Benefits for renting premises for small businesses. Benefits for renting non-residential premises

THE GOVERNMENT OF MOSCOW

RESOLUTION

On the main directions of rental policy for the provision of non-residential premises owned by the city of Moscow *

Document with changes made:

(Bulletin of the Mayor and Government of Moscow, N 61, 05.11.2013);

(Bulletin of the Mayor and Government of Moscow, N 71, 12/26/2013);

dated June 18, 2014 N 349-PP (Official website of the Mayor and Government of Moscow www.mos.ru, 06/19/2014);

(Official website of the Mayor and Government of Moscow www.mos.ru, 07/02/2014);

Decree of the Moscow Government of September 17, 2014 N 541-PP (Official website of the Mayor and Government of Moscow www.mos.ru, 09.18.2014);

Decree of the Moscow Government of November 11, 2014 N 650-PP (Official website of the Mayor and Government of Moscow www.mos.ru, 11/12/2014);

Decree of the Moscow Government of December 9, 2014 N 739-PP (Official website of the Mayor and Government of Moscow www.mos.ru, 12/11/2014);

(Official website of the Mayor and Government of Moscow www.mos.ru, 12/26/2014);

Decree of the Moscow Government of February 24, 2015 N 70-PP (Official website of the Mayor and Government of Moscow www.mos.ru, 02/25/2015);

(Official website of the Mayor and Government of Moscow www.mos.ru, 07/15/2015);

(Official website of the Mayor and Government of Moscow www.mos.ru, 08/27/2015);

Decree of the Moscow Government of December 17, 2015 N 897-PP (Official website of the Mayor and Government of Moscow www.mos.ru, 12/18/2015);

(Official website of the Mayor and Government of Moscow www.mos.ru, 12/22/2015) (came into force on January 1, 2016);

Decree of the Moscow Government of November 28, 2016 N 785-PP (Official website of the Mayor and Government of Moscow www.mos.ru, November 28, 2016);

(Official website of the Mayor and Government of Moscow www.mos.ru, 12/02/2016) (effective from January 1, 2017);

(Official website of the Mayor and Government of Moscow www.mos.ru, 12/22/2016) (effective from January 1, 2017);

(Official website of the Mayor and Government of Moscow www.mos.ru, 03/28/2017);

(Official website of the Mayor and Government of Moscow www.mos.ru, 04/20/2017);

(Official website of the Mayor and Government of Moscow www.mos.ru, 07/11/2017);

(Official website of the Mayor and Government of Moscow www.mos.ru, 12/18/2017) (came into force on January 1, 2018);

(Official website of the Mayor and Government of Moscow www.mos.ru, 04/17/2018);

(Official website of the Mayor and Government of Moscow www.mos.ru, 12/18/2018) (came into force on January 1, 2019);

(Official website of the Mayor and Government of Moscow www.mos.ru, 04/17/2019);

(Official website of the Mayor and Government of Moscow www.mos.ru, 07/03/2019).

____________________________________________________________________

________________

by Decree of the Moscow Government of April 16, 2019 N 369-PP ..

In order to exercise the powers of the constituent entity of the Russian Federation of the city of Moscow to manage state property of the city of Moscow and provide property support to entities leasing non-residential facilities owned by the city of Moscow, in accordance with the requirements of Federal Law of July 26, 2006 N 135-FZ "On protection of competition" Moscow Government

(Preamble as amended, put into effect by Decree of the Moscow Government of April 16, 2019 N 369-PP.

decides:

1. Approve the list of cases of establishing the rent rate under lease agreements for non-residential premises owned by the city of Moscow on preferential terms (Appendix 1).

Decree of the Moscow Government dated August 26, 2015 N 544-PP; Decree of the Moscow Government dated April 16, 2019 N 369-PP.

1(1). To establish that the procedure for determining the amount of rent, defined in Appendix 1 to this resolution, applies to existing and newly executed lease agreements for non-residential premises located in the property treasury of the city of Moscow, with the exception of lease agreements concluded as a result of tenders, as well as lease agreements , for which fixed rental rates are applied, established by the Moscow Government.

(The paragraph was additionally included from September 7, 2015 by Decree of the Moscow Government of August 26, 2015 N 544-PP)

1(2). Establish that the procedure for determining the amount of rent, determined by paragraph 4 of Appendix 1 and Appendix 3 to this resolution, is applied when agreeing on transactions for the transfer of ownership and (or) use to individuals - owners of residential premises located in an apartment building, or citizens who have the right to use residential premises located in an apartment building, provided under rental agreements, for the placement of vehicles of parts of buildings or structures (car spaces) located within the administrative boundaries of the city of Moscow, carried out by state unitary enterprises (state enterprises, state-owned enterprises) of the city of Moscow , government agencies of the city of Moscow.

(The paragraph was additionally included by Decree of the Moscow Government dated April 16, 2019 N 369-PP; as amended by Decree of the Moscow Government dated July 2, 2019 N 748-PP.

2. Establish for 2019 the minimum rental rate for 1 square meter of non-residential premises located in the property treasury of the city of Moscow, located within the administrative boundaries of the city of Moscow, in the amount of 4,500 rubles per year. The rental rate for 1 square meter of non-residential premises located in the property treasury of the city of Moscow cannot be lower than the minimum, unless otherwise established by legal acts of the Moscow Government.

(Paragraph as amended, put into effect on January 1, 2018 by Decree of the Moscow Government of December 15, 2017 N 1018-PP by Decree of the Moscow Government of December 18, 2018 N 1580-PP.

The initial (minimum) price of a lease agreement for a non-residential property put up for auction and included in the List of state property intended for transfer into possession and (or) use of small and medium-sized businesses and organizations forming the infrastructure for supporting small and medium-sized businesses, approved The Government of Moscow or the authorized executive body of the city of Moscow in accordance with, is established in the amount of the minimum rental rate determined by the first paragraph of paragraph 2 of this resolution.

(The paragraph was additionally included from May 1, 2017 by Decree of the Moscow Government of April 19, 2017 N 208-PP by Decree of the Moscow Government of April 17, 2018 N 326-PP.

The initial (minimum) price of a lease agreement for a non-residential property located in the basement, put up for auction and included in the List of state property intended for transfer into possession and (or) use of small and medium-sized businesses and organizations that form the infrastructure for supporting small businesses and medium-sized businesses, approved by the Moscow Government or the authorized executive body of the city of Moscow in accordance with Federal Law of July 24, 2007 N 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”, is set at 1000 rubles per 1 sq. meter per year.

(Paragraph additionally included from April 28, 2018 by Decree of the Moscow Government dated April 17, 2018 N 326-PP)

(Clause as amended, put into effect on July 13, 2014 by Decree of the Moscow Government of July 1, 2014 N 364-PP, by Decree of the Moscow Government of December 24, 2014 N 816-PP; as amended by Decree of January 1, 2016 Moscow Government dated December 22, 2015 N 907-PP; as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 2, 2016 N 812-PP.

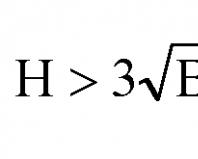

3. When calculating the rental rate under lease agreements (except for lease agreements concluded as a result of auctions), annually from January 1 of the current year, apply a deflator coefficient taking into account the index 1.05:

(Paragraph as amended, put into effect on January 6, 2014 by Decree of the Moscow Government dated December 23, 2013 N 869-PP; as amended, put into effect on January 1, 2015 by Decree of the Moscow Government dated December 24, 2014 N 816-PP; as amended, put into effect on January 1, 2019 by Decree of the Moscow Government of December 18, 2018 N 1580-PP.

3.1. The clause became invalid on July 13, 2014 - Moscow Government Resolution No. 364-PP dated July 1, 2014..

3.2. Under current lease agreements for non-residential premises located in the property treasury of the city of Moscow, with categories of tenants, the purposes of using the non-residential property, provided for in Appendix 1 to this resolution, the rental rate for which is determined on the basis of the conclusion of an independent appraiser on the market value of the annual rent, and also in the form of an estimated rental rate determined using a correction factor.

(Clause as amended, put into effect on September 7, 2015 by Decree of the Moscow Government dated August 26, 2015 N 544-PP.

____________________________________________________________________

Clause 3 is suspended:

until December 31, 2018 - paragraph 3 of the Moscow Government Decree dated December 15, 2017 N 1018-PP.

____________________________________________________________________

4. The clause became invalid on January 1, 2015 - Moscow Government Decree No. 816-PP dated December 24, 2014..

4(1). Establish that:

4(1).1. Under existing and newly executed lease agreements for non-residential premises with categories of tenants, the purposes of using the non-residential property, provided for in Appendix 1 to this resolution, leased on preferential terms, except in cases of rent arrears for two consecutive payment periods or underpayment of rent payment resulting in arrears exceeding the amount of rent for two payment periods (hereinafter referred to as violation of payment discipline), the use of non-residential premises located in the property treasury of the city of Moscow for a purpose not provided for in the lease agreement, as well as in the transfer of leased property to sublease without consent The lessor sets the following rental rates (hereinafter referred to as preferential rates):

(Paragraph as amended, put into effect on July 26, 2015, by Decree of the Moscow Government dated July 15, 2015 N 440-PP; as amended, put into effect on September 7, 2015 by Decree of the Moscow Government dated August 26, 2015 N 544-PP.

Minimum rental rates established by the Moscow Government when approving the forecast for the socio-economic development of the city of Moscow for the corresponding financial year;

Fixed rental rates established by the Moscow Government;

Estimated rates determined from the market rental rate established by the conclusion of an independent appraiser, using a reducing adjustment factor established by a legal act of the Moscow Government."

4(1).2. If tenants violate payment discipline under lease agreements for non-residential premises leased on preferential terms:

4(1).2.1. If the tenant repays the debt within 45 days from the date the Department of City Property of the City of Moscow sent the corresponding notice, the current preferential rate established in the lease agreement for non-residential premises for the corresponding year is maintained.

4(1).2.2. If the tenant fails to repay the debt within 45 days from the date the Moscow City Property Department sent the relevant notice, the current preferential rate established in the lease agreement for non-residential premises for the corresponding year is applied with an adjustment factor of 1.25.

4(1).2.3. If, when applying the adjustment factor of 1.25 (clause 4(1).2.2 of this resolution), the rental rate exceeds the amount determined in the prescribed manner based on the conclusion of an independent appraiser on the market value of the annual rent, then in relation to the specified non-residential premises the rental rate is determined based on the opinion of an independent appraiser.

4(1).3. If tenants repeatedly violate payment discipline under lease agreements for non-residential premises leased on preferential terms:

4(1).3.1. For lease agreements for non-residential premises with a preferential rate established in accordance with paragraph 4(1).2.1 of this resolution, an adjustment factor of 1.25 is applied, taking into account the provisions of paragraph 4(1).2.3 of this resolution.

4(1).3.2. If the tenant fails to repay the debt within 45 days from the date the Department of City Property of the City of Moscow sent the relevant notice under lease agreements for non-residential premises with the rent rate established in accordance with clauses 4(1).2.2 and 4(1).3.1 of this resolution, . The tenant loses the right to apply preferential rental rates under other lease agreements concluded with such a tenant and existing lease agreements for non-residential properties located in the property treasury of the city of Moscow.

4(1).3.3. If the tenant repays the debt within 45 days from the date the Department of City Property of the City of Moscow sent the corresponding notice under lease agreements for non-residential premises with a rental rate established in accordance with clauses 4(1).2.2 and 4(1).3.1 of this resolution, for subsequent years, the current preferential rate established in the lease agreement for non-residential premises for the corresponding year is maintained, using an adjustment factor of 1.25 and a deflator coefficient established by the Moscow Government for the corresponding year, except for the cases provided for in paragraph 4(1).4 of this resolutions.

4(1).4. In the event of subsequent violation by tenants of payment discipline under lease agreements for non-residential premises leased on preferential terms:

4(1).4.1. Under lease agreements for non-residential premises with a rental rate established in accordance with paragraph 4(1).3.3 of this resolution, the rental rate is established on the basis of the opinion of an independent appraiser on the market value of the annual rent.

4(1).4.2. If the debt is not repaid within 45 days from the date the Department of City Property of the City of Moscow sent a corresponding notice, as well as in the event of another violation of payment discipline by tenants who have repaid the debt (clause 4(1.4) of this resolution), the Department of City Property of the City of Moscow shall, in the prescribed manner, procedure for terminating lease agreements for non-residential premises at the initiative of the lessor with the collection of penalties provided for by the terms of the lease agreement.

4(1).5. In the event of sublease of non-residential premises (part of non-residential premises) provided for lease on preferential terms without the consent of the landlord, the Moscow City Property Department ensures recalculation of the rent at a rate determined in the prescribed manner based on the conclusion of an independent appraiser on the market value of the annual rent from the date of discovery in the prescribed manner by the authorized executive body of the city of Moscow of the fact of violation and until the expiration of the lease agreement. If the tenant repeatedly identifies or fails to eliminate such a violation within the prescribed period, the lease agreement is subject to termination at the initiative of the lessor in the prescribed manner with payment of a fine in the amount of the rental rate established for the corresponding year.

(Clause 4(1) was additionally included on July 13, 2014 by Decree of the Moscow Government dated July 1, 2014 N 364-PP)

4(2). When non-residential premises located in the property treasury of the city of Moscow are used for a purpose not provided for in the lease agreement, the City Property Department of the city of Moscow carries out, in accordance with the established procedure, termination of the lease agreement at the initiative of the lessor with payment of a fine in the amount of the rental rate established for the corresponding year.

(Clause 4(2) was additionally included on July 13, 2014 by Decree of the Moscow Government dated July 1, 2014 N 364-PP)

4(3). In the case of transfer in accordance with the established procedure to sublease of non-residential premises (part of non-residential premises) leased on preferential terms, a preferential rental rate is established for the part of non-residential premises not subleased. Wherein:

4(3).1. For part of the non-residential premises subleased to persons who, in accordance with this resolution, do not have the right to lease non-residential premises on preferential terms, the rental rate is established on the basis of the conclusion of an independent appraiser on the market value of the annual rent.

4(3).2. For a part of non-residential premises subleased to persons who, in accordance with this resolution, have the right to rent non-residential premises on preferential terms, the rental rate is set equal to the preferential rental rate under the lease agreement, unless otherwise established by legal acts of the Moscow Government.

(Clause as amended, put into effect on September 7, 2015 by Decree of the Moscow Government dated August 26, 2015 N 544-PP.

4(4). Approve monthly rental rates for the placement of mobile radiotelephone base station equipment at approved facilities (Appendix 2).

by Decree of the Moscow Government of July 15, 2015 N 440-PP)

4(5). The amount of the fee established in accordance with Appendix 2 to this resolution is subject to adjustment no more than once a year by the deflator coefficient annually approved by the Ministry of Economic Development of the Russian Federation.

(The clause was additionally included on July 26, 2015 by Decree of the Moscow Government dated July 15, 2015 N 440-PP)

4(6). Approve rental rates for parts of buildings or structures (parking spaces) intended to accommodate vehicles, located in the property treasury of the city of Moscow, located within the administrative boundaries of the city of Moscow (Appendix 3).

by Decree of the Moscow Government of March 28, 2017 N 123-PP)

4(7). The amount of the fee established in accordance with Appendix 3 to this resolution applies to existing and newly executed rental agreements for parking spaces with individuals, with the exception of individual entrepreneurs who are the owners of residential premises in an apartment building where the parking space is located, or in an apartment building registered in the same household with the building where the parking space is located, or other individuals residing at the place of residence in accordance with the legislation of the Russian Federation in the specified apartment buildings.

(The clause was additionally included on April 8, 2017 by Decree of the Moscow Government dated March 28, 2017 N 123-PP)

5. To recognize as invalid:

5.1. Decree of the Moscow Government of March 21, 2006 N 207-PP “On measures of additional support in 2006 for federal government organizations and institutions working in the field of science, culture and education.”

5.2. Decree of the Moscow Government of March 6, 2007 N 151-PP "On introducing amendments and additions to the Moscow Government Decree of March 21, 2006 N 207-PP".

5.3. Clause 9 of the Moscow Government Resolution No. 1479-PP dated December 29, 2009 “On the implementation of additional measures of state support for organizations and enterprises leasing non-residential properties located in the property treasury of the city of Moscow for the period 2010-2012” regarding amendments to the resolution Moscow Government dated March 21, 2006 N 207-PP.

6. The clause has lost force since November 16, 2013 - ..

7. The clause has lost force - resolution of the Moscow Government of December 17, 2015 N 897-PP ..

8. The clause became invalid on November 16, 2013 - Moscow Government Decree No. 710-PP dated October 29, 2013..

9. Control over the implementation of this resolution is entrusted to the Deputy Mayor of Moscow in the Moscow Government for economic policy and property and land relations V.V. Efimov.

(Clause as amended, put into effect on November 16, 2013 by Decree of the Moscow Government dated October 29, 2013 N 710-PP; as amended, put into effect on January 1, 2018 by Decree of the Moscow Government dated December 18, 2018 N 1580-PP; as amended by Decree of the Moscow Government dated April 16, 2019 N 369-PP.

Mayor of Moscow

S.S. Sobyanin

Appendix 1. List of cases of establishing rental rates under lease agreements for non-residential premises owned by the city of Moscow on preferential terms

____________________________________________________________________

The appendix of the previous edition from July 26, 2015 is considered appendix 1 of this edition - Moscow Government Decree No. 440-PP dated July 15, 2015.

____________________________________________________________________

(As amended as introduced in

effective from September 7, 2015

by decree of the Moscow Government

dated August 26, 2015 N 544-PP. -

See previous edition)

List of cases of establishing rental rates under lease agreements for non-residential premises owned by the city of Moscow on preferential terms *

________________

* The title as amended, put into effect by Decree of the Moscow Government dated April 16, 2019 N 369-PP..

Purpose of using a non-residential property | Amount of rent/procedure for determining the amount of rent per 1 sq. meter of rental object per year | Adjustment factor applied to the market value of the right of use under the terms of the lease agreement |

||

Commercial organizations, with the exception of business entities specified in paragraphs 2-19 of this appendix | Carrying out business activities, except for the purposes specified in paragraphs 2-19 of this appendix | The rent rate is established based on the opinion of an independent appraiser on the market value of the annual rent | ||

Legal entities | Carrying out legal activities | The rent rate is established based on the opinion of an independent appraiser on the market value of the annual rent | ||

Notaries, state notary offices | Carrying out notarial activities | The rent rate is established based on the opinion of an independent appraiser on the market value of the annual rent | ||

Use of one unit of auto or motorcycle transport owned by the tenant as a storage place | 300 rubles | |||

Small businesses | Carrying out economic activities under the conditions established by the Moscow Government Resolution No. 800-PP dated December 25, 2012 “On measures of property support for small businesses renting non-residential properties located in the property treasury of the city of Moscow” | The rent rate is set by the Moscow Government | ||

Public associations (including political parties), their structural divisions and all types of branches registered as a legal entity | 3500 rubles | |||

by Decree of the Moscow Government of December 22, 2016 N 933-PP. |

||||

All-Russian trade unions, all-Russian associations of trade unions, interregional trade unions, interregional associations of trade union organizations, territorial associations of trade union organizations, territorial organizations of trade unions registered as a legal entity | Carrying out the activities of supreme and executive management bodies | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Religious organizations, carrying out activities provided for by the charter and (or) regulations, registered as a legal entity | Carrying out religious rites and ceremonies, carrying out charitable activities, carrying out the activities of governing bodies of a religious organization | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP; as amended by Decree of the Moscow Government dated April 17, 2018 N 326-PP. |

||||

Socially oriented non-profit organizations carrying out activities provided for, having a registration certificate of a participant in the Register of non-governmental non-profit organizations interacting with executive authorities | Carrying out activities from among the types of activities of socially oriented non-profit organizations provided for in Article 31.1 of the Federal Law of January 12, 1996 N 7-FZ "On Non-Profit Organizations" | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Other non-profit organizations, except for those specified in paragraphs of this appendix | Carrying out activities in accordance with the charter of a legal entity, with the exception of entrepreneurial activities | The rent rate is established based on the opinion of an independent appraiser on the market value of the annual rent | ||

Homeowners' Associations | Carrying out the activities of the board of the homeowners association | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Federal government bodies, federal government agencies, federal government agencies and government agencies of the city of Moscow | Carrying out activities provided for by the charter, regulations | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Chambers of Commerce and Industry | Placement of governing bodies of the chamber of commerce and industry, with the exception of entrepreneurial activities | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Creative unions, members of all-Russian creative unions and (or) regional branches of all-Russian creative unions | Placement in a non-residential premises of a creative workshop, studio; use of non-residential premises for the organization of non-state museums, galleries, libraries and other cultural objects open to the public | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Organizations, individual entrepreneurs | Placement of water supply facilities | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Organizations whose maintenance costs are financed from the federal budget | Carrying out activities: In the field of culture; In the field of art; In the healthcare sector; In the field of education; In the field of labor and employment regulation; In the field of science, being a division of the Russian Academy of Sciences | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 22, 2016 N 933-PP. |

||||

Persons with whom government contracts have been concluded as a result of competitions or auctions held in accordance with Federal Law of April 5, 2013 N 44-FZ "On the contract system in the field of procurement of goods, works, services to meet state and municipal needs", if the provision the specified rights were provided for by the tender documentation, auction documentation for the purposes of execution of this government contract | Placement of industrial solid waste processing facilities | 1 ruble | ||

Educational organizations, with the exception of organizations that pay rent in a special manner in accordance with legal acts of the city of Moscow | Implementation of educational activities at the levels of secondary vocational and higher education, as well as additional education | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 2, 2016 N 812-PP. |

||||

Organizations or individual entrepreneurs engaged in medical activities and licensed to carry out such activities | Carrying out medical activities | 3500 rubles | ||

(Clause as amended, put into effect on January 1, 2017 by Decree of the Moscow Government dated December 2, 2016 N 812-PP. |

||||

Research, scientific and production organizations and institutions | Implementation of scientific | 3500 rubles | ||

(The clause was additionally included on July 22, 2017 by Decree of the Moscow Government dated July 11, 2017 N 449-PP) |

||||

Note. If the tenant has the right to set rent on preferential terms for several reasons, the maximum rate from the relevant categories of the tenant and the purposes of use of the real estate property is applied to calculate the annual rent. This rule does not apply to tenants for whom certain legal acts of the Moscow Government have established fixed rental rates per 1 sq. m. meter of non-residential premises.

Appendix 2. Monthly rental rates for the placement of mobile radiotelephone base station equipment at facilities approved by Order of the Moscow Government dated November 29, 2012 N 752-RP “On approval of the List of facilities...

(Extras included

from July 26, 2015 by resolution

Moscow Government

dated July 15, 2015 N 440-PP;

in the version put into effect

by decree of the Moscow Government

dated November 28, 2016 N 785-PP. -

See previous edition)

Monthly rental rates for the placement of mobile radiotelephone base station equipment at facilities approved by Moscow Government Order No. 752-RP dated November 29, 2012 "On approval of the List of state-owned objects of the city of Moscow for the priority placement of mobile radiotelephone base station equipment"

Location of the real estate where the base station is located | Number of pipe stands for antenna placement | Monthly rental rate (RUB, including VAT) depending on the area occupied by the channel-forming equipment of the base station |

||

Outside the Moscow Ring Road, as well as within the territory, | ||||

annexed to the city of Moscow in accordance with the Agreement on changing the border between | ||||

constituent entities of the Russian Federation, the city of Moscow and the Moscow region dated November 29, 2011, | ||||

approved by resolution of the Federation Council of the Federal Assembly of the Russian Federation | ||||

dated December 27, 2011 N 560-SF "On approval of changes in the border between the constituent entities of the Russian Federation, the federal city of Moscow and the Moscow region", and in the city of Zelenograd | ||||

more than 7 | ||||

more than 7 | ||||

Within the Garden Ring | ||||

more than 7 | ||||

Appendix 3. Rental rates for parts of buildings or structures (parking spaces) intended to accommodate vehicles, located in the property treasury of the city of Moscow, located within the administrative boundaries of the city of Moscow

Appendix 3

to the resolution of the Moscow Government

dated December 25, 2012 N 809-PP

(Extras included

from April 8, 2017

resolution

Moscow Government

dated March 28, 2017 N 123-PP)

Rental rates for parts of buildings or structures (parking spaces) intended to accommodate vehicles, located in the property treasury of the city of Moscow, located within the administrative boundaries of the city of Moscow

Parking space location | Rent amount per 1 sq. object meter |

|

Outside the Moscow ring road, as well as within the boundaries of the territory annexed to the city of Moscow in accordance with the Agreement on changing the border between the constituent entities of the Russian Federation, the city of Moscow and the Moscow region dated November 29, 2011, approved by the resolution of the Federation Council of the Federal Assembly of the Russian Federation dated 27 December 2011 N 560-SF "On approval of changes in the border between the constituent entities of the Russian Federation, the federal city of Moscow and the Moscow region", and in the city of Zelenograd | 2000 rubles |

|

Beyond the Third Ring Road to the Moscow Ring Road | 2700 rubles |

|

Beyond the Garden Ring to the Third Ring Road | 4100 rubles |

|

Beyond the Boulevard Ring to the Garden Ring | 6000 rubles |

|

Within the boundaries of the Boulevard Ring | 7300 rubles |

Revision of the document taking into account

changes and additions prepared

JSC "Kodeks"

In 2005 -

The Moscow Government adopted a resolution dated 30.11.2004 N 838-PP"On the calculation of rental rates for the use of non-residential facilities owned by the city of Moscow in 2005", which changes the calculation technology and determines the limits for the growth of rent.

In accordance with clauses 1 and 10 of the appendix to the resolution of the Moscow Government dated 06/29/2004 No. 443-PP"On approval of categories of tenants of non-residential facilities owned by the city of Moscow, for which the rental rate for 2005 is set in a special order", for small businesses included in the Register of Small Businesses of Moscow, retained

To make a recalculation at a preferential rate, you must submit an application to the territorial agency of the Moscow Property Department at the place where the lease agreement was executed, attaching a notarized copy of the Certificate of inclusion in the Register of Small Business Entities of Moscow.

In 2004 -

In accordance with paragraphs 1 and 10 of Appendix No. 1 to the resolution of the Moscow Government dated 01/27/2004 No. 27-PP"On approval of categories of tenants of non-residential facilities owned by the city of Moscow, for whom the rental rate is set in a special order", for small businesses included in the Register of Small Businesses of Moscow, established preferential adjustment factors used when calculating the rental rate:

Taking into account the experience of using the calculation of rent for rented non-residential premises according to the Methodology approved by the Moscow Government Resolution No. 68-PP dated January 22, 2002 “On the results of the work of the Complex for Property and Land Relations of the Moscow Government in 2001 to attract resources to the city budget and tasks of the Complex for 2002", a resolution of the Moscow Government was adopted from 10/14/2003 N 861-PP"On approval of the Methodology for calculating rent for the use of non-residential facilities owned by the city of Moscow."

In 2003 -

In accordance with clause 10 of Appendix No. 1 to the resolution of the Moscow Government dated September 24, 2002. No. 791-PP “On approval of categories of tenants for whom rent is set in a special order”, for small businesses included in the Moscow Register of Small Businesses, preferential adjustment coefficients are established that are used when calculating the rent rate:

Benefits do not apply to office premises.

In accordance with the resolution of the Moscow Government dated March 25, 2003. No. 193-PP "On the specifics of the application in 2003 of the Methodology for calculating rent for the use of non-residential facilities owned by the city of Moscow":

2.1. Calculate rent for newly leased non-residential premises according to the Methodology approved by Decree of the Moscow Government dated January 22, 2002 N 68-PP “On the results of the work of the Complex for Property and Land Relations of the Moscow Government in 2001 to attract resources to the city budget and the objectives of the Complex for 2002."

2.2. For lease agreements concluded before July 1, 2002 and the validity period of which has not expired, the rent for 2003 is calculated according to the Methodology (clause 2.1). At the same time, an increase in the amount of rent for 2003 is allowed no more than twice as compared to that established for 2002.

2.3. If there are sublease agreements for leased space (clause 2.2), issued at a preferential rental rate, the rent for the subleased space is calculated in accordance with the Methodology (clause 2.1) until the end of the sublease period.

2.4. When assessing the market value of rental objects, take into account the costs incurred by the tenant for major repairs of rented non-residential premises in cases where the major repairs were agreed upon by the owner in the prescribed manner.

This paragraph does not apply to lease agreements:

- the condition of the conclusion of which was the carrying out of major repairs at the expense of the tenant,

- if the tenant was exempt from paying for the rented premises during major repairs.

3. Establish that with the consent of the interested parties (owner, tenant and subtenant), the sublease agreement can be re-signed to a lease agreement in the prescribed manner.

For small and medium-sized businesses, renting real estate from the Moscow City Property Department is one of the best ways to save on rent and free up money to solve business problems. By participating in auctions, entrepreneurs can obtain premises at a rate below the market average, and subsequently buy them back on favorable terms. Smart Choice experts talk about how to rent premises from the city of Moscow and take part in special programs to support small and medium-sized businesses.

Step-by-step instructions on how to rent a room from the city

- Choose the right object. They are presented on the website mos.ru. Pay attention to the key lot information: date of auction, rental period, starting rental amount.

- View the property. An application for inspection can be submitted up to a few days before the deadline for accepting applications for participation in the auction. How to rent a room from the city and be sure that the property is ideal for you? Visit it yourself or have it examined by a specialist. A thorough examination, including checking the state of repairs, communications, assessment of transport accessibility, infrastructure, etc., will help avoid problems with the operation of real estate in the future.

- Register on the site that will conduct the auction. Today they are all produced in electronic format. To register, you will need to provide constituent documents and a digital signature, install several certificates and a data cryptographic protection system.

- Collect a package of documents. You will need an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs (it must be received no earlier than 6 weeks before the start of the auction), copies of the constituent papers, a decision to approve the transaction, and a document confirming the authority of the person submitting the application. You also need to attach a statement in which the entrepreneur confirms that no bankruptcy or liquidation case has been opened against the company, and its activities have not been suspended.

- Pay the deposit. Review the lot documentation to find out how to rent space from the city and how much you need to transfer to participate in the auction. As a rule, the deposit is 5% of the lot amount.

- On the day of the auction, go to the auction site and take part in the auction. You can study the rules for bidding on the website or in the documentation for the lot. If you are the only participant in the auction, you will automatically be recognized as the winner.

- Sign the protocol on the results of the auction. As a rule, it is published on the same day when the auction was held. Within 10-20 days after the auction, you must contact the DGI to conclude an agreement.

- Pay the initial amount and sign the contract. After this you will be able to use the premises.

Please note: the rental price for the year, which is indicated in the contract, will be revised after 12 months. The amount will be multiplied by the consumer price index (inflation rate). Keep this in mind when finding out how to get a space to rent from the city: the space will cost more in the future. However, the City Property Department does not have the right to change the rate unilaterally.

How to rent premises from the city of Moscow? Analyzing lot documentation

The best way to find out how to rent premises from the city is to study the lot documentation. All the key information for making a decision and planning actions at the auction will be indicated here. The document states:

- a detailed description of the non-residential property indicating the number in the Unified State Register, intended purpose, address, area, etc.;

- term of the contract;

- the initial price from which bets start;

- deposit for participation in the auction;

- the amount that the auction winner will have to pay and the timing of payment;

- minimum auction step;

- documents for participation;

- start and end dates for accepting applications, holding an auction and other information.

Also in the documentation for the lot you can study the lease agreement (pay special attention to the rights and obligations of the tenant), a sample application for participation in the auction and a power of attorney to represent interests by a third party.

Important: there are several programs to help entrepreneurs in Moscow. For example, property support is provided for small businesses that work in the field of healthcare, social nutrition, education, consumer services, etc. To understand whether your company can count on benefits, contact Smart Choice specialists: they are thoroughly familiar with the legislation on assistance programs for entrepreneurs and will take care of the correct execution of documents.

Pitfalls when renting municipal property

Before you learn how to lease a property from the city and bid on it, you need to make sure you are ready for the auction. There are several difficulties:

- New offers need to be monitored. In order not to miss out on a profitable lot, you need to regularly monitor DGI offers. In addition, you will have to spend time inspecting the property.

- The registration process at the auction site may take several days.. It is best to register before you decide to rent a specific premises from the city of Moscow in order to be sure to become a bidder before the start. It's especially important to start preparing early if your business doesn't yet have an electronic signature. In order not to deal with the rules of trading and not waste time on self-registration, you can use the help of Smart Choice lawyers.

- The winner must conclude an agreement within a short time and, most importantly, make payment. As a rule, the down payment is 25% of the minimum contract amount. Considering that the bidding is not for a monthly, but for an annual rental rate, the amount will be significant. The time frame for transferring it to the DGI account is short - up to 3 days. If the auction winner does not have time to collect the required amount or misses the deadline for concluding the contract, the results of the auction will be canceled, and the deposit will not be returned to the winner.

How to rent commercial real estate from the cityno problem?

Smart Choice offers services to entrepreneurs who want to obtain city real estate on attractive terms. We provide a wide range of services:

Smart Choice offers services to entrepreneurs who want to obtain city real estate on attractive terms. We provide a wide range of services:

- Selection of an object according to the customer’s requirements among DGI proposals, monitoring of new proposals.

- Inspection of the property, assessment of the benefits of the proposal, calculation of the approximate market value of the property.

- Consultations on the possibility of participation in government programs.

- Registration of the client on the trading platform.

- Collecting a package of documents, making a deposit.

- Developing a strategy for participating in the auction, calculating the maximum amount that makes sense to pay for the premises.

- Participation in the auction on your behalf.

- Signing the protocol, transferring the initial amount to the DGI account, signing the agreement.

- Assessing the possibility of purchasing real estate, submitting documents to the State Property Inspectorate.

- Analysis of the contract for the purchase of real estate, conducting an independent assessment.

- Challenging the value of real estate in court.

- Concluding an agreement for the purchase of leased real estate.

Smart Choice employs lawyers with more than 5 years of experience who have repeatedly collaborated with DGI on various issues. We will help you rent ideal premises for your business from the city with the possibility of subsequent purchase in Moscow or the Moscow region, making sure that the conditions are the most favorable.

At the state level, property support for NPOs in the form of providing them with non-residential premises has long existed in the form of federal laws and government regulations (Article 31.1 of the Federal Law No. 7 “On Non-Profit Organizations”, Government Decree of the Russian Federation No. 1478 “On Property Support for Socially Oriented Non-Profit Organizations”). However, in real life things are not so simple.

It is assumed that regional and local administrations can provide NPOs with premises that are in state and municipal ownership. There are several forms of such support:

- Transfer of buildings and premises for free use to non-profit organizations;

- Transfer of buildings and premises for short-term (up to one year) or long-term lease at preferential rental rates;

- Providing NPOs free of charge or on preferential terms with premises for holding individual events;

- Providing non-profit organizations with opportunities to work on the basis of state and municipal institutions of the relevant profile;

- Creation of specialized state and municipal institutions that provide non-profit organizations with premises free of charge or on preferential terms for holding individual events or for regular activities.

For temporary use by non-profit organizations, real estate of some other categories can also be used - in the areas of activity of the relevant NPOs, for example, cultural heritage objects (historical and cultural monuments), sports facilities.

However, established practice shows that the question of the effectiveness of such use of state and municipal property, as well as its independent assessment, has almost never been raised. The regulatory framework that would ensure equal access of non-profit organizations to such a form of support as the transfer of premises to them for temporary use on preferential terms has not been developed.

At the regional and especially local levels, the issues of providing premises for temporary use to NPOs on preferential terms are practically not resolved; there is no detailed description of administrative procedures or requirements for the procedure for their implementation.

But try

get premises SO NPOs can still operate on preferential terms for their activities.

You need find list state and municipal property, which, in accordance with paragraph 7, Article 31.1 of the same Federal Law No. 7 “On Non-Profit Organizations”, must be published in the media and located on the official websites of the federal executive authorities, executive authorities of the constituent entities of the Russian Federation or local administrations.

This list or register contains information about buildings and premises (usually a list of them indicating the address, area and other information) that are offered for rent. But keep in mind that this list or register is general for everyone, and there is no reference there to the fact that these premises are provided specifically by NPOs. For example, the Moscow list can be found here.

After that, you need to contact the relevant executive authority of the subject or the local administration and provide a full package of documents, including those confirming the social orientation of the NPO. You can add to them request on granting preference. If he is not satisfied, you still have nothing to lose. But in case of a positive decision, the NPO will receive serious additional support, for example, preferential rent for the use of a building or premises.

Officials may state that the premises you have chosen can be transferred to an NPO only after a competition or auction, citing Article 17.1 of Federal Law No. 135-FZ “On the Protection of Competition”. But a competition is not held if we are talking about a socially oriented NPO. In the same article, at the end of paragraph 1 it is said: “except for the provision of specified rights to such property,” and then such exceptions are listed, and subparagraph 4 includes socially oriented NPOs as such exceptions. Accordingly, the conclusion of agreements providing for the transfer of rights of ownership and/or use of state or municipal property (including buildings and premises) with NPOs on the basis and subject to the conditions of clause 4, part 1, article 17.1 of the Federal Law “On Protection of Competition” is carried out without bidding.

Remember that the property transferred to you, including premises, can only be used for its intended purpose. It is prohibited to sell it, assign the rights to use it, pledge the rights to use it, and enter the rights to use such property into the authorized capital of any other business entities. Otherwise, the authorities that issued the premises to you have the right to apply to the arbitration court with a demand to terminate the rights of ownership and/or use of the property.

If you liked the article, recommend it to your friends, acquaintances or colleagues related to municipal or public service. It seems to us that it will be both useful and pleasant for them.

When reprinting materials, reference to the original source is required.

gosvopros.ru

The activities of non-profit organizations (hereinafter referred to as NPOs) do not involve making a profit as their main goal. The social orientation of NPOs is supported by the state in the form of certain tax benefits. Let us outline the main ones.

In accordance with the provisions of Article 3 of the Tax Code of the Russian Federation, the legislation of the Russian Federation on taxes and fees is based on the recognition of the universality and equality of taxation. It is not allowed to establish differentiated rates of taxes and fees, tax benefits depending on the form of ownership, citizenship of individuals or place of origin of capital.

In accordance with clause 3 of Article 31.1 of the Federal Law of January 12, 1996 No. 7-FZ “On Non-Profit Organizations”, support for socially oriented non-profit organizations is provided, inter alia, in the form of providing such organizations with benefits for paying taxes and fees in accordance with legislation of the Russian Federation on taxes and fees.

Thus, in particular, non-profit organizations are given the right, when forming the tax base for corporate income tax, not to take into account income established by Article 251 of the Tax Code of the Russian Federation.

NPOs carrying out educational and (or) medical activities have the right to apply a tax rate of 0% for corporate income tax, subject to the conditions established by Article 284.1 of the Tax Code of the Russian Federation.

NPO REGISTRATION

In addition, Article 149 of the Tax Code of the Russian Federation establishes a list of transactions exempt from taxation by value added tax, which includes transactions for the sale of goods (work, services) carried out by non-profit organizations within the framework of charitable, cultural, educational, scientific activities, as well as sphere of citizens' health, development of physical culture and sports.

Subjects of the Russian Federation have the right to establish differentiated tax rates for regional and local taxes depending on the categories of taxpayers and (or) property recognized as an object of taxation, as well as tax benefits and grounds for their use (Letter of the Ministry of Finance of the Russian Federation dated January 13, 2017 No. 03-01 -15/1026).

Tax legislation provides significant benefits for NPOs, exempting a number of transactions from taxation.

AUDIT OF NON-PROFIT ORGANIZATIONS

Tax benefits regarding VAT

Tax benefits are available for certain transactions carried out by NPOs.

The list of transactions not subject to taxation (exempt from taxation) on the territory of the Russian Federation is established by Art. 149 of the Tax Code of the Russian Federation and is closed.

For example, the following are exempt from VAT:

- care services for the sick, disabled and elderly (clause 3, clause 2, article 149 of the Tax Code of the Russian Federation);

- services for the supervision and care of children in organizations carrying out educational activities in the implementation of educational programs for preschool education, services for conducting classes with minor children in clubs, sections (including sports) and studios (clause 4, clause 2, article 149 of the Tax Code of the Russian Federation) .

In connection with this benefit, the question arises: are services for the supervision and care of children in extended day groups in an autonomous non-profit organization (private school of primary education), provided on the basis of an agreement on the provision of relevant services between the parents (legal representatives) of the child and the school, exempt?

Clause 18 of Article 2 of the Federal Law of December 29, 2012 No. 273-FZ “On Education in the Russian Federation” (hereinafter referred to as Law No. 273-FZ) establishes that an educational organization is recognized as an NPO that carries out educational activities on the basis of a license as main type of activity in accordance with the goals for which such an organization was created. In accordance with Part 7 of Article 66 of Law No. 273-FZ, in an educational organization implementing educational programs of primary general, basic general and secondary general education, conditions may be created for students to live in a boarding school, as well as for the supervision and care of children in extended day groups.

At the same time, supervision and care of children is understood as a set of measures to organize meals and household services for children, ensure their compliance with personal hygiene and daily routine (clause 34 of Article 2 of Law No. 273-FZ).

REGISTRATION OF CHANGES IN THE NPO CHARTER

The types of educational organizations are named in Art. 23 of Law No. 273-FZ. So, part 2 of Art. 23 of Law No. 273-FZ establishes that in the Russian Federation the following types of educational organizations are established that implement basic educational programs:

- preschool educational organization - an educational organization that carries out educational activities according to educational programs of preschool education, supervision and care of children as the main goal of its activities;

- general educational organization - an educational organization that carries out educational activities according to educational programs of primary general, basic general and (or) secondary general education as the main goal of its activities.

An autonomous non-profit organization (private school of primary education) is a general education organization, therefore, the benefit established by paragraph 4 of paragraph 2 of Article 149 of the Tax Code of the Russian Federation does not apply to it (Letter of the Ministry of Finance of the Russian Federation dated July 6, 2017 No. 03-07-14/ 42787).

- services provided by NPOs for the implementation of general educational and (or) professional educational programs (basic and (or) additional), professional training programs specified in the license, or the educational process, as well as additional educational services corresponding to the level and focus of educational programs specified in licenses, with the exception of consulting services, as well as services for leasing premises (clause 14, clause 2, article 149 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated August 25, 2015 No. GD-3-3/3230@);

- social services for minors; services for support and social services for elderly citizens, disabled people, street children and other citizens who are recognized as in need of social services and who are provided with social services in social service organizations;

- operations for the sale of goods (except for excisable goods, mineral raw materials and minerals, as well as other goods according to the list approved by the Government of the Russian Federation), works, services produced by public organizations of disabled people, among whose members disabled people (legal representatives) make up at least 80 percent ( paragraph 2, paragraph 3, article 149 of the Tax Code of the Russian Federation);

- operations for the sale of utilities and work (services) for the maintenance and repair of common property in an apartment building (clause 29 and clause 30, clause 3, article 149 of the Tax Code of the Russian Federation).

At the same time, targeted funds received by NPOs (for example, entrance and membership fees, donations and other funds) are not subject to VAT if their receipt is not related to the sale of goods, works, services (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation) .

What documents are needed to confirm the benefit regarding charitable activities?

Such documents may be (letters of the Ministry of Finance of the Russian Federation dated October 26, 2011 No. 03-07-07/66, Federal Tax Service of the Russian Federation for Moscow dated March 5, 2009 No. 16-15/049593.1):

- agreement for the gratuitous transfer of goods (performance of work, provision of services) within the framework of charity;

- accounting registers confirming that charitable assistance has been registered;

- acts or other documents indicating the intended use of charitable property (results of work or services).

WHAT DOCUMENTS ARE REQUIRED FOR ANO REGISTRATION?

TAX BENEFITS FOR LEGAL AND INDIVIDUALS MAKING CHARITABLE DONATIONS

Tax benefits regarding income tax

As a general rule, NPOs are recognized as payers of income tax (Article 246 of the Tax Code of the Russian Federation).

NPOs are subject to income tax only on profits (the difference between income received and expenses incurred) received in connection with business activities.

Income that is not taken into account when determining the tax base for income tax is given in Article 251 of the Tax Code of the Russian Federation. Their list is exhaustive. At the same time, funds received by NPOs for their maintenance and conduct of statutory activities are not subject to income tax (Clause 1, Clause 14, Article 251 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated February 29, 2016 No. 03-03-06/3/ 11364, dated March 23, 2015, No. 03-03-06/4/15749).

When determining the tax base for income tax, targeted revenues are not taken into account (clause 2 of Article 251 of the Tax Code of the Russian Federation). Targeted revenues for the maintenance of non-profit organizations and the conduct of their statutory activities include, in particular, donations recognized as such in accordance with the Civil Code of the Russian Federation (clause 1, clause 2, Article 251 of the Tax Code of the Russian Federation), funds and other property, property rights that have been received to carry out charitable activities (clause 4, clause 2, article 251 of the Tax Code of the Russian Federation).

In accordance with clause 1.1 of the Procedure for filling out a tax return for corporate income tax (Appendix No. 2 to the Order of the Federal Tax Service of the Russian Federation dated November 26, 2014 No. ММВ-7-3/600@) when receiving donations recognized as such by organizations when drawing up a declaration For the tax period, sheet 07 is filled out.

One of the conditions for recognition for the purposes of Ch. 25 of the Tax Code of the Russian Federation of received funds and (or) other property, targeted receipts mean that these receipts were made for the maintenance of non-profit organizations and the conduct of their statutory non-profit activities free of charge.

Property received as part of targeted revenues and used not for its intended purpose is taken into account when determining the tax base for corporate income tax as part of non-operating income on the basis of the provisions of clause 14 of Article 250 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated April 11, 2016 No. 03-03-6/3/20413).

Donations received for the maintenance of NPOs and the conduct of their statutory activities and used for purposes other than their intended purpose (in particular, in paid activities) are included in non-operating income and are subject to income tax in the generally established manner (Clause 14, Part 2, Article 250 of the Tax Code RF, Letter of the Ministry of Finance of the Russian Federation dated November 13, 2015 No. 03-03-06/4/65618).

The established right of NPOs not to take into account for profit tax purposes income received in the form of a donation that is used for their intended purpose is an income tax benefit. Therefore, tax authorities have the right, during a desk audit, to request primary documents confirming the amount of donations received, considering them as a benefit (clause 6 of Article 88 of the Tax Code of the Russian Federation).

Some NPOs have the right to apply a 0 income tax rate. Thus, medical and educational institutions can apply a rate of 0 income tax rate for the types of medical and educational activities included in the List approved by Decree of the Government of the Russian Federation of November 10, 2011 No. 917. To do this, the conditions established by Article 284.1 of the Tax Code of the Russian Federation must be met.

And institutions providing social services to the population, from January 1, 2015, have the right to apply a 0 rate subject to a number of conditions (Article 284.5 of the Tax Code of the Russian Federation).

For the legality of applying the 0 rate by medical and educational institutions, the following conditions must be met:

- the organization has a license (licenses) to carry out educational and (or) medical activities;

- the organization’s income for the tax period from educational and (or) medical activities, as well as from scientific research and (or) development, taken into account when determining the tax base, amounts to at least 90 percent of its income;

When calculating for a tax period the percentage of income that gives an organization the right to apply a 0 rate, only income received from the sale of medical and (or) educational services included in the List, as well as income from scientific research and (or) development work are taken into account. developments (Letter of the Ministry of Finance of the Russian Federation dated September 21, 2011 No. 03-03-06/1/580).

It is this requirement that most often becomes a stumbling block between taxpayers and tax authorities. Most arbitration disputes on this topic are related to the correct determination of the share of income from educational and (or) medical activities.

- in the staff of an organization carrying out medical activities, the number of medical personnel with a specialist certificate in the total number of employees continuously during the tax period is at least 50%;

- the organization continuously employs at least 15 employees during the tax period;

To calculate the number, you should use the list number of employees, which is used to determine the average number of employees (Letter of the Ministry of Finance of the Russian Federation dated September 21, 2011 No. 03-03-06/1/580).

- The organization does not carry out transactions with bills of exchange and financial instruments of futures transactions during the tax period.

A tax rate of 0 percent applies to the entire tax base during the entire tax period (Clause 2 of Article 284.1 of the Tax Code of the Russian Federation).

CONCEPT, TYPES AND PROCEDURE FOR LIQUIDATION OF NPOs

ACCOUNTING SERVICES FOR NON-PROFIT ORGANIZATIONS (NPOs)

Benefits for other taxes

The list of tax benefits for property tax for some non-profit organizations is established by Article 381 of the Tax Code of the Russian Federation. All-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people (legal representatives) make up at least 80%, are exempt from taxation in relation to property used by them to carry out their statutory activities (clause 3 of Art. 381 of the Tax Code of the Russian Federation).

In addition, on the basis of clause 2 of Article 372 of the Tax Code of the Russian Federation, when establishing a property tax for organizations, the laws of the constituent entities of the Russian Federation may provide for tax benefits and grounds for their use by taxpayers.

For example

Autonomous, budgetary and state institutions of the city of Moscow and intra-city municipalities in Moscow are exempt from paying property tax (Article 4 of the Moscow Law of November 5, 2003 No. 64 “On Property Tax”).

When establishing land tax, regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol) may establish tax benefits, grounds and procedure for their application, including establishing the amount of land tax-free amount for certain categories of taxpayers (clause 2 Article 387 of the Tax Code of the Russian Federation).

Thus, clause 12, clause 1, article 3.1 of the Moscow Law of November 24, 2004 No. 74 “On Land Tax” establishes that non-state non-profit organizations are exempt from paying land tax - in relation to land plots provided and used in in particular, for the placement of cultural objects. That is, private museums are exempt from paying land tax (letter of the Ministry of Finance of the Russian Federation dated August 19, 2015 No. 03-05-06-02/47904).

Subjects of the Russian Federation can establish benefits in terms of payment of transport tax. Thus, Article 7 of the Law of the Moscow Region dated November 24, 2004 No. 151/2004-OZ “On preferential taxation in the Moscow Region” provides that public organizations of disabled people are exempt from paying transport tax, except for water and air vehicles. Public organizations of disabled people are understood as organizations registered in accordance with federal legislation as public organizations of disabled people, in which the number of disabled people is at least 90% of the total number of members. At the same time, tax benefits are not provided to public organizations of disabled people if they carry out the following types of business activities: acquisition and sale of securities, property and non-property rights.

REGISTRATION OF AN AUTONOMOUS NON-PROFIT ORGANIZATION (ANO)

AUTONOMOUS NON-PROFIT ORGANIZATIONS: FEATURES OF THIS NPO FORM (PART II)

AUTONOMOUS NON-PROFIT ORGANIZATIONS: FEATURES OF THIS NPO FORM (PART I)

rosco.su

Naturally, these funds must be used exclusively for their intended purpose, which must be confirmed by a report.

- Non-targeted income must be taken into account among “other”; these are two types of income:

- sales - income from performing work, providing services (for example, selling company brochures, selling educational literature, organizing seminars, trainings, etc.);

- non-operating - those whose source does not have a direct connection with the activities of the NPO, for example, fines for non-payment of the membership fee, late fees, interest from a bank account, money for rented real estate - the property of an NPO member, etc.

Non-targeted income of NPOs (both groups of income), according to the Tax Code of the Russian Federation, constitutes the income tax base.

Features of taxation of non-profit organizations

Zavyalov Kirill, Melnikova Elena, experts from the Legal Consulting Service GARANT According to clause 1 of Art. 2 of Federal Law No. 7-FZ of January 12, 1996 “On Non-Profit Organizations” (hereinafter referred to as Law No. 7-FZ), a non-profit organization is an organization that does not have profit as the main goal of its activities and does not distribute the profits received among participants. Non-profit organizations can be created to achieve social, charitable, cultural, educational, scientific and managerial goals, in order to protect the health of citizens, develop physical culture and sports, satisfy the spiritual and other non-material needs of citizens, protect the rights, legitimate interests of citizens and organizations, resolve disputes and conflicts , providing legal assistance, as well as for other purposes aimed at achieving public benefits (clause 2 of Art.

Taxation of non-profit organizations

Type of NPO and taxation procedure Non-profit organizations are usually divided into several types according to the source of funding:

- municipal (state) - they are financed by the state budget;

- public (non-state) - exist at the expense of their own profit and public contributions;

- autonomous - finance themselves.

IMPORTANT! The procedure and amount of taxes for non-profit organizations are directly related to whether the NPO conducts business activities. As a rule, non-profit structures are not registered as entrepreneurs, but in the course of their operation they often have to provide services or perform work for the benefit of others in order to earn funds to finance the organization, thereby generating taxable profit.

Tax benefits for non-profit organizations

For example, it includes the following activities:

- looking after the elderly in nursing homes;

- work in social protection centers;

- activities with children in free clubs;

- medical services of private physicians;

- sale of goods made by disabled people (or organizations where at least half of them are disabled);

- charitable cultural events, etc.

Requirements for the types of activities of NPOs for VAT exemption:

- social significance as the main goal according to Ch. 25 of the Tax Code of the Russian Federation is the main condition;

- a license to engage in this type of activity;

- the service provided must meet certain requirements (most often these are the conditions of time and place).

In case of payment, VAT is calculated according to the same principles as for commercial organizations.

Taxes for non-profits in 2018

The Tax Code of the Russian Federation provides that non-profit organizations that do not have income from the sale of goods (works, services) pay only quarterly advance payments based on the results of the reporting period. In turn, clause 2 of Art. 289 of the Tax Code of the Russian Federation contains rules determining that non-profit organizations that do not have obligations to pay tax submit a tax return in a simplified form after the expiration of the tax period. In other words, a non-profit organization that does not have an obligation to pay income tax does not have the obligation to submit income tax returns to the tax authority based on the results of the reporting periods (letter from the Federal Tax Service Department for the city of No.

Moscow dated March 15, 2005 N 20-12/16361). Tax benefits for non-profit (public) organizations

The Tax Code of the Russian Federation is not subject to taxation (exempt from taxation) on the territory of the Russian Federation the sale of goods (with the exception of excisable goods, mineral raw materials and minerals, as well as other goods according to the list approved by the Government of the Russian Federation on the proposal of all-Russian public organizations of disabled people), works, services (for excluding brokerage and other intermediary services) produced and sold by: - public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80 percent; - organizations whose authorized capital is entirely from the contributions specified in the second paragraph. 2 p. 3 art.

Tax benefits for non-profit organizations, confirmation procedure (part 2)

Attention

But this payment “does not look at individuals”, but exclusively at goods, therefore it is not exempted from it on the basis of the status of an NPO, but only if the goods are included in the appropriate list. Regional taxation of NPOs Local authorities establish the procedure for such taxation and rates, as well as benefits , including for non-profit organizations. Property tax Even if an organization has a benefit for this tax, it is still required to report to regulatory authorities in a tax return.

The basis for accounting is the residual value of funds according to the data in the accounting records. The generally accepted rate of this tax is 2.2%, unless the regional authorities deem it necessary to reduce it, to which they have the right.

Local structures also have the power to expand the list of non-profit organizations recognized as beneficiaries. NPO taxes and benefits thereon

General rules for taxation of NPOs They are determined by the peculiarities of these structures, namely:

- profit is not their main goal;

- they are not entrepreneurs, and they need licenses to permit certain types of activities;

- NPOs can receive income in the form of voluntary contributions, donations and other gratuitous income.

These specific properties of NPOs are the basis for the general principles by which their taxation is carried out:

- All profits received by NPOs in the course of their activities are subject to appropriate tax (Article 246 of the Tax Code of the Russian Federation).

- Certain types of profit of NPOs are not included in the base for this tax (Article 251 of the Tax Code of the Russian Federation), namely, the profit that is received free of charge to ensure statutory activities.

Payment of taxes by non-profit organizations

REFERENCE! The income tax rate for NPOs is the same as for commercial structures: 24%, of which 6.5% will go to the federal budget, and 17.5% to the budget of the constituent entity of the Russian Federation to which the non-profit organization belongs. The last part can be reduced at the initiative of local authorities, into whose budget it is intended. Specifics of taxation of non-profit structures with VAT If a non-profit organization provides any services or sells goods, it cannot avoid paying value added tax if the activity does not qualify for exemption from it. The list of preferential activities without VAT is presented in Chapter.

21 Tax Code of the Russian Federation.

VAT), non-profit organizations pay other taxes and fees:

- State duty. If NPOs turn to government agencies to carry out legal actions, they pay a fee on the same basis as other individuals or legal entities.

Certain NPOs and their types of activities may be exempt from state duty, namely:- financed by the federal budget - logical, because the duty is sent there anyway;

- state and municipal repositories of cultural property (archives, museums, galleries, exhibition halls, libraries, etc.) - they may not pay state duty for the export of valuables;

- Non-profit organizations of disabled people – state fees in courts and notaries are abolished for them;

- special institutions for children with socially dangerous behavior - they are allowed not to pay a fee to collect parental debt;

- Customs duty.

Benefits for non-profit organizations 2018 on the general tax exemption system

For different types of NPOs, the procedure for collecting property tax and benefits for it differs:

- Unconditional perpetual benefits for this tax on the basis of the law are provided for a number of non-profit organizations, such as:

- organizations of a religious nature and those serving them;

- scientific government agencies;

- criminal-executive departments;

- organizations that own cultural and historical monuments.

- Property tax benefits are provided to NPOs whose membership is made up of more than 50% (one type of benefit) or 80% disabled people.

- Autonomous NPOs, various foundations other than public ones, as well as non-profit partnerships do not receive property tax benefits.

Land tax If NPOs have land plots in their ownership, perpetual use or inheritance, they are required to pay land tax.

prodhelp.ru

MOSCOW, November 3. /TASS/. Socially oriented non-profit organizations (NPOs) should receive access to the infrastructure to support small and medium-sized businesses, as well as a number of benefits in terms of renting premises and taxation. Appropriate measures to support such NPOs are provided for in the draft Concept for promoting the development of socially oriented non-profit organizations in the Russian Federation, which was presented at the final forum of NPOs “Community” that opened on Thursday in Moscow.

Benefits, taxes, infrastructure

The document, the text of which is available to TASS, lists measures that, in particular, should promote the formation of socially oriented NPOs “as an independent and full-fledged public institution.”