procedure for issuing a travel certificate.

Dates and operating hours employee who left for official reasons is indicated in section 4. This should contain information about the methodology for calculating the duration of a business trip, including the day of departure and arrival.

In addition, it is mandatory to indicate work and rest schedule employee on such a trip. The registration of his attendance at work both on the day of departure and on the day of arrival is separately described.

Section 5 contains information on the procedure for granting sick leave to a posted employee, and in seventh contains provisions on the procedure for travel of representatives of the organization, carried out on its behalf, abroad. This is information about sick leave payments, as well as daily allowances and travel allowances.

Moreover, the general provisions on such payments, according to Art. 168 of the Labor Code of the Russian Federation, are placed in a separate section of this document.

Final section is dedicated to the preparation of reports for an employee who is away. It contains information about the order in which an advance travel report is drawn up and submitted, the deadline for its submission, as well as the algorithm for submitting a report on the work performed during the business trip.

In addition to those listed, this local regulatory act may include other sections, as well as applications, for example, samples of official documentation - official and explanatory notes for the expense report.

Sample for 2018

Documentation for business trips periodically undergoes major changes. The last such change occurred in 2015, when was canceled mandatory requirement for registration of official assignment and travel certificate.

The regulations on business trips for 2018 are drawn up in the same manner. The legislation does not establish a unified form for this document.

Features of foreign business trips

The subtleties of foreign business trips of employees are also indicated in the Regulations under consideration. Its text must contain information on the procedure for reimbursement of expenses for obtaining a foreign passport and visa.

In addition, the payment of travel allowances, daily allowances and other payments here also has its own characteristics related to the conversion of foreign currency. Separately, the document specifies the procedure for paying sick leave abroad while on a business trip.

For remote workers

According to the Labor Code, remote employees are subject to all guarantees provided to ordinary employees of the organization. Thus, such a specialist can be sent on a business trip on a general basis, while he has the right to to receive all payments that an ordinary employee of the enterprise receives.

The regulations on business trips are approved by the head of the organization by order. At the same time, its text is prepared by personnel department employees and agreed with the chief accountant. IN in the same order This document is subject to change.

The regulations on business trips are approved by the head of the organization by order. At the same time, its text is prepared by personnel department employees and agreed with the chief accountant. IN in the same order This document is subject to change.

That is, if you need to change something in the Regulations, The HR department must prepare the text of such changes. Next, it goes for approval to the accounting department, which checks such a proposal for compliance with its legislation on accounting and the Tax Code.

Typically these changes do not require coordination with the trade union organization of the enterprise. The finished text of changes to the Regulations is approved by the head of the company by a special order. The order approving this document, along with the order amending it, is brought to the attention of employees against signature.

Guarantees for seconded employees

Labor legislation establishes strict guarantees seconded employees. All of them must be reflected in the document in question. Thus, these include the requirement to comply with working hours and rest hours on a business trip.

Besides, the amount and procedure for payment are strictly established business travelers and daily allowances. The Regulations under consideration may also provide for measures of employer liability for violation of these guarantees and ways to protect the violated rights of the employee. The usual measure is to apply to the Labor Dispute Commission or directly to the court.

Court almost always takes the employee’s side, so the employer needs to carefully monitor the execution of all documents. If the same Regulations on Business Travel are drawn up and executed correctly, it can help avoid conflict situations in the future.

In addition, with the help of such a document, an organization can save a lot on payments to posted workers.

Details on business trips are presented in this video.